Welcome to the US Cryptocurrency Morning News Briefing. We'll briefly summarize today's important cryptocurrency developments.

The world's largest sovereign wealth fund showed a quiet but dramatic movement in Bitcoin (BTC). The details are subtle, but its impact may not be negligible.

Today's Cryptocurrency News: World's Largest Wealthy Fund, Bold 83% Movement in Bitcoin

The world's largest Norwegian sovereign wealth fund significantly increased Bitcoin exposure in a pioneering, quiet but important institutional move.

Norway's Central Bank Investment Management (NBIM) increased its Bitcoin equivalent holdings by 83% in the second quarter (Q2) of 2025. Notably, NBIM manages Norway's $1.6 trillion oil fund.

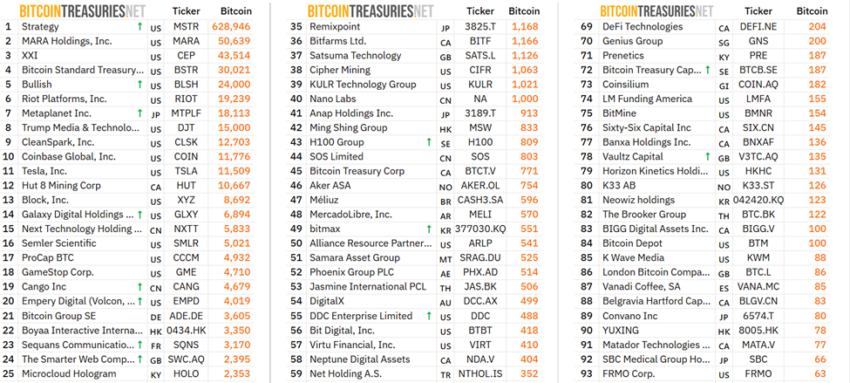

The fund's exposure increased from 6,200 to 11,400 BTC equivalent. Most of NBIM's Bitcoin exposure is indirectly held through MicroStrategy (MSTR) stocks, which is the largest corporate Bitcoin holder.

Nevertheless, NBIM has started a small position of 200 BTC equivalent in Japan's MetaPlanet.

Jeff Kendrick, Standard Chartered's Digital Assets Research Head, mentioned the scale of this movement in a statement to BeInCrypto.

"I wrote a 13F report on BTC ETF, MSTR, and MetaPlanet. The most interesting detail this time was NBIM's purchase of MSTR and MetaPlanet," Kendrick stated.

NBIM has not released a public statement about the increase, but this move occurred within a broader wave of institutional participation in Bitcoin through listed stocks and ETFs.

Sovereign wealth funds are considered particularly long-term and strategically cautious investments. Therefore, this significant exposure increase is noteworthy.

This point coincides with Bitcoin's steady price rise over the last quarter. Strong ETF inflows and increased corporate and government adoption are the driving forces. Other factors include macroeconomic uncertainty.

For NBIM, which must ensure long-term returns for Norway's future generations, Bitcoin allocation represents a small portion of total assets.

However, as mentioned in recent US cryptocurrency news publications, this could be a strategic hedge against currency value decline and geopolitical risks.

NBIM's recent movement may not be an isolated case. Industry analysts point to an increasing trend among sovereign wealth funds and large pension managers.

As BeInCrypto reported, some of these institutions are quietly exploring Bitcoin as part of a diversified long-term portfolio.

If these quiet but decisive allocations continue, they could significantly improve Bitcoin's liquidity profile and institutional credibility. This change could be the early stages of sovereign wealth fund-backed Bitcoin adoption.

Today's Chart

Byte Size Alpha

Summary of today's notable US cryptocurrency news:

- Cryptocurrency market liquidation exceeded $1 billion. PPI report triggered the decline.

- Bitcoin price closed the $117,400 CME gap. This raised high interest and attention.

- SEC filing documents revealed Wells Fargo and Abu Dhabi's Bitcoin ETF strategy.

- Senator Lummis is pushing for gold revaluation. To bypass the 15% seized Bitcoin bottleneck.

- Experts are concerned about SKALE's trading volume. Experiencing a 145% price surge.

- Ethereum faces second-highest annual selling wave. Is $5,000 still valid?

- Investors are abandoning Pie Network. Three signals of increasing exodus.

- Meme coin dominance drops to 18-month low. What caused the decline?

- Is SKALE (SKL) collaborating with Google? Speculation drove a 51% price increase.

- Binance Bitcoin deposits surged. This is a potential selling signal.

Cryptocurrency Stock Market Overview

| Company | Closed on August 14 | Market Overall Overview |

| Strategy (MSTR) | $372.94 | $373.23 (+0.078%) |

| Coinbase Global (COIN) | $324.89 | $325.00 (+0.034%) |

| Galaxy Digital Holdings (GLXY) | $28.57 | $28.84 (+0.95%) |

| MARA Holdings (MARA) | $15.75 | $15.77 (+0.12%) |

| Riot Platform (RIOT) | $12.25 | $12.20 (-0.41%) |

| Core Scientific (CORZ) | $13.84 | $13.62 (-1.55%) |