Author: TechFlow

Yesterday's market dynamics

Trump: US ready to implement new round of strong tariffs

According to Jinshi Data, US President Trump said that the United States is ready to implement a new round of strong tariffs.

OECD: The Federal Reserve is expected to cut its key interest rate again in 2025 and twice more in early 2026

According to Jinshi Data, the Organization for Economic Cooperation and Development said it expects the Federal Reserve to cut its key interest rate again in 2025 and twice more in early 2026.

US SEC plans to introduce 'innovation exemption' for crypto companies by year-end

According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) plans to introduce an “innovation exemption” for crypto companies by the end of the year.

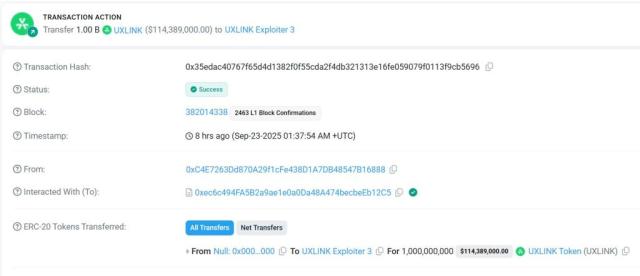

UXLINK: Token contract migration will be carried out in the future, and the new contract has been submitted for security audit

According to UXLINK, the project released its fourth security announcement, announcing that it will migrate the token contract.

UXLINK stated that the continued unauthorized minting has damaged the project's white paper and community consensus. The team has already been in communication with major centralized exchange partners regarding the planned token swap and has received full support.

The new smart contract, which has been submitted for security audit, will set a fixed supply, ensuring that additional supply will never be created. The team decided to forgo the minting and burning functions typically used in cross-chain solutions to ensure community benefits.

Additionally, UXLINK is responding to inquiries from the Korea Digital Asset Exchange Association (DAXA) and will be preparing a comprehensive incident report in conjunction with security expert partners.

The team reminds users not to trade unauthorized tokens on decentralized exchanges and to take extra precautions to ensure wallet security.

STBL founder: A buyback plan will be launched in the fourth quarter, and 100% of the minting fees will be used for buybacks

According to STBL founder Avtar Sehra, STBL will initiate a buyback program in the fourth quarter. 100% of the minting fees will be used for buybacks, thereby driving the value of $STBL to grow.

Avtar Sehra said that with the launch of STBL, the following features will be released next: 1. Multi-factor staking; 2. Buyback launch; 3. USST minting launch; 4. 100% of fees diverted to buyback and provide on-chain logging.

According to previous news, Binance has launched the STBL perpetual contract.

Avantis announces its third season rewards program: 40 million AVNT tokens worth over $80 million

According to Avantis' official disclosure, the platform announced the launch of the third quarter reward plan, which will distribute 40 million AVNT tokens as rewards, accounting for 4% of the total supply of AVNT, which is worth more than US$80 million at the current price.

The program will distribute rewards to XP holders over the next five months, with 75% going to traders (approximately $60 million) and 25% to liquidity providers (approximately $20 million). Season 3 launched on September 3rd and is scheduled to end on February 28th of next year, when the AVNT token claiming function will be launched.

daos.fun core member: The elizaOS team will reorganize the tokens, and ai16z holders will be eligible to receive a snapshot of the new tokens

Baoskee, a core member of daos.fun, announced in a post that the elizaOS team will be restructuring its tokens. All $ai16z holders will be eligible to receive a snapshot of the new tokens and redeem them for new $elizaOS tokens at a fixed ratio. Baoskee explained that the restructuring aims to establish a new treasury, reset the capitalization table while preserving existing community interests, achieve full cross-chain interoperability from the outset (in line with Shaw's wishes), resolve copyright issues regarding the "ai16z" brand, and update token metadata. The team will release more details on value capture in the future.

Sign's intraday gain exceeded 30%, and CZ said Sign is a company in YZiLabs' portfolio.

SIGN rose to $0.135 and has now retreated to $0.11167, with an intraday increase of over 30%.

