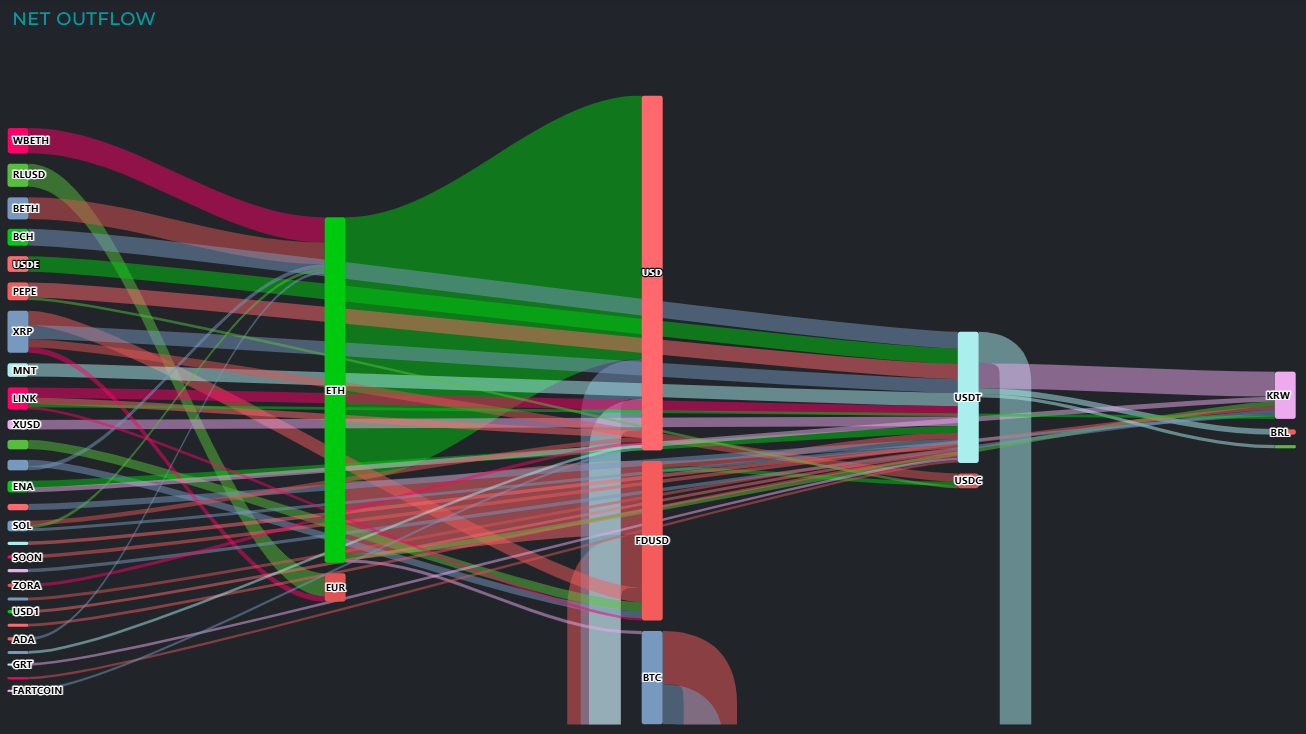

In the cryptocurrency market, a clear pattern of 'major coin concentration vs. profit-taking' emerged as funds concentrated on Bitcoin and Ethereum while massive cash conversion to dollars occurred simultaneously.

According to Cryptometer's compilation as of the 14th, the most active inflow in the global cryptocurrency market over the past 24 hours was Euro (EUR) funds, totaling $82.7 million.

Euro funds were distributed primarily to ▲BTC ($44.5 million) ▲ETH ($23 million) ▲USDT ($12.6 million) ▲ADA ($2.5 million), with a notable concentration on traditional strong assets Bitcoin and Ethereum.

Korean Won-based inflow was calculated at $54.8 million. The main directions were ▲BTC ($27.1 million) ▲XRP ($10.9 million) ▲Doge ($10.5 million) ▲ADA ($3.3 million) ▲WLD ($3 million), with a clear buying trend centered on major assets.

