Foresight News takes you through this week's hot topics and recommended content:

01 Regulatory Trends

《Will Retirement Funds Be the Booster? How Big is the 401(k) Scale?》

《Crazy Under the Tariff Countdown: Bitcoin Miners' Global Shipping Battle》

02 People

《Circle CEO: How Wild is the Prophet Who Put Dollars "On-Chain"?》

《Bitwise Chief Investment Officer: Three Opportunities I Saw in SEC's "Crypto Plan"》

《Uncovering Pantera Founder: The Thousand-Fold Legend of Buying Bitcoin at $65》

《Michael Saylor: How to Implement a Bitcoin Strategy Without Liquidation?》

03 Project Observation

《Pendle is Difficult, But Not Understanding It is Your Loss》

《US-Exclusive USDT Coming? Tether CEO Explains Company Strategy in Detail》

《Linea TGE Time Lock? Deciphering the "42" Mystery and Ecosystem Planning》

《Galaxy Earned Money, Next Step is Putting Itself On-Chain》

04 Industry Insights

《Crypto Baptism: Meeting Wall Street》

《2024 Crypto Industry Compensation Report》

《Cambodia's Remittance Hub, the "Super Hub" of Crypto Black Industry》

《Statue Sunk in Lake, Who is Erasing Satoshi Nakamoto?》

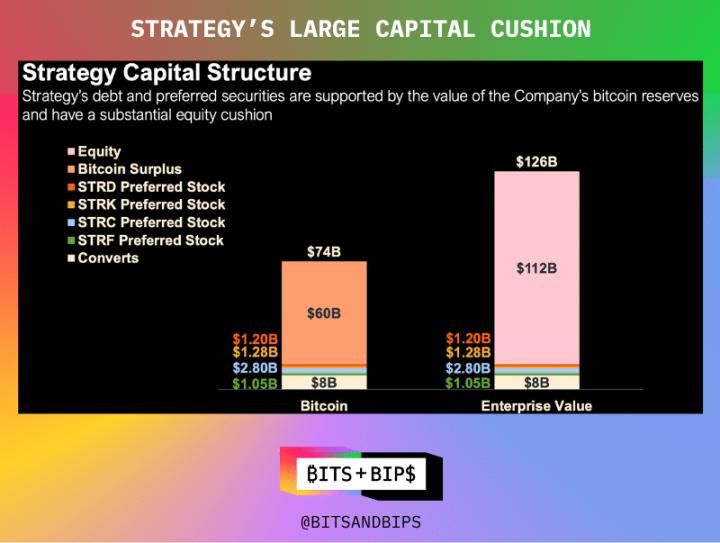

(The rest of the translation follows the same pattern, maintaining the structure and translating the text while preserving any specific terms or names as specified in the initial instructions.)《Michael Saylor: How to Implement a Bitcoin Strategy Without Liquidation?》

Currently, the company plans to make a significant adjustment to its financing method - specifically, to completely eliminate debt. Although its balance sheet looks good (according to the financial report, the enterprise value is $126 billion, with debt of only $8.2 billion), the company still hopes to reduce its debt to zero. During the investor conference call after the July 31 financial report, the company announced plans to redeem the issued convertible bonds and focus on multiple issuances of preferred stocks.

This means that its $6.3 billion preferred stock issuance is expected to grow significantly. In fact, during the investor meeting, the company announced plans to refinance $4.2 billion through its latest preferred stock product Stretch (STRC), which aims for a monthly yield of 10%.

03 Project Observation

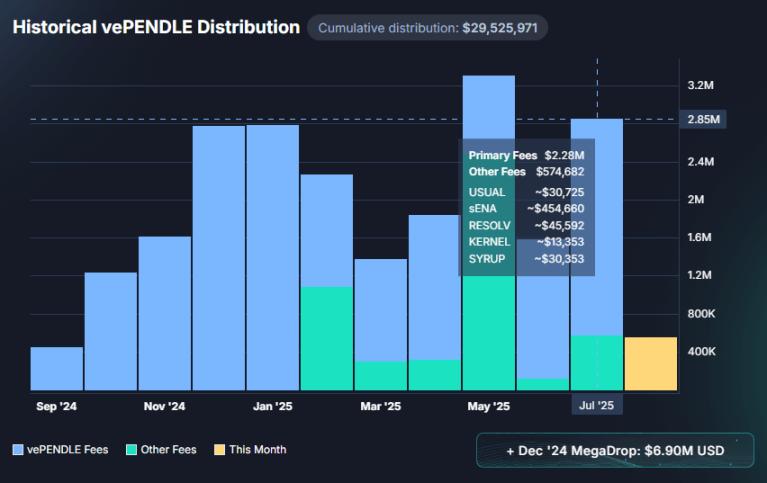

Pendle is the most successful DeFi protocol in this cycle, without needing the qualifier "one of". Its token price has reached a new high in the past 7 months. A new perspective provides an in-depth analysis of Pendle's mechanism and value capture. Why is it different? Recommended article:

《Pendle May Be Difficult to Understand, But Not Understanding It Will Cost You》

The PENDLE token uses a ve (voting escrow) mechanism, where holders can lock PENDLE tokens to receive vePENDLE tokens. Currently, all profits from the Pendle protocol are distributed to vePENDLE holders. Pendle charges a 5% fee on all yields generated by YT (including points, meaning vePENDLE holders can receive airdrops from various tokens), and the same percentage fee on yields from SY that have expired but not been redeemed. Transaction fees for PT and YT are also entirely given to vePENDLE.

