By Omkar Godbole (All times ET unless indicated otherwise)

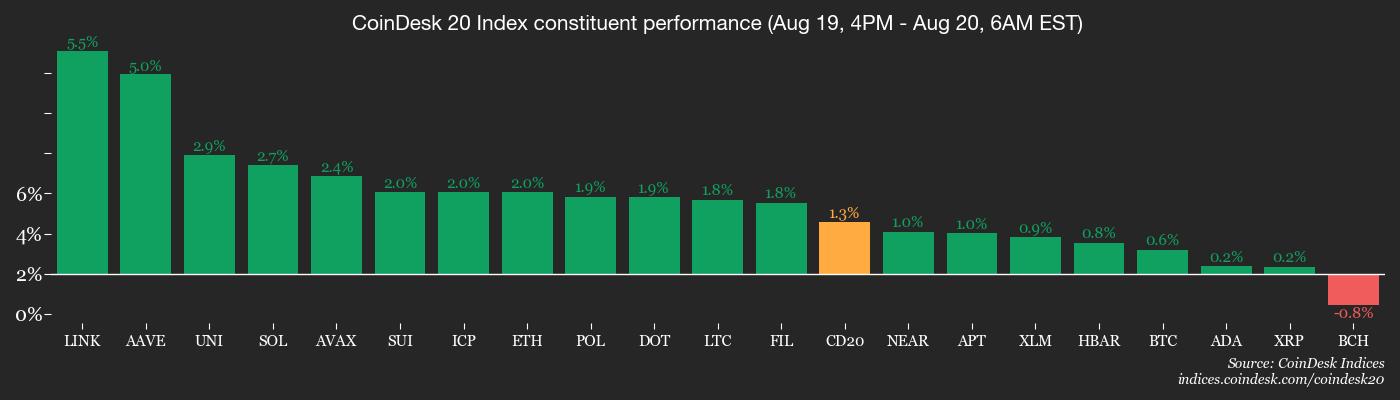

Bitcoin (BTC) and ether (ETH) have recovered slightly from late Tuesday lows, though both CoinDesk 20 and CoinDesk 80 indexes are lower over 24 hours, signaling a broad market weakness. Among the top 100 coins, only OKB and LINK have gained more than 3%.

The analyst community remains squarely focused on Fed Chair Jerome Powell's speech at Jackson Hole later this week.

"The recent sell‑off suggests that short‑term positioning remains fragile," Singapore-based QCP Capital said. "Risk assets may be vulnerable to further swings if Powell strikes a hawkish tone or if upcoming labor or inflation data surprise to the upside."

Powell's speech will come after publication of the minutes of the Fed's July meeting, due later today.

