Written by Li Dan, Wall Street Journal

In his first public speech since the Federal Reserve announced its interest rate cut last week, Fed Chairman Powell, like in his press conference last week, continued to leave room for further rate cuts and hinted at a cautious approach in a challenging risk environment. During the question-and-answer session, Powell warned of overvalued stocks, triggering a decline in the broader US stock market.

In a speech delivered on Tuesday, the 23rd, Powell again warned that the Fed's dual mandate—maximum employment and price stability—is facing threats. These dual risks mean there is no risk-free policy path. If interest rate cuts are too large or too rapid, they could fail to contain high inflation and keep inflation above the Fed's 2% target. If monetary tightening persists for too long, it could unnecessarily strain the labor market.

Powell noted that "in the near term, risks to inflation are upside, while risks to employment are downside—a challenging situation." The downside risks to employment have increased amid a "lack of dynamism and some softness in the labor market." It was precisely this shift in the balance of risks, driven by the increased employment risks, that led to the Federal Reserve's decision to cut interest rates last week.

Regarding tariffs, Powell reiterated that it's reasonable to expect that tariffs will have a short-term impact on inflation, resulting in only a one-time price fluctuation. However, a "one-time" fluctuation doesn't necessarily mean "immediate," and it could persist for several quarters. Powell still believes the Fed must closely monitor the potential lasting effects of tariffs, emphasizing the need to ensure they don't become a persistent inflationary problem.

Powell's speech did not reveal any information, suggesting whether he would support a rate cut at the next Federal Reserve monetary policy meeting in October.

David Russell, global head of market strategy at TradeStation, commented that Powell is laying the groundwork for a scenario in which tariffs lead to higher inflation in the fourth quarter of this year. This is intended to give himself leeway in responding to political pressure from the Trump administration and to appease public opinion by emphasizing that the impact of tariffs is temporary. He said:

"Powell doesn't want to offend the White House, but he won't give in either. He's leaving room to respond to future inflationary pressures. Powell isn't intentionally taking a hawkish stance, but he's trying to avoid some of the strong calls for aggressive rate cuts."

New Fed News Agency: Powell keeps the door open to rate cuts, indirectly responding to Bessant's criticism

Nick Timiraos, a veteran Fed reporter known as the "New Fed News Agency," commented that Powell's prepared speech largely repeated his remarks at the press conference the day the Fed announced the rate cut last week. A highlight of the speech was that despite last week's rate cut, Powell concluded that the policy rate "remains moderately restrictive."

Timiraos believes Powell's assessment suggests that if Fed officials continue to believe that the negative impact of recent labor market weakness on the economy outweighs the impact of rising inflation, the Fed has room to cut interest rates further this year. He believes Powell's remarks indicate he is keeping the door open to future rate cuts.

On the 5th of this month, U.S. Treasury Secretary Jeff Bessant criticized the Federal Reserve for its bloated structure and expanded functions, citing these as the primary reasons for the Trump administration's doubts about the Fed's independence. Tmiraos noted that in his speech, Powell indirectly addressed these criticisms from Bessant and others.

Powell reviewed how the 2008 financial crisis and the 2020 coronavirus pandemic forced the Federal Reserve to take extraordinary measures to avoid a more severe economic crisis. He concluded:

"Despite two unprecedented shocks, the U.S. economy has remained resilient compared to, and even outperformed, other major developed economies."

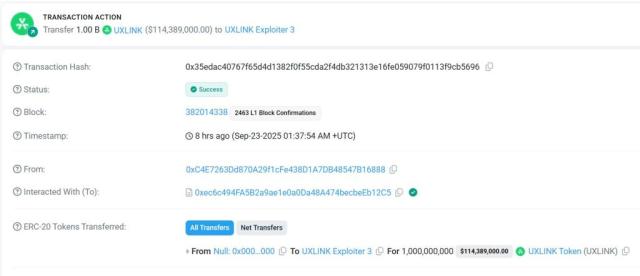

The three major stock indexes hit new lows after Powell called stock valuations "quite high"

During a question-and-answer session following his speech on Tuesday, Powell stated that the U.S. labor market can no longer be considered robust, and that we are indeed seeing substantial weakness in the labor market. He also stated that risks to financial stability have not increased. Banks are well capitalized, and households are in good financial shape. Current financial stability risks are not elevated.

Regarding tariffs, Powell stated that they are not a significant factor in inflation. The pass-through mechanism for tariffs is less pronounced than previously thought. Most forecasts indicate that the pass-through of tariffs will continue until 2026.

