Bitcoin's price has fallen from its all-time high (ATH), suggesting changes in market conditions. While this decline may seem ordinary, it could indicate concerns about future volatility.

Historical clues suggest that a volatility explosion may be approaching, and major holders might turn neutral.

Bitcoin Faces Calm Before the Storm

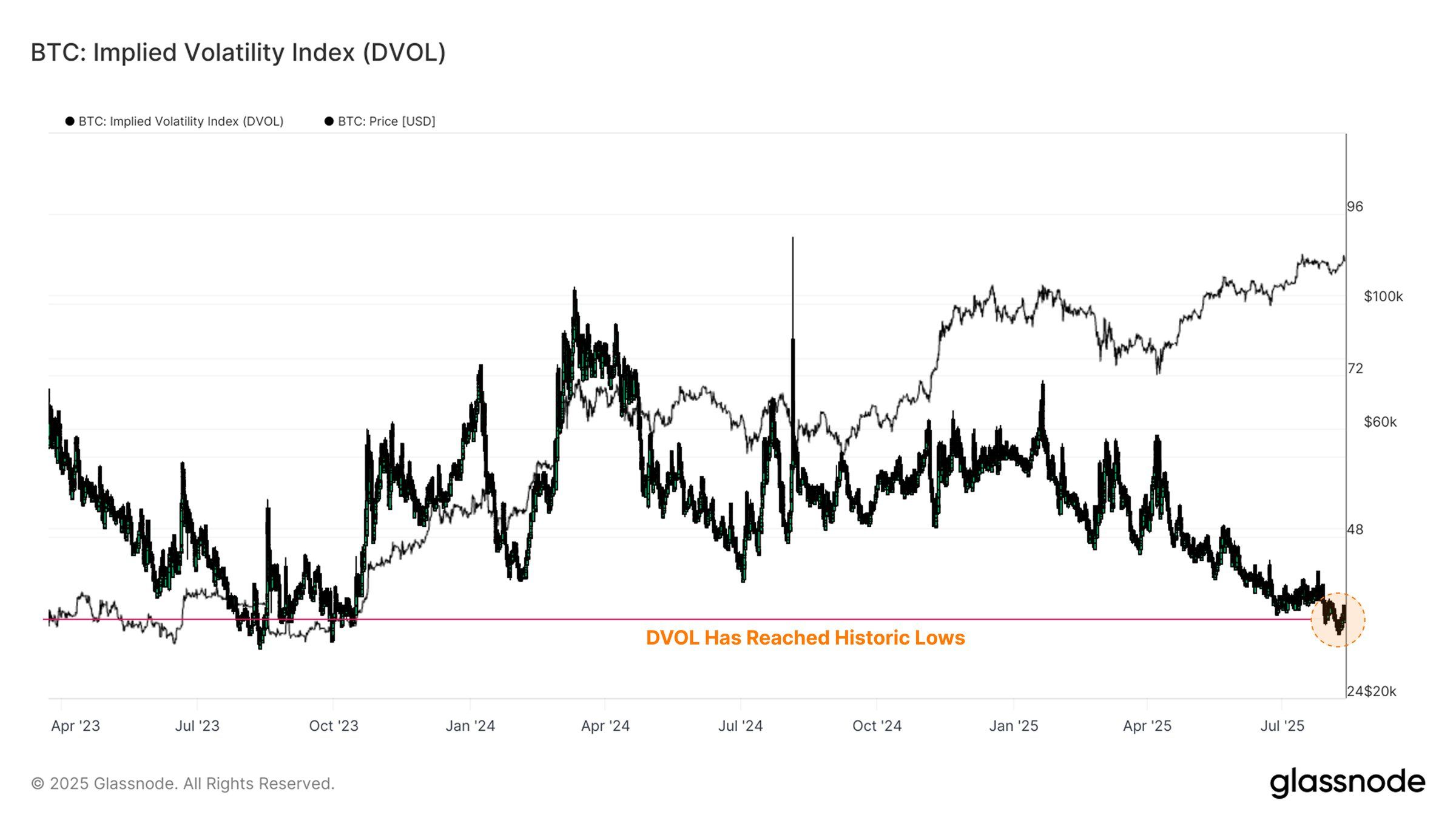

The Bitcoin DVOL index tracks the asset's volatility and is historically at low levels. Only 2.6% of days have experienced lower values, indicating extreme market complacency. This suggests that investors are not preparing for potential declines, and unexpected events could trigger significant price movements.

