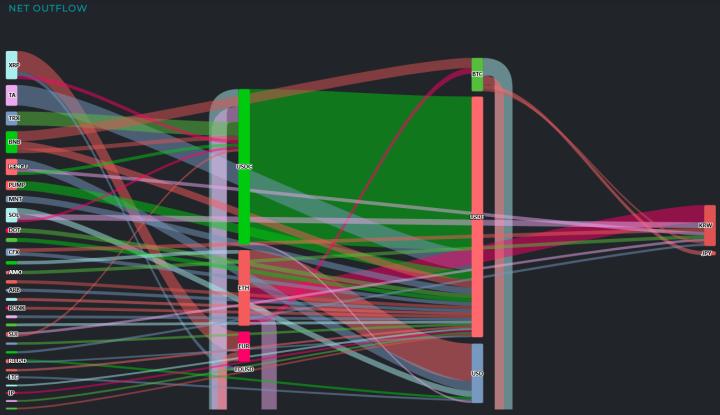

ETH Spot ETF Experiences 'Largest Ever' Net Outflow

According to TraderT, the US ETH spot ETF experienced a net outflow of $465.77 million (646.2 billion won) on the 4th (local time). This is the largest net outflow on record. BlackRock ETHA saw $375.68 million withdrawn, Fidelity FBTC saw $55.11 million, while Grayscale Mini ETH and ETHE saw $28 million and $6.98 million withdrawn respectively.

Kakao Group Launches Stablecoin Task Force with Kakao, Bank, and Pay Representatives

According to Maeil Economic Daily, Kakao Group is fully launching its stablecoin business centered on key affiliates like Kakao, Pay, and Bank. Having all three elements of platform, payment, and custody, the group plans to focus its capabilities on a won-based stablecoin as a growth engine for the future. Recently, Kakao launched a group-level stablecoin task force (TF). Jeong Shin-ah from Kakao, Shin Won-geun from Kakao Pay, and Yoon Ho-young from Kakao Bank are members, holding weekly meetings to review situations and discuss implementation tasks. A working-level team with affiliate staff has also been formed to execute TF-derived agenda.

USDe and USDS Circulation Surges Following US Regulation

Following the passage of the US stablecoin regulation GENIUS, the circulation of staking-yield stablecoins like Ethena's USDe and Sky's USDS has surged, reported CoinTelegraph. Since July 18th (local time), USDe's circulation increased by 70% to $9.5 billion, while USDS's circulation grew 23% to $4.8 billion. Crypto Quant's senior analyst Julio Moreno analyzed that "as the GENIUS bill prohibits stablecoin issuers from directly providing returns to holders, investors are moving towards stablecoins offering staking yields."

MEXC Ventures Invests $200 Million in Indonesian Exchange

MEXC Ventures, the investment arm of cryptocurrency exchange MEXC, has invested $200 million in Indonesian crypto exchange Triv, reported The Block. Triv has over 3 million users and operates under supervision from Indonesian regulatory authorities.

US Remittance Company Remitly Plans Stablecoin Introduction

Seattle-based digital remittance service Remitly plans to introduce stablecoins to enhance its international transfer capabilities, reported CrowdfundInsider. Remitly aims to provide faster and more cost-efficient cross-border payment solutions to customers in over 170 countries using blockchain technology.

Danal to Launch First Domestic Prepaid Card Supporting Stablecoin

Danal, operator of PaeCoin (PCI), plans to integrate stablecoins into its foreigner-exclusive prepaid card launching in the third quarter, reported Prime Economy. This marks the first domestic card supporting stablecoins. The prepaid card payment scale for foreign visitors was estimated at 56 trillion won annually in 2023 by the Immigration Policy Research Institute. Danal has previously filed trademark rights related to stablecoins.

Coinone Plans to Sell Cryptocurrencies Worth 4.1 Billion Won

Coinone announced plans to sell cryptocurrencies worth 4.1 billion won to cover operating expenses including personnel costs. This includes 10 BTC, 300 ETH, 200,000 XRP, and 40,000 ADA.

Animoca Brands to Buyback Web3 Game Token TOWER

NFT and blockchain game development and investment firm Animoca Brands announced support for its ecosystem by initiating TOWER token buyback. Co-founder Yat Siu explained via X that "Web3 games are a crucial area for on-chain development. TOWER is one of Animoca Brands' early community Web3 game tokens issued without investor sales, and is being utilized in various games like Farcaster." According to CoinMarketCap, TOWER has traded at $0.0007832, rising 63.99% in the last 24 hours.

Indian IT Firm JetKing to Accumulate 18,000 BTC Within 5 Years

Indian IT firm JetKing announced a strategy to purchase 210 BTC by year-end and 18,000 BTC by 2030, reported FinanceSpeed. JetKing previously raised 115 million Indian rupees (about $1.3 million) through bond issuance and currently holds 21 BTC.

Binance Temporarily Suspends USDC Deposits and Withdrawals

Binance officially announced that USDC wallet maintenance on August 6th at 5 PM (Korean time) will temporarily suspend USDC deposits and withdrawals on Ethereum, Polygon, Arbitrum, Base, and Optimism networks.

Base Network Experiences 20-Minute Blockage

According to block explorer Basescan, Coinbase's Layer 2 Base (BASE) network has not generated new blocks for over 27 minutes.

Base Network Resumes Block Generation

According to block explorer Basescan, block generation has resumed on Coinbase's Layer 2 Base (BASE) network after approximately 30 minutes of interruption.

Analyst: BTC Volatility Drops Significantly Post-Spot ETF

Bloomberg ETF specialist Eric Balchunas shared via X that Bitcoin's volatility has dramatically decreased since the spot ETF launch. BTC's 90-day rolling volatility, which exceeded 60 at ETF launch, has now fallen below 40 for the first time. Balchunas added that "BTC previously showed volatility over 3 times higher than gold, but this difference has now reduced to less than 2 times."

Long-Short Ratio of BTC Perpetual Futures at Top 3 Exchanges

Based on open interest, the long-short position ratio for BTC perpetual futures across the world's top 3 crypto futures exchanges in the last 24 hours is as follows:

Overall Exchanges: Long 49.47% / Short 50.53%

1. Binance: Long 48.78% / Short 51.22%

2. Bybit: Long 47.03% / Short 52.97%

3. Gate.io: Long 49.2% / Short 50.8%

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>