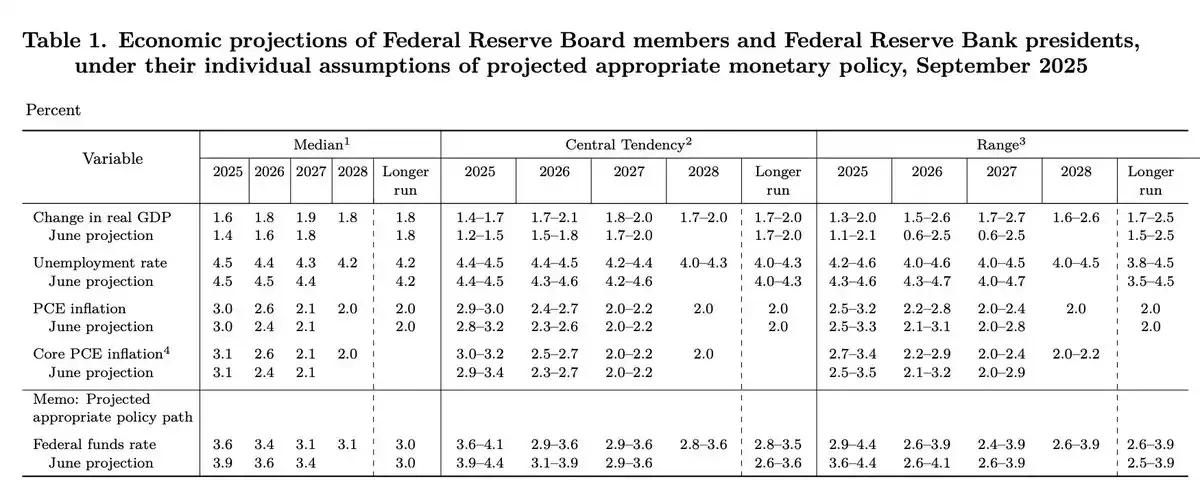

On September 24, just one week after the Federal Reserve's first interest rate cut of 2025, Chairman Powell spoke publicly again, sending a complex and nuanced signal. He warned that the weakening U.S. labor market, weighing on the economic outlook, and inflation remaining above 2% present a "two-way risk" that has posed a dilemma for policymakers, adding, "There is no risk-free path."

