- AUDD remains small with a market cap near USD 3.36 million, limited adoption, and recent decline, but its role in Project Acacia signals potential regulatory recognition.

- XSGD has grown stronger, with USD 11–18 million market cap, thousands of holders, and over USD 78 million monthly volume, supported by Singapore’s regulatory clarity.

- Their comparison highlights regional stablecoin growth, with AUDD facing liquidity hurdles while XSGD advances as a trusted tool in DeFi and cross-border payments.

AUDD and XSGD are regional stablecoins pegged to the Australian and Singapore dollar. Explore their scale, growth, adoption, risks, and regulatory outlook in the evolving stablecoin market.

INTRODUCTION

Stablecoins have become essential tools bridging traditional currencies and blockchain ecosystems, offering predictable value in a market known for volatility.

While the U.S. dollar dominates this space through tokens like USDT and USDC, regional initiatives are steadily gaining traction.

Among them, AUDD, pegged to the Australian dollar, and XSGD, backed by the Singapore dollar, stand out. Though modest in size compared to their global counterparts, these stablecoins highlight the importance of local currencies in digital finance. Their development also provides a window into how stablecoins can evolve under distinct regulatory and economic environments.

UNDERSTANDING AUDD

AUDD is issued by AUDC Pty Ltd, a subsidiary of Novatti Group, and is pegged 1:1 to the Australian dollar. It has been deployed across multiple blockchains, including Stellar and, more recently, Hedera.

In June 2025, AUDD became the first commercial implementation of Hedera’s Stablecoin Studio, signaling its ambition to function as programmable money bridging traditional finance with decentralized infrastructure.

However, its footprint remains small. As of the latest data, AUDD’s market capitalization is approximately USD 3.36 million, with around 5.07 million tokens in circulation. The number of holders is limited to about 634 addresses, and only 36 have been active over the past month. Monthly transfer volume has been recorded at just under USD 120,000. Notably, its market cap fell by nearly 23% in the last thirty days, underscoring liquidity challenges and limited adoption. Despite this, AUDD’s inclusion in Project Acacia, an Australian initiative exploring tokenized assets and real-time payment interoperability, signals that regulators and financial institutions recognize its potential.

UNDERSTANDING XSGD

By contrast, XSGD has built a far more substantial presence. Issued by StraitsX, a regulated entity under Singapore’s Monetary Authority, XSGD is backed one-to-one with Singapore dollar reserves held at banks including DBS and Standard Chartered. StraitsX also publishes monthly attestation reports, adding credibility and transparency to its operations.

