Binance, the world's largest cryptocurrency exchange, has released its 33rd Proof of Reserves report. The report highlights significant differences in customers' Bitcoin (BTC) and Ethereum (ETH) holdings.

According to the report, users' net Bitcoin balance increased in July. In contrast, the exchange's Ethereum holdings noticeably decreased.

Ethereum Decline, Bitcoin Rise

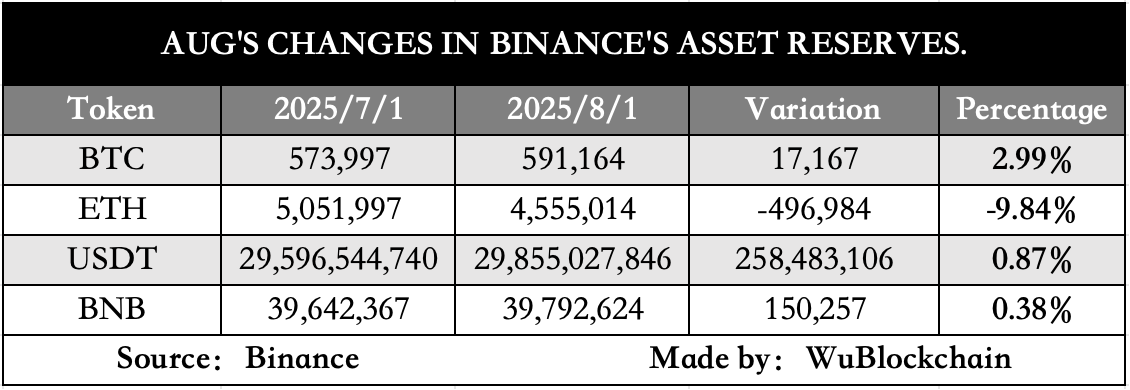

Based on Binance data, as of August 1st, users held approximately 591,164 BTC on the exchange, which is a 2.99% increase from the previous month.

This indicates that users either deposited more Bitcoin or held more Bitcoin on Binance, increasing by 17,167 BTC. Similarly, balances of Tether (USDT), BNB (BNB), and XRP (XRP) also increased on the exchange.

In contrast, users have reduced their Ethereum holdings on the exchange over the past three months. From June 1st to July 1st, Ethereum balance decreased by 5.34%.

The decrease was more pronounced from July 1st to August 1st, dropping by 9.84% to a total of 4.55 million ETH, a reduction of 496,984 ETH.

However, this does not necessarily mean a decrease in interest in Ethereum. When users withdraw assets from the exchange, it can indicate increased trust. Such withdrawals often reflect long-term holding strategies rather than short-term trading activities.

"BTC + USDT reserves increase = bullish dip buying. ETH supply decrease = users moving ETH from exchange, potentially staking or holding," wrote analyst Cas Abbé.

While retail users adjust their portfolios, institutional ETH accumulation has surged. According to data from the Strategic ETH Reserve website, institutions increased their holdings from 916,268 ETH to 2.3 million ETH between June and July.

In fact, BeInCrypto reported that reserves exceeded $10 billion by the end of July.

"The ETH Treasury has bought 1% of all circulating ETH in two months, which is twice the rate of corporate treasuries buying Bitcoin (BTC)," Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, told BeInCrypto at the end of July.

Players like Bit Miner Emergence Technology and Sharplink Gaming are driving this movement, investing billions of dollars in ETH. Investor confidence in the second-largest cryptocurrency is also significantly high.

Ethereum outperformed everything this decade, even Bitcoin and the NASDAQ.$ETH is on another level. pic.twitter.com/b2pvsHY6Be

— Ak47♛ (@HolaItsAk47) August 6, 2025

Tom Lee, co-founder of Fundstrat and chairman of Bit Miner, recently called Ethereum the 'biggest macro trade of the next decade'. In a recent interview, he also suggested that Ethereum could 'flip' Bitcoin in terms of network value.

"The upside potential of ETH is actually higher than Bitcoin potentially rising 100x. Could Ethereum rise 100x... I think it can. Because there's a substantial possibility that Ethereum can flip Bitcoin in terms of network value. If someone thinks Bitcoin is a million dollars, imagine what that means for Ethereum. This is not just about Wall Street financializing blockchain, but also part of the focus on US AI dominance," he said.

These statements show an increasing preference for ETH. This also emphasizes Ethereum's role as a foundational asset for Web3, adding appeal for long-term investors.