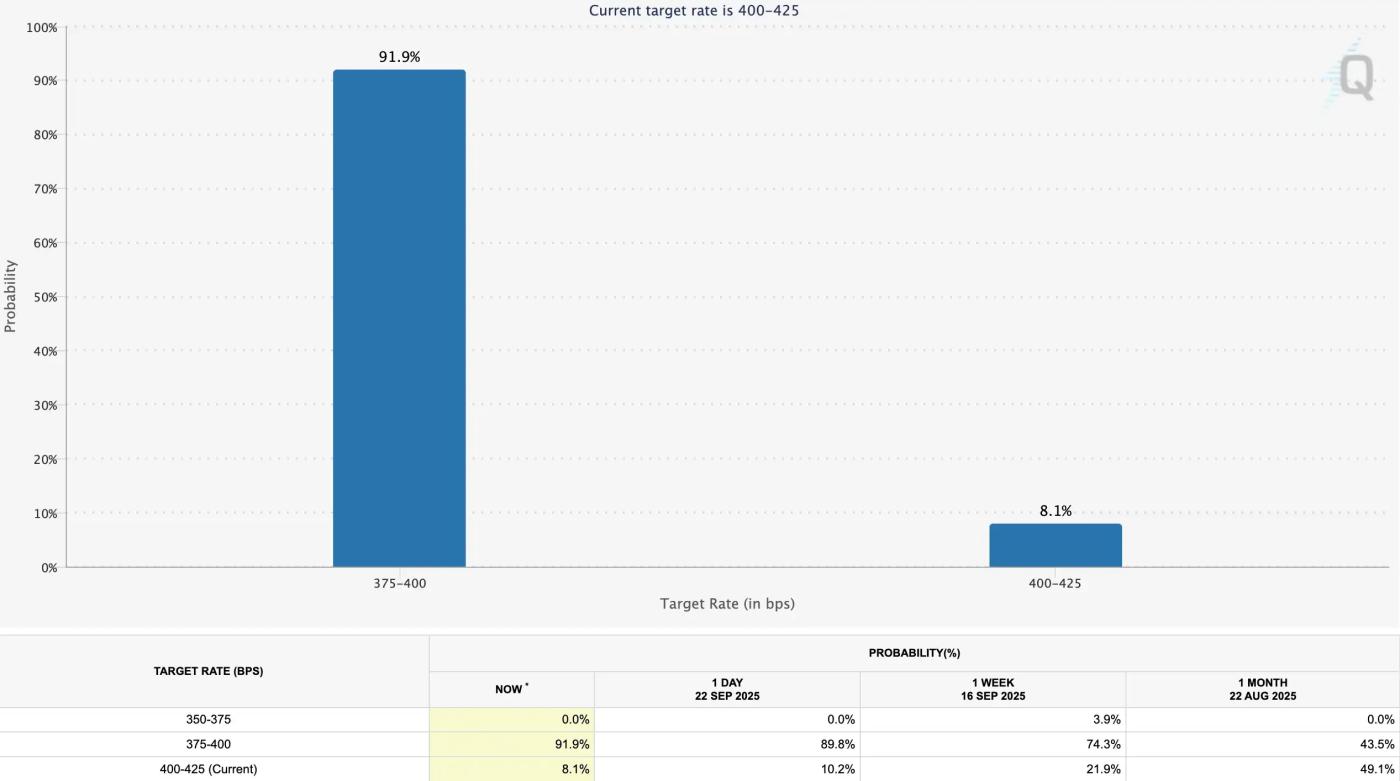

Powell also commented on the high valuations of the stock market, but emphasized that this is "not a period of elevated financial risk." Regarding the October meeting, Powell stated that there was no predetermined policy path. The market interpreted this speech as a "dovish" stance: following the speech, the probability of an October rate cut rose from 89.8% to 91.9%, with the market essentially pricing in three rate cuts this year.

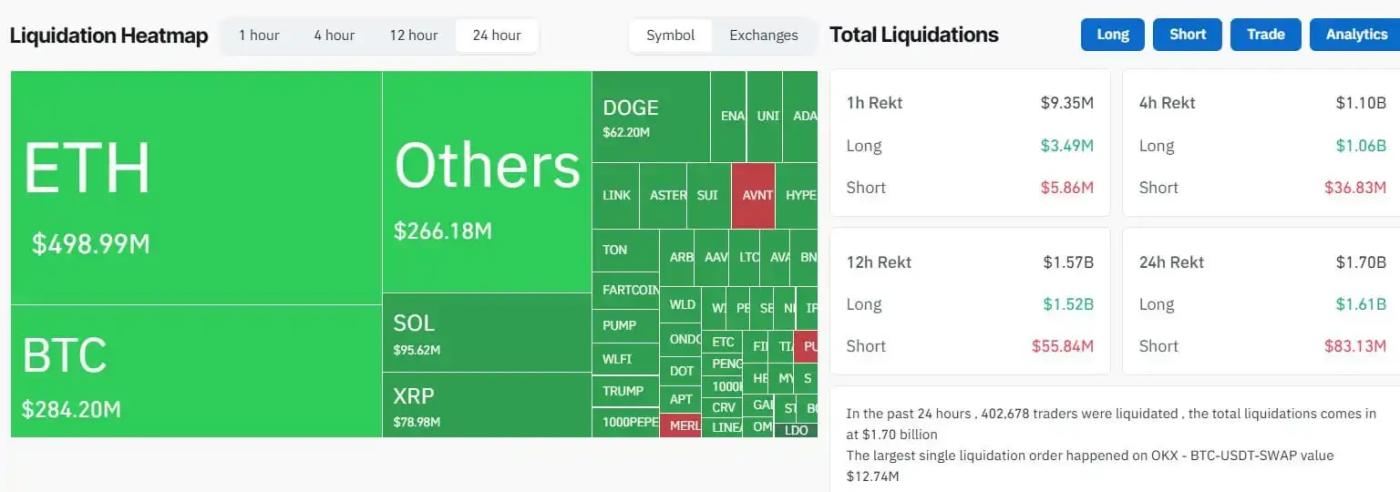

Driven by expectations of easing, US stocks have repeatedly reached new highs, but the crypto market presents a starkly different picture. On September 22nd, crypto markets saw a single-day liquidation of $1.7 billion, the largest such liquidation since December 2024. BlockBeats, BlockBeats has compiled traders' perspectives on the upcoming market conditions, providing some guidance for your trading decisions this week.

@0 xENAS

Traders believe that all signs point to a gradual weakening of the crypto market.

