Ethereum's price has shown volatility in recent days due to market uncertainty. August started with weakness, but Ethereum successfully recovered during the weekend.

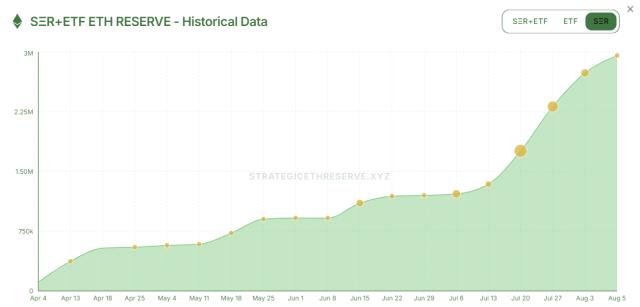

However, Ethereum's ETF faced significant challenges during this period, with massive outflows especially on Black Monday.

Highest Ethereum ETF Outflows

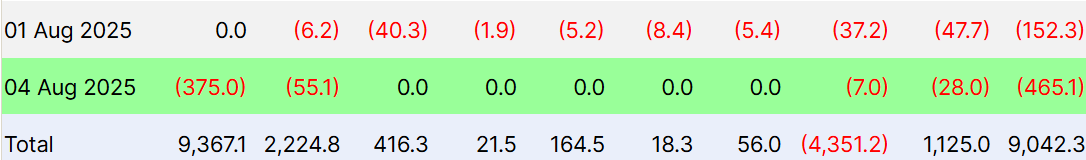

The Ethereum ETF experienced its largest single-day outflow since its launch over a year ago. On "ETH ETF Black Monday", over $465 million was withdrawn, indicating negative investor sentiment heading into August. On Friday, an additional $152 million was withdrawn, bringing the total outflow this month to $617 million.

These outflows, the largest for the Ethereum ETF, highlight investors' bearish outlook.

Investors may be cautious due to market conditions or global event uncertainties. However, the pressure from these massive withdrawals does not seem to have a Long-term impact on Ethereum's price.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

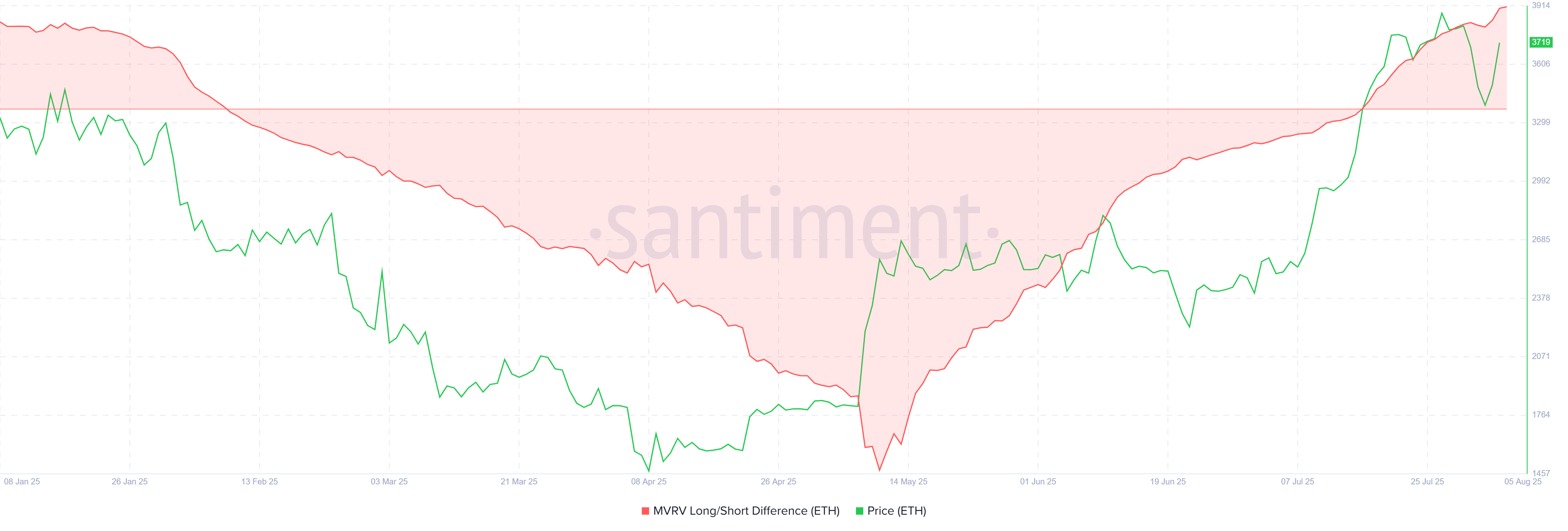

Despite significant ETF outflows, Ethereum's macro momentum shows positive indicators. The MVRV Long/Short difference, measuring Long-term and Short-term holder profitability, is currently at a seven-month high. This suggests that Long-term holders (LTH) are dominating the Ethereum market and benefiting from their accumulated gains.

