After rising by more than 37% over the past 7 days, the Pump Token (PUMP) price continues to show strength. Despite a moderate +6% movement in the past 24 hours, the Token remains strong amid weakening overall market momentum.

Let's analyze on-chain data, liquidation settings, and chart patterns to see what comes next.

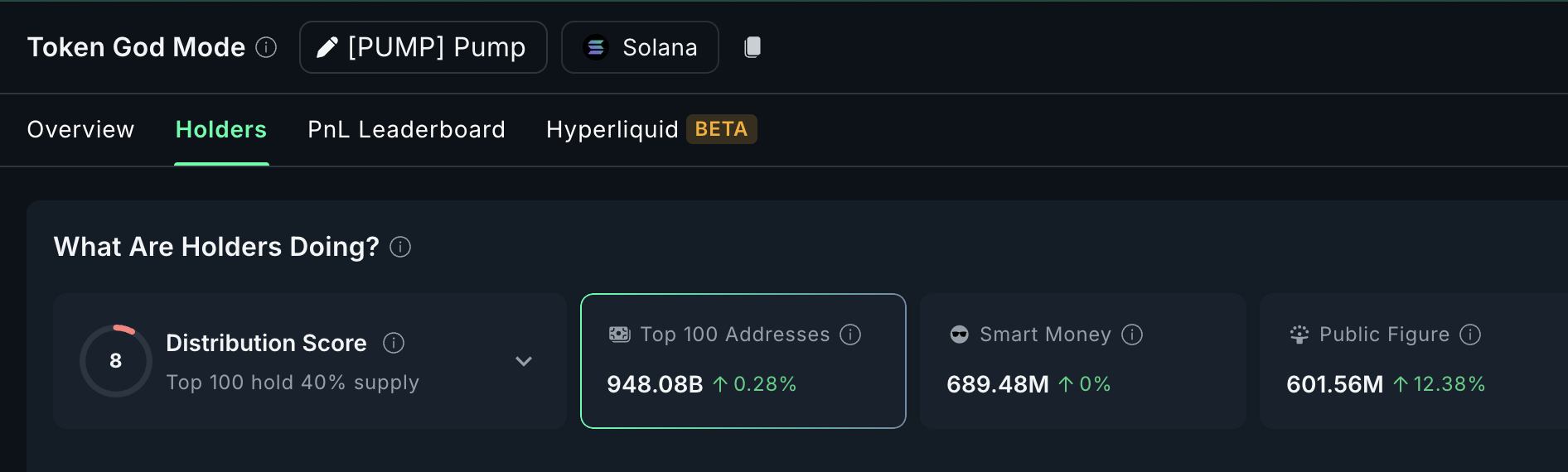

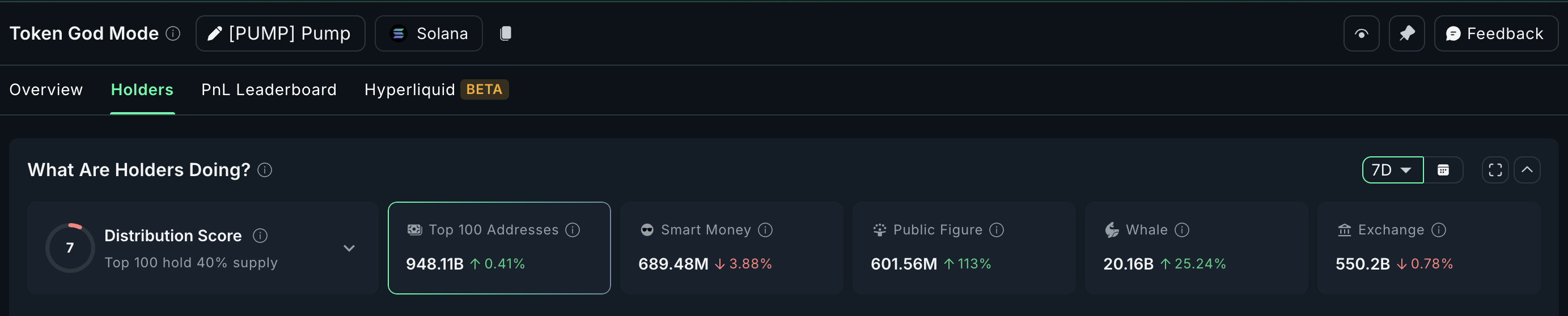

Influencer Purchases, Whale Activity... Confidence Signals

While adjusting just below $0.0035, key addresses and public figures are not backing down. According to Nansen data, the top 100 addresses currently hold 94.808 billion Tokens, which is a 0.28% increase over the past 24 hours. Public figure wallets, often connected to influencers and famous crypto traders, have increased by 12.38%, holding 615.6 million PUMP.