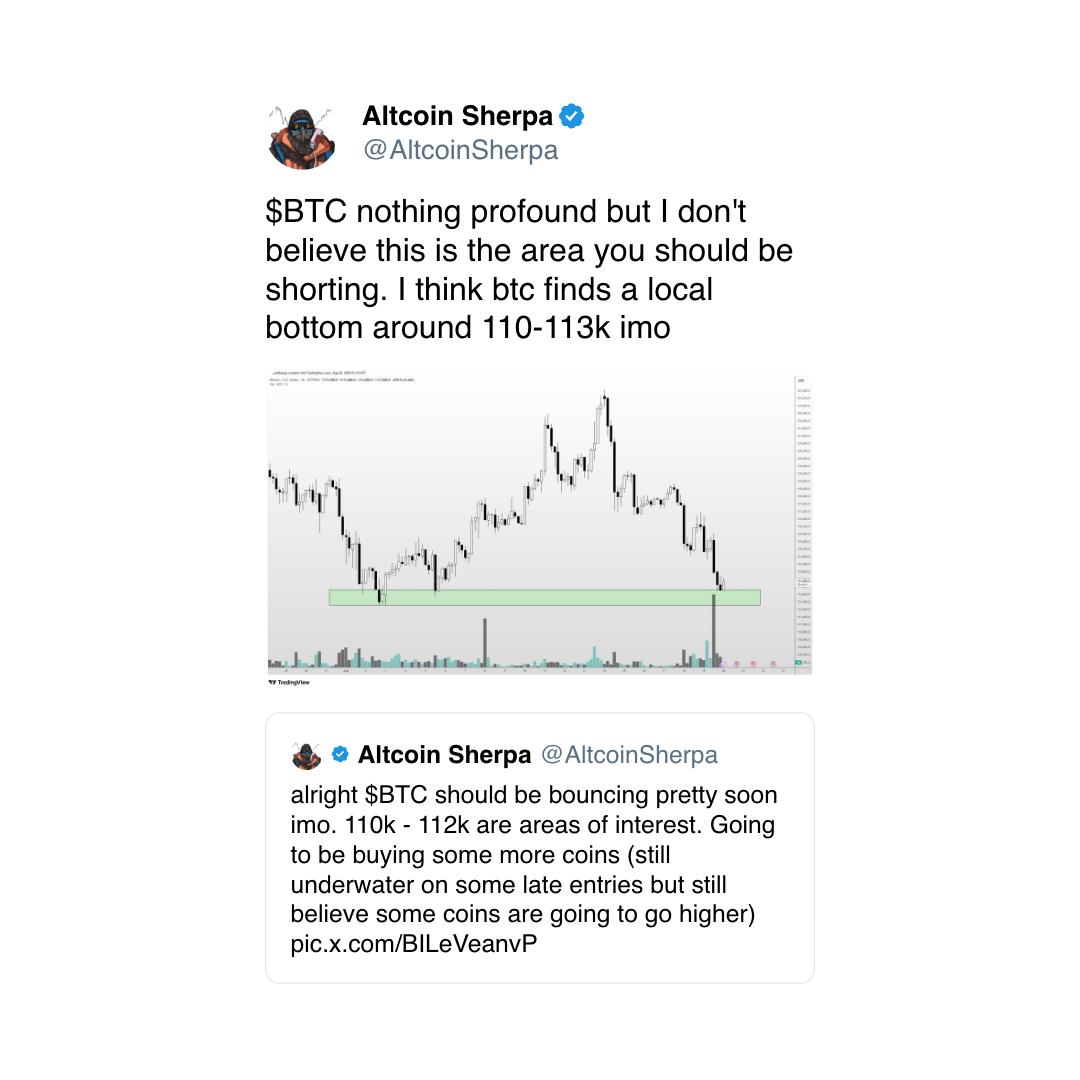

The latest decline in BTC has been marked by profit-taking by short-term holders, or wallets with a history of owning coins for less than 155 days, according to CryptoQuant. The last time this occurred, in January, the bitcoin rally lost momentum near $110,000, eventually leading to a deep sell-off in March and early April.

Here's another sign of investor disquiet: Spot bitcoin and ether ETFs registered almost $1 billion in total net outflows on Tuesday.

"At this stage, the market broadly expects cuts, so much of that is already priced in," Nicolai Sondergaard, a research analyst at Nansen, said in an email, referring to U.S. interest rates. "If Powell delivers exactly what’s anticipated, crypto could see sideways-to-slightly-bearish action, a classic 'sell the news' dynamic."

Sondergaard said markets will likely rally if Powell signals deeper or faster-than-expected rate cuts. Stay alert!

What to Watch

- Crypto

- Aug. 20, 1 p.m.: Hedera (HBAR) plans to upgrade its mainnet to version 0.64. The process is expected to last around 40 minutes, during which network services may experience temporary interruptions.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, will undergo its first yearly halving event as part of a controlled emission model. Although gross emissions remain fixed at one trillion QUBIC tokens per week, the adaptive burn rate will increase substantially — burning some 28.75 trillion tokens and reducing net effective emissions to about 21.25 trillion tokens.

- Aug. 21: Layer-1 blockchain Viction (VIC), formerly known as TomoChain, finalizes the Atlas hard fork upgrade on mainnet. The update launched on July 23. All node operators must complete the upgrade by Aug. 21 to ensure full network functionality.

- Macro

- Aug. 20, 11 a.m.: Fed Governor Christopher J. Waller will speak on “Payments” at the Wyoming Blockchain Symposium 2025. Watch live.

- Aug. 20, 2 p.m.: The Fed will release the minutes from the July 29-30 FOMC meeting.

- Aug. 21, 8:30 a.m.: Statistics Canada releases July producer price inflation data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%

- PPI YoY Prev. 1.7%

- Aug. 21, 9:45 a.m.: S&P Global releases (flash) August U.S. data on manufacturing and services activity.

- Composite PMI Prev. 55.1

- Manufacturing PMI Est. 49.5 vs. Prev. 49.8

- Services PMI Est. 54.2 vs. Prev. 55.7

- Aug. 21-23: The Jackson Hole Economic Policy Symposium, which is hosted by the Federal Reserve Bank of Kansas City and held annually in Jackson Hole, Wyoming, brings together global central bankers and policymakers to discuss key economic challenges and monetary policy.

- Aug. 22, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (final) Q2 GDP growth data.