LTH typically have low selling tendencies and high price influence, which helps offset the negative impact of ETF outflows. This LTH dominance appears to help maintain Ethereum's price stability despite investor hesitation.

ETH Price Enters Adjustment

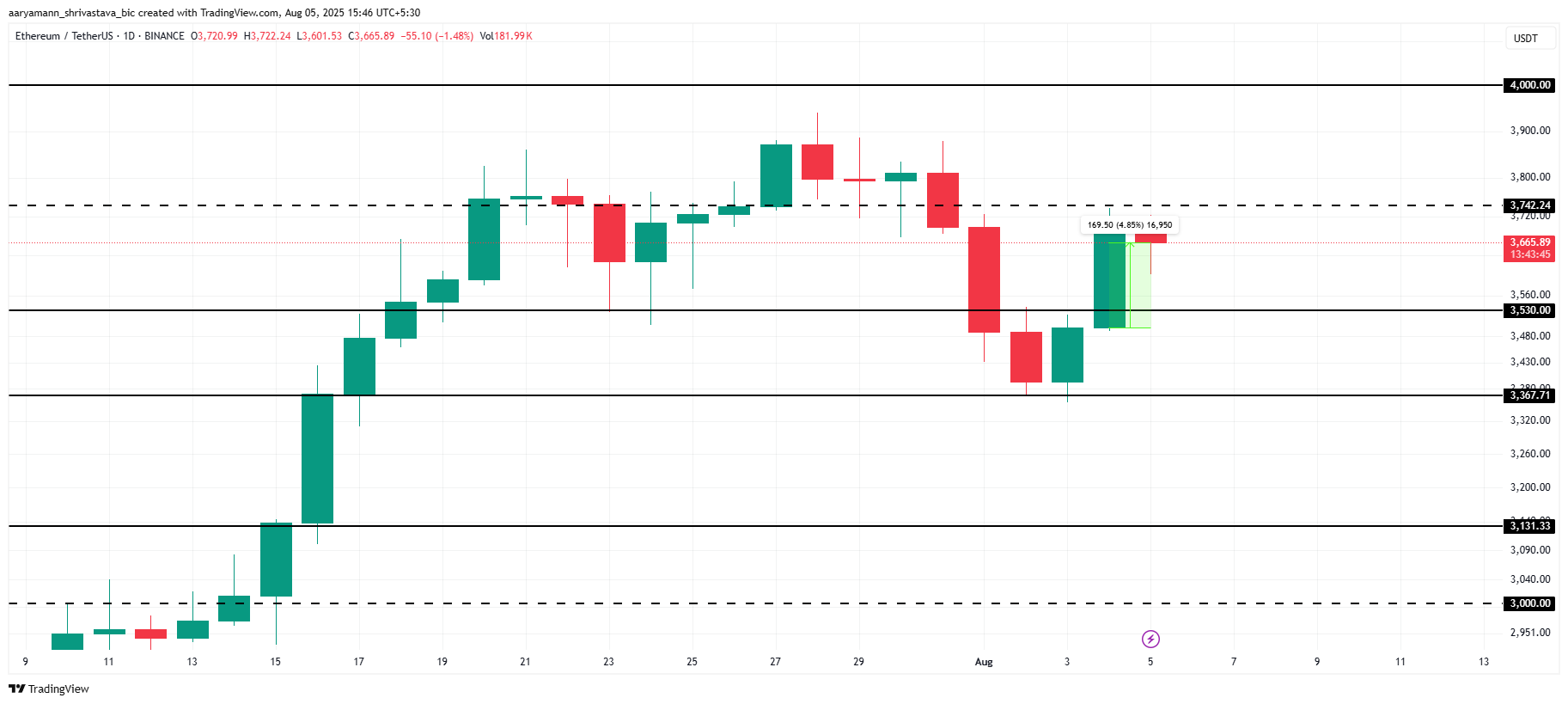

Ethereum's price has risen 4.85% in the past 24 hours, currently trading at $3,665. Ethereum is currently facing resistance at $3,742, which is the last barrier before a potential move to $4,000.

Considering the mentioned factors, Ethereum is likely to trade sideways within the $3,742 and $3,530 range in the coming days. This adjustment provides an opportunity for altcoins to find their next direction, which can rise or fall based on broader market signals.

If Ethereum's price faces continued selling pressure or ETF outflows persist, the cryptocurrency could drop below the $3,530 support level and potentially fall to $3,367. This would invalidate the bullish outlook and suggest a larger market correction.