Layer-1 coin Solana has gained nearly 10% over the past week, fueled by fresh momentum from the broader crypto market. Bitcoin’s recent price surge has helped lift the market, pulling SOL and other altcoins up.

However, upon closer examination of SOL’s performance, it can be seen that this rally lacks strong support and could soon reverse.

Solana Price at Risk of Falling: Data Hints at Trouble

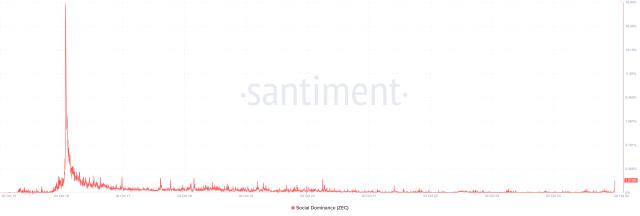

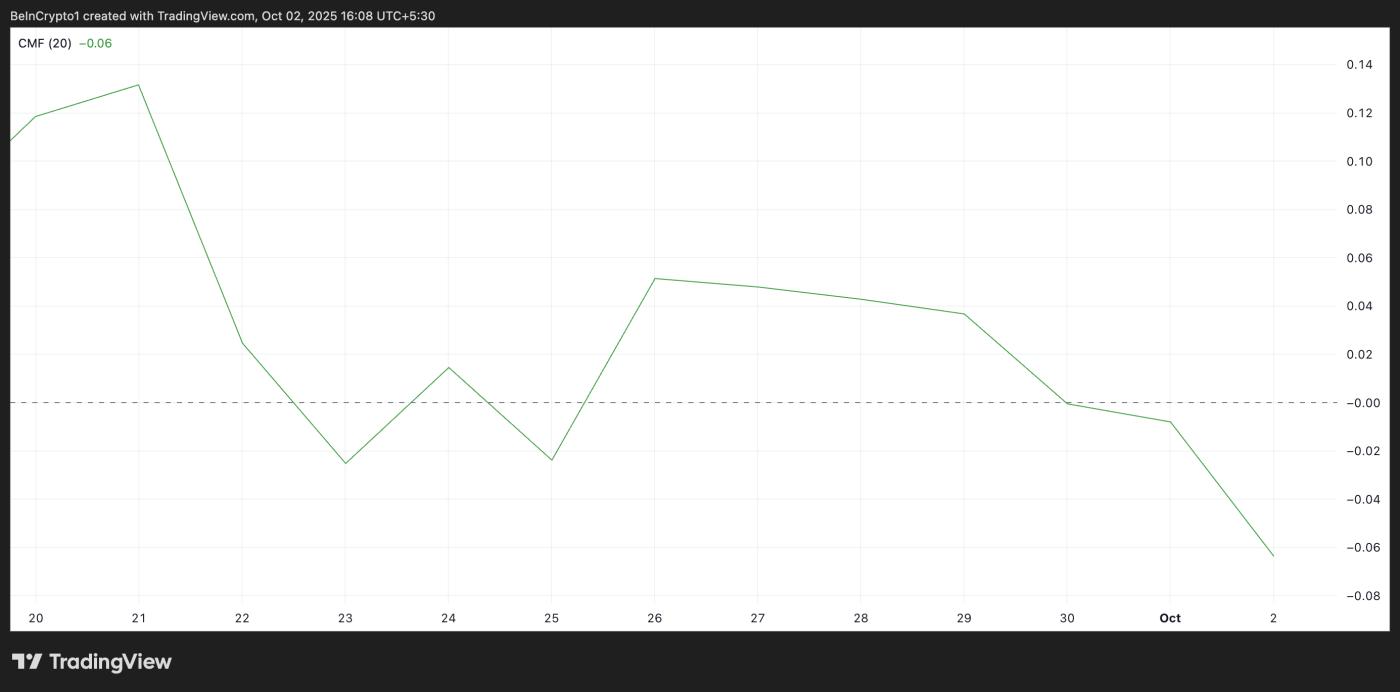

SOL ’s rally is facing a downside risk as its Chaikin Money Flow (CMF) indicator is trending lower, creating a bearish divergence. At the time of writing, the momentum indicator is below the zero line at -0.06 and continues to trend lower.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Solana CMF. Source: TradingView

Solana CMF. Source: TradingViewThe CMF measures the flow of money into and out of an asset. When it returns a negative value while the asset price is rising, it creates a bearish divergence, indicating that liquidation is weakening.

This pattern shows that while SOL buyers are still pushing the price higher, Capital inflows into the asset are decreasing and could trigger a reversal in the short term.

