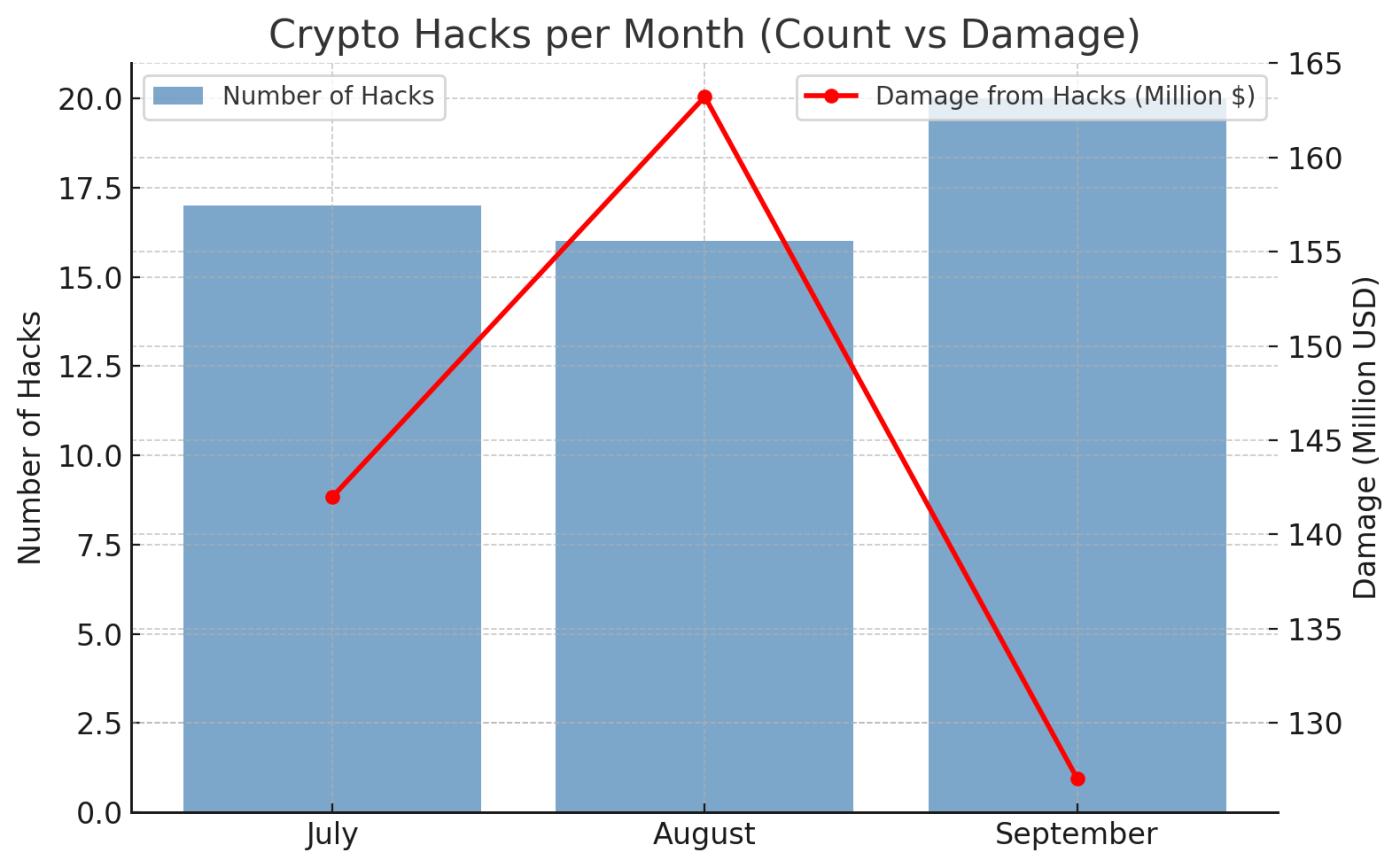

September saw a total loss of $127.06 million from 20 cryptocurrency-related attacks, according to PeckShield.

While this figure is down 22% from August’s $163 million, the actual number of incidents increased, suggesting that cryptojacking in September highlights the risks that still exist in the cryptocurrency ecosystem.

Cryptojacking in September – Cooling Down, But Risks Remain

According to PeckShield , September 2025 saw around 20 large-scale attacks in the cryptocurrency industry, causing an estimated $127.06 million in losses. Major cryptojacking incidents in September included UXLINK ($44.14 million), SwissBorg ($41.5 million), Venus ($13.5 million, later recovered), Yala ($7.64 million), and GriffAI ($3 million).

While the total value of damage is decreasing, the number of hacks is increasing, as attackers continue to evolve their methods, leaving no link in the ecosystem completely unscathed.

