[How's the domestic market today?] Upbit sees 3.4 trillion won in transactions... The bullish theme is 'infrastructure,' while the bearish trend is centered on DeFi.

This article is machine translated

Show original

According to Upbit market data, from midnight to 1:08 PM on August 16th, the daily trading volume was 598.462 billion won, and the cumulative trading volume for the recent 24 hours was 3.37 trillion won. The 24-hour trading volume decreased by 54.26% compared to the previous day, showing a noticeable contraction in trading.

Looking at the theme-based trading flow, trading volume was concentrated in the 'Infrastructure' and 'Smart Contract Platform' areas.

In the Infrastructure theme, Gas (+3.86%) showed a prominent upward trend, recording the highest increase within the theme. XRP (+0.49%), BTC (-0.20%), and ETC (-0.26%) displayed limited fluctuations.

In the Smart Contract Platform, ADA (+0.53%) and SOL (+0.38%) remained in a strong consolidation range and drew attention, while ETH (-0.45%) and WAVES (-1.80%) showed a downward trend.

The DeFi theme continued to perform poorly. STRIKE (-4.32%) showed a significant decline, and USDT (-0.43%) also experienced a slight adjustment. ENA remained flat (0.00%).

In the Meme theme, Doge (+0.94%) saw a slight increase and maintained a steady trend, while PENGU (-0.66%) and TRUMP (-1.24%) declined slightly.

In the Culture & Entertainment theme, M CONTENT (+0.33%) showed a strong consolidation, while other assets declined by 2.33%. In the Unclassified theme, PROVE (+3.64%) demonstrated a clear upward trend, differentiating itself from other assets.

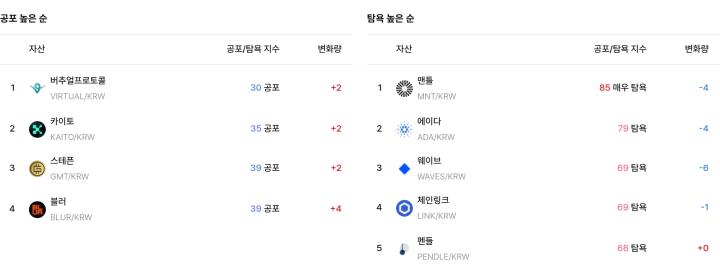

In the Upbit market, the number of rising assets generally exceeded the number of declining assets. The asset fluctuation count was +37, meaning 37 more assets rose than fell.

The 7-day moving average was -23.57, indicating a continued weak trend, but the day-to-day change was +49, suggesting a potential improvement in investment sentiment.

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content