Powell believes that some asset prices are high relative to historical levels. By many indicators, stock market valuations are quite high.

Asked how closely Fed officials are watching market prices and whether they are more tolerant of higher prices, Powell said:

“We’re going to be looking at overall financial conditions and whether our policies are impacting financial markets in the way we want them to. But you’re right, by many measures, like stock prices, valuations are quite high right now.”

Powell believes businesses are hesitant because they don't know what to do. The U.S. economy is in a state of low layoffs and low hiring. Low unemployment and a low employment economy are difficult for young workers.

Regarding artificial intelligence (AI), Powell believes it's too early to judge its impact. While AI will eliminate certain jobs, research suggests AI isn't a primary reason for the hiring slowdown. Instead, the slowdown is partly due to uncertainty surrounding government public policy.

Powell also said the Fed's monetary policy decisions are independent of partisan politics. Many people don't believe this. Powell criticized those who believe some of the Fed's actions are politically motivated, calling their claims "without basis."

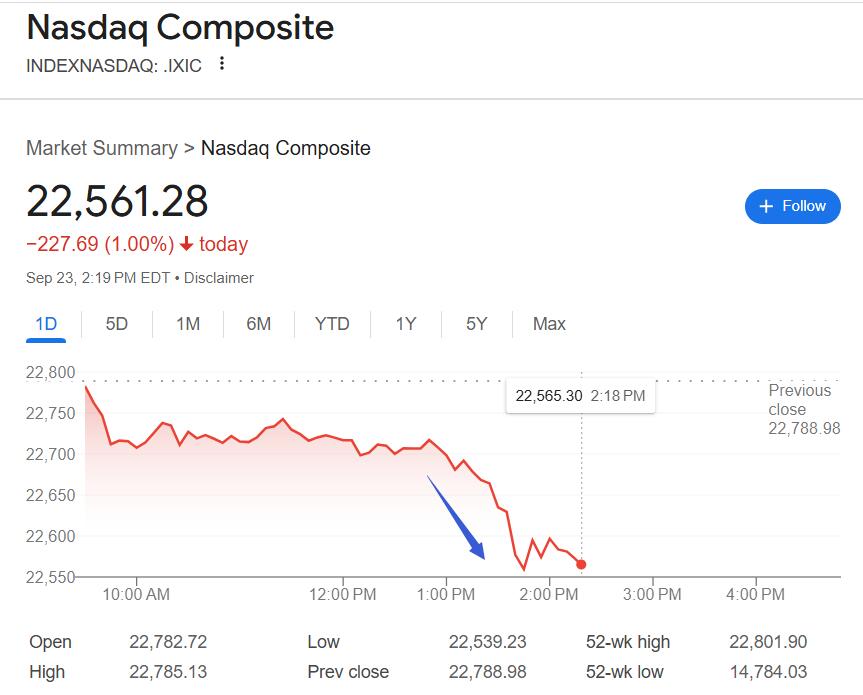

After Powell mentioned the stock market as overvalued, the Dow Jones Industrial Average turned negative, sending all three major US stock indices into intraday declines. The S&P 500 and Nasdaq Composite extended their losses. Shortly after Powell's speech, the three major indices hit new lows for the day, with the Nasdaq down nearly 1.1%, the S&P 500 down over 0.7%, and the Dow down just over 100 points, or over 0.2%.

Powell's full speech on the economic outlook

The following is the full text of Powell's speech titled "Economic Outlook":

Remarks by Chairman Jerome H. Powell at the Greater Providence Chamber of Commerce's 2025 Economic Outlook Luncheon in Warwick, Rhode Island

Thank you all. It's a pleasure to be back in Rhode Island. The last time I had the opportunity to speak to the Greater Providence Chamber of Commerce was in the fall of 2019. At that time, I said, "If the situation changes significantly, policy will also adjust accordingly."

Who could have imagined that just a few months later, the COVID-19 pandemic would strike? The economic landscape and policies shifted dramatically beyond anyone's expectations. While Congress, the government, and the private sector took a series of measures, the Federal Reserve's decisive response also helped avert a historic economic shock.

The world is undergoing a long and arduous economic recovery from the financial crisis, followed by the COVID-19 pandemic. These two global crises have left indelible scars on humanity, the impact of which will last for a long time. In democracies around the world, public trust in economic and political institutions has also been challenged. Those of us in public service need to remain even more focused on diligently fulfilling our responsibilities amidst this precarious and uncertain landscape.