- GDP Growth Rate QoQ Est. 0.7% vs. Prev. 0.6%

- GDP Growth Rate YoY Est. 0.1% vs. Prev. 0.8%

- Aug. 22, 10:00 a.m.: Fed Chair Jerome Powell delivers his keynote speech at the Jackson Hole Economic Policy Symposium.

- Aug. 22, 5 p.m.: The Central Bank of Paraguay announces its monetary policy decision.

- Policy Rate Prev. 6%

- Aug. 22, 8 p.m.: Peru’s National Institute of Statistics and Informatics releases Q2 GDP YoY growth data.

- GDP Growth Rate YoY Prev. 3.9%

- Earnings (Estimates based on FactSet data)

- Aug. 25: Windtree Therapeutics (WINT), pre-market, N/A

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting on a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month corporate membership (logo on sponsor wall, team access, newsletter feature, one branded meetup/month) or a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 20: Chintai and Chainlink to host Xspaces with Jordan Calinoff, the global head of stablecoin & RWA-issuer sales at Chainlink Labs at 16:00 UTC.

- Livepeer (LPT) to host fireside "ask me anything" ecosystem chat at 17:00 UTC.

- Aug. 22: Basic Attention Token (BAT) to host Xspaces event at 17:00 UTC.

- Unlocks

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating supply worth $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating supply worth $27.55 million.

- Token Launches

- Aug. 20: DecentralGPT (DGC) to list on Binance Alpha and Bitget.

- Aug. 20: Mog Coin (MOG) to list on EdgeX.

- Aug. 20: MYX Finance (MYX) to list on Coinone with MYX/KRW pair.

- Aug. 20: Palladium Network (PLLD) to list on Poloniex with PLLD/USDT pair.

- Aug. 20: Sapien (SAPIEN) to list on Binance Alpha.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Day 4 of 5: Crypto 2025 (Santa Barbara, California)

- Day 3 of 4: Wyoming Blockchain Symposium 2025 (Jackson Hole)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

Token Talk

By Shaurya Malwa

- Solana token issuance platform Pump.fun has crossed $800.6 million in lifetime revenue, Dune data shows, mostly from its 1% swap fee, with daily intake averaging over $1 million. This puts it among a small list of platforms earning high revenues in the crypto space.

- Pump originally collected fees when tokens “graduated” to Raydium, but now earns from its in-house DEX, PumpSwap. The model has proven sticky despite competition.

- LetsBonk briefly overtook Pump in graduated tokens last month, driven by its Raydium LaunchLab integration and Bonk community push, but lost ground as top memecoin deployers migrated back to Pump.

- Pump’s token ICO last month raised $600 million in 12 minutes, with the platform now running buybacks above market price to stabilize trading. This is indicative of how the launchpad has become an asset in itself.

- In contrast, LetsBonk revenue has collapsed to under $30,000 a day from around $1 million earlier this month, showing the volatility of memecoin platforms competing for flow.

- New entrant Token Mill is trying to stand out with a “King of the Mill” mechanism in which fees are used to buy and burn the highest-volume token every 30 minutes. The aim is to gamify volatility as a growth loop.

- Solana, meanwhile, lost its crown as the dominant memecoin chain to Coinbase's Base, which has tied token issuance into decentralized social media via Zora. On Monday, Base hosted nearly 58,000 new memecoins versus 33,000 on Solana.

Derivatives Positioning

- Leveraged crypto futures bets worth $448 million have been liquidated in the past 24 hours. Most were longs, which means significant bullish leverage has been cleared from the market.

- Open interest in BTC, DOGE and XRP has declined, indicating that the price drop has yet to trigger a surge in new bearish bets.

- Meanwhile, LINK, HYPE and SUI have seen increases in open interest, while OI has held flat in ETH, according to data source Coinglass.

- Perpetual funding rates for most major cryptocurrencies continue to remain mildly positive, indicating a bias towards long positions. The opposite is the case for ADA and XMR.

- Solana futures open interest on CME remains elevated near record highs above 4.6 million SOL, with the annualized three-month premium rising to 16% from 12% last week. The uptick indicates bullish capital inflows.

