Over the past two weeks, the cryptocurrency market has shown poor performance, keeping Ethereum within a narrow trading range.

Since July 21st, this altcoin has repeatedly tested resistance near $3,859 while finding support at $3,524. It has been struggling to break out of this zone. With weakening momentum, key on-chain indicators suggest that ETH may enter a prolonged sideways consolidation or experience a price decline.

Ethereum Whales Take a Step Back

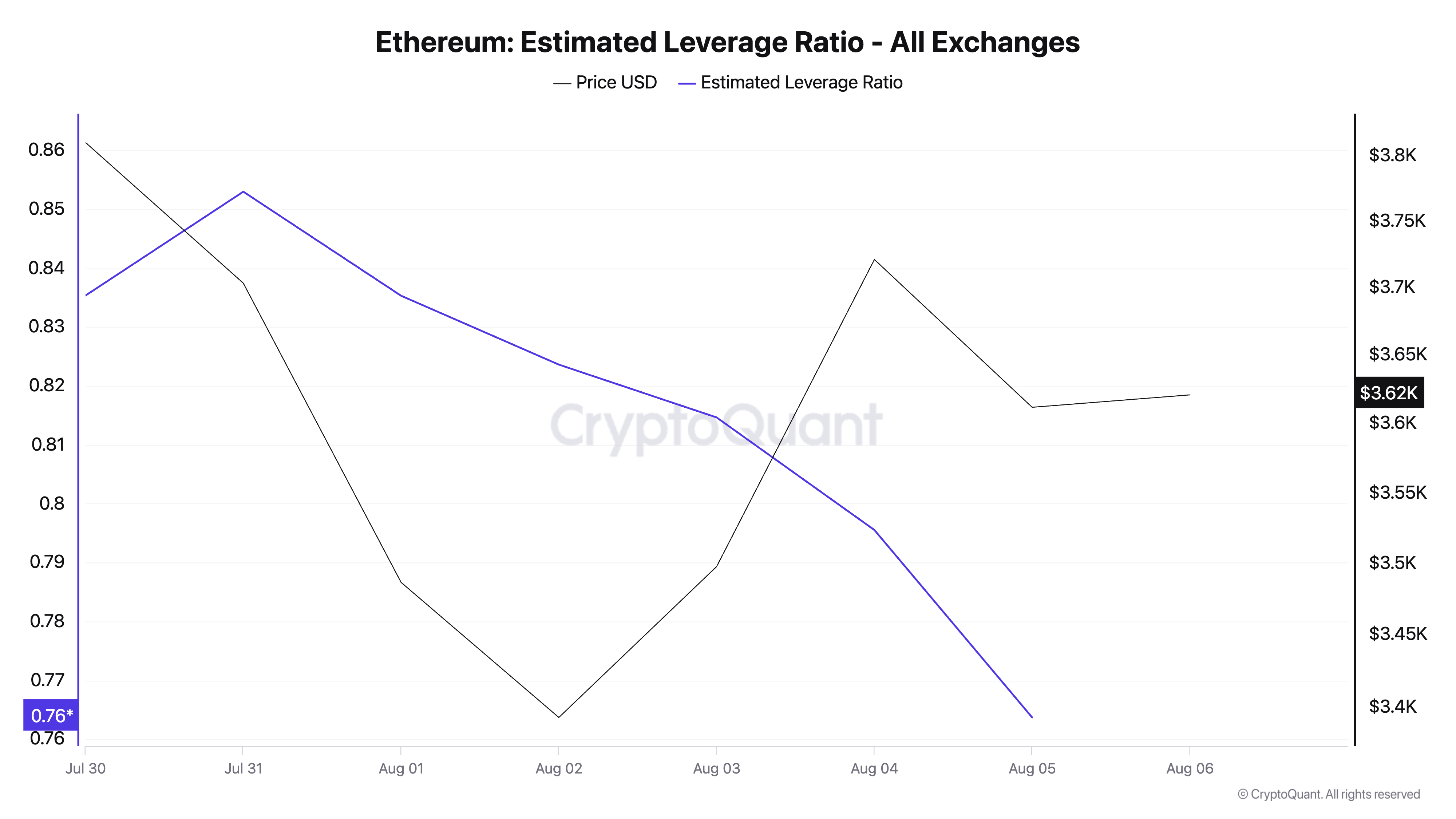

According to data from the on-chain cryptocurrency platform CryptoQuant, the Estimated Leverage Ratio (ELR) for ETH is declining across all cryptocurrency exchanges. This reflects weakening investor confidence and decreased risk appetite among futures traders. The data provider notes that ETH's ELR is currently at its weekly low of 0.76.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

The ELR indicator measures the average leverage amount traders use to execute asset trades on cryptocurrency exchanges. It is calculated by dividing outstanding commitments by the exchange reserves of that currency.

