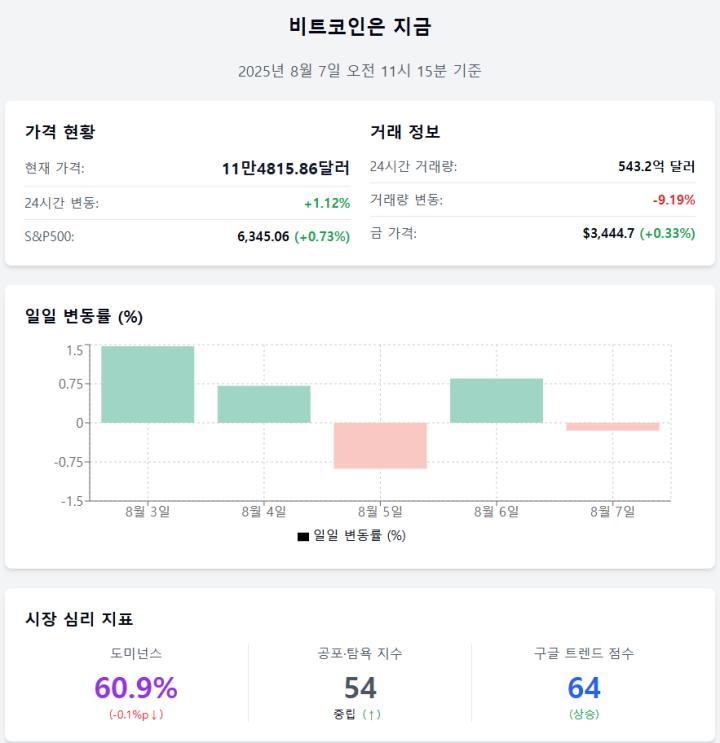

Bitcoin (BTC) has recovered to $116,000 (approximately 161.24 million won) after a short-term correction, with strong low-price buying detected. According to on-chain analytics firm Glassnode, approximately 120,000 Bitcoins were accumulated while Bitcoin recovered from $112,000 (approximately 155.68 million won) to $114,000 (approximately 158.46 million won).

This buying is analyzed as a proactive response from investors who saw the recent price drop as an 'opportunity'. Volume analysis suggests that the $110,000-$116,000 range is a 'zero volume node' with few historical transactions, indicating potential increased volatility if selling pressure rises again. Glassnode evaluated that "while a short-term rebound is confirmed, active accumulation is required to support the price".

Meanwhile, long-term holders also realized profits at this point. On-chain analyst Ali Martinez revealed that approximately $44 million (about 61.16 billion won) in profits were realized while Bitcoin reached the $114,000 level again. He explained that "while profit-taking trends were irregular throughout July, the recent sharp increase suggests some whales strategically sold during short-term strength".

Currently, Bitcoin is showing stability around $116,100 (approximately 161.38 million won) and attempting to break through the box range's upper limit. In the short term, $112,000 serves as the lower support line, and $116,000 acts as the upper resistance line. The next trend is likely to be determined by the direction of breaking these levels.

Global liquidity and the Federal Reserve's interest rate policy are also influencing the cryptocurrency market. Analyst ZYN explained that "Bitcoin is sensitive to global M2 supply, while altcoins are more influenced by US liquidity". The expansion of short-term Treasury bond issuance by the US Treasury and the expected 2-3 interest rate cuts by the end of the year could create a favorable environment for the entire cryptocurrency market.

Ultimately, Bitcoin's short-term rebound is based on liquidity and market sentiment, but its direction depends on securing medium to long-term support. It is a critical time to carefully observe on-chain indicators and buying trends.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>