Ethereum has performed worse than Bitcoin in the recent adjustment period, however, with nearly 30% of ETH supply being staked, this currency may recover more strongly in the coming time.

Ethereum is more heavily impacted than Bitcoin in terms of price and derivative markets, but this volatility brings potential for an outstanding recovery if the market reverses.

- Ethereum drops more sharply than Bitcoin, but high volatility provides good recovery potential during market reversal phases.

- Nearly 30% of ETH supply is staked, reducing circulating supply and boosting growth potential when capital flows return.

- ETH's profit performance surpasses Bitcoin at certain times, demonstrating Ethereum's role as a high-beta asset.

Has Ethereum Dropped More Than Bitcoin in the Latest Adjustment?

In the recent adjustment period, Ethereum declined more deeply compared to Bitcoin, clearly demonstrating its high-volatility and risk-sensitive asset characteristics.

Ethereum experienced an 8% decline compared to Bitcoin's 5%, despite both losing their cycle peak.

AMBCrypto, August 2025

Data shows that since August 14, the total cryptocurrency market capitalization dropped around 220 billion USD, with Bitcoin declining about 130 billion USD and Ethereum 40 billion USD. This indicates that although the absolute money outflow from Bitcoin is larger, ETH experienced a stronger technical shock. According to technical assessment, ETH is a higher beta asset compared to Bitcoin, showing more significant price fluctuations when the market shifts to a risk-off state.

A larger decline means stronger volatility, typically associated with the potential for rapid acceleration during recovery phases, offering high-profit opportunities for risk-tolerant investors.

Is Similar Volatility Occurring in ETH Derivative Markets?

Ethereum is not only volatile in the spot market but also experiences widespread impact in the derivative market, demonstrated by a significant drop in Open Interest (OI).

Ethereum witnessed OI on Binance drop over 1 billion USD, far exceeding Bitcoin's 750 million USD decline.

Source: Coinglass, August 2025

Data from Binance shows Bitcoin's Open Interest dropped around 750 million USD, while Ethereum's exceeded 1 billion USD. This indicates that leveraged positions on ETH have been significantly "washed", showing strong sensitivity to derivative market reversals.

However, this volatility triggers ETH's potential for strong recovery whenever risk capital returns, as clearly demonstrated in previous stages.

Does ETH Outperform BTC in High-Risk Periods?

Despite facing significant selling pressure, ETH still records outstanding performance compared to Bitcoin in certain periods, especially when the market moves positively again.

ETH's profit in July was nearly 6 times BTC's 8.13% ROI, while August reached nearly 20% compared to BTC's 2%.

AMBCrypto, August 2025

In fact, performance data from July 2025 shows ETH's ROI was nearly 6 times Bitcoin's, while early August saw a nearly 20% increase compared to BTC's 2%. This is concrete evidence of its high-beta asset position, capable of superior profitability during strong cryptocurrency market recovery phases.

Outstanding profitability and high volatility margins become attractive features for adventurous investors.

Why Might Deep Declines Trigger Strong Recovery for Ethereum?

ETH has often declined more deeply than BTC but recovered quickly and twice as strongly due to its high-volatility characteristics.

When a strong weekly decline chain ends, ETH has bounced back 12.17% and sustained growth for many weeks, approaching cycle peak with a 115% profit margin.

AMBCrypto, June 2025

For example, when the market reversed on June 16, Bitcoin dropped 4.33% in a week while ETH lost 12.55%. Subsequently, as the market improved, ETH surged 12.17% compared to BTC's 7.29%, triggering a seven-week sustained growth that brought ETH close to its historical peak, while BTC also approached its "ATH" at 123,000 USD.

This strong surge emphasizes ETH's "trampoline effect", with a 115% profit performance compared to BTC's 22% in the same period. This provides a basis for ETH's attractiveness to high-beta asset investors during market recovery.

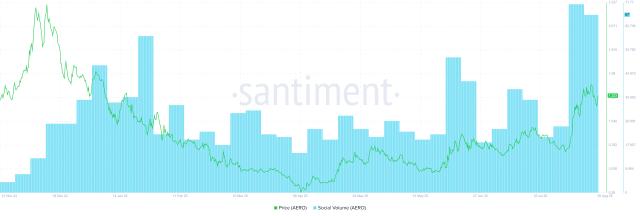

How Does 30% of ETH Supply Being Staked Impact the Market?

With nearly 30% of ETH supply in staking status, circulating ETH supply significantly decreases, increasing momentum for potential price surge phases.

30% ETH staked helps reduce liquidity supply, increasing recovery potential whenever market demand returns.

X.com/crypto_goos, August 2025

Compressed circulating supply reduces selling pressure and makes ETH's post-adjustment growth phases more dramatic, potentially leading to higher price volatility when capital flows return to the market.

Compared to Bitcoin, ETH is in a more favorable position to trigger breakthrough price surge waves if the recovery trend continues through the end of 2025.

Could Ethereum Outperform Bitcoin by the End of 2025?

With high volatility characteristics, large staking ratio, and strong recovery history, Ethereum is assessed as having superior profit potential for the remainder of 2025 under favorable market conditions.

Fundamental indicators and smart money are paying more attention to ETH during major adjustment phases due to its quick and strong bounce-back ability, which Bitcoin, while stable, cannot match in terms of growth margin.

Comparing Recovery Strength Between Ethereum and Bitcoin in Major Market Phases

The table below summarizes the progression of deep decline and recovery phases between the two largest cryptocurrencies, helping clarify differences in profit rates and volatility levels.

| Time | BTC Decrease | ETH Decrease | BTC Increase | ETH Increase | ETH Profit Compared to BTC |

|---|---|---|---|---|---|

| 16/06/2025 | -4.33% | -12.55% | 7.29% | 12.17% | 1.7 Times |

| 07-08/2025 (Multi-Week Cycle) | 22% | 115% | Gradually Increasing Chain Approaching ATH | Gradually Increasing Chain Approaching ATH | 5.2 Times |

| July/2025 | 8.13% | Nearly 6 Times BTC | BTC ROI | ETH ROI | Superior |

Frequently Asked Questions

How Much Did Ethereum Decrease Compared to Bitcoin in the Latest Correction?

Ethereum decreased by 8% while Bitcoin only decreased by 5%, showing that ETH is more volatile and sensitive to risk capital.

Why Is Ethereum's Volatility a Plus for Investors?

High volatility helps ETH typically achieve superior profits when the market recovers, suitable for investors who prefer high-beta assets.

How Does Staking Nearly 30% of ETH Affect the Price?

Staking 30% reduces the circulating ETH supply, increasing opportunities for strong price increases when buying demand emerges.

What Is the Yield Performance of ETH Compared to BTC in July and August?

In July, ETH's ROI was nearly 6 times BTC's 8.13%; in August, ETH reached nearly 20% while BTC only reached 2%.

Why Can ETH Recover Stronger Than BTC After a Deep Decline?

History shows ETH has a trampoline effect, often bouncing back strongly and extending the recovery chain after a deep decline.

Can Ethereum Lead the Market by the End of 2025?

With a large staking rate, strong recovery history, and smart capital inflow, ETH has superior potential in the remaining part of 2025.

What Benefits Does ETH Price Volatility Bring to the Derivative Market?

Investors can leverage to maximize profits during high volatility phases if risk management is effectively implemented.