Two simple and important things

Abalone stated calmly: Our decision-making is not based on any "political considerations" [I am still independent, still not laid off, and still don't buy into the King of Understanding's advice]. I think this year's interest rate cuts are enough. This actually shrinks and even eliminates the remaining 50 basis points of room for interest rate cuts before the end of the year. On the other hand, this is essentially stopping the idea of interest rate cuts. There will be no more massive liquidity, and the large-scale quantitative easing (QE) that global central banks are competing for will no longer exist. In other words, the big pool is beginning to return to tightening. The market fell accordingly.

Another statement from Abalone: the three major US stock indexes are now at a high valuation (superimposed on the cessation of QE), which is shocking.

The second thing

Trump's comments on the ground in eastern Ukraine have led to a major strategic adjustment. I believe that with the support of the European Union, we will definitely recover lost ground [yes, that means I will not participate and will not be within the NATO framework]. In addition, the current adjustments in the Middle East regarding Israeli-Palestinian relations and the recognition of the State of Palestine by the US and Europe will likely lead to the concentration of US military resources in the Middle East. In the Western Pacific, they dare not concentrate too much, and they have no advantage at all. The entangled brothers crossing the Taiwan Strait are just symbolic.

However, when the US military submits a clear position on the establishment of a Palestinian state will be a decisive turning point, because this will lead to direct Israeli action (not only Gaza and the West Bank, but also proactively attacking Arab League countries).

No other major events

Today is the first anniversary of 924

Based on the certainty of the QE outlook not meeting expectations [return to tightening] and profit-taking

Micro-strategy adjustments are as follows

Golden2

military2

Energy 1.5 [Russia's exports are severely affected and it threatens to further extend the export ban]

Air Robert 1【Nvidia exceeds 4.5 Thousand billion】

Risk Portfolios 0.5【 T】

Cash 3 [Waiting for a possible stock, bond, and currency waterfall]

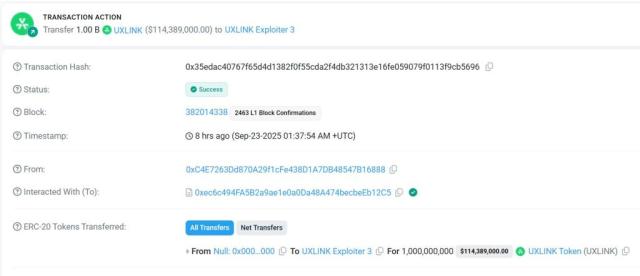

Crypto weekly line basic support below 102x 97x

I wish all traders in South China are safe this year and can work from home.

#BTC

#WildernessHunterInvestor

#Crypto Big Short Arbitrage Hedge Strategy

#Post-Lighthouse Era Geopolitical and Economic Perception

#Multi-asset strategy based on anti-fragility