Gemini, the cryptocurrency exchange co-founded by Cameron and Tyler Winklevoss, has officially filed an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC). This application follows an initial private draft submission in early June.

According to the application, Gemini plans to list Class A common stock on the Nasdaq Global Select Market with the ticker symbol GEMI.

Winklevoss Brothers Maintain Strict Control

The application provided details about the dual-class stock structure with multiple voting rights held by the Winklevoss brothers.

The company stated that Class A shares have one vote per share, while Class B shares held by co-founders and their affiliates are granted ten votes per share. This structure classifies Gemini as a "controlled company" under Nasdaq regulations.

Gemini's IPO will be managed by major banks including Goldman Sachs, Morgan Stanley, Citigroup, and Cantor Fitzgerald.

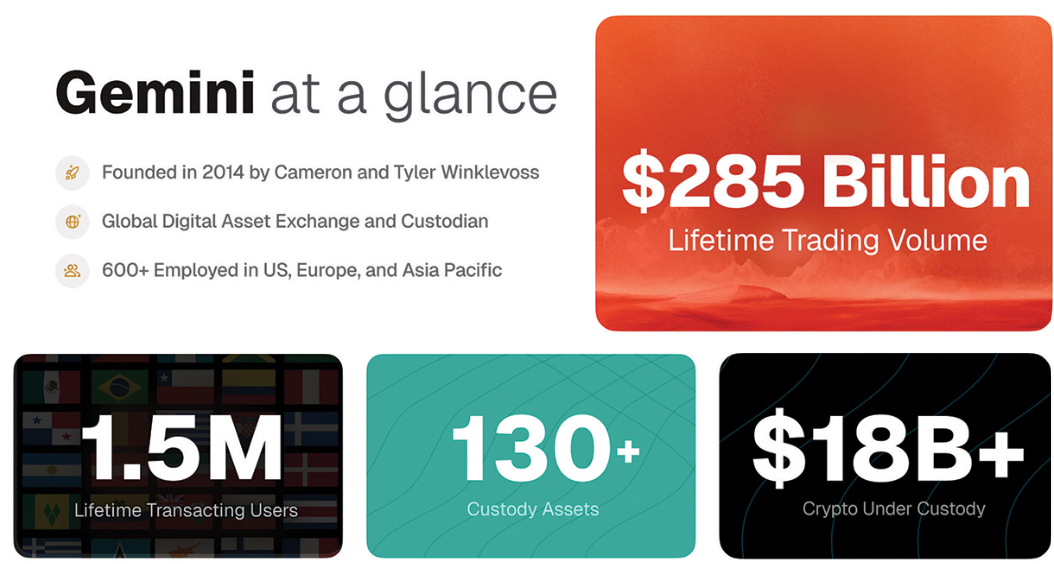

Gemini has positioned itself as a secure and user-friendly platform for digital asset trading and custody. The exchange reports having over 500,000 monthly active users across more than 60 countries and approximately 10,000 institutional clients.

The platform manages over $18 billion in customer assets, has processed more than $800 billion in transfers since its inception, and exceeded $285 billion in total trading volume.

The company's application presents these metrics as evidence of cryptocurrency market growth potential, anticipating significant opportunities through broader adoption and new applications in the coming years.

Gemini Records $440 Million Recent Loss

Despite the growth narrative, Gemini's financial situation reveals ongoing challenges for cryptocurrency companies in the current market.

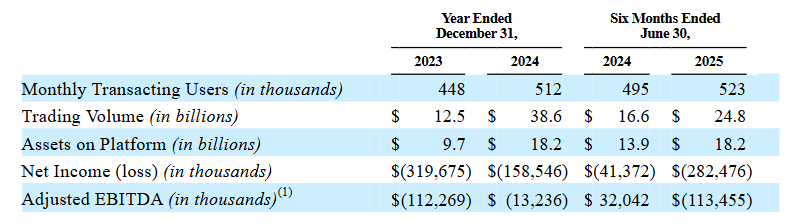

In 2024, the company generated $142.2 million in revenue but recorded a net loss of $158.5 million. The company noted that losses expanded to $282.5 million in the first half of 2025, with revenue reaching only $67.9 million.

Market analysts suggest these figures highlight challenges in expansion and the need for additional capital through public funding.

Meanwhile, the application also detailed Gemini's financial contracts with Ripple and other companies.

Gemini maintains a credit facility with Ripple, which can be expanded from $75 million to $150 million and is denominated in Ripple's RLUSD stablecoin. To date, no funds have been drawn from this facility.

Historically, the company has borrowed 133,430 ETH and 10,051 BTC from the Winklevoss Capital Fund (WCF) for operations, margin requirements, and regulatory compliance. WCF is a family office established by the Winklevoss brothers.

As of June 30, 2025, 39,699 ETH and 4,682 BTC remain outstanding, with annual fees ranging between 4% and 8%.