More and more institutions are adding Ethereum ($ETH) to their financial assets, showing a trend similar to the previous Bitcoin institutional investment boom. According to Jeffrey Kendrick, Head of Digital Assets Research at Standard Chartered, these companies are being called 'ETH Treasury Companies' and are emerging as an attractive investment asset class. This perspective was cited in a The Block article on August 6th.

Kendrick emphasizes that the market value and Net Asset Value (NAV) multiple of these companies have stabilized. He expects this multiple to exceed 1, believing it will be a more attractive investment target than the US spot $ETH ETF.

These companies offer several key advantages that ETFs cannot provide:

- Staking Rewards: By participating in Ethereum's Proof-of-Stake, they can earn approximately 3% returns.

- DeFi Access: They can participate in decentralized financial platforms to generate additional revenue.

- Regulatory Flexibility: These companies can operate with a level of regulatory freedom that traditional investment instruments do not possess.

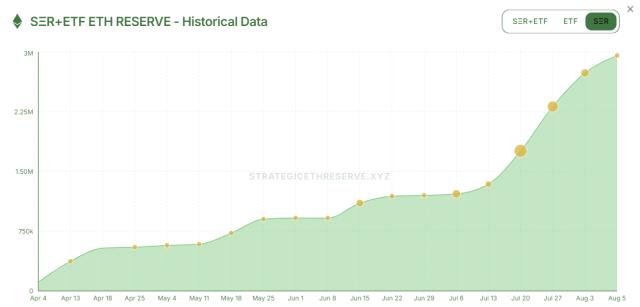

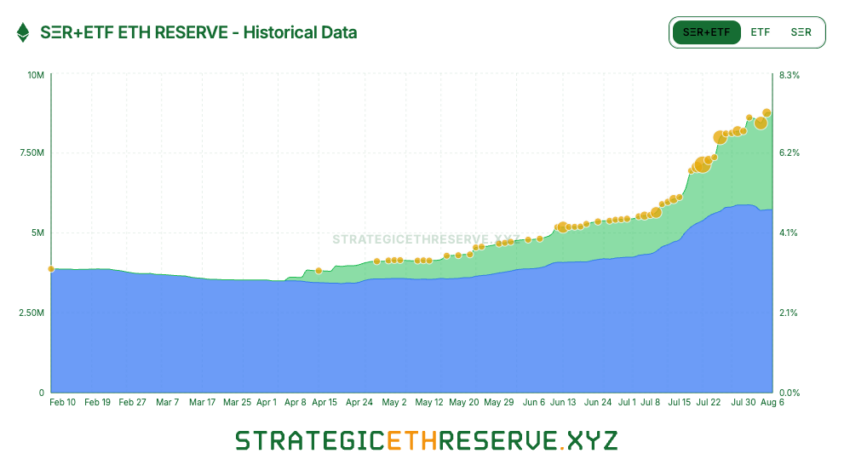

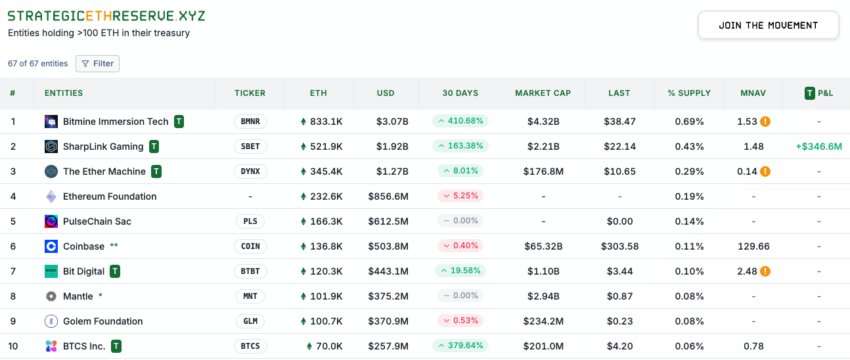

Kendrick noted that from June, ETH Treasury Management companies have purchased 1.6% of circulating $ETH, which aligns with $ETH ETF purchase rates. He highlighted SharpLink Gaming (ticker: SBET), supported by Ethereum co-founder Joe Rubin, as a prime example, with its NAV multiple recently stabilizing slightly above 1. The largest company, BitMine (ticker: BMNR), aims to accumulate 5% of total $ETH.

"ETH Treasury is essential to the development of the Ethereum ecosystem. While a large amount of $ETH is currently in circulation, there's a lack of activity to utilize it, which is why I became involved with SharpLink Gaming."

Joseph Lubin, Chairman of SharpLink Gaming and former Ethereum co-founder, stated in a CNBC interview on July 9th, 2025.

This is where we start getting rewarded with much higher highs. That probably starts with @ethereum $ETH Treasuries.$BMNR $SBET pic.twitter.com/6T8RS4Uo6Z

— Micro2Macr0 (@Micro2Macr0) August 7, 2025

Surge in Institutional Investor Purchases

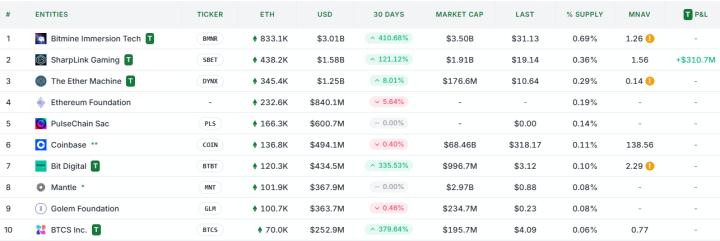

According to strategic Ethereum holdings data, major institutions and companies are accumulating substantial amounts of $ETH. As of August 6th, approximately 64 companies each hold over 100 $ETH, with some companies building particularly large holdings.

BitMine leads with approximately 833,100 $ETH. SharpLink Gaming follows with 521,900 $ETH, and The Ether Machine ranks third with about 345,400 $ETH. The Ether Machine and GameSquare have recently made purchases, with The Ether Machine's holdings currently calculated at 345,362 $ETH ($1.2 billion), and GameSquare entering the top 20.

Several companies have recently attracted attention with large $ETH purchases:

- GameSquare (GAME): On July 21st, a Nasdaq-listed media company announced purchasing 8,351 $ETH and plans to expand its digital asset portfolio to $250 million.

- Aurora: On June 24th, this Nasdaq-listed company announced plans to invest up to 20% of its cash reserves in a cryptocurrency portfolio including Bitcoin (BTC), Ethereum ($ETH), and Solana.

- Unknown Investor: On August 4th, on-chain analyst AmberCN reported that an unidentified institutional investor purchased $50 million worth of $ETH through Hong Kong-based digital asset platform OSL.

However, Risks Remain

Despite the positive outlook, Franklin Templeton, a global asset management company, warned about potential risks in institutional investors' cryptocurrency strategies. In a report released on July 3rd, the company noted that while such strategies could increase a company's market value, they could simultaneously expose it to serious risks.

The report warns of a potential 'negative feedback loop'. If the cryptocurrency market experiences a prolonged downturn, companies might need to sell digital assets to maintain stock prices, which could further weaken investor confidence and create a downward spiral.