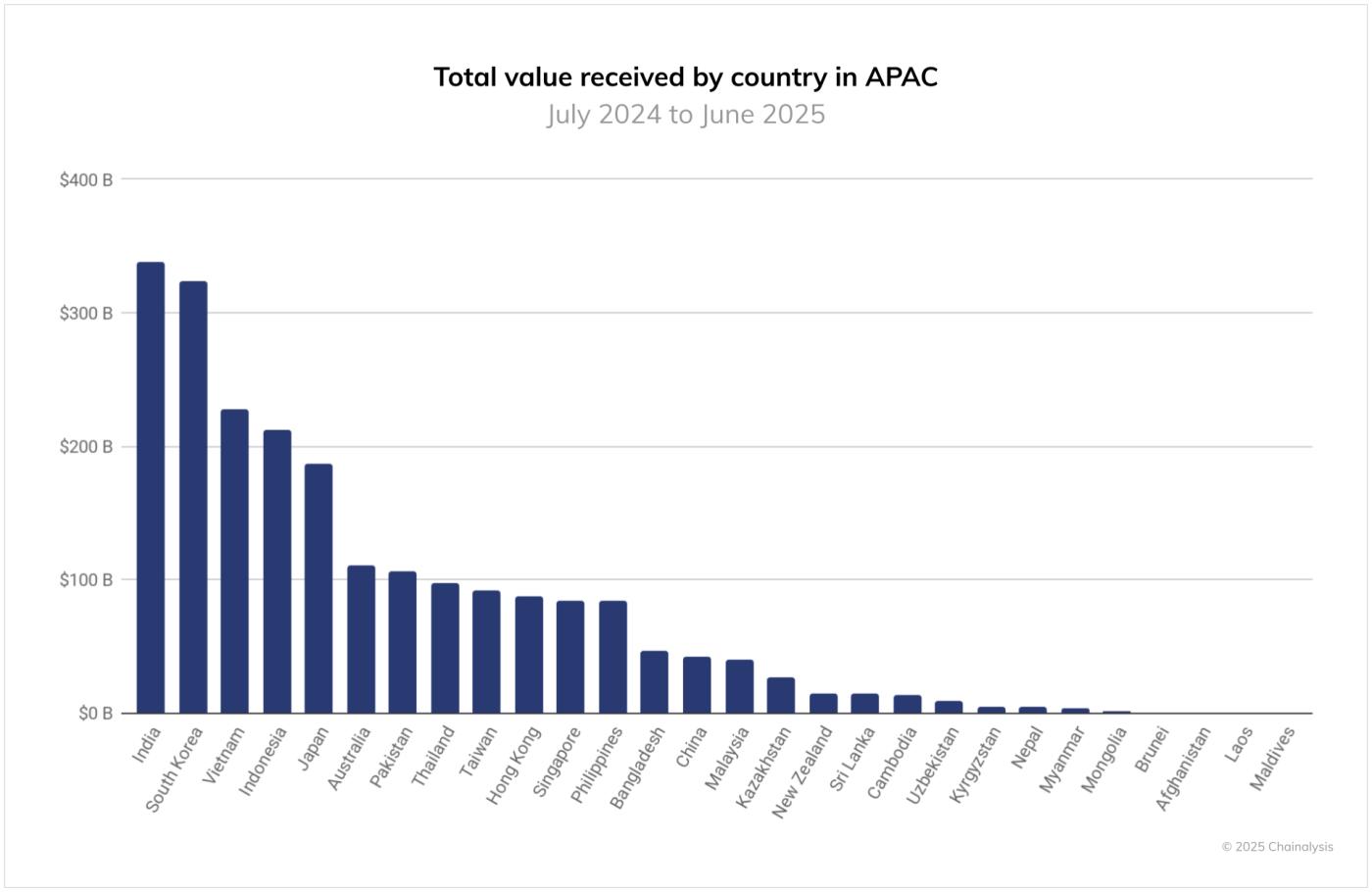

Chainalysis’ APAC 2025 Cryptocurrency Adoption Report shows rapid growth in the region’s cryptocurrency activity, with monthly on- chain transaction value tripling from around $81 billion in July 2022 to $244 billion in December 2024.

India remains the largest market by volume , supported by grassroots adoption, remittances and fintech integration.

