Total cryptocurrency liquidation exceeded $1 billion in the past 24 hours. The cryptocurrency market capitalization dropped to $3.98 trillion, decreasing by $133 billion during the same period.

90% of the top 10 cryptocurrencies declined. Experts point to the July Producer Price Index (PPI) report as the primary cause of the decline.

PPI Report Impact...Cryptocurrency Market Liquidates Over $1 Billion

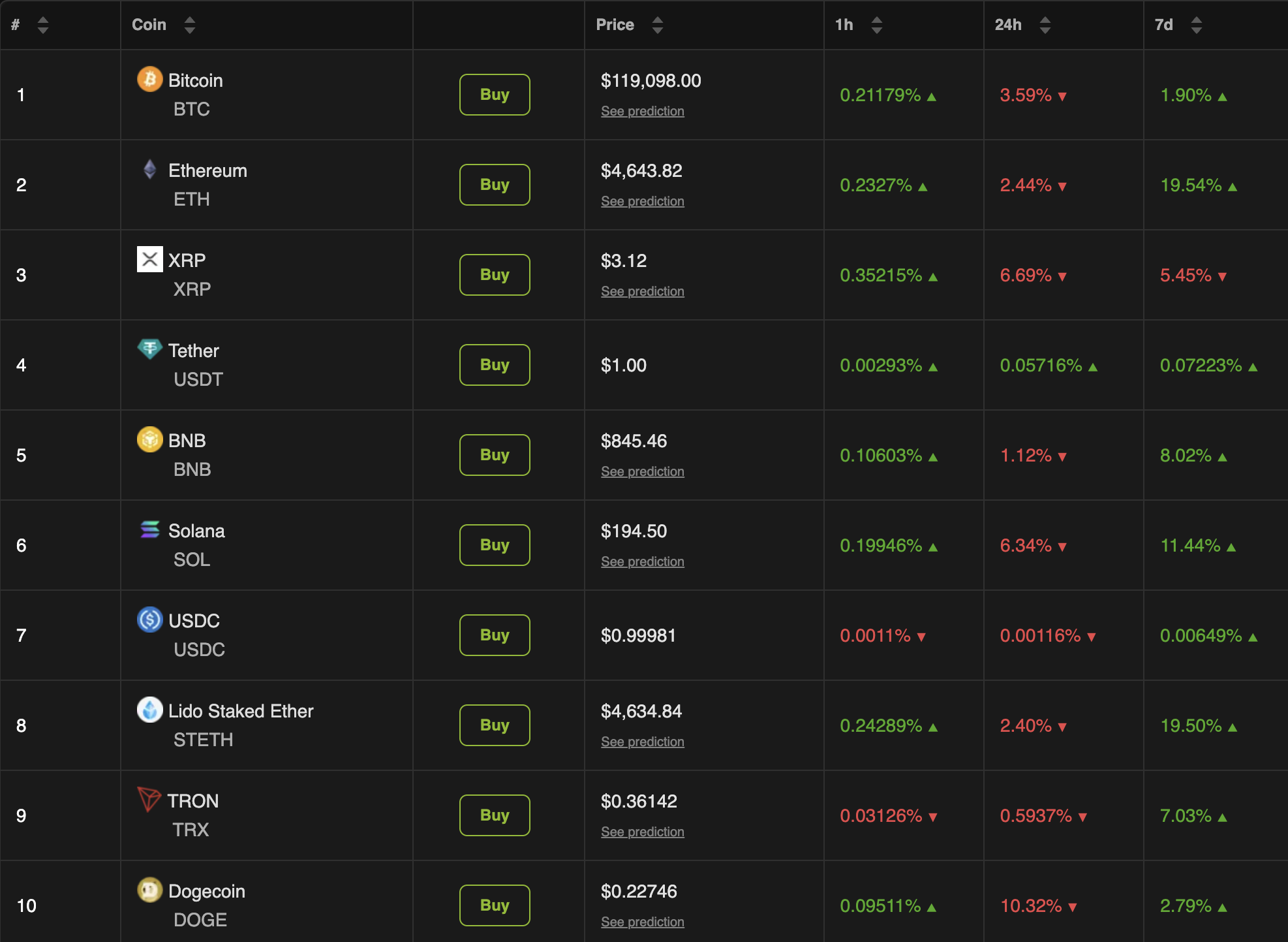

According to Beincrypto Market Data, the market dropped 3.9% over the past day. All top 10 coins except USDT experienced losses.

BTC dropped to $119,098 at the time of reporting, after reaching an all-time high of over $123,700 yesterday.

ETH also dropped to $4,452 yesterday and was adjusted to $4,643 at the time of reporting. It still declined by 2.4% over the past day.

Doge experienced the largest loss among the top 10 coins, with its value dropping by 10.3%. This market decline triggered massive liquidations.