More importantly, whales have been quietly accumulating throughout the week. Whale holdings have increased by 25.24% over the past 7 days. This is a signal of confidence, not exhaustion.

These large investors are buying on strength, suggesting they see potential for further increases.

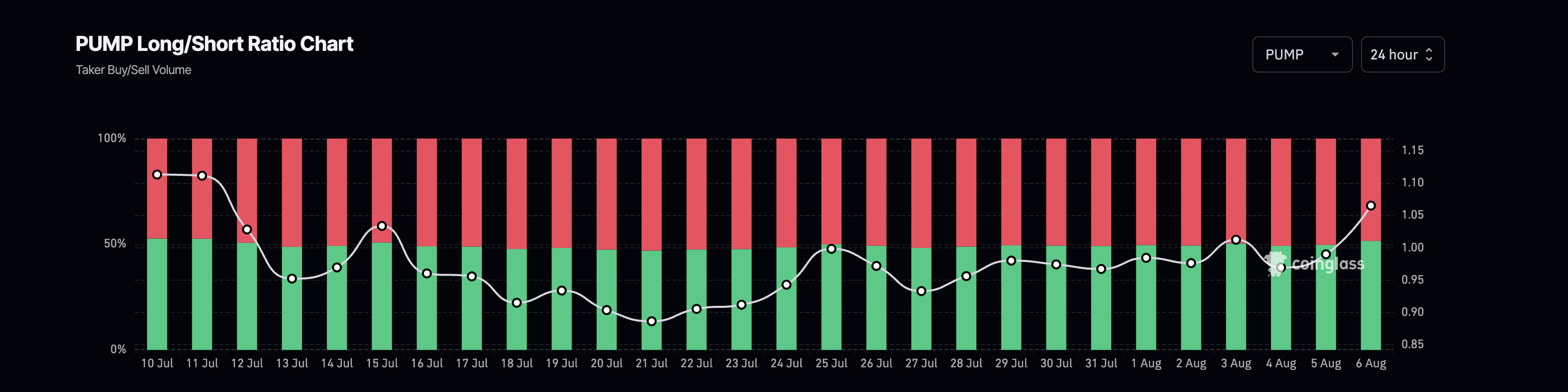

The derivatives market supports this perspective. The Longing/Short ratio has definitely shifted to strength, maintaining above 1.05 in recent days.

This means more traders are entering Long positions over Short, and this increasing leverage bias aligns with on-chain smart money activity.

Token TA and Market Update: Want more such Token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