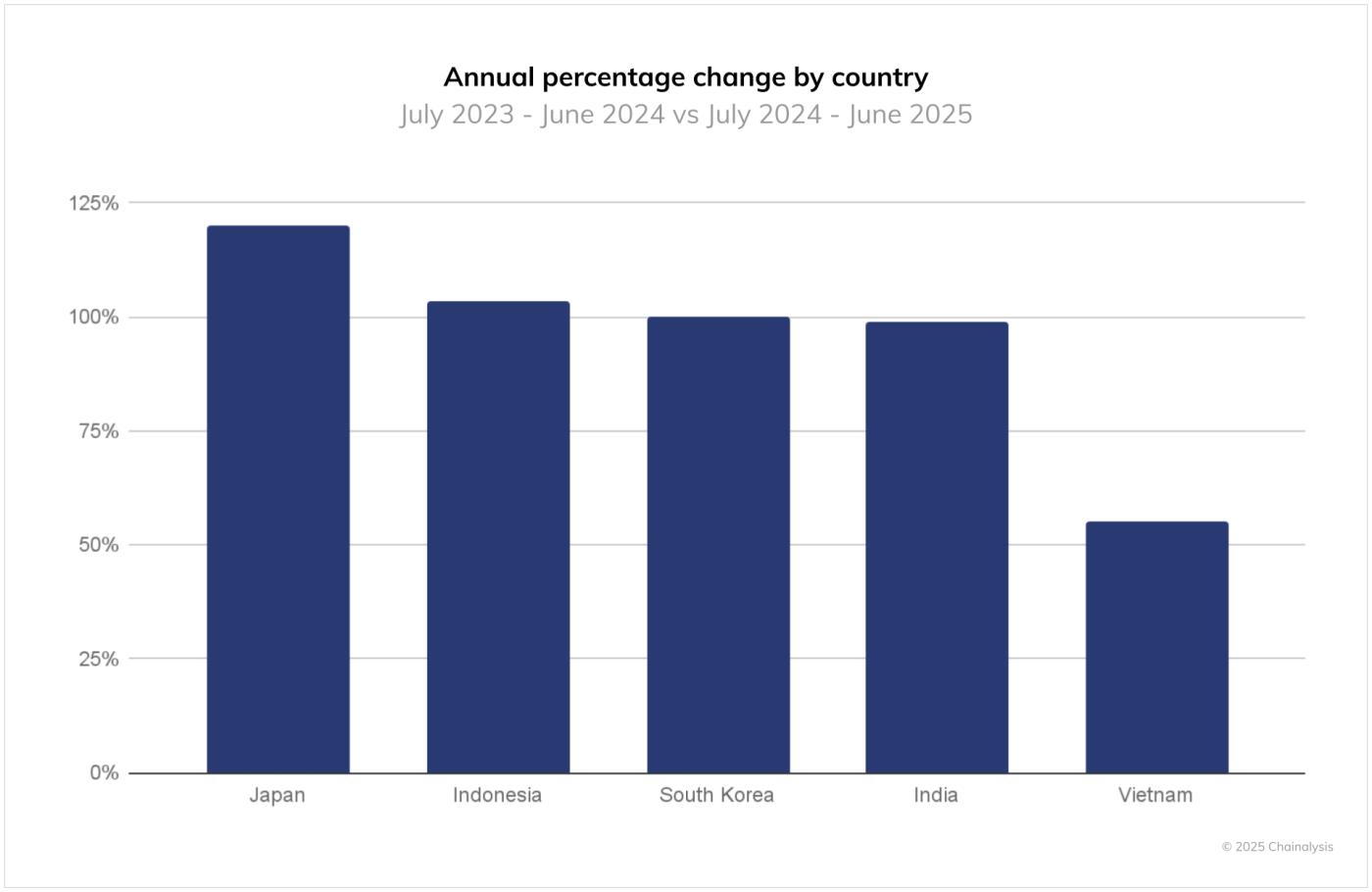

Japan, despite having a smaller absolute volume, recorded the fastest year-on-year growth of 120% to June 2025, thanks to regulatory reform, widespread investor participation, and growing use of major cryptocurrencies. This growth highlights the diverse adoption models shaping the crypto landscape in APAC.

India maintains dominance amid widespread crypto adoption wave

India continues to lead the Asia-Pacific region in cryptocurrency adoption by total on- chain volume . By mid-2025, India will account for approximately $338 billion in monthly on chain transactions, significantly higher than any other APAC market.

