Author: BlockBeats

Only those who dare to burn money have the chance to print new money.

This afternoon, OKX dropped a heavyweight message in the market - a one-time massive destruction of 65.25 million OKB, with a market value calculated at current prices reaching hundreds of millions of dollars. After the announcement, OKB's price quickly surged, rising over 100% in a short time, instantly becoming the focus in a relatively sluggish market environment. Such volatility evoked a sense of familiarity for many investors.

The market's association quickly returned to four years ago - the sensational "Platform Token Destruction War" of 2021. At that time, exchanges were using real money to repurchase and destroy their platform tokens, not only reducing market circulation and creating scarcity but also signaling profitability and business growth to the outside world. It was an incredibly fierce arms race without gunpowder: each destruction announcement drove token prices up and reshuffled market capitalization rankings.

Now, when OKB launches another massive destruction move, the market's emotions and memories are simultaneously ignited. The difference is that the industry environment in 2025 is far different from back then - global regulations are stricter, and competition models and ecosystem layouts among exchanges have significantly changed.

However, this does not prevent us from asking the same question - is it still possible to see a tenfold market performance in today's platform token track like in 2021?

Reviewing the Platform Token Destruction War of 2021

Let's rewind the timeline to four years ago.

From the end of 2020 to early 2021, the crypto market welcomed an epic bull market. After Bitcoin broke through the $20,000 mark and continued to climb, Ethereum returned to the thousand-dollar range, driving a comprehensive outbreak in the Altcoin sector. Large speculative funds first rushed into low-priced, highly volatile Altcoins, pushing up short-term gains and quickly igniting market sentiment.

Subsequently, as Altcoin profit-taking funds were realized and reflowed, exchanges' trading volumes and profits were significantly boosted.

At this point, platform tokens had the conditions for "subsequent rise": the high profits brought by the bull market gave exchanges the ability to massively repurchase and destroy tokens, reducing circulation and creating scarcity; the need for market value management also made exchanges happy to demonstrate their strength through destruction.

Top platforms keenly captured this opportunity, using destruction as a tool for brand competition and investor confidence gaming.

A "muscle-showing destruction show" catalyzed by the Altcoin boom and backed by exchange profits thus began, with platform tokens completing a position transformation from "catching up" to "leading" in the market.

In that destruction war, no one wanted to be a silent bystander.

The frequency, scale, and styles of major exchanges were almost as exciting as the price curves. To occupy a higher position on the market cap list, they showed their strength to the market in different ways - some made shocking one-time attacks, some chose stable rhythms to build trust, some directly confronted in the secondary market, and some relied on high-frequency presence.

Eventually, four camps with distinct styles emerged on the battlefield, each representing a different approach: BNB, HT, OKB, and FTT. They not only shaped the platform token landscape of 2021 but also provided a template for later participants to imitate or even improve.

In that smoke-filled destruction war, BNB was the first cannon to fire.

In April 2021, Binance burned 1,099,888 BNB in one go, calculated at the price at that time, reaching $595 million, directly breaking the single destruction record in crypto history. This not only dramatically reduced circulating supply but also demonstrated the "speed of profit realization". Immediately after, CZ threw out an even more radical signal - completing the 100 million destruction target in advance and introducing an automatic destruction mechanism, making this action sustainable and predictable. Such boldness and steady rhythm allowed BNB to rise from $37 to $690 during that year's bull market, breaking into the global top three by market value.

Similar to BNB, HT's rise was not the first wave of leadership but followed a "Altcoins rise first - platform tokens rise later" rhythm. In January-February 2021, funds mainly flowed to hot Altcoins. When these funds reflowed to exchange profits and platform tokens, HT ushered in a concentrated outbreak. From around $4 in early January 2021 to nearly $39 at the May high point, it rose nearly tenfold.

OKB chose a more direct route. It eliminated the intermediate repurchase link, directly buying and destroying in the secondary market. This approach was like shooting bullets directly into the price curve, reducing speculative front-running space on one hand and creating significant market impact at the moment of announcement on the other. In 2021, OKB destroyed nearly 30 million tokens, with prices jumping from single digits to $40, firmly occupying the second-tier position.

