Perpetual futures have price differences based on investment sentiment. The futures market adjusts these price differences through the Funding Rate. When futures prices are high, longs pay shorts, and when low, shorts pay longs to balance spot and futures prices. By utilizing this structure, an investment strategy exists where one can purchase spot assets, take a short position in futures to hedge asset price fluctuations, and earn revenue through funding rates. Top items indicating profit opportunities through real-time data with high funding rates have been compiled. [Editor's Note]

As of August 15th, 12:11, according to DataMaxiPlus, SKL (BitGet futures and BitGet spot) was calculated as the item expected to have the largest funding rate revenue based on $10,000.

SKL has a funding rate of −0.0063, with an annualized return rate of 6.91%, and annual funding rate revenue is analyzed to reach approximately $34,476. In a strategy taking a long position on BitGet futures and a margin short position on Binance spot, the same return rate is maintained with a price difference of 0.97%.

Additionally, similar revenues can be obtained through combinations of various exchanges such as HTX, Gate.io, and Binance, with strategies based on negative funding rates being particularly prominent. This strategy involves receiving funding rates through futures long positions and hedging price risks with short positions or similar assets in spot markets.

Margin trading inevitably involves interest costs and slippage, so developing a strategy reflecting actual return rates is crucial. For assets with persistent negative funding rates, profit can be realized even through short-term holding, making the entry barrier relatively low.

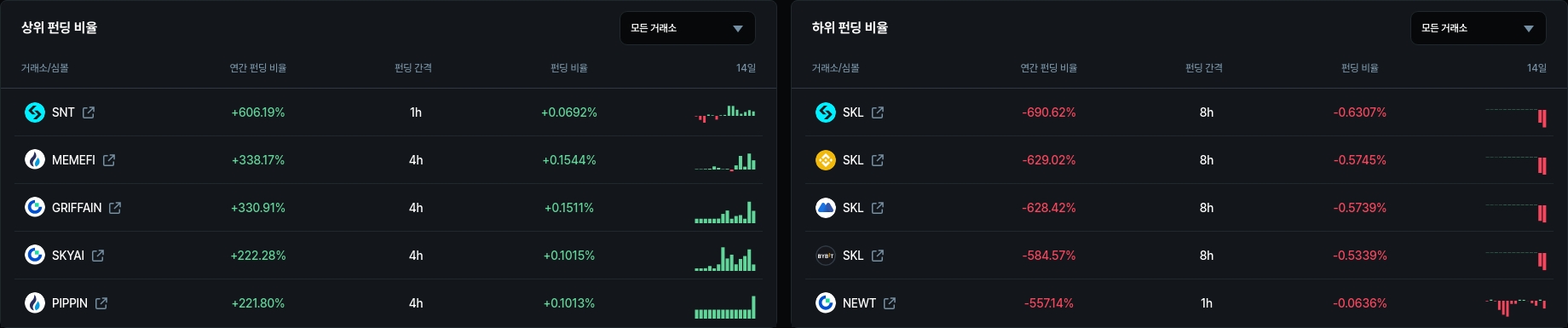

Highest and Lowest Funding Rate Items at This Moment

🔼 Top 5 Highest Funding Rates

▲SNT(BitGet, 0.000692, Annualized 6.06%)

▲MEMEFI(HTX, 0.001544, Annualized 3.38%)

▲GRIFFAIN(Gate.io, 0.001508, Annualized 3.30%)

▲SKYAI(Gate.io, 0.001019, Annualized 2.23%)

▲SKYAI(HTX, 0.001015, Annualized 2.22%)

🔽 Bottom 5 Lowest Funding Rates

▲SNT(BitGet, previously recorded −0.00343)

▲MEMEFI(HTX, previously recorded −0.00138)

▲SNT(BitGet, previously recorded −0.00198)

▲SNT(BitGet, previously recorded −0.00189)

▲No clear negative funding rate items at the current point

Experts interpret that items with high funding rates show a clear preference for long positions, while items with negative funding rates indicate selling dominance. By comprehensively analyzing funding rate trends and price movements, market sentiment can be more effectively understood.

When funding rates are high or positive, long position demand is high, making futures prices relatively more expensive than spot prices, requiring long positions to pay funding rates to short positions. Investors can secure funding rate revenue by implementing spot purchase and futures short-selling strategies.

Conversely, when funding rates are low or negative, short position demand is high, making futures prices lower than spot prices, requiring short positions to pay funding rates to long positions. Investors can maximize funding rate arbitrage by utilizing spot selling and futures long strategies.

Funding rate arbitrage is a strategy that can aim for stable revenue regardless of market volatility, even when long-term market direction is difficult to predict. However, as funding rates are highly variable depending on market participants' position ratios, a strategic approach considering funding rate differences between exchanges and capital costs is necessary.

[This article does not provide financial advice, and investment results are the sole responsibility of the investor.]

News in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>