The total cryptocurrency liquidation exceeded 1 billion USD in the past 24 hours, with the crypto market capitalization dropping to 3.98 trillion USD, a decrease of 133 billion USD in the same timeframe.

90% of the top ten cryptocurrencies declined in price. Moreover, experts point out that the July Producer Price Index (PPI) report was the primary reason for this decline.

Crypto Market Witnesses Over 1 Billion USD Liquidation Following PPI Report Impact

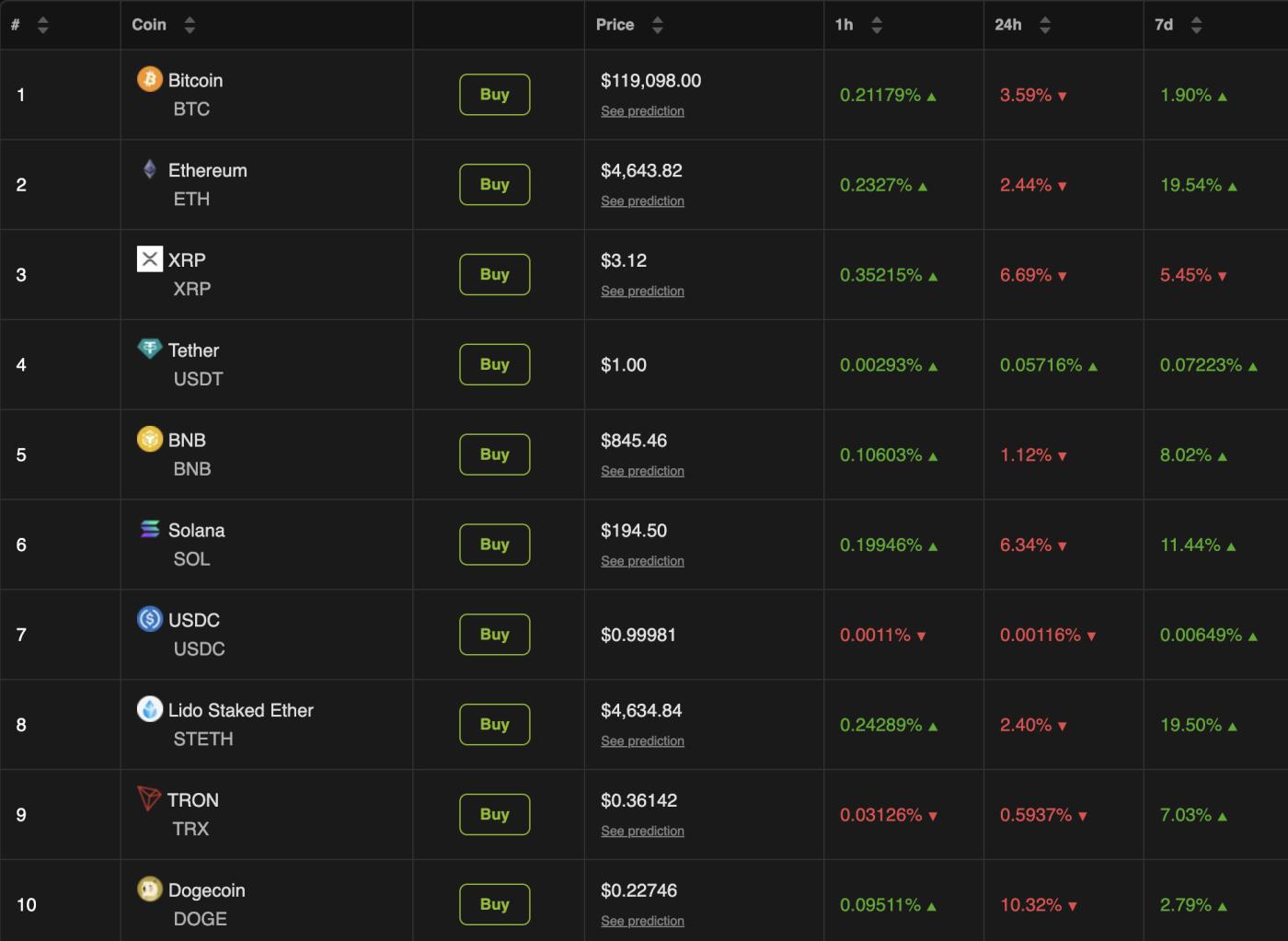

Data from BeInCrypto Markets shows the market dropped 3.9% in the past day. All currencies in the top ten except Tether (USDT) decreased in price.

Bitcoin (BTC) dropped to 119,098 USD at the time of writing, after reaching a new ATH of over 123,700 USD yesterday.