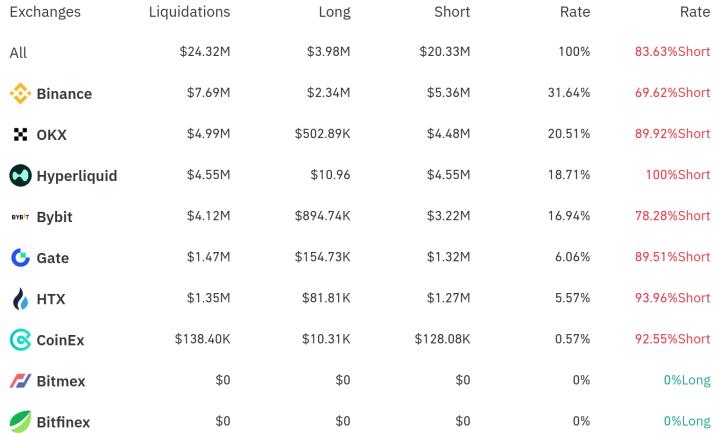

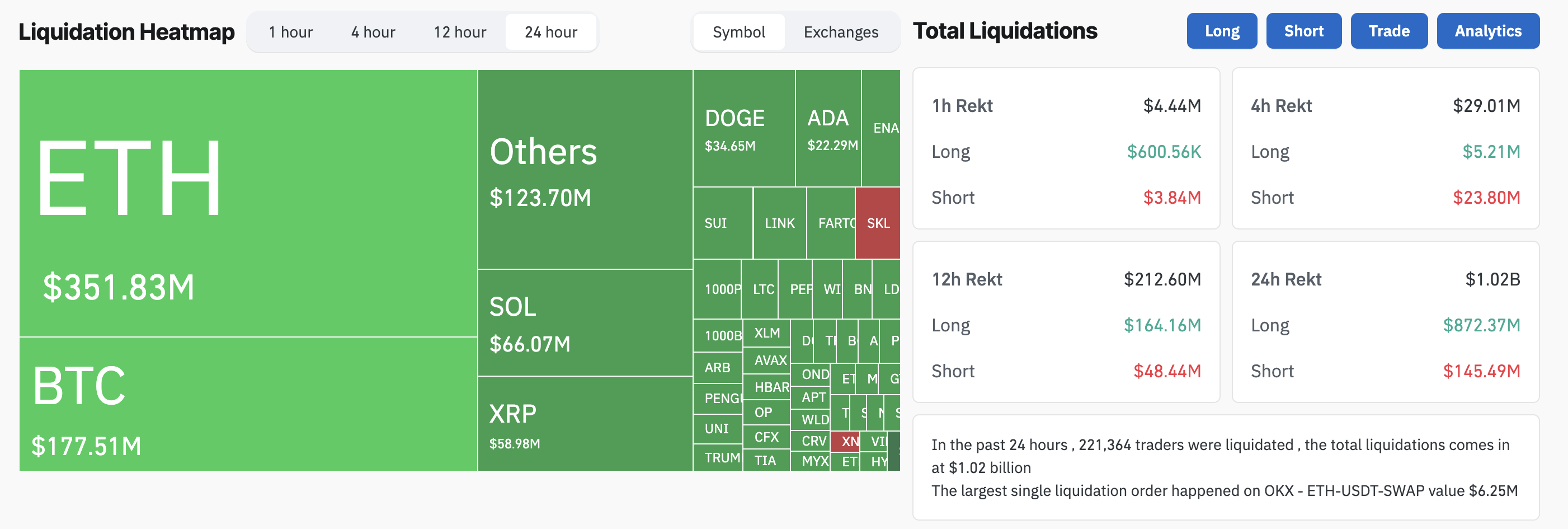

According to glassnode data, $1.02 billion in cryptocurrency positions were liquidated within 24 hours, affecting 221,364 traders. Long positions accounted for most of the losses, with $872.37 million liquidated.

Meanwhile, short positions saw $145.49 million in liquidations, suggesting the market moved contrary to price rise expectations.

Ethereum recorded the highest liquidation at $351.8 million, including $272.47 million from long positions and $79.36 million from short positions.

But what caused this sharp market collapse and liquidations? According to renowned cryptocurrency expert Michael van de Poppe, it's due to PPI data.

"There's always 'some news' that brings the market down. That 'some news' is PPI. This is just liquidation after altcoin long liquidations. So the correction is essential and steep." – Michael van de Poppe, Cryptocurrency Expert Post

The US Bureau of Labor Statistics released the July PPI report on August 14. The PPI index rose 0.9%, exceeding economists' 0.2% increase expectation. Additionally, PPI increased by 3.3% year-on-year.

"On an unadjusted basis, the final demand index rose 3.3% in the 12 months ending in July. This is the largest 12-month increase since a 3.4% rise in February 2025." – Report

🇺🇸 PPI RISES TO 3.3%

— Mister Crypto (@misterrcrypto) August 14, 2025

HIGHER THAN EXPECTATIONS.

BEARISH FOR MARKETS. pic.twitter.com/j0FSOafK4d

This higher-than-expected data is bearish for cryptocurrencies, indicating strong inflationary pressure. This could ultimately lead to tightening monetary policy and higher interest rates.

This could reduce liquidity, make traditional investments more attractive, and cause a retreat from risky assets like cryptocurrencies. Structural factors further exacerbated the market's vulnerability.

A recent glassnode post highlighted that altcoin open interest reached an all-time high, making the market particularly vulnerable.

"This leverage concentration increases reflexivity, amplifying price reactions' ups and downs and increasing market structure vulnerability." – glassnode Post

Additionally, US Treasury Secretary Scott Bessent's statement could contribute to bearish sentiment. Bessent recently revealed that the US strategic Bitcoin reserve would be funded solely by seized assets.

Therefore, the combination of high PPI index, cryptocurrency market vulnerability, and policymakers' signals created the perfect storm of cryptocurrency liquidations. The broader market is now tense, and investors are carefully monitoring future economic data and Federal Reserve actions to find additional clues about monetary policy direction.