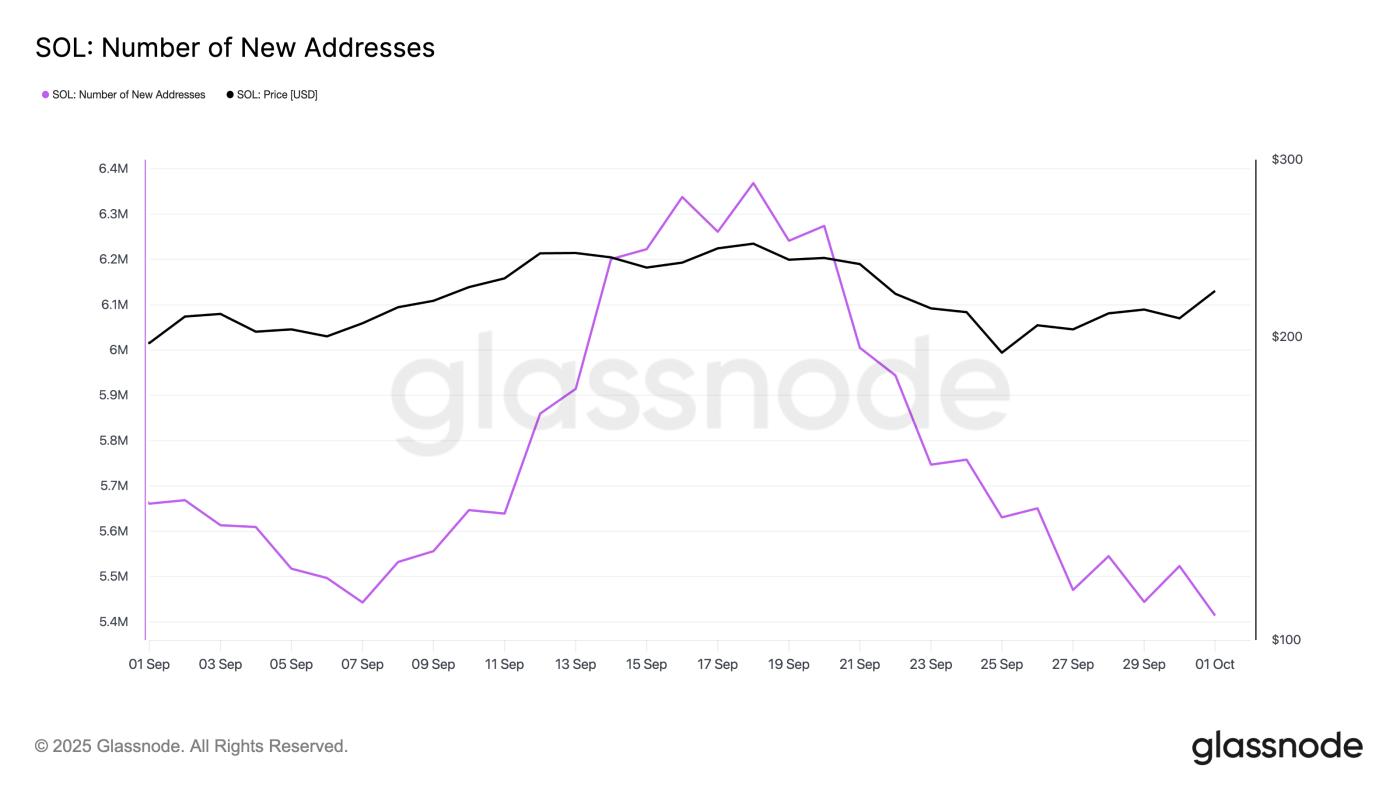

Furthermore, the number of new addresses joining the Solana network daily has decreased, indicating reduced activity and weakening demand. According to Glassnode, the number of new daily wallet addresses on Solana has decreased by 15% since September 18, 2023.

Solana New Address Count . Source: Glassnode

Solana New Address Count . Source: GlassnodeA decline in the number of daily active addresses reflects a slowdown in network participation, which can be a warning sign for the underlying demand for an asset.

This could lead to reduced buying pressure for SOL, reducing the ability to sustain the uptrend.

Weak demand overshadows Solana 's rally

SOL ’s rally over the past week has placed its price within a rising parallel channel, which typically signals an uptrend. However, with underlying demand losing strength, the Token ’s price could break this pattern and fall to $205.02.

Solana Price Analysis. Source: TradingView

Solana Price Analysis. Source: TradingViewConversely, if the altcoin maintains its bullish momentum, its price could reach $253.66.