When I re-entered the market after a two-week hiatus, I was caught in the biggest liquidation pullback of the year. However, those "liquidation buy orders," which historically trigger 80% rebounds, continued to decline. This dislocation was a clear red flag. The 20% failure rate often means there are no longer enough marginal buyers in the market, and no one is willing to take up the baton of a rebound.

I suspect we'll increasingly deviate from the logic of "risk assets" like US stocks, and begin to lose several key support levels. My observations are: BTC breaking through the $100,000 support structure, ETH falling below $3,400, and SOL falling below $160.

@MetricsVentures

We believe the global asset bubble cycle has likely entered its warming phase, and its activation appears to be only a matter of time. This bubble cycle is occurring against the backdrop of unemployment and social divisions driven by the impact of AI, supported by the global fiscally-driven economic cycle and political and economic ecosystem. Accelerated by the further strengthening of global bipolarity and the shared desire of the two major powers to export inflation to resolve internal conflicts, it is expected to enter public discussion in the coming months.

Looking ahead, while the cryptocurrency market, which has remained relatively stable for nearly a year, is a potential winner, global cyclical mining and AI-derived investment chains will continue to generate excess returns. Regarding cryptocurrency stocks, the success of ETH will lead to the emergence of a series of copycat platforms. It is expected that the combination of strong large-cap cryptocurrencies and strong stocks will become the most eye-catching segment in the coming months.

As countries with competitive advantages begin to consider setting up investment accounts for newborns, further relaxing investment restrictions on pensions, and elevating the capital market, which has historically served as a financing channel for a long time, to new heights, the bubble of financial assets has become a high-probability event.

We are also pleased to see that the US dollar market has begun to welcome the native volatility of digital currencies and provide ample liquidity pricing for it. This was unimaginable two years ago, just as the success of MSTR was a financial magic that we could not predict two years ago.

In short, we are clearly bullish on the cryptocurrency market over the next six months, and on the global mining and cyclical markets and AI-derived industry chains over the next one to two years. At this moment, economic data is no longer so important. As many in the crypto community jokingly say, "economic data is always good news." As history rumbles forward, following the trend and embracing bubbles may have become the most important task for our generation.

@Murphychen 888

According to the trend of "three lines in one", after October 30 this year, MVRV will enter a long-term downward trend of fluctuations, which is completely aligned with the time pattern of BTC's past 4-year cycle.

However, according to this macro-expectation data, the overall signal conveyed is "soft landing + falling inflation + gradual easing of monetary policy."

Although the future is unknown, if this is true, then the 4-year cycle theory may really be broken, and Bitcoin may enter an "eternal bull market."

@qinbafrank

The logic behind the outperformance of US stocks during large-scale fluctuations lies in the fact that the overall market remains subtly concerned about the future trend of inflation. The strength of US stocks lies in their strong fundamentals, with AI accelerating, allowing them to withstand concerns about inflation and continue their rapid growth. The problem with currencies is that they are driven by capital and expectations, and concerns about macroeconomic conditions can affect the flow of external funds.

The current cryptocurrency market is driven by traditional funds entering the market through ETFs and listed companies as buyers, while whale and trend-based investors acting as profit takers act as sellers. The market's price fluctuations and volatility are largely driven by the interplay between these two forces. In the short term, economic strength, inflation trends, and interest rate expectations all influence the inflow of buyer funds. Positive expectations can accelerate inflows, while negative expectations can halt or even reverse the outflow.

The Fed has resumed cutting interest rates, but inflation is still slowly rising. The market is naturally worried that the Fed's rate cuts will be interrupted by inflation again in the future. In this case, the inflow of buyer funds will be affected, which can be seen from the changes in the scale of ETF net inflows. The AI penetration rate of the core main line of the US stock market is about to reach 10%. Once it jumps over, it will enter a golden period of rapid penetration rate growth. It is still said that AI is accelerating. From this perspective, the strength and weakness are naturally reflected.

The subsequent market trends need to refer to macroeconomic data:

1) Best case scenario: The pace and magnitude of rising inflation are lower than expected, which is beneficial to both the currency and US stocks.

2) Medium scenario: The pace of inflation is in line with expectations, which is more beneficial to the US stock market because of its stronger fundamentals. The currency is relatively good but is likely to experience large-scale wide fluctuations.

3) Worst case scenario: If inflation significantly exceeds expectations in the future, the U.S. stock and cryptocurrency markets will both pull back. The U.S. stock market may be at a small level, and the cryptocurrency market may be at a medium level.

@WeissCrypto

The liquidity impact of the Fed's rate cuts won't be injected into the crypto market until mid-December. Its model suggests that sideways fluctuations could last 30 to 60 days, with a clear bottom likely to appear on October 17th. Notably, Weiss Crypto recently predicted a peak around September 20th.

