Spot Ethereum ETF sees 646.4 billion won in daily outflows, sharply cooling investor sentiment.

This article is machine translated

Show original

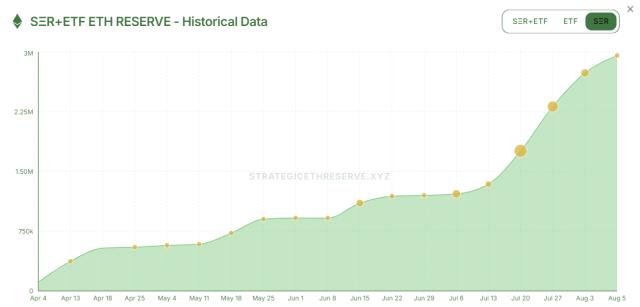

On August 8th, U.S. local time, it was revealed that the spot Ethereum ETF experienced the largest daily net outflow in history, with $465 million (approximately 646.4 billion won) leaving the market. This represents the largest daily net outflow since the ETF's listing, reflecting a sharp contraction in investment sentiment towards Ethereum (ETH).

According to investment analysis firm Farside Investors, this outflow was recorded as the second instance after ending a 20-day consecutive net inflow streak as of the 5th. Following an outflow of $152 million (approximately 211.3 billion won) just two days ago, this significant decline has heightened concerns about capital flight. Notably, the most substantial outflows occurred from the ETF managed by BlackRock ($BLK), amplifying market shock.

This capital outflow stands in stark contrast to the net inflow of $5.43 billion (approximately 7.5477 trillion won) recorded in a single month last July. At that time, the spot Ethereum ETF demonstrated strong buying momentum and elicited a positive market response, but the recent abrupt shift suggests a reversal in investor sentiment.

In terms of pricing, a sharp decline was also observed. Ethereum (ETH) dropped 12% from $3,858 (approximately 5.36 million won) on the 4th to $3,380 (approximately 4.70 million won) on the 7th, partially recovering to $3,629 (approximately 5.04 million won) as of the 9th. This supports the interpretation that significant capital outflows and potential investor position liquidations have impacted the market.

The flow of the Ethereum ETF market is an important indicator for assessing institutional cryptocurrency investment trends, and its market impact is expected to be long-lasting. Investors are closely monitoring whether the current downward trend represents a short-term adjustment or a structural turning point.

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content