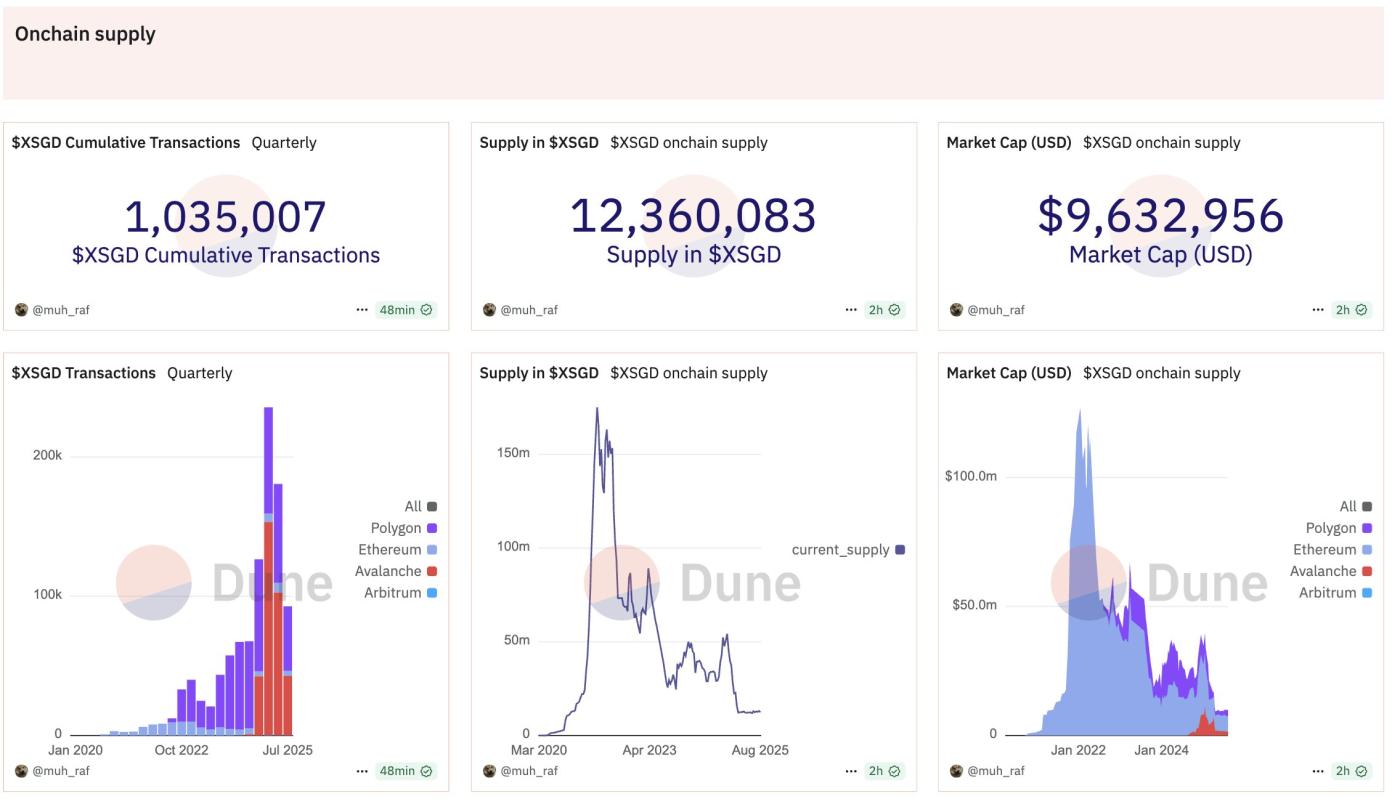

XSGD is available on a wide range of blockchains, from Ethereum and Polygon to Avalanche, Hedera, Zilliqa, and XRP Ledger. This multi-chain presence enhances its usability across DeFi and cross-border payment systems. As of now, its market capitalization ranges between USD 11 and 18 million, with roughly 14.48 million tokens in circulation. The token is held by around 8,245 addresses, with more than 1,500 active in the past month. Monthly transfer volume exceeds USD 78 million, reflecting meaningful adoption beyond speculative trading. While small compared to dollar-pegged stablecoins, XSGD is among the largest non-USD stablecoins in Asia.

COMPARING SCALE AND GROWTH

The contrast between AUDD and XSGD is striking. XSGD’s market capitalization is roughly five times larger, and its user base is an order of magnitude broader.

Transaction activity also differs significantly: AUDD’s monthly transfer volume remains under USD 120,000, while XSGD processes more than USD 78 million over the same period. Moreover, AUDD’s recent 23% decline in market capitalization highlights its fragility, while XSGD has maintained relatively steady adoption. These disparities underscore the importance of liquidity, regulatory support, and ecosystem integration in stablecoin growth.

REGULATORY ENVIRONMENTS

The regulatory landscape plays a decisive role in shaping these stablecoins.

In Australia, AUDD benefits from growing interest in digital payments, but regulatory clarity is still evolving. Its involvement in Project Acacia highlights how the country is testing stablecoin applications in tokenized settlement and real-time systems. In Singapore, StraitsX benefits from a well-defined regulatory framework. The Monetary Authority of Singapore has consistently positioned the city-state as a leader in financial innovation, offering XSGD a strong foundation of legitimacy and trust. This contrast in regulatory support explains much of the difference in adoption between the two tokens.

RISKS AND CHALLENGES

Despite their promise, both stablecoins face risks common to fiat-backed digital assets.

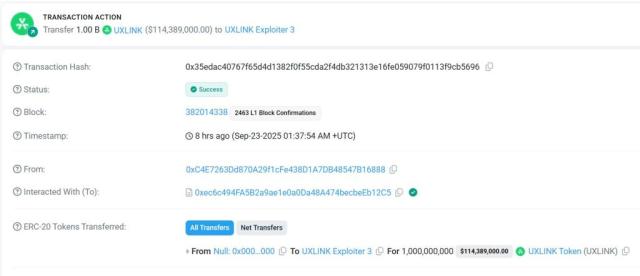

Reserve security and transparency remain critical. While StraitsX publishes independent attestations, AUDD’s smaller size increases vulnerability to shocks. Both tokens must also navigate rising regulatory scrutiny as policymakers worldwide evaluate stablecoin risks. Liquidity concerns are another challenge, particularly for AUDD, where thin trading volumes could amplify volatility. In addition, technical risks—such as smart contract vulnerabilities and cross-chain deployment issues—add to operational complexity. Finally, macroeconomic factors, such as shifts in the strength of the Australian or Singapore dollar, could indirectly influence demand.

FUTURE OUTLOOK

Though their current sizes are modest, AUDD and XSGD symbolize an important shift toward localized stablecoins.

AUDD’s immediate challenge lies in expanding liquidity and proving its role in cross-border payments across the Asia-Pacific region. XSGD, meanwhile, is better positioned to deepen its presence in DeFi and potentially become a preferred settlement currency in Southeast Asia. Both projects also serve as testing grounds for how stablecoins might one day align with central bank digital currencies, offering programmable settlement mechanisms within regulated frameworks. Their trajectories highlight that scale is not the only determinant of significance; vision, utility, and compliance will shape their long-term relevance.

CONCLUSION

AUDD and XSGD may not rival USDT or USDC today, but they reflect a more nuanced narrative in the stablecoin market.

AUDD, though tiny and volatile, is pioneering experiments in programmable finance within Australia. XSGD, larger and more established, benefits from strong regulatory support and growing adoption across networks. Together, they illustrate the gradual diversification of the global stablecoin ecosystem, where local currencies are beginning to find a meaningful role in the digital economy.

〈AUDD AND XSGD: THE EMERGING STABLECOINS OF AUSTRALIA AND SINGAPORE〉這篇文章最早發佈於《CoinRank》。