This article is contributed and does not represent ChainCatcher's perspective, nor does it constitute any investment advice.

For a long time, Bitcoin has been viewed as the "digital gold" of the crypto world, attracting numerous long-term holders due to its value storage and inflation-resistant properties. However, with the rapid development of on-chain finance, Bitcoin's potential for capital efficiency remains largely untapped. Ethereum has given birth to the Liquid Staking Token (LST) ecosystem through its staking mechanism - stETH not only allows ETH holders to earn staking rewards but also enhances DeFi liquidity and capital composability. In comparison, despite leading the market with approximately 60% market share and a market capitalization of around $2.4 trillion, Bitcoin's on-chain operability, yield generation, and composability have been long limited - leaving enormous space for BTC DeFi development.

Over the past year, the crypto market's discussion has gradually shifted from short-term speculation to asset efficiency and on-chain yield generation. Ethereum's staking economy has become mature, with liquid staking assets like stETH unlocking new capital deployment strategies: users can obtain staking rewards while simultaneously deploying these assets in DeFi to generate additional income. Meanwhile, as the largest market cap crypto asset, Bitcoin has lacked similar mechanisms. Most BTC holders either choose to keep assets idle or rely on centralized exchanges for limited returns, restricting their ability to actively participate in on-chain capital operations.

Bitcoin's composability challenges have also become a focal point of market discussions. With the rise of multi-chain ecosystems, investors are no longer satisfied with holding BTC merely as a value store, but hope it can generate yields, serve as collateral for lending, and participate in derivatives markets. This expectation shift has driven community and institutional exploration of BTC liquidity innovation - especially in Asia, where DeFi adoption is accelerating and BTC holders' demand for secure yield channels continues to rise.

In this context, Lombard launched LBTC, an interest-bearing Bitcoin asset. LBTC is an institutional-grade yield-generating Bitcoin, 100% backed by BTC and freely composable in DeFi. Its passive income comes from staking the underlying BTC to Babylon's Bitcoin staking protocol, enabling capital allocators to achieve asset growth while maintaining Bitcoin's core exposure. Compared to WBTC, LBTC adds yield attributes; compared to decentralized wrapping solutions like tBTC, LBTC offers superior security and liquidity. LBTC's launch fills a critical gap in Bitcoin staking liquidity, allowing BTC investors to participate in on-chain "capital operations" similar to ETH holders.

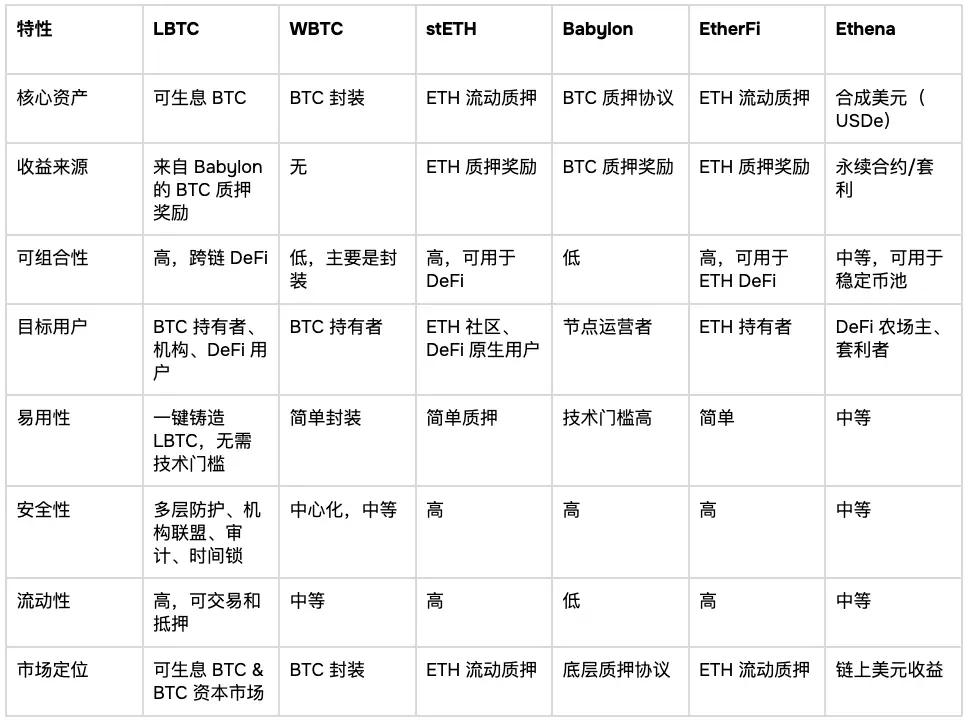

Compared to other platforms, LBTC's market positioning is very clear: Babylon provides the underlying staking protocol for technical node operators; EtherFi offers ETH liquid staking for the ETH community; Ethena provides synthetic dollar yields through perpetual contracts and arbitrage strategies; LBTC focuses on BTC holders and institutional investors, balancing low volatility and cross-chain composability, enabling users to efficiently deploy capital while maintaining safety.

