Several Bitcoin mining companies recorded clear performance recovery with increased mining volume in July.

This recovery reflects the flexible adaptability of mining infrastructure and the effectiveness of energy management strategies.

Bitcoin Miners Strongly Recover

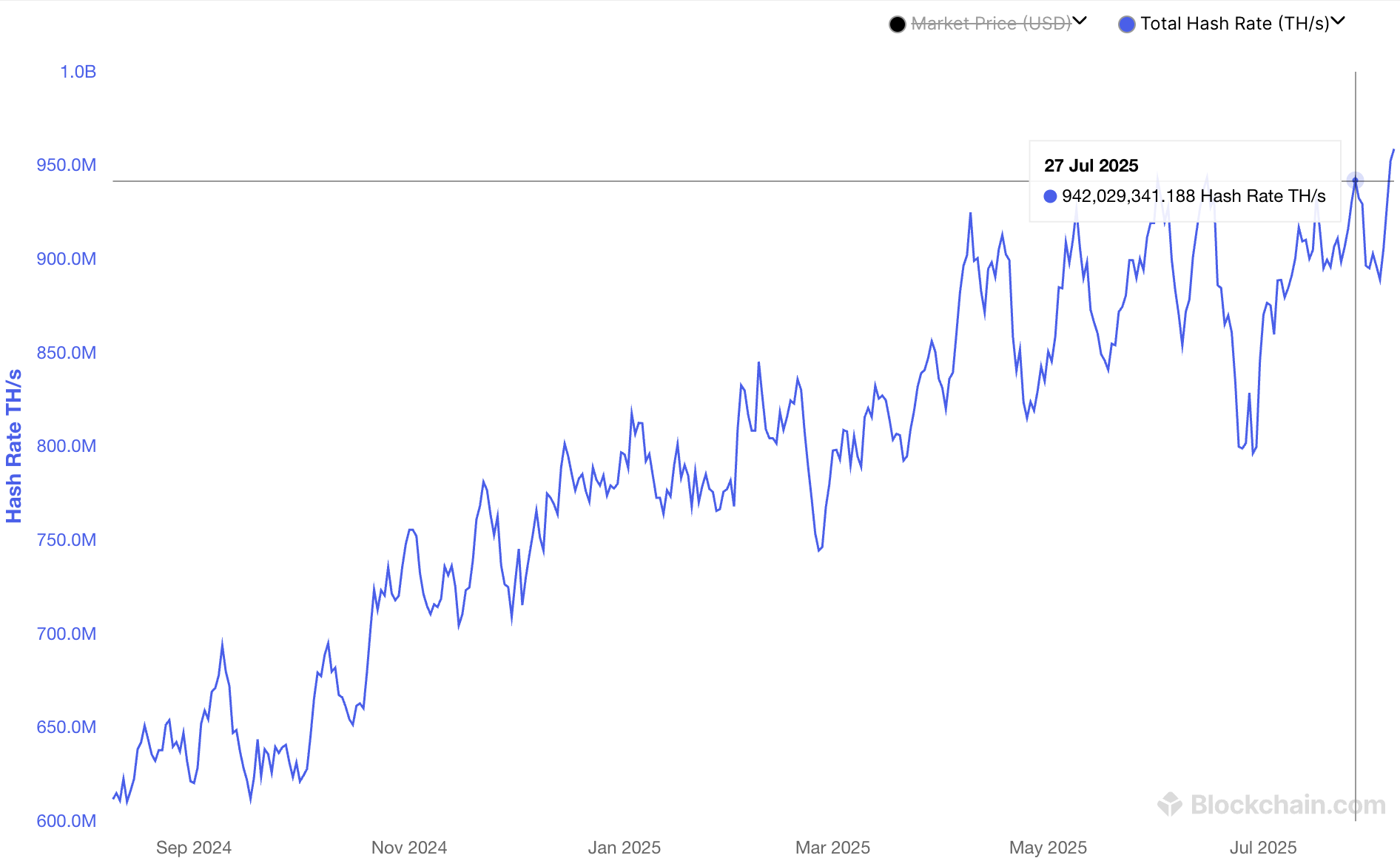

According to Blockchain.com's data, the total network hash rate significantly rebounded in July, approaching an all-time high. This shows that mining companies have overcome various challenges from the previous month and are returning to expansion mode.

However, the hash rate revival means that network difficulty is rising, increasing competitive pressure on companies that cannot optimize energy and hardware efficiency.

Bitcoin mining difficulty set a record of 127.6 trillion in August 2025, while miner revenue increased by 105% year-on-year. In this context, several Bitcoin mining companies showed impressive performance in July.

Cipher Mining produced 214 BTC, increasing total Bitcoin holdings to 1,219 BTC. In the Q2 2025 report, the company announced revenue of $44 million and adjusted revenue of around $30 million. This growth is due to the initial stage release of the Black Pearl data center, increasing total operational mining capacity to 20.4 EH/s.