CZ previously stated that Sign is a YZiLabs portfolio company. Retweeting a tweet about Sign launching SIGN, a blockchain technology stack designed for sovereign nations, he said, "I may have helped a little bit in this matter. Of course, it was just a chat, no coding involved. I made some connections and introductions in a few countries." Sign is a YZiLabs portfolio company.

SBF X account posted again after half a year

FTX founder SBF’s account posted “gm” again after half a year.

Perhaps affected by this, FTT rose by more than 40% and is now trading at US$1.19.

Kraken Co-CEO: Not considering an IPO for now , will continue to seek more acquisition opportunities

According to DL News, Arjun Sethi, co-CEO of cryptocurrency exchange Kraken, said in an exclusive interview that the company will continue to seek acquisition opportunities but will not conduct an initial public offering (IPO) for the time being.

“We are always evaluating strategic fit, but we don’t do ‘blindly cast a wide net’ trades,” Sethi said. In September, Kraken acquired proprietary trading firm Breakout after acquiring retail futures trading platform NinjaTrader for $1.5 billion.

Regarding IPOs, while competitors Bullish and Gemini went public on the New York Stock Exchange and Nasdaq this summer, Sethi made it clear that Kraken would not follow suit: "If we were in a panic about going public, we would have already filed."

Stablecoin giant Tether seeks up to $20 billion in funding at a $500 billion valuation

Tether Holdings, the issuer of the world’s largest stablecoin, is in talks with investors to raise as much as $20 billion, according to two people familiar with the matter, a deal that could catapul the cryptocurrency company into one of the world’s most valuable private companies.

Tether is looking to raise $15 billion to $20 billion in a private placement, representing approximately a 3% stake in the company. Negotiations are at an early stage. Depending on the percentage of shares offered, the deal could value Tether at approximately $500 billion, putting it on par with OpenAI and SpaceX. Its most direct competitor, Circle, had a market capitalization of approximately $30 billion on Tuesday afternoon.

Tether is at the forefront of stablecoins, with its USDT token pegged to the US dollar and a market capitalization of $172 billion, making it the largest stablecoin, while Circle's second-largest stablecoin, USDC, has a market capitalization of around $74 billion.

Market Dynamics

Recommended Reading

US stocks are playing a new kind of AI roulette game

This article describes the new AI capital game in the US stock market, where OpenAI, Oracle, and Nvidia have formed a closed capital loop, driving the development of the AI industry through massive investments and contracts. This loop capitalizes on the market's optimistic expectations for the future of AI, creating a self-reinforcing investment chain, but it also relies on external financing and commitments to be fulfilled.

This article explores Ethereum's decade-long development, exploring the evolution of its technical roadmap, shifts in its core narrative, and the community's criticisms and misunderstandings of its governance model. The panelists share Ethereum's unique value—trusted neutrality—and discuss future trends in Layer 2 scaling solutions and their impact on the Ethereum ecosystem. The article also touches on the role of the Ethereum Foundation, its institutional development, and its relationship with Wall Street.

Burning Half of $HYPE? A Radical Proposal Sparks a Debate on Hyperliquid's Valuation

This article recounts a radical proposal that sparked widespread discussion around Hyperliquid's token supply and valuation. The proposal, which proposed reducing the fully diluted value (FDV) by burning tokens and adjusting the supply structure to attract more institutional investors, sparked disagreements within the community about who the token should serve.

Arthur Hayes' Full Speech at the KBW Summit: Welcoming Bitcoin's Million-Dollar Era

This article discusses the potential for Bitcoin's price to reach a million-dollar era. It analyzes the potential for the US to print money in a frenzy, the yield curve control mechanism, and its impact on Bitcoin's price, predicting that Bitcoin could reach $3.4 million by 2028. While this figure is considered unlikely, Hayes highlights the economic and political drivers that cryptocurrency investors should pay attention to.

An in-depth analysis of the opportunities and concerns behind MetaMask tokens

This article discusses MetaMask's upcoming token, MASK, and its potential impact, including its token economics, revenue streams, fully diluted valuation (FDV), potential airdrop size, and strategy. It also discusses the launch plans and technical support for MetaMask's stablecoin, mUSD.