@joao_wedson

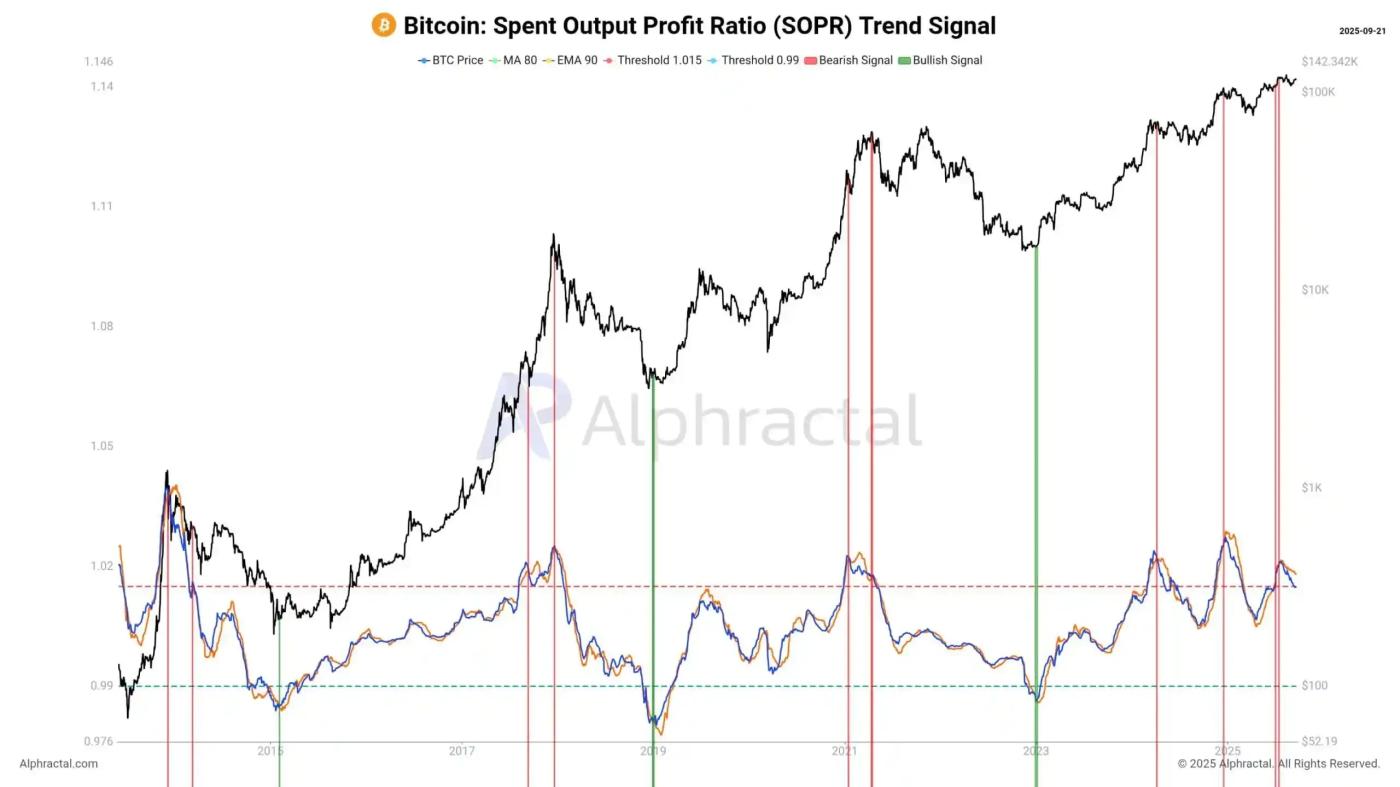

Joao Wedson, founder of the blockchain analytics platform Alphractal, stated that Bitcoin is showing clear signs of cyclical exhaustion. He noted that the SOPR trend signal, which tracks on-chain realized profitability, suggests that investors are buying at all-time highs while profit margins are already shrinking. The realized price for short-term Bitcoin holders is currently $111,400, a level that institutional investors should have reached earlier. He also noted that Bitcoin's Sharpe ratio, a measure of risk-return, has weakened compared to 2024.

He suggested that "those who bought BTC at the end of 2022 would be satisfied with the +600% gain, but those who accumulated in 2025 should reconsider their strategy," and that market makers tend to sell BTC and buy Altcoin, which will perform better in the future.