Cleanspark mined 671 BTC in July. The company exceeded 1 GW in contracted power capacity and holds over 12,700 BTC.

Canoo surprised the market by reaching 650.5 BTC with a 45% increase in monthly production. Deployed hash rate reached 50 EH/s, and Bitcoin holdings exceeded 4,500 BTC.

Canaan Technology mined 89 BTC in July, reaching Bitcoin holdings of 1,511 BTC by month-end.

MARA mined 703 Bitcoin in July, a 1% decrease from June but still one of the top BTC producing companies in the industry. Notably, MARA holds over 50,000 BTC.

Despite minor fluctuations in production, the long-term accumulation strategy remains a key strength, becoming more prominent as Bitcoin supply becomes increasingly scarce.

Supply-Demand Gap

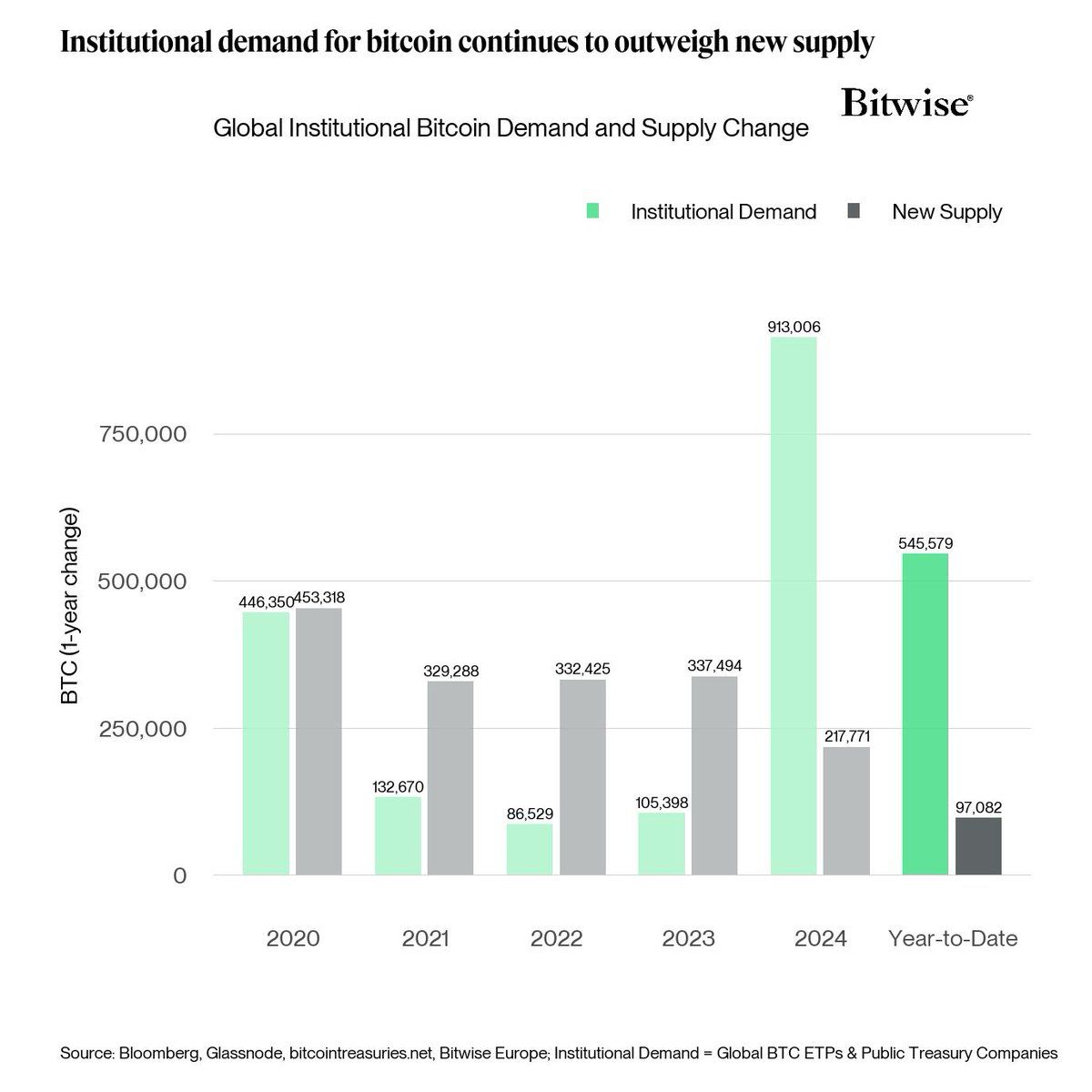

While some Bitcoin mining companies reported production increases in July, overall figures remain relatively low compared to market demand.

According to Bitwise data, institutions purchased over 545,000 BTC in 2025, while total mined supply during the same period was only around 97,000 BTC.

If this trend continues, limited supply from mining will further enhance the strategic importance of companies with substantial Bitcoin holdings in their finances.