#TRX

- Technical Consolidation: TRX trades near moving average with mixed momentum signals suggesting near-term range-bound activity

- Ecosystem Expansion: Launch of SunPerp and cross-chain solutions provide fundamental growth catalysts

- Regulatory Overhang: Legal developments create uncertainty that may temper bullish momentum

TRX Price Prediction

TRX Technical Analysis: Key Levels and Momentum Indicators

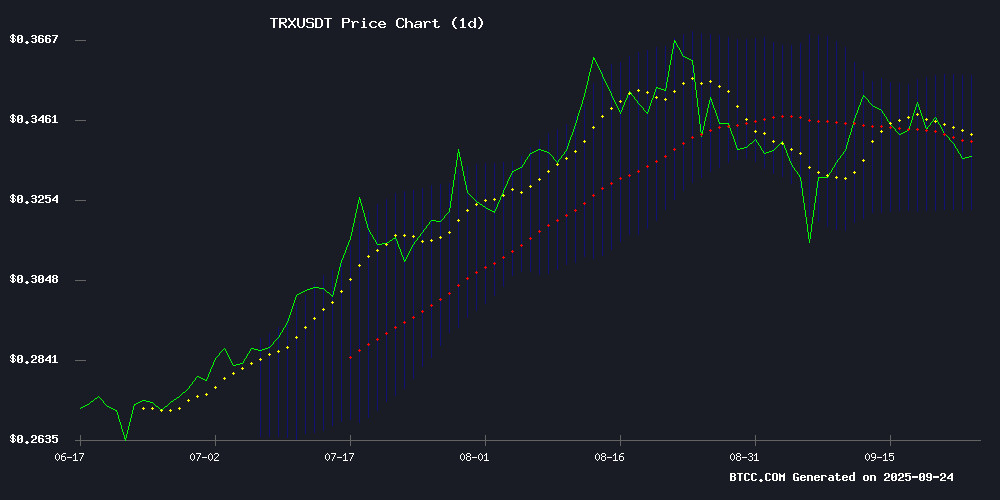

According to BTCC financial analyst Ava, TRX currently trades at $0.3381, slightly below its 20-day moving average of $0.34033, indicating near-term consolidation. The MACD histogram shows negative momentum at -0.002704, though the signal line convergence suggests potential weakening of downward pressure. Bollinger Bands placement reveals TRX trading closer to the middle band than the upper resistance at $0.357653, with support established at $0.323007.

Ava notes that while technical indicators show mixed signals, the proximity to the moving average and middle Bollinger Band suggests equilibrium between buyers and sellers. 'The current technical setup points to consolidation rather than strong directional momentum,' Ava commented.

Market Sentiment Analysis: Legal and Ecosystem Developments

BTCC financial analyst Ava highlights that recent news creates a complex sentiment backdrop for TRX. The court denial of Justin Sun's portfolio disclosure bid introduces regulatory uncertainty, while the launch of SunPerp - TRON's first native perpetual DEX - represents significant ecosystem development.

'The $16M presale for Best Wallet's cross-chain solution addresses fragmentation concerns, but legal developments may temper immediate bullish enthusiasm,' Ava stated. 'These mixed fundamentals suggest sentiment is cautiously optimistic rather than overwhelmingly positive.'

Factors Influencing TRX's Price

Court Denies Justin Sun’s Bid to Block Disclosure of $3B Crypto Portfolio

A federal court has ruled against Tron founder Justin Sun in his attempt to prevent Bloomberg from revealing details of his cryptocurrency holdings exceeding $3 billion. Judge Colm Connolly of the U.S. District Court for the District of Delaware found Sun failed to prove Bloomberg agreed to confidentiality regarding his digital asset portfolio.

The September 22 decision highlights Sun's substantial holdings, including 17,000 BTC, 224,000 ETH, 60 billion TRX, and 700 million USDT. These disclosures emerged after Bloomberg contacted Sun's team for its Billionaires Index in February, prompting immediate legal action that was later withdrawn during settlement talks.

The ruling underscores the tension between financial transparency and privacy in cryptocurrency markets. Sun's portfolio composition—particularly the massive TRX position—offers rare insight into the asset distribution of a major industry figure. The court's rejection of the injunction sets a precedent for media coverage of crypto wealth.

Best Wallet's Cross-Chain Solution Addresses Crypto Fragmentation with $16M Presale

The crypto landscape is fracturing as traders diversify across chains—Solana and BNB for memecoins, NEAR Protocol for AI development, Tron for stablecoins. This fragmentation strains asset tracking, dilutes liquidity, and exposes users to bridge vulnerabilities. Legacy wallets like MetaMask struggle to keep pace.

Best Wallet emerges as a next-generation solution, integrating cross-chain infrastructure with MPC security and Coinbase-like UX—all while remaining non-custodial. Its Ethereum-based BEST token presale has attracted $16M at $0.025685, signaling strong demand for unified crypto management.

Justin Sun Launches SunPerp, TRON's First Native Perpetual DEX

Justin Sun, founder of TRON and advisor to HTX, unveiled SunPerp during an X Space event hosted by HTX Live, TRON, and SunPerp. The platform marks TRON's entry into the perpetual decentralized exchange (Perp DEX) arena, boasting the lowest trading fees in the market. SunPerp aims to pivot TRON from a transfer-focused blockchain to a trading hub, leveraging its dominance in USDT circulation.

The strategic launch fills a critical gap in TRON's ecosystem, as major blockchains typically feature native perpetual futures platforms. With USDT as the backbone, SunPerp targets TRON's vast user base, unlocking new trading potential. "This transforms TRON into a trading chain," Sun emphasized, signaling accelerated ecosystem growth.

Will TRX Price Hit 1?

Based on current technical and fundamental analysis, BTCC financial analyst Ava provides a measured perspective on TRX's potential to reach $1.

| Factor | Current Status | Impact on $1 Target |

|---|---|---|

| Price Position vs MA | $0.3381 (below 20-day MA) | Needs 196% increase |

| MACD Momentum | Negative but converging | Requires significant bullish shift |

| Bollinger Band Position | Near middle band | Needs break above upper band |

| Ecosystem Development | SunPerp launch positive | Long-term supportive |

| Regulatory Environment | Legal uncertainties | Near-term headwind |

Ava concludes: 'While TRX's ecosystem growth through SunPerp and cross-chain solutions provides fundamental support, the technical picture suggests reaching $1 would require overcoming multiple resistance levels and significant market momentum shift. Current indicators don't support an immediate move to this level, making it a longer-term possibility rather than near-term probability.'