In the past 24 hours, approximately $2.594 billion (about 3.8 trillion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, these liquidations were predominantly short positions, and the market's sharp rebound is analyzed to have triggered massive short liquidations.

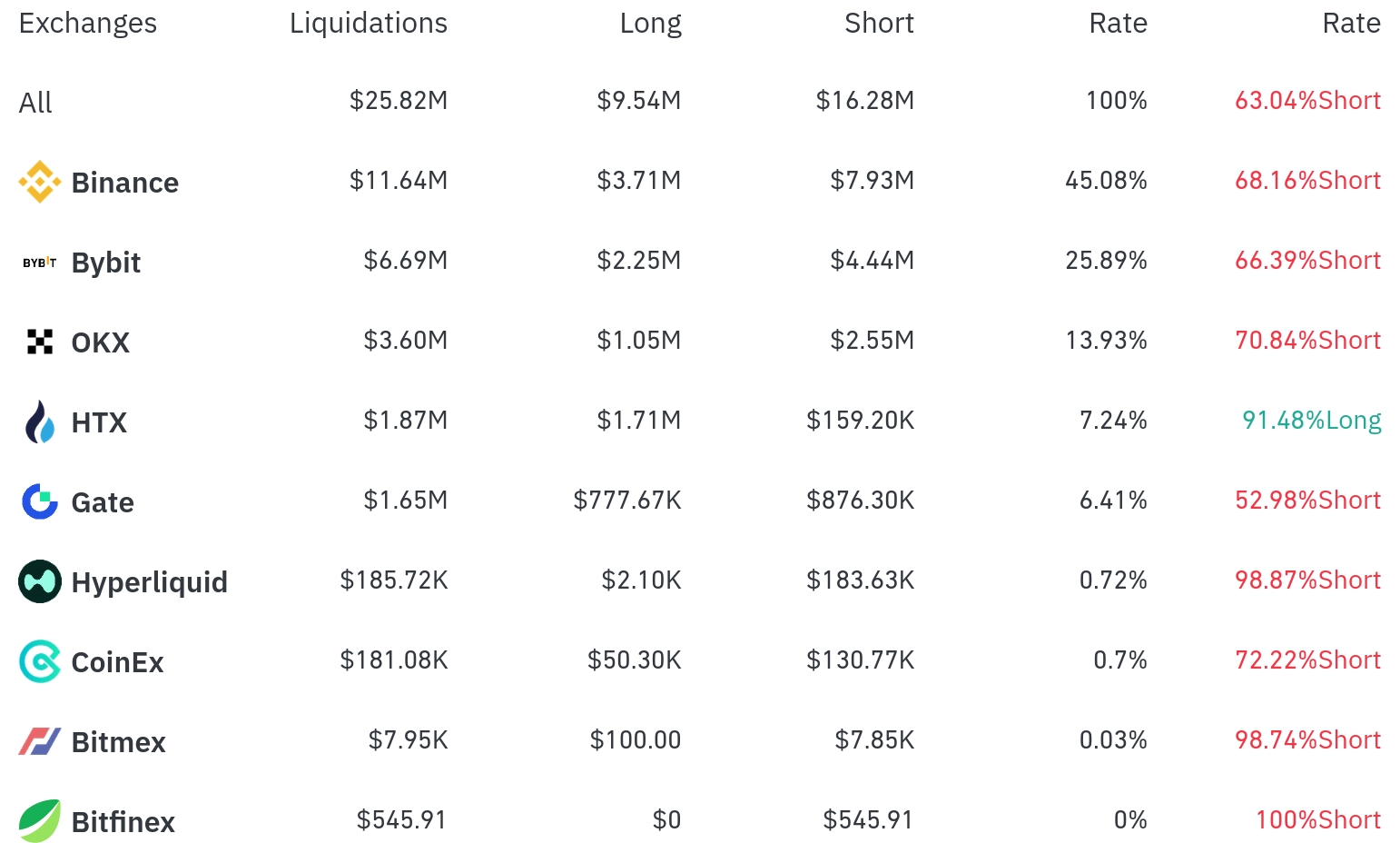

Binance experienced the most position liquidations in the past 4 hours, with a total of $11.64 million liquidated (45.08% of the total). Notably, short position liquidations accounted for $7.93 million, or 68.16% of Binance's total liquidations.

Bybit was the second-highest exchange with $6.69 million (25.89%) of positions liquidated, with short positions making up $4.44 million (66.39%).

OKX saw approximately $3.6 million (13.93%) in liquidations, with a high short position ratio of 70.84%.

Notably, HTX showed a distinctly different pattern, with long position liquidations at an overwhelming 91.48%, unlike other major exchanges. Additionally, Hyperliquid and BitMEX recorded extreme short position liquidation rates of 98.87% and 98.74%, respectively.

By coin, Ethereum (ETH) recorded the highest liquidation volume. Approximately $108.7 million in Ethereum positions were liquidated in 24 hours, accounting for a significant portion of total liquidations. Ethereum is currently trading at $3,896, up 2.03% in the past 24 hours.

Bitcoin (BTC) had about $35.76 million in positions liquidated in 24 hours and is currently trading at $116,538, with a slight 0.21% increase. On a 4-hour basis, $310,000 in long positions and $180,000 in short positions were liquidated.

XRP recorded $27.65 million in liquidations over 24 hours and is currently priced at $3.31, a sharp 7.86% surge. Notably, XRP's short position liquidations were about 3 times higher than long position liquidations.

Solana (SOL) had approximately $14.72 million liquidated in 24 hours and is currently trading at $176.63, up 2.08%.

Doge saw $9.92 million in liquidations over 24 hours with a 4.64% price increase, with short position liquidations about 4.8 times higher than long position liquidations.

Notably, LINK showed a significant 12.13% increase with total liquidations of $2.22 million, while popular altcoins like ADA and PEPE also triggered substantial short position liquidations with increases of 4.93% and 3.12%, respectively.

This massive short position liquidation occurred alongside an overall cryptocurrency market rebound, characterized by strong upward momentum in major altcoins. Market experts are watching closely to determine whether this rebound is a short-term technical correction or a signal of a larger upward trend.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>