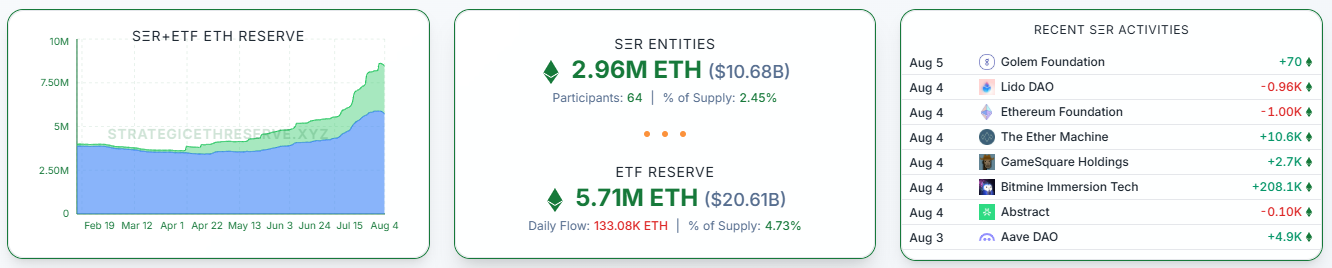

The scale of strategic Ethereum holdings has surpassed 2.96 million ETH. 64 organizations hold more than 100 ETH, which is acting as a structural bullish factor in the market along with supply reduction.

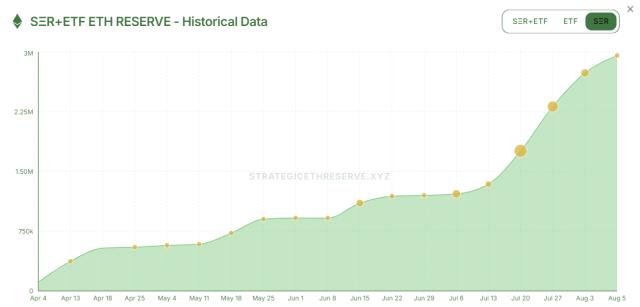

According to the 'StrategicETHReserve' tracking platform as of 5 PM, a total of 2.96 million ETH is being held as strategic assets. This is approximately $10.79 billion (about 15.034 trillion won), accounting for 2.45% of the total Ethereum supply.

A total of 64 organizations hold more than 100 ETH as strategic assets. By type (including duplicates), there are ▲14 blockchain organizations ▲31 DAOs ▲14 DeFi projects ▲3 government agencies ▲4 L1 ▲11 L2 ▲6 metaverse projects ▲2 unlisted companies ▲14 listed companies ▲12 financial wallets ▲40 Web3 organizations.

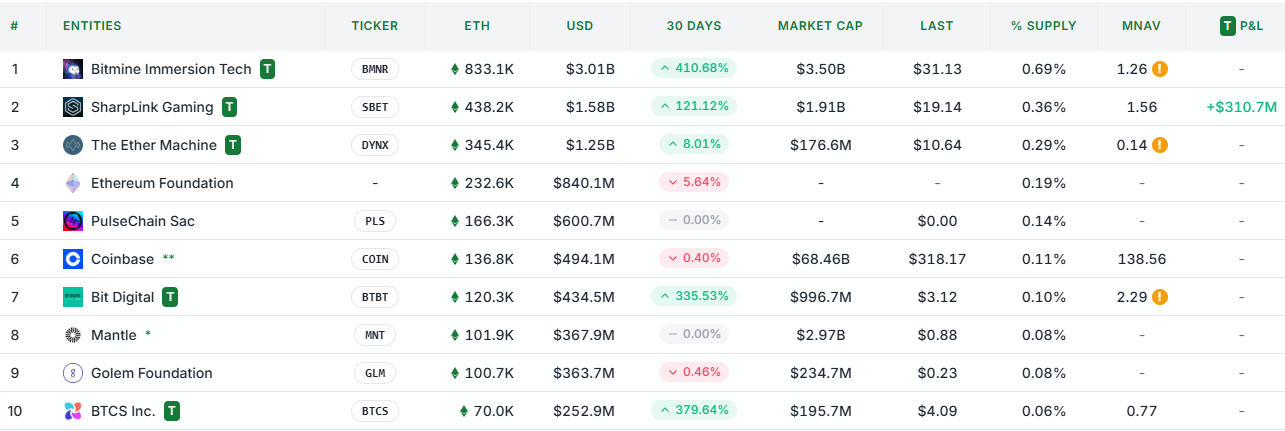

Bitmain Immersion Tech (BMNR) holds the most Ethereum, maintaining its top position by significantly increasing its holdings from 566,800 ETH last week to 833,100 ETH (approximately $3.04 billion) currently. This accounts for about 0.69% of the total Ethereum supply.

