#TRX

- TRX is trading in consolidation mode below its 20-day moving average with Bollinger Band squeeze indicating potential volatility expansion

- MACD shows diminishing bearish momentum despite negative readings, suggesting possible trend reversal formation

- TRON ecosystem growth and competitor developments create both opportunities and challenges for TRX price appreciation

TRX Price Prediction

TRX Technical Analysis: Consolidation Phase with Bullish Potential

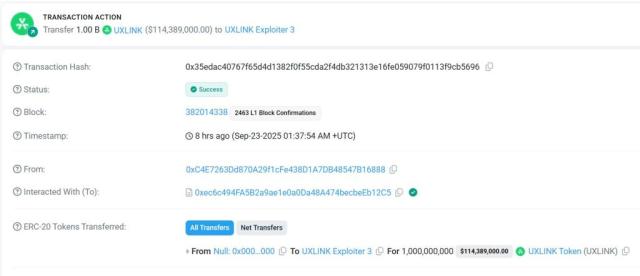

According to BTCC financial analyst William, TRX is currently trading at $0.3366, slightly below its 20-day moving average of $0.340255, indicating a neutral to slightly bearish short-term momentum. The MACD reading of -0.006104 suggests weak momentum, though the histogram shows decreasing bearish pressure. Bollinger Bands placement at $0.322881 (lower) to $0.357629 (upper) with the price NEAR the middle band points to consolidation. William notes that a break above the 20-day MA could trigger movement toward the upper band resistance.

TRON Ecosystem Developments Drive Positive Sentiment

BTCC financial analyst William observes that recent TRON ecosystem news, including SUN Token's 32% monthly surge and growing institutional interest in related projects like Ruvi AI, creates a favorable backdrop for TRX. While competitive threats from emerging tokens exist, the sustained ecosystem growth supports positive market sentiment. William emphasizes that technical levels should take precedence over news-driven speculation in determining entry points.

Factors Influencing TRX's Price

Ruvi AI (RUVI) Gains Institutional Backing, Emerges as Strong Contender to Reach $1 Before Tron (TRX)

Ruvi AI (RUVI) is rapidly emerging as a formidable challenger in the race to a $1 valuation, potentially outpacing established players like Tron (TRX). With $3.9 million raised in its presale and over 280 million tokens distributed to 3,800 holders, the project has demonstrated explosive market demand. Institutional capital is flowing into RUVI, signaling confidence in its accelerated growth trajectory.

Unlike TRX, which faces a gradual climb due to its large market cap, Ruvi AI's low entry point and strong fundamentals position it for near-term explosive growth. The project's early bonus structure and institutional support are key differentiators, making it a magnet for smart money seeking high-potential opportunities.

Best 100x Coin to Watch in 2025: BullZilla, Bitcoin, Ethereum, and the Giants of the Next Bull Run

The crypto market's allure lies in its volatility and the potential for life-changing gains. In 2025, nine projects stand out: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), Binance Coin (BNB), TRON (TRX), Cardano (ADA), Chainlink (LINK), and BullZilla ($BZIL). These tokens span narratives from meme-driven speculation to institutional adoption.

BullZilla emerges as a presale phenomenon with a dynamic pricing model that escalates every $100,000 raised or 48 hours. Built on Ethereum, it combines scarcity mechanics with meme coin virality. The project's 24-stage presale is engineered for exponential growth, positioning it as a dark horse in the 100x conversation.

SUN Token Surges 32% in a Month Amid TRON Ecosystem Growth

SUN, the utility and governance token of the SUN.io ecosystem, has emerged as one of the most active assets in the TRON blockchain network. The token's market capitalization now exceeds ₹55.06 billion, with 24-hour trading volumes topping ₹72.61 billion as of September 2025.

The decentralized finance platform offers token swaps, liquidity mining, and DAO governance through its TRON-based infrastructure. SUN's price has appreciated 58.99% over the past week, currently trading at ₹2.87. The token's supply stands at 19.9 billion following a 2021 redenomination that adjusted circulation without impacting market valuation.

How High Will TRX Price Go?

Based on current technical indicators and ecosystem developments, BTCC financial analyst William provides this TRX price outlook:

| Timeframe | Price Target | Key Levels |

|---|---|---|

| Short-term (1-4 weeks) | $0.35-$0.36 | Upper Bollinger Band resistance |

| Medium-term (1-3 months) | $0.38-$0.42 | Break above 20-day MA confirmation |

| Long-term (6+ months) | $0.45+ | Ecosystem growth dependent |

William cautions that TRX needs to reclaim the 20-day moving average at $0.3403 as support before attempting higher targets. The MACD improvement suggests weakening selling pressure, but sustained volume is required for meaningful upside.