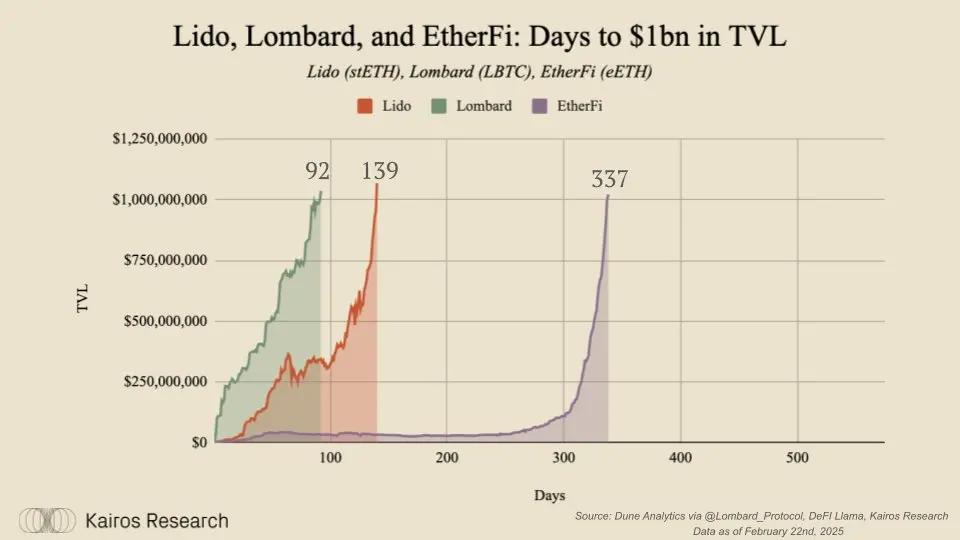

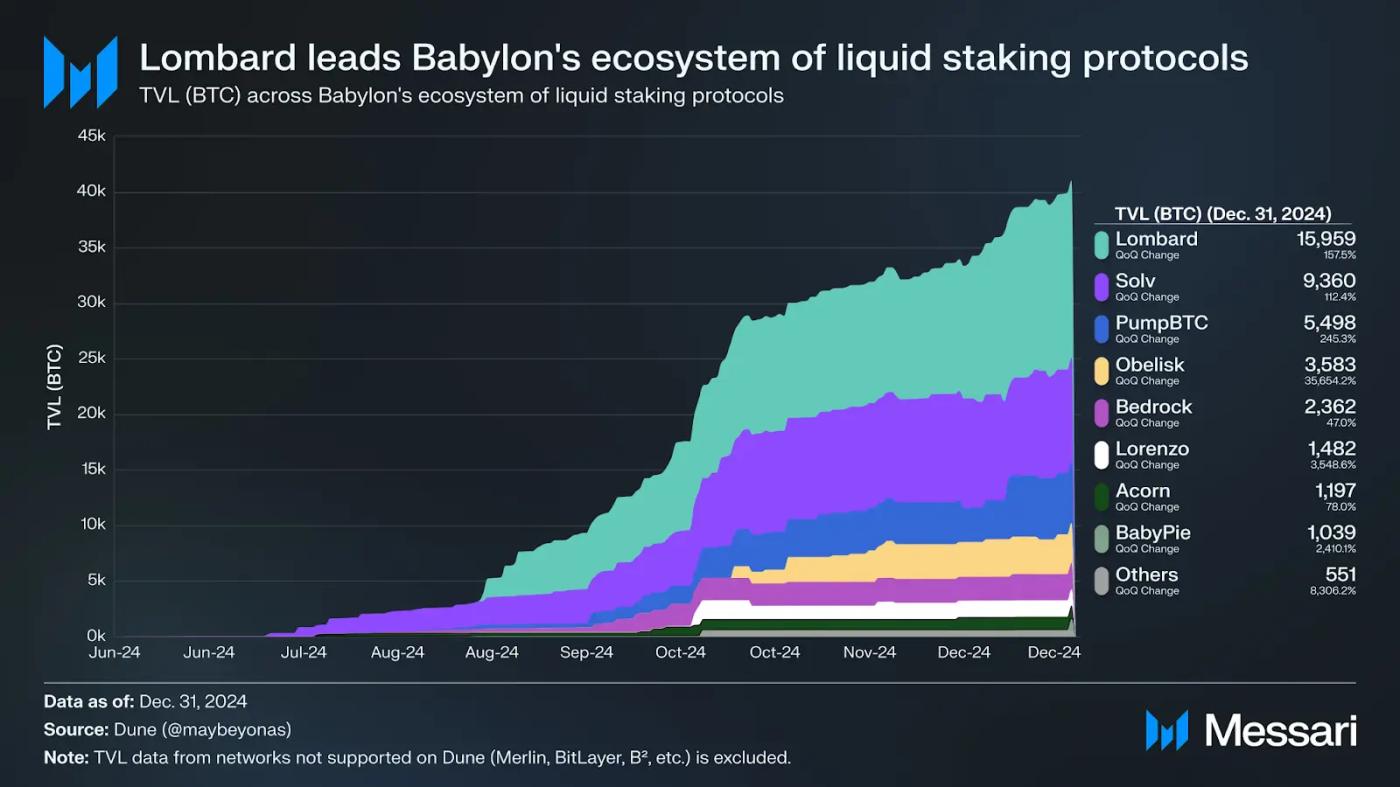

In terms of market performance, since launching in September 2024, LBTC has set records, reaching over $1 billion in TVL in just 92 days. Over 80% of LBTC is active in DeFi, used for lending, liquidity provision, and re-staking strategies, attracting over $2 billion in new liquidity. LBTC is also a crucial component of Babylon's Bitcoin staking protocol, occupying 40% market share and deeply collaborating with Finality Providers like Galaxy, Figment, Kiln, and P2P. Top DeFi protocols including Aave, Maple, Spark, and Morpho have incorporated LBTC as an institutional-grade collateral asset, providing BTC holders with low-risk, composable capital deployment capabilities.

In terms of security and technology, LBTC also maintains a leading position. Lombard has constructed a multi-layered security model, combining institutional alliances, audits, multi-approval, and time locks to ensure staked BTC's safety. Since launch, LBTC has never experienced a de-pegging event and achieves transparency through on-chain Proof of Reserves (PoR), further enhancing user confidence. This security and transparency have positioned LBTC as a "high-quality Bitcoin asset", similar to AAA-rated products in traditional finance.

LBTC's cross-regional deployment also highlights its strategic potential. Lombard SDK has integrated with Binance and Bybit, facilitating Asian users' participation in BTC DeFi. LBTC is already available on chains like Base, Sui, Katana, and BNB Chain, providing innovative tools and liquidity infrastructure for DeFi developers in China, Korea, and other regions. Combining low-risk yields with multi-chain composability, LBTC is not only a core asset for DeFi users but also opens new on-chain yield channels for long-term BTC holders.

