#SOL

- SOL trades below 20-day MA but shows MACD bullish crossover potential

- Mixed market sentiment with strong ecosystem growth offset by whale movement concerns

- Key technical levels at $257 resistance and $196 support will dictate near-term direction

SOL Price Prediction

SOL Technical Analysis: Key Indicators Signal Potential Rebound

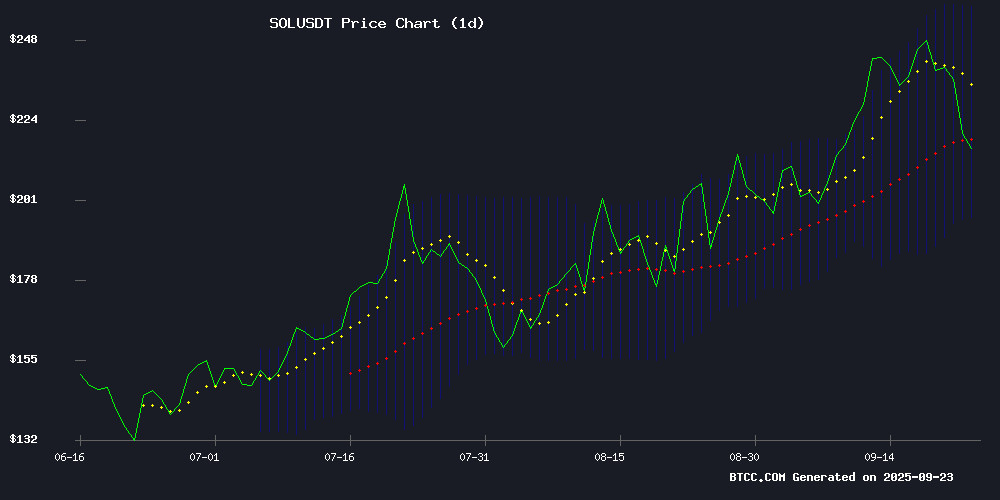

SOL currently trades at $215.48, below its 20-day moving average of $226.71, indicating short-term bearish pressure. However, the MACD shows promising signs with a reading of -16.09 crossing above its signal line at -16.69, suggesting potential momentum shift. The Bollinger Bands position SOL NEAR the middle band with upper resistance at $257.23 and lower support at $196.20.

According to BTCC financial analyst Mia, "The technical setup suggests SOL is testing crucial support levels. The MACD crossover and proximity to Bollinger's middle band could indicate consolidation before a potential upward move."

Market Sentiment Mixed Amid Solana Ecosystem Developments

Recent news highlights both positive and concerning developments for Solana. The successful $4M Snorter Token presale and Alpenglow upgrade demonstrate strong ecosystem growth, while whale movements have created market anxiety as SOL tests key support levels.

BTCC financial analyst Mia notes, "The conflicting signals - strong ecosystem development versus whale-induced volatility - create a complex sentiment landscape. The technical prediction of consolidation aligns with this mixed fundamental backdrop."

Factors Influencing SOL's Price

Snorter Token Presale Surges to $4M Amid Solana Trading Bot Craze

The Snorter (SNORT) token presale has eclipsed $4 million as traders flock to its Solana-native Telegram trading bot. Targeting meme coin volatility, the platform promises millisecond-level token sniping and whale wallet copy-trading—features critical for capitalizing on Solana's high-speed, high-stakes ecosystem.

Unlike multipurpose bots, Snorter specializes in Solana DEX liquidity events. Its Telegram integration eliminates app-switching, offering traders mobile control over lightning-fast swaps with minimal fees. The presale's momentum suggests growing appetite for automated tools that outpace human reaction times.

Solana Price Prediction: Analysts Project 2026 Targets Amid Market Volatility

Solana's price dropped 7% in 24 hours amid a broader crypto market correction that liquidated $1.7 billion. Despite the short-term pressure, analysts forecast a rebound, with September targets between $223-$230 and 2026 projections ranging from $109 to $238.

The market downturn affected over 402,000 traders, highlighting the risks of leveraged positions. Solana remains a key focus, but investors are increasingly diversifying into utility-driven projects like Remittix, which raised $26.3 million through its token sale.

Remittix's resilience underscores a shift toward PayFi solutions, contrasting with speculative altcoin cycles. The Solana network's long-term adoption potential keeps bullish sentiment alive, though volatility remains a persistent challenge.

Solana Price Prediction Today, September 23, 2025

Solana's price exhibited sharp volatility early in the trading session, plunging around 02:30 before rebounding decisively above $220. The recovery formed a V-shaped pattern, though momentum has since softened as traders consolidate gains. Market participants remain cautious amid broader crypto weakness.

Key technical levels are in focus. Resistance sits at $225-$230, a zone that could ignite bullish momentum if breached. Beyond lies the $250 target, a significant long-term hurdle. Support appears firm at $210-$215, with $200 representing a psychological floor where buyers are likely to mount a stronger defense.

The immediate outlook hinges on whether SOL can maintain its footing above $210. A breakout above $225 may fuel a retest of $230, potentially extending toward $250. Conversely, failure to hold $210 risks a slide toward the $200 support level.

Solana's Alpenglow Upgrade Aims to Outpace Tech Giants with Blazing Speed

Solana's latest Alpenglow upgrade has set a new benchmark in blockchain performance, slashing transaction finality from 13 seconds to a mere 100–150 milliseconds. This leapfrogs not only crypto competitors but challenges traditional tech behemoths—processing faster than Google's average search response time of 200ms and matching Visa's payment speeds.

The near-unanimous validator approval (99%) signals strong consensus for this technical revolution. For traders and decentralized applications, this could erase the friction between blockchain interactions and mainstream web experiences. Ethereum's multi-minute settlements now appear archaic against Solana's sub-second finality, while even newer rivals like Sui (400ms) lag behind.

Market implications are profound. Instant settlement could unlock new frontiers for high-frequency DeFi trading and real-time NFT applications. As Layer 1 blockchains evolve into performance-centric infrastructures, Solana's architectural choices may redefine expectations for web3 usability.

Solana Whale Movements Trigger Market Anxiety as Price Tests Key Support

Solana faces mounting pressure as whale activity rattles traders. Over $836 million in SOL moved to Binance within hours, with an additional $54 million deposited into Coinbase Institutional wallets. These transfers represent more than 2.5 million tokens changing hands—a liquidity event that typically precedes volatility.

The altcoin currently trades at $219.35 after a 7% decline, with technical indicators flashing warning signs. The Directional Movement Index shows bearish momentum crossing, while the ADX reading of 31 confirms strong trend strength. Market sentiment has turned negative, registering -1.09 on weighted metrics as traders brace for a potential retest of the $200 support level.

Network activity tells a parallel story. Daily Active Addresses plunged 27% week-over-week, dropping from 2.6 million to 1.9 million users. This on-chain metric suggests weakening retail participation even as institutional players reposition.

Is SOL a good investment?

Based on current technical and fundamental analysis, SOL presents a mixed investment case with both opportunities and risks.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $215.48 | Below 20-day MA, bearish short-term |

| MACD | 0.6061 (positive crossover) | Potential bullish momentum building |

| Bollinger Bands | Middle: $226.71 | Consolidation phase indicated |

| Key Support | $196.20 | Critical level to watch |

The technical indicators suggest SOL is at a potential inflection point. While current price action shows weakness, the MACD crossover and strong ecosystem developments provide reasons for cautious optimism. Investors should monitor the $196 support level closely.