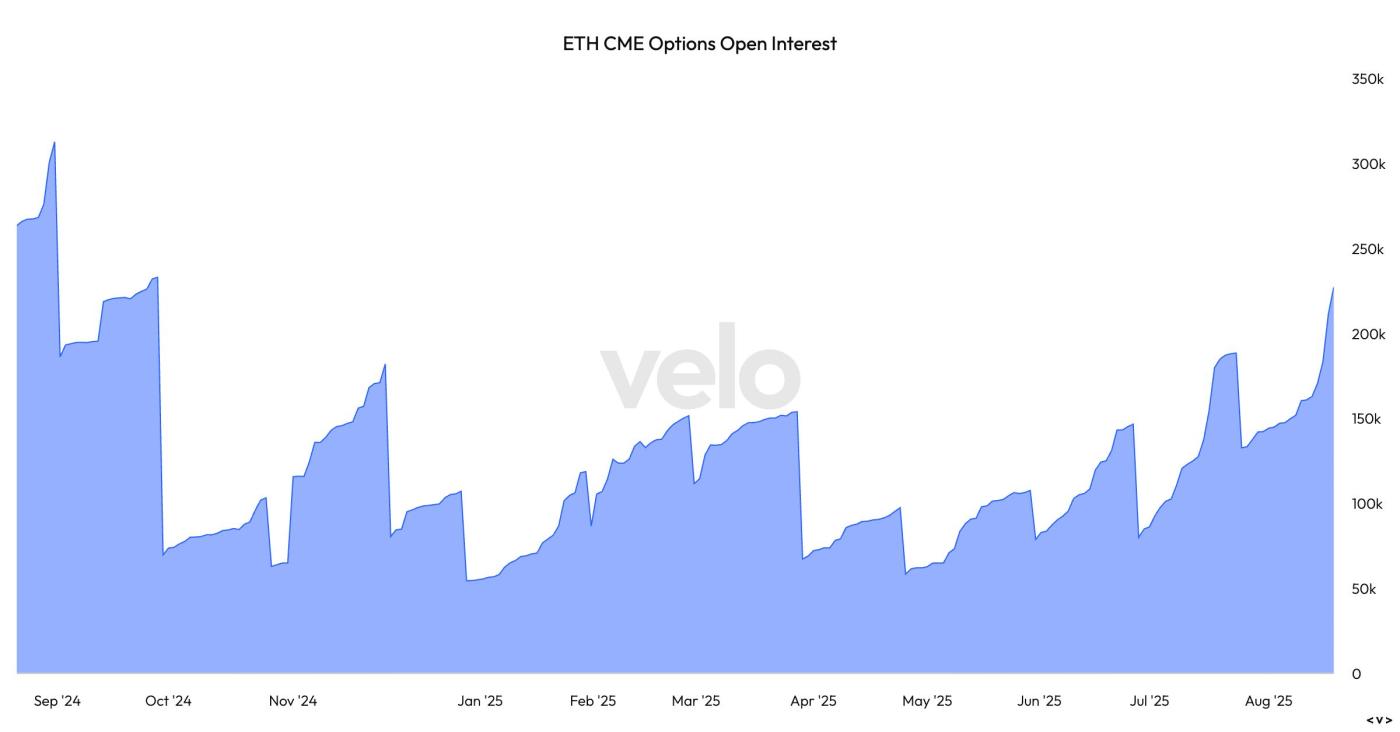

- BTC open interest is beginning to recover, now at 145.76K BTC, the highest since late July. Premium remains below 10%. In ETH's case, the premium again faded the spike above 10%, with open interest approaching the 2 million ETH mark.

- On Deribit, short-dated (one-week) and near-dated (coming months) BTC and ETH puts continue to trade at a premium to calls, reflecting concerns about downside risks.

- Flows over the OTC network Paradigm featured increased activity in put options tied to bitcoin and ether, with activity across outrights, spreads, and calendar spread strategies.

Market Movements

- BTC is up 0.4% from 4 p.m. ET Tuesday at $113,757.49 (24hrs: -1.53%)

- ETH is up 1.55% at $4,217.10 (24hrs: -1.62%)

- CoinDesk 20 is up 1.06% at 3,983.85 (24hrs: -2.26%)

- Ether CESR Composite Staking Rate is up 2 bps at 2.94%

- BTC funding rate is at 0.0022% (2.4276% annualized) on Binance

- DXY is unchanged at 98.29

- Gold futures are up 0.29% at $3,368.50

- Silver futures are down 0.70% at $37.07

- Nikkei 225 closed down 1.51% at 42,888.55

- Hang Seng closed up 0.17% at 25,165.94

- FTSE is up 0.17% at 9,204.66

- Euro Stoxx 50 is unchanged at 5,483.55

- DJIA closed on Tuesday unchanged at 44,922.27

- S&P 500 closed down 0.59% at 6,411.37

- Nasdaq Composite closed down 1.46% at 21,314.95

- S&P/TSX Composite closed down 0.35% at 27,823.88

- S&P 40 Latin America closed down 2.02% at 2,637.60

- U.S. 10-Year Treasury rate is down 0.7 bps at 4.295%

- E-mini S&P 500 futures are down 0.14% at 6,423.50

- E-mini Nasdaq-100 futures are down 0.18% at 23,427.50

- E-mini Dow Jones Industrial Average Index are down 0.18% at 44,919.00

Bitcoin Stats

- BTC Dominance: 59.8% (+0.48%)

- Ether-bitcoin ratio: 0.0371 (2.74%)

- Hashrate (seven-day moving average): 962 EH/s

- Hashprice (spot): $55.71

- Total fees: 3.27 BTC / $374,274

- CME Futures Open Interest: 145,760 BTC

- BTC priced in gold: 34.2 oz.