ETH's declining ELR indicates a market environment where traders are avoiding high-leverage bets. Investors are becoming cautious about the coin's short-term outlook and are not taking high-leverage positions that could potentially amplify losses.

If this reduction in speculative activity continues, the short-term breakout possibility will decrease, and ETH is likely to remain within its current range.

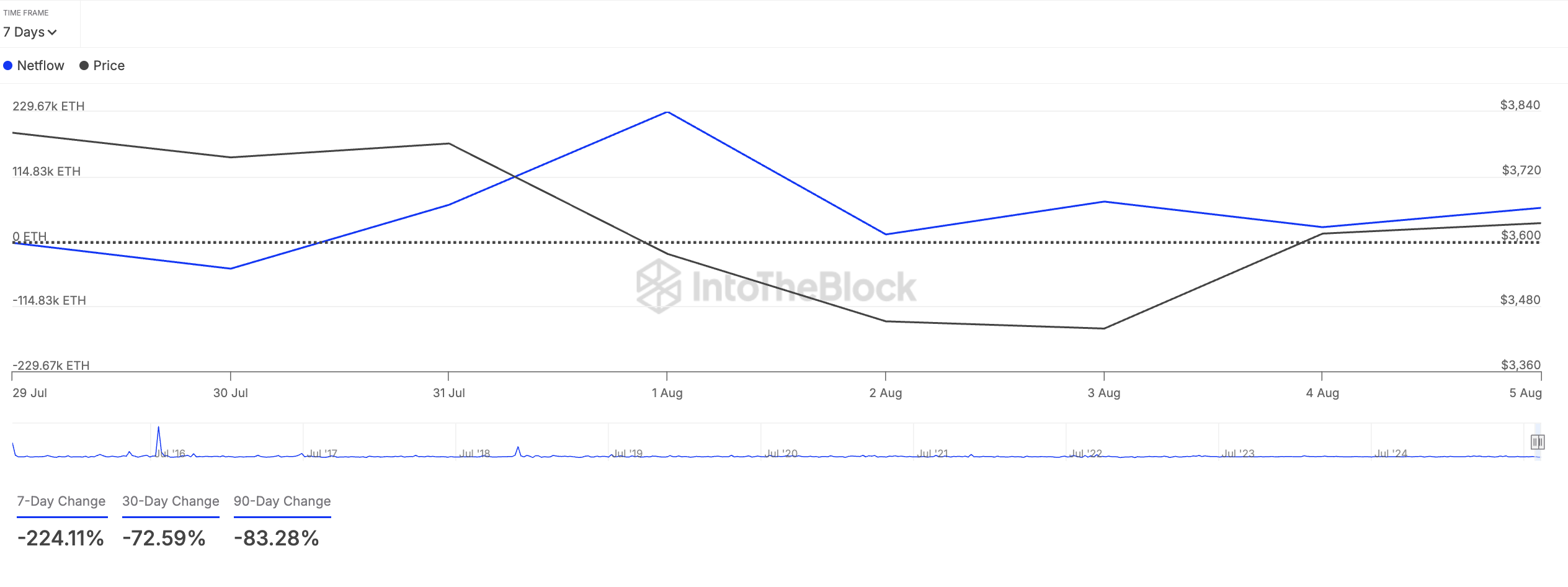

Moreover, ETH whales have also reduced their accumulation over the past week, possibly to realize profits. According to data from the on-chain cryptocurrency data platform IntoTheBlock, the net inflow of the coin's large holders decreased by 224% over the past seven days. This shows a retreat from ETH's major holders.

Large holders are whale addresses that control more than 0.1% of the asset's circulating supply. Their net inflow tracks the difference between coins bought and sold during a specific period.

An increase in an asset's large holder net inflow indicates that whales are buying more coins/tokens from exchanges, anticipating a price increase.

Conversely, a decrease, as with ETH, indicates reduced activity and profit-taking among major investors.

ETH Bulls vs. Bears Showdown

The above indicators highlight the weakening confidence in ETH's short-term price appreciation and the reluctance of major holders to inject significant capital into the market. If this continues, downward pressure on the coin could increase, potentially breaking the $3,524 support line.

In such a case, the coin could decline to $3,067. However, if buying pressure regains dominance, it could break through the $3,859 resistance. If successful, ETH's price could rise above $4,000.