Looking back at August , it was a volatile month with 16 major security incidents losing over $163 million, up 15% from July. Q3 2025 saw over $432 million lost from 53 hacks, confirming that cryptojacking in September is part of an ongoing threat.

Number of cryptojackings in Q3 2025. Source: BeInCrypto

Number of cryptojackings in Q3 2025. Source: BeInCryptoGrowing pressure on RWA projects

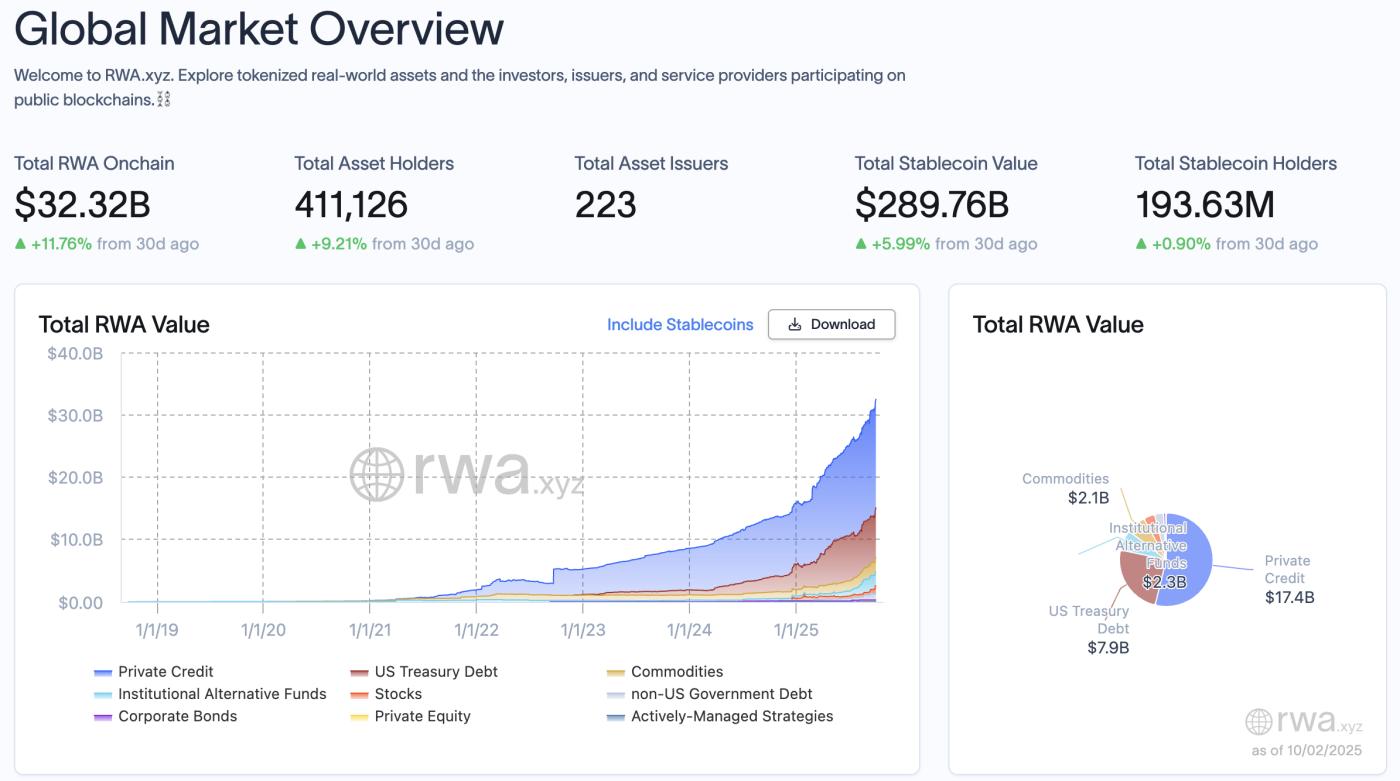

As BeInCrypto reported, a growing trend of attacks targeting RWA projects has been noted, causing losses of around $14.6 million in the first half of 2025 alone. Since these projects have to connect on- chain infrastructure with Off-Chain assets, they open up new vulnerabilities for hackers.

RWA segment image. Source: rwa.xyz

RWA segment image. Source: rwa.xyzThe RWA segment is booming , with on- chain value reaching $32.32 billion, up 11.76% in the last 30 days.

While RWA projects promote “security and transparency” to attract traditional investors, the complexity of integrating blockchain and real-world assets has actually created more entry points for attackers.

If this trend continues, confidence in the RWA segment—considered one of the main growth drivers of the crypto market—could be shaken. Therefore, strengthening independent security audits, multi-layered protections like multisig and timelocks, and continuous on- chain monitoring will protect institutional investor confidence against future September-style cryptojacking incidents.