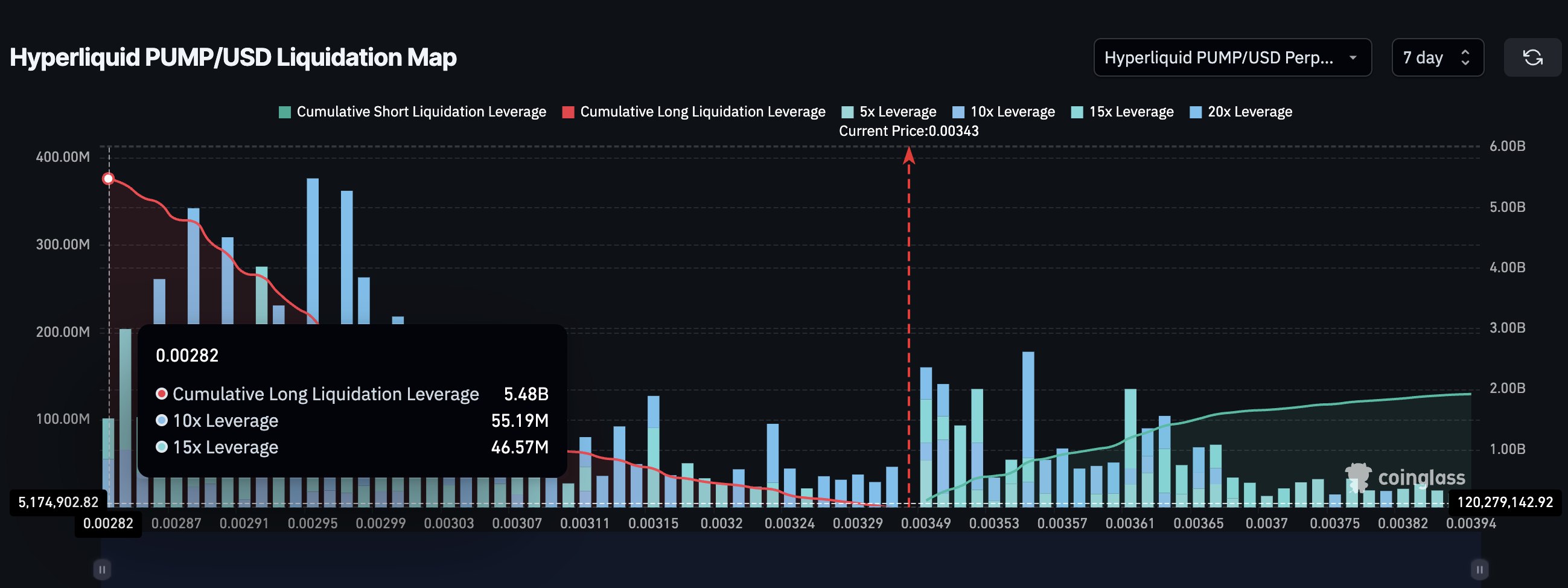

Liquidation Map Reveals Short Position Risk Areas

Hyperliquid's liquidation map supports the same bullish outlook. At the current price of $0.0034, PUMP is getting closer to a concentrated cluster of Short positions.

The largest Short liquidation cluster starts at $0.0035 and strengthens in the range from $0.0035 to $0.0039. These price levels coincide with points where Short sellers begin to be liquidated.

While total Short open interest is around $1.92 billion, Long positions are currently nearly three times higher at $5.48 billion. Though Shorts are few, their exposure size makes them vulnerable. If PUMP breaks above $0.0035, it could trigger a liquidation chain reaction, closing Shorts and driving the price up.

These liquidation thresholds are not just numbers, but pressure points. And they almost perfectly align with the price action pattern forming on the chart.

