The cryptocurrency TRUMP related to US President Donald Trump showed limited movement after the meeting between Trump and Russian President Vladimir Putin held in Alaska.

Despite high market expectations, this altcoin did not experience the significant surge that some had anticipated.

Trump Investors Selling Holdings

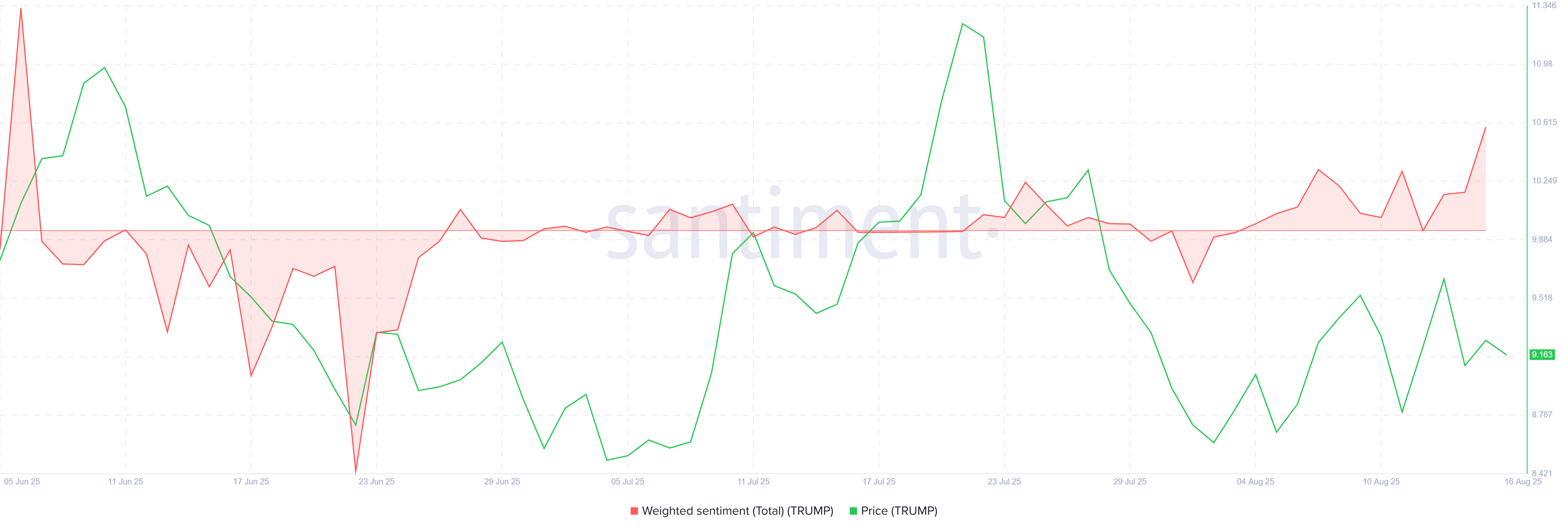

After the high-level meeting between Trump and Putin, investor sentiment towards TRUMP noticeably increased. Considering the ongoing geopolitical tensions, many viewed this summit as a step towards improving US-Russia relations.

Such developments often stimulate market optimism for assets associated with major political figures. However, the positive sentiment did not lead to a price increase in TRUMP and was not significantly impacted by these macroeconomic events.

Despite the importance of the meeting, TRUMP investors seem hesitant to take large positions due to concerns about future market volatility. The market's minimal reaction highlights the cautious outlook currently held by investors. The cryptocurrency's price showed relatively stable and limited movement in response to political developments.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