Sharplink Gaming (SBET) maintained second place with 438,200 ETH (approximately $1.6 billion), and The Ether Machine (DYNX) rose from 4th to 3rd place with 345,400 ETH (approximately $1.26 billion).

The Ethereum Foundation dropped from 3rd to 4th place with 232,600 ETH (approximately $848.7 million), while Pulse Chain Sac (PLS) maintained 5th place with 166,300 ETH (approximately $606.8 million).

Following that, ▲Coinbase (136,800 ETH) ▲Bit Digital (120,300 ETH) ▲Mantle (101,900 ETH) ▲Golem Foundation (100,700 ETH) ▲BTCS Inc. (70,000 ETH) ranked from 6th to 10th. The US government is in 12th place.

Looking at the listed company rankings, BMNR, SBET, DYNX, along with cryptocurrency exchange Coinbase (136,800 ETH, approximately $499.1 million) and mining company Bit Digital (120,300 ETH, approximately $439 million) are in the top 5. Blockchain infrastructure company BTCS Inc. (BTCS), which was previously in the top 5, was pushed down to 6th place with 70,000 ETH.

The unlisted companies holding Ethereum as strategic assets are ▲Harbinger Digital (875 ETH) and ▲Blockscape (627 ETH), both maintaining the same holdings as last week.

Three government agencies have adopted Ethereum as strategic assets, with no changes in holdings. The US government holds the largest amount with 60,000 ETH (approximately $218.8 million), followed by the Michigan state government with 4,000 ETH (approximately $14.6 million), and the Kingdom of Bhutan with 495 ETH (approximately $1.8 million).

The most recent activity shows that the Golem Foundation added 70 ETH on the 5th. On the 4th, Bitmain Immersion Tech made the largest move by purchasing 208,100 ETH, while The Ether Machine bought 10,600 ETH, and Gamesquare Holdings bought 2,700 ETH. In contrast, the Ethereum Foundation sold 1,000 ETH, Lido DAO sold 960 ETH, and Abstrac sold 100 ETH.

In addition to directly held strategic assets, Ethereum held indirectly through ETFs also accounts for a significant amount.

The total amount held in Ethereum-based ETFs is currently 5.71 million ETH, worth approximately $20.82 billion. This represents 4.73% of the total Ethereum supply.

Recent Ethereum ETF fund flows show net outflows of 41,200 ETH on the 1st and 133,100 ETH on the 4th, interrupting the 20-day inflow trend.

The top 3 ETF holdings are ▲BlackRock ETHA (2.9 million ETH, approximately $9.4 billion) ▲Grayscale ETHE (1.2 million ETH, approximately $4.9 billion) ▲Grayscale Mini ETH (653,100 ETH, approximately $2.1 billion).

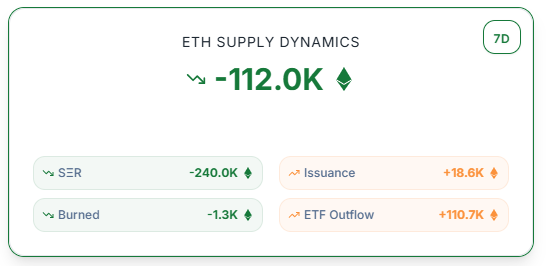

Ethereum Strategic Asset Reservation (SER) and ETF absorption are acting as key factors in supply reduction.

In the past 7 days, a total of 112,000 ETH has decreased, with ETF outflows of 110,700 ETH and strategic asset outflows of 240,000 ETH. New issuance was 18,600 ETH, and burning was 1,300 ETH.

Daily basis (-83,800 ETH) ETF 133,100 ETH inflow|Strategic assets 219,500 ETH outflow|Issuance 2,700 ETH|Burning 70 ETH

30-day basis (-2.9 million ETH) ETF 1.4 million ETH outflow|Strategic assets 1.6 million ETH outflow|Issuance 79,900 ETH|Burning 7,400 ETH

Post-Merge (-7 million ETH) ETF 5.7 million ETH outflow|Strategic assets 1.8 million ETH outflow|Issuance 2.4 million ETH|Burning 2 million ETH

According to TokenPost Market as of 5:30 PM on the 5th, Ethereum is trading at $3,630, up 2.16% from the previous day.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>