ETF Expert Believes BlackRock is Waiting for Legal Framework to Submit Spot XRP ETF, Leveraging Crypto Asset Leadership

Nate Geraci, President of Novadius Wealth Management and top ETF expert, predicts BlackRock will submit a Spot XRP ETF filing during the Thinking Crypto podcast on 8/6/2025. Geraci – host of ETF Prime and co-founder of ETF Institute – notes the world's largest asset manager is adopting a "wait-and-see" strategy to await a clearer legal framework.

"I have publicly stated that I believe BlackRock will file for both spot XRP and Solana ETFs," Geraci confirms. He explains the lack of filing: "We are at a slightly late stage... close to the finish line but they haven't filed yet. They may be waiting for the official legal framework to be issued, and then will act at the last minute."

Dominant Position in Crypto Asset ETFs

According to Geraci, BlackRock is currently the "absolute leader" in the crypto asset ETF market. "They own the largest bitcoin ETF, with a clear lead. They also have the largest ether ETF," he emphasizes. Based on their strategy of prioritizing index-based approaches across asset groups, limiting crypto asset ETFs to bitcoin and ethereum would contradict BlackRock's overall direction.

Geraci sees this as a defensive decision, as it would be too early to determine the "winner" in the crypto asset space without providing access to other blockchains like XRP or Solana. This motivation aligns with the trend of portfolio diversification among major asset managers.

Regarding market sentiment, Geraci emphasizes that BlackRock's decisions are primarily "driven by profits", not based on assessing the decentralization level or credibility of crypto assets. "That's not an area they're focused on evaluating. I think ultimately it comes down to this factor," he says, hinting at BlackRock's maximum focus on profitability.

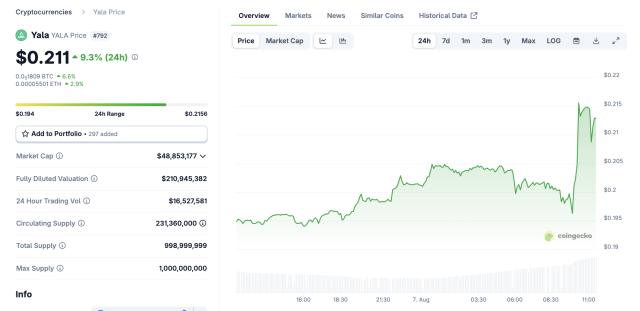

Investor demand clearly shows market potential. "We've seen quite good demand for future XRP ETF and Solana ETF," Geraci notes. This level of interest indicates significant potential for spot versions once launched, especially when legal barriers are removed.

The legal landscape has seen positive developments as Ripple and the US Securities and Exchange Commission agreed to withdraw their appeals in the long-running lawsuit on 8/7. This decision closes a prominent case, with the market responding as XRP prices rose alongside clearer regulatory prospects.