In comparative dimensions, LBTC inherits the logic of ETH liquid staking (stETH model) but applies it to the BTC market, solving Bitcoin's long-standing lack of on-chain yields and composability. Compared to WBTC, LBTC adds yield; compared to Babylon, LBTC offers usability, tradability, and DeFi composability; compared to EtherFi, LBTC focuses on BTC's low-volatility assets and multi-chain deployment; compared to Ethena, while different asset categories, both provide on-chain capital appreciation tools. These comparisons clearly demonstrate LBTC's unique value and strategic positioning.

Comparison Table:

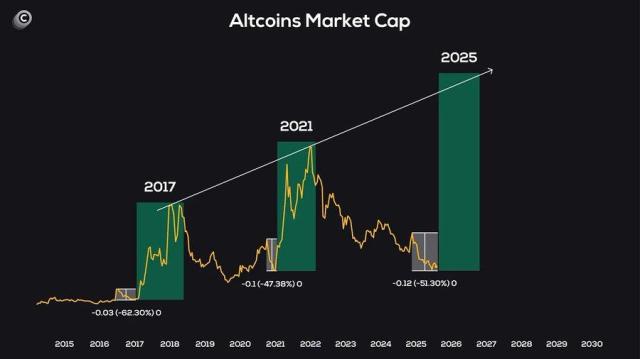

From an independent researcher's perspective, BTC's on-chain liquidity market still has enormous growth potential. As Bitcoin gradually becomes integrated into institutional asset management and DeFi products more deeply integrate BTC, liquid staking assets like LBTC will become mainstream investment tools. Especially in the Asian market, there is strong demand for low-risk, highly transparent, and highly composable BTC products, and LBTC has already validated the product's feasibility and market acceptance. For investors, early participation in such assets not only provides base returns but also allows them to occupy a first-mover advantage in BTC's on-chain financial ecosystem expansion.

Overall, LBTC is not only a critical juncture in Bitcoin's evolution from a value store to an on-chain capital market but also has the potential to become a cyclical engine driving BTC's on-chain financialization. Its core advantages in security, liquidity, yield, and cross-chain composability enable BTC holders and institutional users to unlock capital efficiency similar to the Ethereum ecosystem. In the next cycle, such products will reshape BTC's role in on-chain finance, transforming it from "digital gold" to a fully functional capital market and opening a new growth curve for the entire crypto industry.