- A Rate Cut lowers borrowing costs, boosts liquidity, and often drives demand for higher-risk assets, making crypto markets more attractive.

- Lower rates can fuel inflation fears, increasing Bitcoin’s appeal as a hedge to protect purchasing power and strengthen its long-term investment narrative.

- While moderate cuts may lift crypto prices, larger ones could signal economic distress, potentially limiting risk appetite and weighing on digital assets.

Discover what a Rate Cut means, why the Fed uses it, and how it impacts global markets—including its potential to boost crypto prices through liquidity, inflation hedging, and dollar trends.

WHAT IS A RATE CUT?

A Rate Cut refers to when a central bank lowers its benchmark interest rate. Just like a rate hike, it is one of the key tools in monetary policy.

When the Federal Reserve (Fed) announces a Rate Cut, it means the Federal Open Market Committee (FOMC) has decided to reduce the target range for the federal funds rate. This target rate serves as the benchmark for overnight lending between banks. While the actual lending rates are set by negotiations among banks, they typically move in line with the target. The target is often referred to as the “federal funds rate” or the “nominal interest rate.”

Why does it matter? The federal funds rate is highly influential because many domestic and international interest rates are either directly linked to it or closely correlated. A Fed Rate Cut doesn’t just impact traditional markets like bonds and equities—it also plays a significant role in shaping global liquidity and can influence the behavior of the crypto market.

>>> More to read: When the Fed Cuts Again: Echoes of History and the Future of Risk Assets

WHY DOES THE FED IMPLEMENT A RATE CUT?

The federal funds rate is one of the Fed’s most important tools for managing monetary policy, aimed at maintaining price stability (low inflation) and supporting long-term economic growth. Changes in this rate affect the overall money supply, beginning with banks and ultimately influencing consumers.

In general, a Rate Cut is used to stimulate economic growth. By lowering borrowing costs, businesses and individuals are encouraged to borrow and invest more, injecting additional capital into the market and fueling economic activity. However, when rates stay too low for too long, this can overstimulate growth and even trigger inflation. Rising inflation erodes purchasing power and may jeopardize the sustainability of future economic expansion.

On the other hand, when the economy overheats, the Fed often raises rates to slow down inflation and bring growth back to a more sustainable level. Higher borrowing costs can help prevent excessive expansion but also risk dampening economic activity if kept too high for too long.

Ultimately, the Fed adjusts between rate hikes and Rate Cuts to balance its dual mandate: keeping inflation under control while promoting maximum employment and sustainable growth.

>>> More to read: What is CBDC? A Beginner’s Guide

ARE RATE CUTS GOOD FOR CRYPTO PRICES?

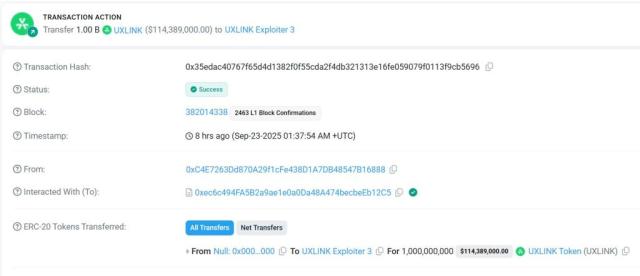

Anticipated Rate Cuts can significantly influence digital asset markets. Historically, Bitcoin and other cryptocurrencies have reacted negatively to Fed rate hikes aimed at curbing inflation. In contrast, a Rate Cut is typically viewed as positive for crypto, as it is considered a risk-on asset class.

🔍 Key impacts of a Rate Cut on cryptocurrencies include:

- Liquidity Boost: Lower borrowing costs increase access to credit, injecting capital into markets. This often drives demand for higher-yield, higher-risk assets such as Bitcoin and altcoins. For instance, between February 2020 (when the Fed cut rates near zero) and February 2022 (when hikes resumed), Bitcoin surged nearly 375%.

- Inflation Hedge Appeal: Reduced rates can stoke inflation fears by encouraging more borrowing and spending. In this environment, investors may seek Bitcoin as a hedge to preserve purchasing power. Analysts predict potential cuts of up to 175 basis points over the next nine months, which could add strong momentum to crypto markets.

- Weaker Dollar Effect: Rate Cuts often pressure the U.S. dollar, making crypto more attractive as an alternative store of value against currency debasement.

⚠️ Caveats:

- Markets may have already priced in some of the bullish effects of a Rate Cut.

- The scale of the cut matters: a modest 25-basis-point cut may support gradual crypto gains by easing recession fears, while a larger cut could signal deeper economic stress, weighing on risk assets.

CONCLUSION

Overall, do crypto investors have more reasons to remain optimistic? While we cannot fully predict the impact of a Fed Rate Cut on the digital asset market, certain indicators suggest that policy changes expected later in September could represent a timely opportunity.

As the Federal Open Market Committee (FOMC) prepares for its September meeting, an anticipated Rate Cut may mark the beginning of a new phase of economic recalibration, potentially injecting fresh momentum into crypto markets. Although outcomes remain uncertain, the backdrop of lower borrowing costs and increased liquidity offers a favorable outlook for digital assets.

Historical trends and unique crypto-specific drivers—such as Bitcoin’s halving cycle and seasonal trading patterns—further reinforce a bullish narrative. Together, these factors suggest that upcoming policy shifts may accelerate growth and innovation in the crypto sector, presenting investors with a hopeful horizon.

〈What is a Rate Cut? How Will It Affect the Crypto Market?〉這篇文章最早發佈於《CoinRank》。