DVOL measures expected price fluctuations for the upcoming month, and the current low level reflects traders' relaxed outlook. However, this calm may be temporary, with volatility shocks often occurring after periods of complacency. If unexpected market events occur, Bitcoin could experience sharp price changes that might surprise investors.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

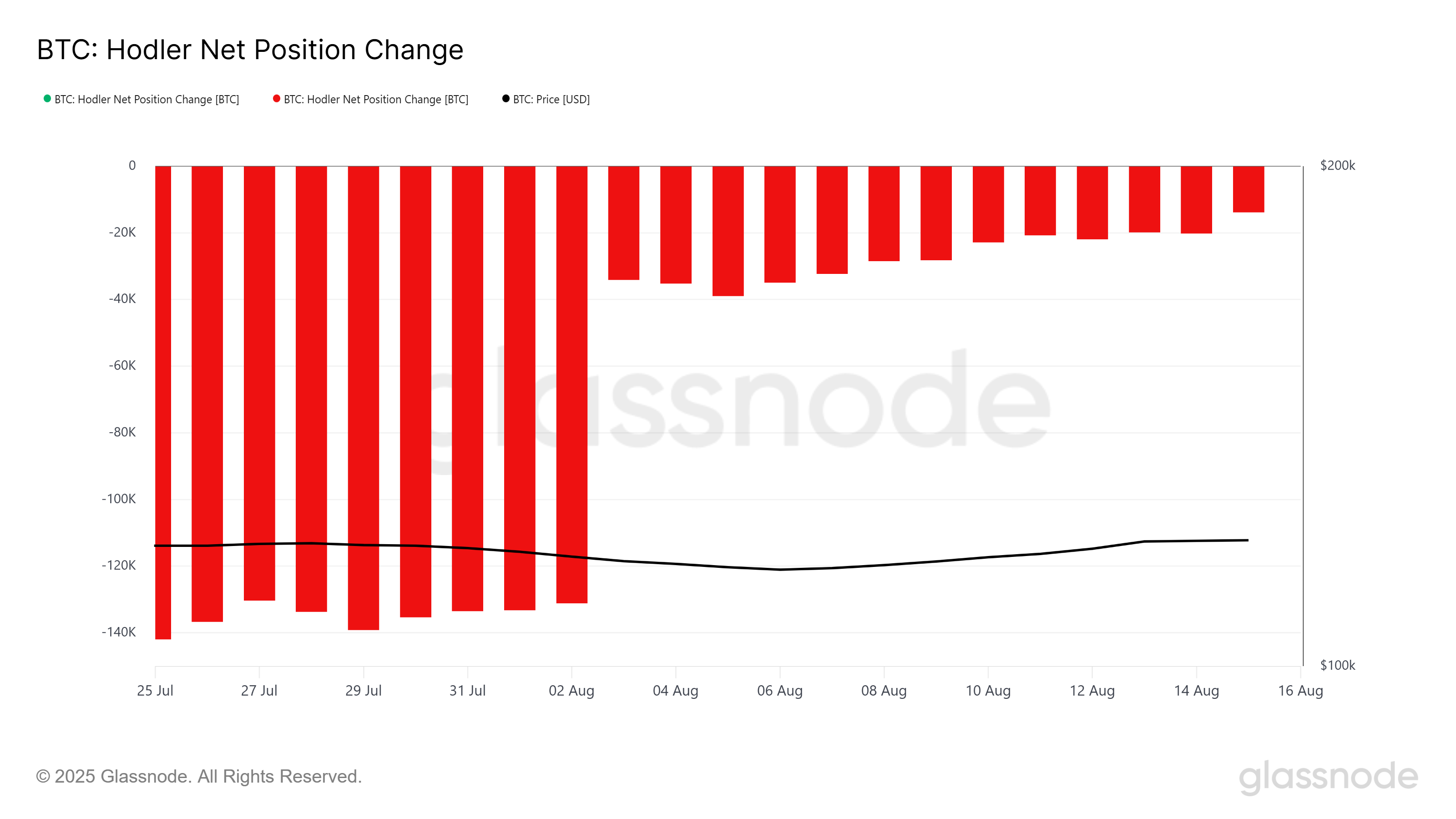

Bitcoin's overall macro momentum shows a distinct change in investor behavior. HODLer net position change has slowed, indicating decreased activity among long-term holders (LTH). LTH began accumulating at the beginning of this month, but this purchasing trend was interrupted due to market uncertainty.

Despite the lack of new buying activity, the absence of selling suggests some optimism among these holders. They appear to be waiting for a clearer market direction before making their next move. This indicates that LTH are cautious but are maintaining their positions, expecting that a volatility surge could eventually lead to price increases.

BTC Price May Maintain Support

Bitcoin's price had been rising throughout the month, but its momentum weakened in the past 24 hours, with BTC dropping to $117,305. This decline, falling below the established uptrend line, suggests a shift in market sentiment.

If investors maintain their positions during the expected volatility surge, Bitcoin could stabilize above $117,000. This opens the potential for a rise to $120,000, which could be converted to a support level, enabling further increases.

However, if investor sentiment turns bearish and selling increases in response to volatility, Bitcoin could experience a significant drop. In this case, the price could break below the $115,000 support and fall to $112,526. This would invalidate the August rise and negate the bullish outlook.