As a newcomer, FTT clearly didn't want to lag in rhythm. FTX chose high-frequency strikes - weekly repurchase and destruction, incorporating all income from trading fees, leveraged token redemption fees, and futures funding fees into its ammunition. This rhythm kept it at the center of topics during the 2021 bull market, with prices reaching as high as $85, second only to BNB and OKB. However, this model was highly dependent on trading volume, and its firepower would dry up once the market reversed. As expected, when exchanges collapsed in 2022, FTT's story came to an abrupt end, falling from stardom to ruins.

The destruction war's firepower was concentrated in the first four months of 2021, from early January to spring.

During January-April, platform tokens like BNB, OKB, HT, and FTT almost regularly released record-breaking repurchase and destruction data, often billions of dollars per instance. Combined with the bull market's high trading volumes, token prices were continuously pushed higher, driving market sentiment to its peak.

From July to September, the destruction rhythm continued but with reduced scale compared to the first half of the year, more aimed at maintaining expectations, with moderate market reactions. By the fourth quarter, as BTC and ETH entered adjustment phases and exchange trading volumes significantly dropped, destruction scale and frequency declined, and news effects could no longer drive platform tokens' strong performance, with enthusiasm quickly cooling.

Ultimately, this nearly year-long destruction arms race not only left steep peaks and valleys on price curves but also reshaped the platform token landscape. BNB, with its dual advantages of firepower and rhythm, firmly sat at the absolute top; OKB, with stable mechanisms and decisive execution, firmly occupied the second-tier position; while FTT, though momentarily prominent during the bull market, collapsed in 2022 due to over-reliance on trading volume and external environment, becoming a cautionary tale in platform token history.

The aftermath of this battle continues today, providing a clear footnote for later participants - in the world of platform tokens, being able to burn is important, but surviving is even more crucial.

Platform Tokens Surging in 2025

Platform token trends are often not linear climbs but "step-like" jumps: seemingly calm usually, but once key events are triggered (massive destruction, major product launches, license acquisition, ecosystem explosion), prices can steeply surge in a short time, then establish a new price center on a new level.

In past cycles, these "super surge-type" platform tokens almost always followed a common script:

First, pave the way - lay foundations in ecology, products, compliance, etc.; then ignite - trigger market enthusiasm through a massive action, like BNB's Alpha launch, OKB's massive destruction, BGB's dual ecosystem loop; and then expand - continuously release new benefits at new price highs to maintain momentum and capital inflow.

In 2025, we can see BNB, OKB, and BGB are all interpreting this logic in their own ways.

1、BNB

From around $250 at the beginning of 2023 to breaking through $800 in 2025, BNB achieved over three times growth in two years.

This round of price increase was largely ignited by Binance Alpha.

Over the past half year, Binance Alpha became the largest traffic pool in the crypto. On the Alpha page, users can participate in early project IDOs by completing tasks, staking BNB, and have the opportunity to obtain token lottery qualifications before the project launch, with monthly earnings far exceeding the average white-collar salary.

However, Alpha is not an isolated product, but is connected by on-chain operation scenarios across the entire BNB Chain: Alpha not only provides tasks and lottery opportunities but also serves as a traffic entry point guiding users to explore the BNB Chain.

Users transformed from passively "hoarding coins and offsetting fees" to becoming "chain natives" - learning to use Binance Wallet, PancakeSwap, and other on-chain ecosystem tools for Swap, LP, lending, and even trading meme coins and contracts, becoming true "BNB Chain natives". This change in operational habits is an important driving force for BNB's growth in this cycle.

Since the beginning of 2024, BNB Chain has not only seen the emergence of core projects like Pancake, Lista, Four.meme, and Aster at the protocol layer, but network basic indicators have also simultaneously risen.