Cryptocurrency market performance. Source: BeInCrypto Markets

Cryptocurrency market performance. Source: BeInCrypto MarketsEthereum (ETH) also declined to a low of 4,452 USD yesterday, before adjusting to 4,643 USD at the time of writing. However, it still decreased by 2.4% in the past day.

Furthermore, Dogecoin (DOGE) experienced the largest decline among the top ten currencies. Its value dropped by 10.3%. This market decline triggered significant liquidations.

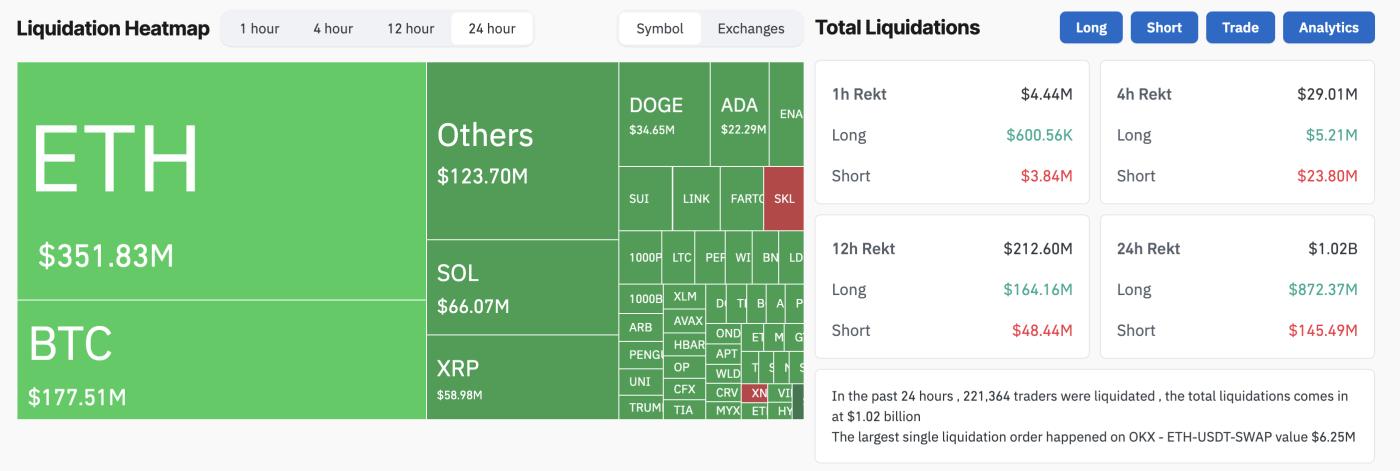

According to Coinglass data, 1.02 billion USD in cryptocurrency positions were liquidated within 24 hours, affecting 221,364 traders. Long positions accounted for most of the losses, with 872.37 million USD liquidated.

Meanwhile, short positions saw 145.49 million USD liquidated. This indicates the market moved contrary to price increase predictions.

Cryptocurrency liquidation in the past 24 hours. Source: Coinglass

Cryptocurrency liquidation in the past 24 hours. Source: CoinglassEthereum recorded the highest liquidation, reaching 351.8 million USD. This includes 272.47 million USD from long positions and 79.36 million USD from short positions.

But what caused this rapid market collapse and liquidation wave? According to famous crypto expert Michaël van de Poppe, it was PPI data.

"There's always 'some news' causing the market to drop. 'Some news' is PPI. It was just consecutive liquidations on altcoin long positions, which is why the correction was necessary and strong," he posted.

The Labor Statistics Bureau released the July PPI report on 08/14. The PPI increased by 0.9%. This exceeded economists' expectations of a 0.2% increase. Moreover, PPI increased by 3.3% compared to the same period last year.

"On an unadjusted basis, the index for final demand increased 3.3% in the 12 months ending in July, the largest 12-month increase since a 3.4% rise in February 2025," the report read.

This hotter-than-expected data is negative for cryptocurrency as it signals strong inflation pressure. This, in turn, could lead to tighter monetary policy and higher interest rates.

This reduces liquidity, making traditional investments more attractive and potentially causing a withdrawal from risky assets like cryptocurrencies. Structural factors further exacerbate market fragility.

A recent Glassnode post emphasized that open interest in altcoins has reached an ATH, making the market particularly vulnerable.

"This leverage concentration enhances reflexivity, amplifying both price increase and decrease reactions, and intensifying market structure fragility," Glassnode wrote.

Additionally, comments from US Treasury Secretary Scott Bessent could also contribute to negative sentiment. Bessent recently declared that the US Strategic Bitcoin Reserve will only be funded by confiscated assets and not through new purchase transactions.

Therefore, the combination of high PPI, vulnerability in the cryptocurrency market, and signals from policymakers created a perfect storm for cryptocurrency liquidations. Currently, the broader market remains tense, with investors closely monitoring upcoming economic data and Federal Reserve actions to find more clues about monetary policy direction.