Cardano (ADA) has recovered from its recent decline, surpassing the $0.85 level and moving closer to the important $1 mark.

This recovery came despite a significant increase in selling activity, as investor demand appeared to be balancing market pressures and maintaining the upward momentum.

Cardano investors sell lightly

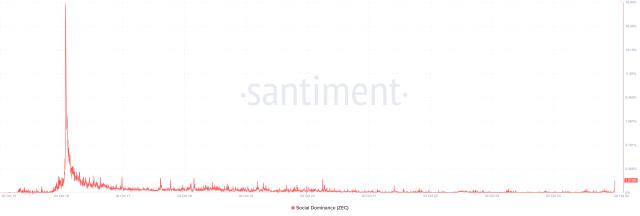

Network data shows that realized profits have spiked multiple times in the past few weeks. Investors have sold ADA to secure profits, reflecting cautious market sentiment. However, most of these sales have been modest, with realized profits often below $50 million.

This level is important because selling above this level usually puts a lot of pressure on the price. With most of the selling below this level, ADA has maintained its bullish momentum.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Real Profit/Loss of Cardano Network . Source: Santiment

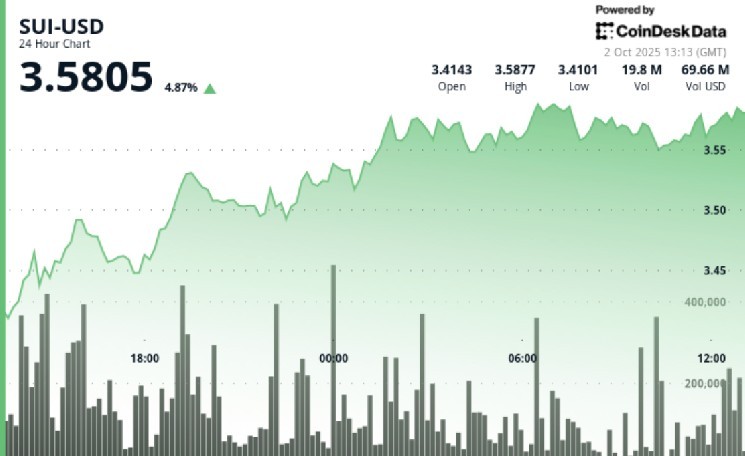

Real Profit/Loss of Cardano Network . Source: SantimentCardano ’s macro performance remains closely tied to Bitcoin. The current correlation between ADA and BTC is 0.78, showing the influence of the “king of cryptocurrencies” on ADA’s journey . As Bitcoin approaches $120,000, a breakout above this barrier could directly boost demand for Cardano.

However, the correlation index has shown a slight decline recently, raising concerns about whether this decline will continue. If Cardano decouples further from Bitcoin, its dependence on BTC 's momentum for growth could weaken.

Correlation between Cardano and Bitcoin. Source: TradingView

Correlation between Cardano and Bitcoin. Source: TradingViewADA Price Aiming for Higher Highs

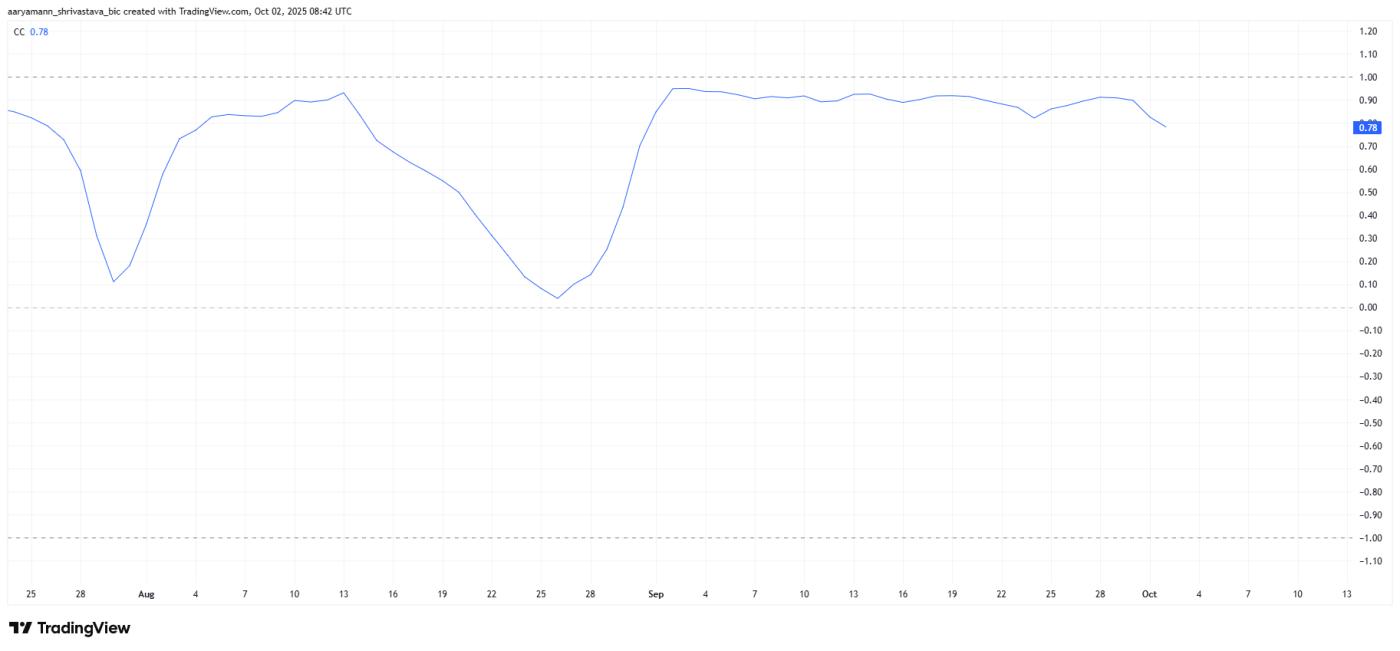

At the time of writing, Cardano is trading at $0.85, up from $0.75 just a week ago. The Token is currently about 16.8% away from $1, a psychological barrier that could have a significant impact on market sentiment if reached.

Breaking above $1 could spark strong demand for ADA . To reach this milestone, the altcoin must overcome resistance levels at $0.88 and $0.93. Maintaining the current bullish momentum will be key for ADA to build the strength needed to overcome these barriers and move closer to $1.

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingViewIf the bullish momentum wanes, Cardano is at risk of losing momentum . A drop below the $0.83 support could push ADA back to $0.80 or even $0.75. Such a decline would invalidate the bullish thesis and cast doubt on the Token's ability to sustain its recent recovery.