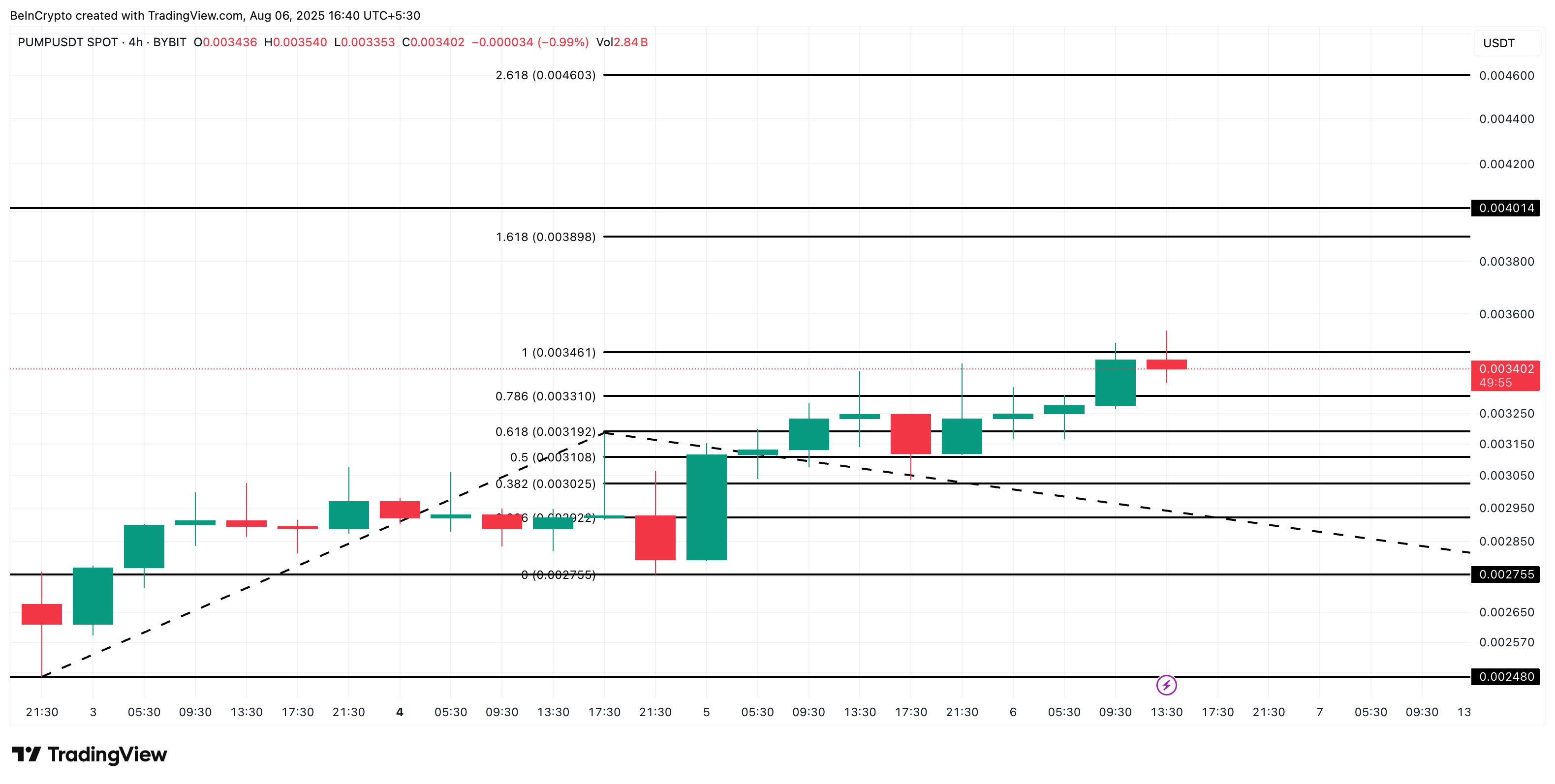

PUMP Price, Watching Ascending Triangle Pattern Breakout

The PUMP price is trading within an ascending triangle pattern on the 2-hour chart. This setup typically resolves with an upward breakout, especially when supported by higher lows and accumulation. This is what we are currently seeing.

Note: Two downward movements pierced the bottom trendline, but both were only tail breaks without the full candle body closing. According to standard technical analysis principles, a valid triangle breakout typically requires a decisive full candle body closing below the trendline and confirmation volume. Since that hasn't occurred, the ascending triangle pattern remains valid.

The key resistance to break is near $0.0035, where previous breakout attempts occurred. This price overlaps with the liquidation cluster we just discussed, creating a double trigger point for momentum.

If this level breaks, the next immediate resistance is $0.0038, followed by $0.0040. The former represents a 15% increase from the current price of $0.0034. This level aligns with major Fibonacci extension zones and psychological round numbers, often acting as magnet resistance. If momentum continues beyond $0.0040, the next target is near $0.0046, representing a 35% increase from today's levels.

However, traders should also be cautious of invalidation. If PUMP fails to maintain support at the ascending trendline near $0.0033 and breaks through, the current upward structure could be invalidated. This could lead to a deeper correction to $0.0030 or lower.