Total value received by country in APAC Source: Chainalysis

Total value received by country in APAC Source: ChainalysisGrassroots adoption is the main driver of this growth. Key factors include remittances from the Indian diaspora, retail investor transactions, and fintech integration through platforms like the Unified Payments Interface (UPI). Young people are increasingly using cryptocurrencies as an investment and source of income. This trend shows the growing familiarity and acceptance of digital assets among the population.

The Indian market benefits from a combination of demographic factors and a supportive financial infrastructure. Capital , a key economic component, are increasingly being channeled through cryptocurrency channels, which offer lower costs and faster settlement times than the traditional banking system.

Additionally, fintech platforms have integrated cryptocurrency trading with existing payment systems, making transactions seamless for retail users. Regulatory developments, including clearer tax guidance and licensing frameworks, have also contributed to market confidence.

Despite the large scale of adoption, volatility remains a factor, and regulators continue to monitor trading activity to prevent systemic risk. Overall, the Indian market illustrates how a large, digitally connected population can drive significant on- chain volume even in an evolving regulatory environment.

Japan records fastest year-on-year growth

India leads in total volume, but Japan has seen the fastest year-over-year growth in APAC. By June 2025, Japanese transactions had increased by 120%. This rapid growth follows regulatory reforms. These changes clarify the legal and tax status of cryptocurrencies, improve investor protection, and support institutional participation.

Clearer investment frameworks and revised reporting rules have encouraged broader adoption. Retail investors and small financial institutions have been particularly affected. Use of major digital assets—Bitcoin, Ethereum, and XRP—has increased. Exchanges now offer smoother onboarding and offboarding to support this growth.

Japan’s growth is also influenced by cultural and economic factors. In urban areas such as Tokyo and Osaka , cryptocurrency adoption has been integrated into mainstream finance, while acceptance in other areas remains limited but is gradually expanding. The country’s established banking system, combined with high smartphone penetration and digital literacy, supports seamless access to the cryptocurrency market.

Additionally, Japanese consumers are increasingly adopting cryptocurrencies for a variety of purposes, including remittances, transactions, and payment solutions. The APAC market is still larger overall, but Japan’s rapid growth highlights the impact of regulatory clarity and market education. Analysts say continued government oversight and compliance rules could shape Japan’s cryptocurrency market in the coming years.

Different acceptance models in APAC

Apart from India and Japan, other APAC countries show distinct adoption patterns that reflect local economic and cultural contexts.

In South Korea, cryptocurrency trading operates similarly to the stock market, with high liquidation , institutional participation, and growing demand for stablecoins. Regulatory oversight is relatively strict, emphasizing transparency, anti-money laundering compliance, and investor protection. This structure allows South Korea to integrate cryptocurrency trading into the broader financial ecosystem, supporting both retail and institutional investors.

Vietnam presents a contrasting model, with cryptocurrencies increasingly integrated into everyday life. Digital assets are used for remittances, gaming and personal savings, reflecting a pragmatic approach to adoption. Mobile access is widespread, and cryptocurrencies have become an alternative means of storing value amid inflationary pressures.

Pakistan demonstrates a mobile-first adoption model, relying heavily on stablecoins to hedge against inflation and facilitate payments for freelancers and remote workers. These markets illustrate how economic constraints and access to technology influence adoption strategies .

Smaller but more mature markets such as Australia, Singapore and Hong Kong have emphasized regulatory refinement and licensing clarity, creating a favorable environment for institutional participation and market stability.

Overall, adoption models in APAC reveal the region’s adaptability and diversity in integrating cryptocurrencies into economic and financial frameworks.

Regional outlook and impact

The Asia-Pacific region is expected to continue to see significant growth in cryptocurrency adoption, although trends will vary by country. India’s large volume make it a major driver of on- chain activity in APAC. Japan’s rapid growth shows that regulatory clarity can drive adoption even in mature markets.

Emerging countries, including Vietnam and Pakistan, could continue to embrace everyday use cases like remittances and mobile payments.

Regulatory frameworks will continue to be central to shaping market adoption and stability. Countries that provide transparent guidance on taxation, licensing and compliance are likely to encourage participation from both retail and institutional investors.

The development of digital infrastructure, including fintech integration and mobile access, will also be crucial in maintaining momentum.

Chainalysis analysts note that cross-border remittances and stablecoin use could increasingly influence regional flows, especially in countries facing currency volatility. For investors and policymakers, understanding the different national adoption patterns in the APAC region will be important to navigate both opportunities and risks in the evolving cryptocurrency ecosystem.