Even though it is holding up fairly well, XRP raises one red flag after another. Although price action indicates that the asset is consolidating around $3.05 following a significant correction, short-term fundamental on-chain metrics present a much less optimistic picture. Only 1,741 new wallets were activated on the XRP Ledger as of Aug. 5.

XRP: No activity

That is among the lowest daily numbers in recent months, indicating that new market participants are becoming less interested. This decline suggests a growing reluctance among retail or speculative investors to join the network given that only a few weeks ago, thousands of wallets were created every day for XRP.

Despite this, there is still a lot of transaction activity; on Aug. 4, more than two million transactions were successfully completed. This discrepancy between the large number of transactions and the small number of new wallets created indicates that automated systems and current holders, rather than fresh demand, are driving current activity. It is not a bullish pattern — particularly in a market where price rallies depend on new inflows.

XRP loses key levels

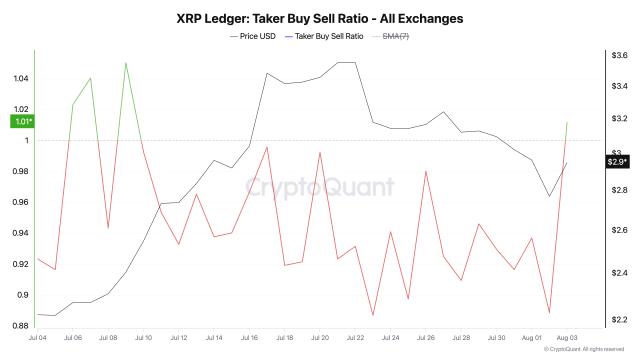

On the price chart, XRP is just about holding above the 21 EMA. With the RSI hovering just above 55, the market is neither overbought nor oversold. However, volume keeps declining, suggesting that the recent recovery rally may be coming to an end. At the moment, XRP is gaining momentum with little fresh backing.

If there is not any new demand, as shown by weak wallet activation, there might not be much more upside. A retest of the $2.80 support zone appears likely if sentiment continues to wane, but the price may settle in the $2.95-$3.10 range. As fundamental levels are winding down, staying as cautious as possible might be the right choice.

Although there is not yet any panic in the data, if macro or regulatory sentiment shifts negatively, the lack of new users and declining engagement may be the first indications of deeper consolidation or even a temporary breakdown.