During this turbulent period, the Federal Reserve and other central banks were forced to innovate their policies to address the challenges of the crisis rather than for day-to-day economic management. Despite two unprecedented shocks, the U.S. economy has remained resilient compared to, and even outperformed, other major advanced economies. As always, we must continue to reflect on these difficult times and learn from them, a process that has been ongoing for more than a decade.

Looking ahead, the U.S. economy has demonstrated remarkable resilience despite significant changes taking place in areas such as trade, immigration, fiscal policy, regulation, and geopolitics. These policies are still evolving, and their long-term impact will take time to unfold.

Economic Outlook

Recent data suggest a slowdown in economic growth. The unemployment rate, while low, has risen. Job growth has slowed, and downside risks to employment have increased. Meanwhile, inflation has recently risen and remains elevated. The balance of risks has shifted significantly in recent months, prompting us to adjust the stance of monetary policy closer to neutral at last week's meeting.

In the first half of this year, GDP growth was approximately 1.5%, down from 2.5% last year. This slowdown primarily reflects a slowdown in consumer spending. While the housing market remains weak, business investment in equipment and intangible assets has already surpassed last year's pace. As noted in the September Beige Book, a collection of economic information from across the Federal Reserve's district, businesses continue to see uncertainty weighing on their future outlook. Consumer and business confidence indicators fell sharply in the spring; they have since rebounded, but remain below their levels at the beginning of the year.

In the labor market, both labor supply and demand have slowed significantly—an unusual and challenging phenomenon. In such a less dynamic and slightly sluggish labor market, downside risks to employment have increased. The unemployment rate rose slightly to 4.3% in August, but has remained at a low level over the past year. Job growth slowed significantly during the summer, averaging only 29,000 jobs per month over the past three months. The current employment growth rate appears to be below the "equilibrium point" required to maintain an unchanged unemployment rate. However, some other labor market indicators have remained generally stable. For example, the ratio of job vacancies to unemployed people remains close to 1. In addition, various measures of job vacancies and the number of initial unemployment claims have also remained roughly stable.

Inflation has retreated significantly from its peak in 2022 but remains above our 2% longer-run objective. The latest data show that overall personal consumption expenditures (PCE) prices rose 2.7% in the 12 months ending in August, up from 2.3% in August 2023. Excluding volatile food and energy prices, core PCE prices rose 2.9% last month, also above their year-ago level. Commodity prices, which began to rise after declining last year, have been the primary driver of rising inflation. Available data and surveys suggest that these price increases primarily reflect tariff increases rather than broader price pressures. Inflation in the services sector, including housing prices, remains subdued. Short-term inflation expectations have generally trended upward this year, influenced by the tariff news. However, looking ahead about a year, most indicators of longer-term inflation expectations remain consistent with our 2% inflation objective.

The overall economic impact of major changes in trade, immigration, fiscal, and regulatory policies remains to be seen. It's reasonable to expect that the impact of tariffs on inflation will be short-lived—a one-time price fluctuation. "One-time" does not mean "immediate." Higher tariffs may take time to ripple through the supply chain. Therefore, a one-time increase in price levels could persist for several quarters and lead to slightly higher inflation over that period.

However, uncertainty about the trajectory of inflation remains high. We will carefully assess and manage the risks of high and persistent inflation. We will ensure that this price increase does not develop into a persistent inflationary problem.

Monetary Policy

Near-term inflation risks are tilted to the upside, while employment risks are tilted to the downside—a challenging situation. These two-way risks mean there is no risk-free path. If monetary policy is loosened too much, we may not be able to effectively control inflation, and we may need to adjust policy in the future to achieve our 2% inflation target. If monetary policy tightening is prolonged, labor market slack could become unnecessary. In this conflicting landscape, our policy framework requires us to maintain a balance in achieving our dual mandate.

Downside risks to the employment outlook have increased, shifting the balance of risks to achieving our goals. Therefore, at our last meeting, we decided to move further toward a more neutral stance of policy by lowering the target range for the federal funds rate by 25 basis points to 4% to 4.25%. I believe that the current stance of policy remains moderately restrictive but better positions us to respond to evolving economic conditions.

Our policy is not on a predefined path. We will continue to determine the appropriate stance of policy based on incoming data, the economic outlook, and the balance of risks. We are committed to supporting maximum employment and inflation consistently at our 2% target. Achieving these goals is of vital importance to all Americans. We recognize that our policy actions affect communities, families, and businesses across the country.

Thank you again for inviting me to today's meeting. I look forward to further discussions with you.