- BTC vs gold market cap: 9.68%

Technical Analysis

- While the S&P 500 and Nasdaq indexes recently rallied above their January highs, the Dow Jones Industrial Average (DJIA) has yet to do so.

- The daily chart shows the DJIA bulls are struggling to establish a foothold above the trendline connecting December-February highs.

- As a barometer of risk appetite, a turn lower could add to the bearish momentum in cryptocurrencies.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $336.57 (-7.43%), +7.91% at $363.19 in pre-market

- Coinbase Global (COIN): closed at $302.07 (-5.82%), +5.93% at $319.98

- Circle (CRCL): closed at $135.23 (-4.49%), +5.98% at $143.31

- Galaxy Digital (GLXY): closed at $24.09 (-10.06%), +10.23% at $26.56

- Bullish (BLSH): closed at $59.51 (-6.09%), +3.68% at $61.70

- MARA Holdings (MARA): closed at $15.17 (-5.72%), +6.46% at $16.15

- Riot Platforms (RIOT): closed at $11.96 (-2.92%), +3.09% at $12.33

- Core Scientific (CORZ): closed at $14.35 (-1.24%), +0.63% at $14.44

- CleanSpark (CLSK): closed at $9.36 (-4.88%), +5.13% at $9.84

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.6 (-5.97%), +5.30% at $28.01

- Semler Scientific (SMLR): closed at $31.89 (-5.55%), +5.07% at $33.50

- Exodus Movement (EXOD): closed at $27.1 (+1.96%), -1.37% at $26.73

- SharpLink Gaming (SBET): closed at $18.38 (-8.65%), +6.42% at $19.56

ETF Flows

Spot BTC ETFs

- Daily net flows: -$523.3 million

- Cumulative net flows: $54.31 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: -$422.2 million

- Cumulative net flows: $12.07 billion

- Total ETH holdings ~6.35 million

Source: Farside Investors

Chart of the Day

- Open interest, or the number of active contracts, in CME-listed ether options has increased to 226.9K ETH, the most since September.

- The gain shows growing institutional demand for hedging instruments tied to Ethereum's native token.

While You Were Sleeping

- Bitcoin, Stocks Hit by $400B Liquidity Drain From U.S. Treasury Account, Not Jackson Hole: Analysts (CoinDesk): Coinbase’s head of institutional research, David Duong, said traders are cutting risk ahead of new Treasury issuance, while Marcus Wu, a research analyst at Delphi Digital, said lower bank reserves and weaker foreign demand make conditions shakier than in 2023.

- UK Bitcoin ETNs Could Be a Bigger Deal Than People Expect (CoinDesk): Crypto ETNs, banned by the U.K.'s Financial Conduct Authority in January 2021, return on Oct. 8. ByteTree’s Charlie Morris said the relaunch could rival U.S. bitcoin ETF approvals in importance.

- Trump Family Expands Crypto Bets as Thumzup Pivots Into Dogecoin Mining (CoinDesk): The Nasdaq-listed digital marketing platform, part-owned by Donald Trump Jr., will buy Dogehash Technologies to pivot into DOGE and LTC mining, rebrand as Dogehash Technologies Holdings and trade under the ticker XDOG.

- Elon Musk Pledged to Start a Political Party. He Is Already Pumping the Brakes. (The Wall Street Journal): Musk paused his “America Party” plans, citing business priorities and concern that a third party would alienate Republicans and weaken ties with JD Vance, seen as a 2028 presidential contender.

- Bessent Says China Tariff Status Quo ‘Working Pretty Well’ (Bloomberg): The U.S. Treasury Secretary said tariffs on China remain the biggest U.S. revenue source and signaled no change before November as the Trump administration aims for a potential Trump-Xi summit.

- The Iranian Connection: How China Is Importing Oil From Russia (Financial Times): Russian oil has been reaching China through a system first built for Iran’s oil exports, using offshore-registered tankers and shell firms to disguise the source of sanctioned crude.

In the Ether