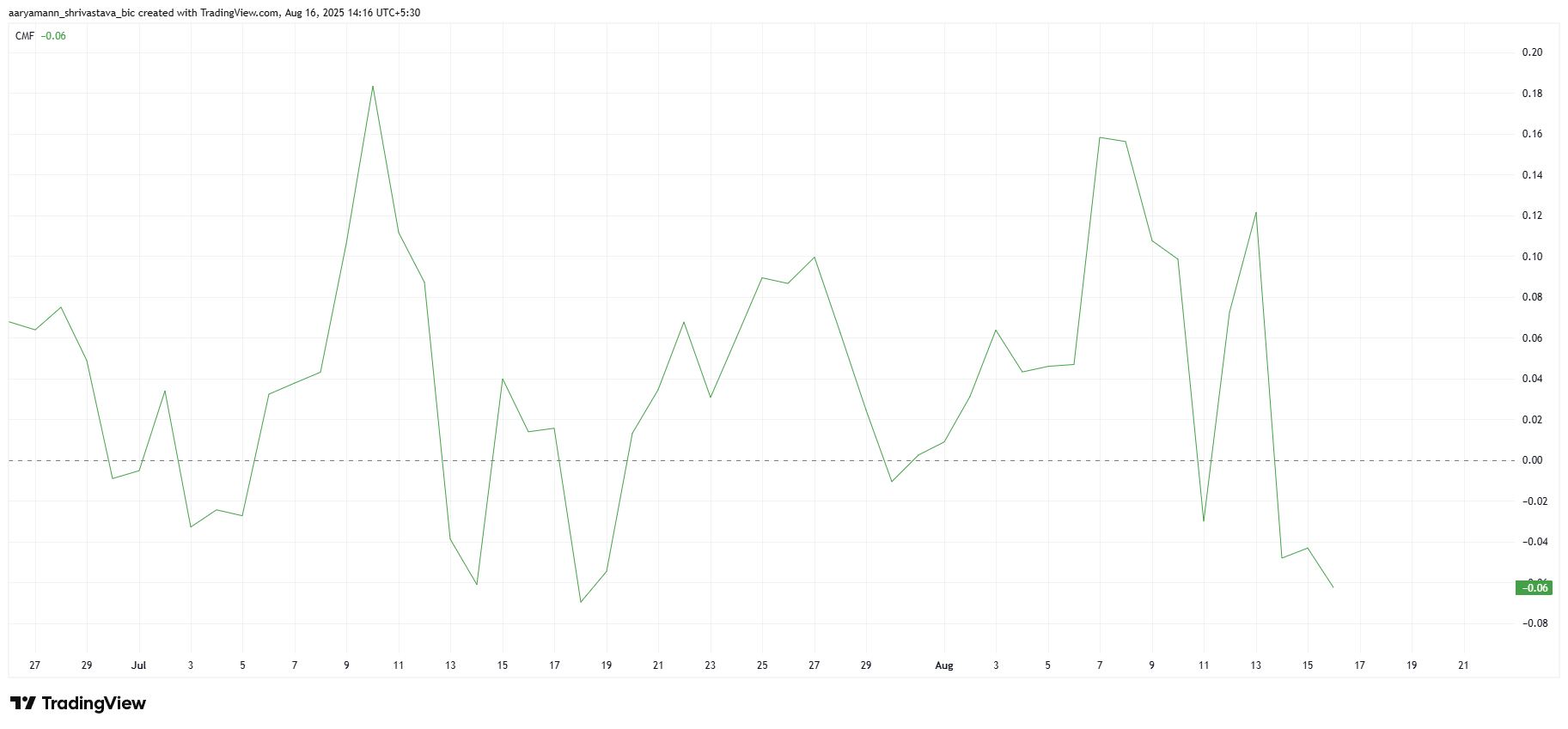

The Chaikin Money Flow (CMF), a broad market indicator for TRUMP, shows signs of concern. The CMF, a key indicator of buying and selling pressure, is declining, indicating weakening investor sentiment.

Investor skepticism appears to be driving this trend. As uncertainty grows, investors may be withdrawing funds from TRUMP, fearing additional declines or a lack of positive catalysts.

