HDS plans to issue more than 365 million shares, raising 7,300 billion VND, and plans to spend 1,470 billion VND to contribute Capital to establish the HD crypto asset trading floor.

HDS wants to invest 1,500 billion VND to establish a crypto asset exchange in Vietnam

HDS wants to invest 1,500 billion VND to establish a crypto asset exchange in Vietnam

HDS announced plans to issue shares to increase Capital

On September 24, 2025, HD Securities Corporation (HDS) officially announced its plan to seek shareholders' opinions on the plan to issue more than 365 million shares at a ratio of 2:5 (shareholders owning 2 shares will have the right to buy 5 new shares). The expected offering price is 20,000 VND/share.

If the issuance is successful, HDS's charter Capital will increase from VND1,460 billion to more than VND5,115 billion, strengthening the company's position in the group of large-cap Capital companies in the market.

Plan for allocating mobilized Capital

- Total revenue is expected to reach more than 7,300 billion VND, including:

About 63% (~VND 4,600 billion) will be used for investment activities, including securities trading, deposit certificates and government bonds.

25% of Capital is for margin lending.

10% of Capital to advance money from selling securities to customers.

The remaining 2% is invested in fixed assets, software and operating costs.

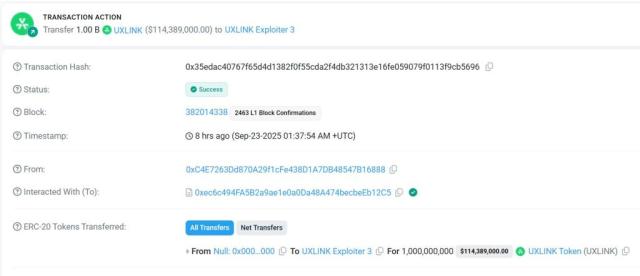

- In addition, 1,470 billion VND will be Capital to establish a business operating a crypto-asset exchange, expected to be named HD Crypto-Asset Exchange Joint Stock Company with a charter Capital of 10,000 billion VND.

- This move shows that HDS not only strengthens its traditional financial capacity but also pushes forward into the field of crypto assets, a market that is being legalized in Vietnam.

Legal context

- HDS's plan took place right after the Government issued Resolution 05/2025/NQ-CP dated September 9, 2025, allowing a 5-year pilot of the crypto asset market.

- According to the resolution:

Licensed enterprises must have a minimum charter Capital of VND 10,000 billion.

At least 65% of Capital must come from domestic institutions.

Over 35% of charter Capital must be held by at least two organizations belonging to the banking group, securities companies, fund management companies, insurance or technology companies.

Foreign ownership ratio does not exceed 49%.

- With the plan to invest 1,470 billion VND in the crypto asset exchange, HDS clearly shows its determination to participate in the emerging market and is expected to become a new growth driver.

- However, HDS is not the only securities company or bank betting on the Vietnamese crypto asset market recently:

- MB Bank partners with South Korea's largest crypto exchange Upbit to develop a digital asset trading platform.

VIX Securities contributed 15% of Capital to establish VIXEX Company, with an initial scale of VND 1,000 billion.

VPBankS holds 11% of Capital at Vietnam Prosperity Crypto Asset Exchange Company (CAEX).

Big names like SSI and TCBS are also mentioned in the plan to develop a digital asset exchange.

Coin68 synthesis