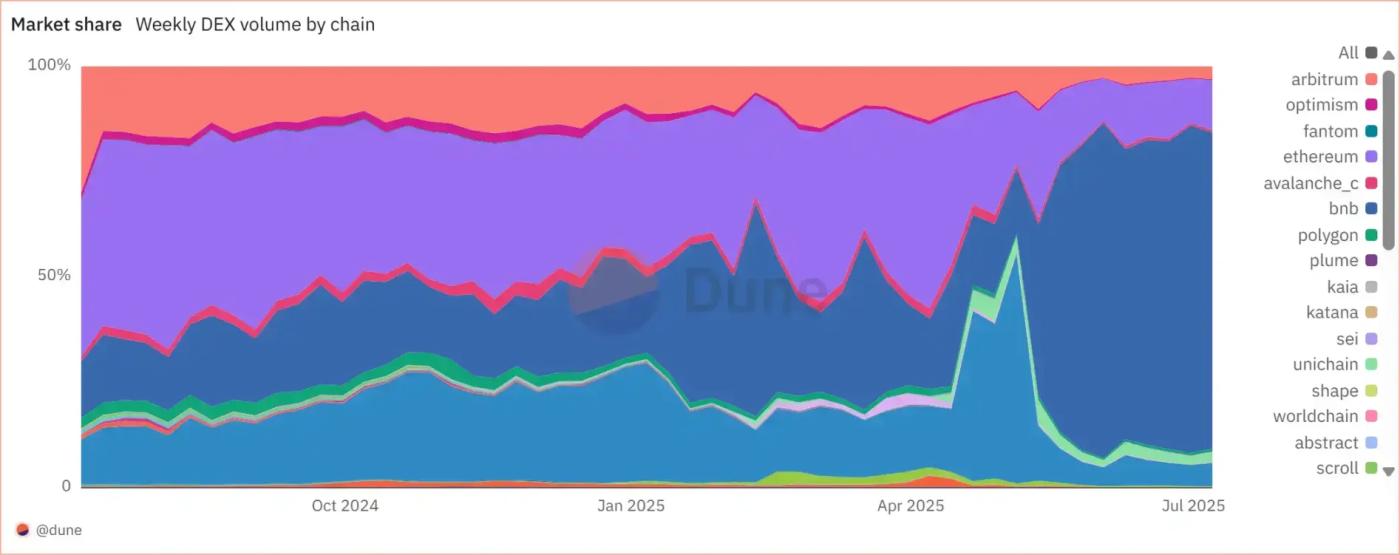

Evolution of each public chain's share in weekly DEX trading volume, where deep blue represents BNB Chain, data source: Dune

From this stacked area chart, it can be seen that BNB Chain has risen from a "steady follower" to the public chain with the largest trading volume in the past year. Additionally, the Maxwell upgrade has brought new breakthroughs, reducing block time from 1.5 seconds to 0.75 seconds as the third core network upgrade this year, making on-chain responses more rapid.

In a sense, BNB has completed an evolution from "platform token endorsement" to "ecosystem value carrier", and achieved absolute dominance in the multi-chain landscape.

From a broader financial market perspective, BNB has attracted major institutions to convert billions of dollars in strategic bets into on-chain reserves and capital appreciation, becoming a key choice for stock hoarding.

This evolution path from platform rights to ecosystem main currency, and then to institutional reserve assets, is the primary reason for BNB's continuous rise over the past two years.

(The translation continues in the same manner for the rest of the text, following the specified translation rules)After Bitget Wallet's upgrade, BGB and its points system are interconnected, allowing wallet users to directly earn or consume BGB points when Swapping on-chain, cross-chain, or participating in DeFi. This step extends BGB's usage scenarios beyond exchanges, expanding the platform token's value anchor from a single CEX to real on-chain demand.

This "internal and external" approach allows BGB to carve out an independent path in the CEX platform token competition:

Internally using Launchpad and staking to lock liquidity, externally using wallet and on-chain points to create consumption scenarios, supplemented by high-frequency burning to support value. From the price curve, BGB's rise is not driven by single positive news, but by new actions that can be implemented each quarter, continuously building market expectations.

This might also explain why BGB can maintain high Beta in 2025 among similar platform tokens while steadily rising.

Platform Token Track Will Not Cease Warfare

Looking back at 2021, that "burning war" smashed out market value and landscape; four years later, platform tokens remain the sharpest weapon for exchanges - capable of creating scarcity and FOMO while delivering real utility in ecosystem expansion.

The difference is that 2025's platform tokens are no longer mere fee deduction vouchers, but complex assets fighting on three fronts: global licenses, on-chain ecology, and capital markets. The rising paths of BNB, OKB, and BGB are samples of this evolution.

Could this be the starting point of a new CEX "arms race"?

No one can provide an exact answer. But one thing is certain: in this track, there has never been a true ceasefire - whoever can burn, sustain, and run faster will leave competitors behind in the next market trend.

After all, in the increasingly competitive CEX track, what matters is not just burning circulation to enhance token price, but also seizing opportunities from competitors.