TRUMP Price Stability

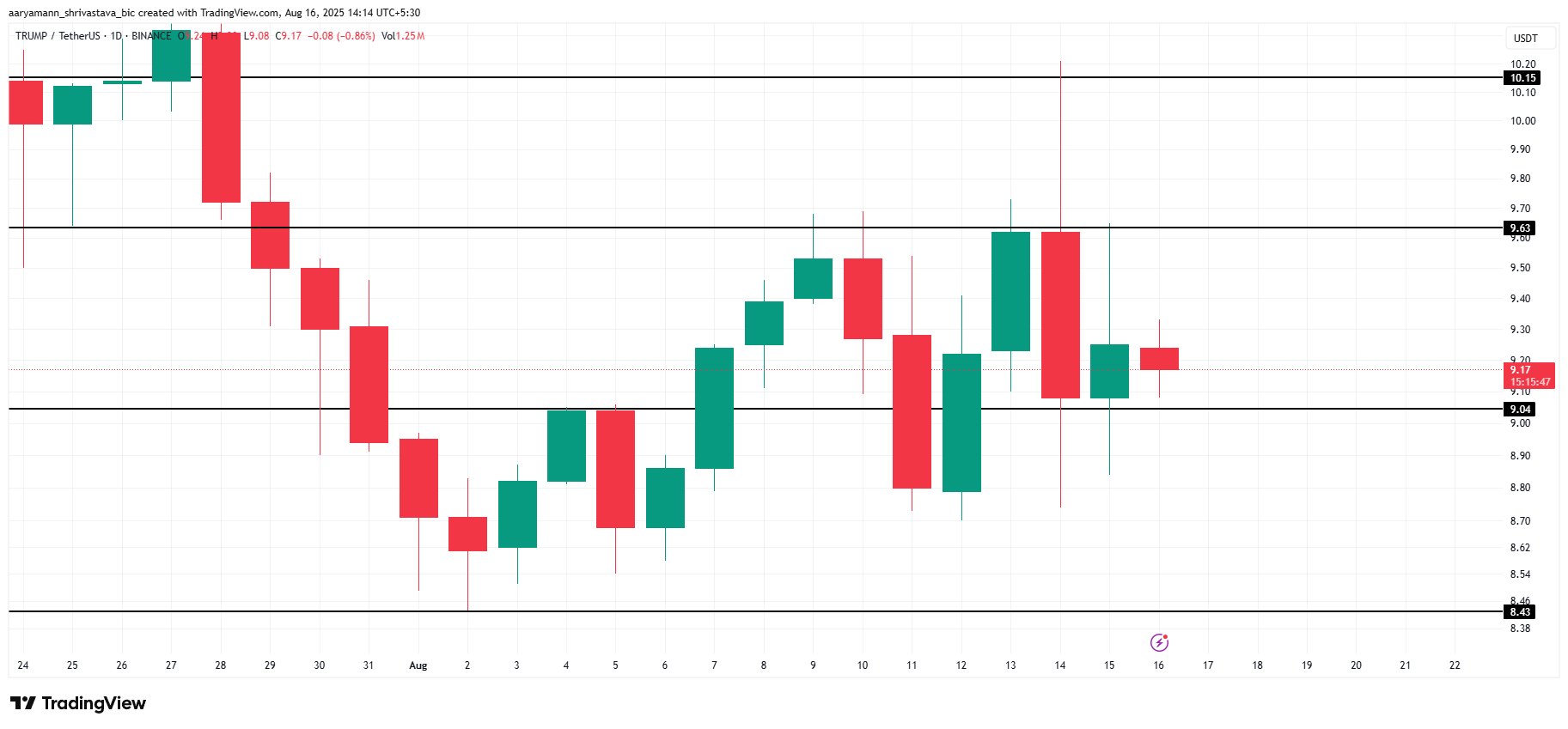

TRUMP is currently trading at $9.17, above the support level of $9.04. Movement within this range suggests the price may enter a consolidation phase between the $9.04 support and $9.63 resistance levels. The market's indecisiveness indicates a period of low volatility.

However, if fund outflows continue, TRUMP could break below the $9.04 support and drop to the next support level at $8.43. This could extend losses and apply additional downward pressure on the price, potentially signaling a further decline.

Conversely, if TRUMP can convert the $9.63 resistance level into a support, it could move towards $10.00. This would likely be driven by a restoration of investor confidence in the asset's potential.