US Dollar funds totaling $40.3 million were distributed to ▲RLUSD ($11.9 million) ▲Doge ($9.9 million) ▲ADA ($8.6 million) ▲XRP ($7.2 million) ▲XLM ($2.7 million), spreading relatively diversely across assets.

Japanese Yen funds of $14.9 million were entirely directed to BTC, showing a single concentration.

In stablecoin USDT, $405.3 million moved. This was distributed to ▲ETH ($128.2 million) ▲OKB ($41.2 million) ▲USDC ($36.9 million) ▲BNB ($32.6 million) ▲Doge ($32.1 million) ▲TRX ($20.8 million) ▲ADA ($17.5 million) ▲SOL ($10 million). Some were also inflow to altcoins like HBAR, RAY, BETH, INJ, XLM, and WBETH.

The fund flow starting from stablecoin USDC was calculated at a total of $145.6 million. Over half flowed into ▲BTC ($88.2 million), with distributions to ▲ETH ($41 million) ▲SOL ($7.1 million) ▲FET ($2.8 million) ▲Aave ($2.6 million).

On this day, the concentration on the two major assets ETH ($192.2 million) and BTC ($190.2 million) was maintained. Only small amounts of funds moved from ETH to TRX ($3.5 million), and from BTC to ARB ($5.1 million) and BNB ($2.8 million).

Other major inflow destinations included ▲Doge ($52.5 million) ▲OKB ($41.2 million) ▲ADA ($31.9 million) ▲BNB ($35.3 million) ▲TRX ($24.3 million) ▲SOL ($17.1 million) ▲RLUSD ($23 million) ▲OKB ($41.2 million) ▲XRP ($18.1 million).

On this day, XRP showed the most prominent selling pressure. A total of $50.6 million was withdrawn, recording an overwhelming scale. Funds were distributed to ▲FDUSD ($17.4 million) ▲USDT ($16.4 million) ▲USDC ($9.9 million) ▲Euro ($6.7 million).

Pepe also saw $21.2 million withdrawn, distributed to ▲USDT ($18 million) ▲USDC ($3.2 million), confirming a selling trend.

LINK saw $26.6 million withdrawn, flowing into ▲USDT ($12.3 million) ▲Dollar ($7.7 million) ▲Korean Won ($3.5 million) ▲FDUSD ($3.1 million).

WBETH ($29.5 million) and BETH ($25.5 million) were massively converted to ETH, reinforcing the concentration on the Ethereum network.

RLUSD ($27 million) was converted to Euro, while BCH ($19.8 million), USDE ($18.2 million), MNT ($15.5 million), XUSD ($11.1 million) moved to USDT, supporting the cash conversion trend.

Selling trends were also observed in ENA, SOL, SOON, ZORA, USD1, ADA, WLD, etc.

At the central transit point, ETH funds of $406.2 million moved, mostly converted to ▲Dollar ($310.3 million). Additionally, it moved to ▲FDUSD ($86.6 million) ▲Korean Won ($5.8 million) ▲BTC ($3.5 million). BTC also saw $121.3 million withdrawn, flowing to ▲FDUSD ($67.6 million) ▲Dollar ($53.7 million).

Stablecoin USDT accumulated $179.7 million. This was dispersed to ▲Dollar ($39 million) ▲Korean Won ($28.3 million) ▲Real ($6.7 million) ▲Lira ($3.9 million).

FDUSD gathered $194 million, with some moving to ▲USDT ($13 million) and ▲USDC ($4.8 million). USDC ($17.9 million) showed a circulation flow mostly to USDT ($16.6 million).

Ultimately, the largest conversion to fiat currency was ▲Dollar ($420.7 million), with cash conversion movements also seen to ▲Korean Won ($55.3 million) ▲Euro ($33.6 million) ▲Brazilian Real ($6.7 million) ▲Turkish Lira ($3.9 million).

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>