Additionally, the standard ve token mechanism includes: earning LP liquidity mining bonuses by locking vePENDLE, voting rewards from project bribes, etc., which bring income to locked tokens while reducing token circulation and enhancing token demand. (The details of the ve token mechanism could fill 3000 words, which will not be expanded here. Readers unfamiliar can refer to CRV and Curve War related materials)

This week, Tether CEO Paolo Ardoino had an in-depth conversation with American entrepreneur and Professional Capital Management founder and CEO Anthony Pomplian, discussing Tether's strategy for entering the US market, plans to launch a US-based stablecoin, and exploring areas such as AI, gold, and brain-computer interfaces. Recommended article:

《US-Exclusive USDT Coming? Tether CEO Explains Company Strategy》

Paolo Ardoino: The recently passed Genius Act drives Tether to explore the US market and creates a fair competitive environment for all other financial institutions. Tether holds over $127 billion in US Treasury bonds and has recently surpassed South Korea to become the 18th largest US Treasury bond holder. We might become one of the best allies of the United States. Tether plans to launch a domestic stablecoin in the US. At that time, US banks and financial institutions will also cooperate with Tether, using Tether's global distribution network to expand new customers and revenue sources.

For example, the financial infrastructure efficiency in Nigeria is between 10% and 20%, while in the US it is 90%, almost perfect. Therefore, if the quality of the financial transmission track in Nigeria can be improved to 50%, but in the US it can only be improved from 90% to 95%. Since the number of people underserved by US banking services is relatively small, Tether's products for the US market must be unique.

Consensys founder and SharpLink board chairman Joseph Lubin and Linea project lead Declan Fox responded to the external focus on Linea during "The SomETHing Podcast" in the early morning of August 6. Recommended article:

《Linea TGE Time Lock? Breaking the "42" Mystery and Ecosystem Planning》

When will the TGE or airdrop be checked? Joseph Lubin responded with "42". This number has sparked many speculations:

- "42" is a reference from the science fiction novel "The Hitchhiker's Guide to the Galaxy". In the book, 42 is described as the "ultimate answer to life, the universe, and everything", but its specific meaning is vague, symbolizing a playful simplification of complex problems. Joseph Lubin's answer might be using "42" to avoid directly answering the specific time of the TGE.

- Some community users speculate that "42" means 42 days, which would be September 17, also US Constitution Day.

- Some users guess "42" refers to the 42nd week of 2025, which is October 13-19.

- 42 hours or August 24?

- Some users jokingly suggested it might be 2042.

- More coincidentally, the Ethereum address is a 42-character hexadecimal address.

On August 5, after experiencing structural adjustment and strategic restructuring in the first half of the year, Galaxy Digital released its Q2 2025 financial report. Despite a significant reduction in total assets, Galaxy achieved a rare quarterly net profit due to the rebound in digital asset markets and improved trading business. What's next? Recommended article:

《Galaxy Earns Money, Next Step is to Put Itself on the Chain》

Beyond the financial report, another market-attracting item is Galaxy's formal disclosure of its stock tokenization exploration plan.

According to the documents submitted to the US SEC, Galaxy is "evaluating the feasibility of tokenizing Class A common stock" and has signed a "Digital Asset Transfer Agency Agreement" with Superstate Services in May. The latter is a registered RWA platform and an early participant in the tokenization market.

Founder Mike Novogratz previously stated in media interviews that Galaxy has met with the SEC's crypto asset special group to discuss how to promote tokenization within a compliant framework. He mentioned that they are developing a version of GLXY stock that can be used in DeFi applications, while hoping to tokenize more assets in the future, including ETFs and fixed-income products.

However, Galaxy also stated in its declaration that it cannot currently confirm whether the tokenized stock will gain sufficient market acceptance, nor is it clear whether an active trading market will be established. The on-chain trading system still has significant differences from traditional exchanges in terms of transparency, liquidity, and regulatory coverage.

04 Industry Insights

Altcoins were in their glory during the 2020-2021 bull market, but in this cycle, Altcoins have collapsed. Under US crypto compliance, Wall Street's regular army is flooding in, changing the industry landscape. The wave of crypto company IPOs may become a new direction, and the industry is experiencing a transformation. Recommended article:

《Crypto Baptism: Encountering Wall Street》

While many are still waiting for the Altcoin season, four years later, the crypto industry has actually quietly approached the end of the bull market. Between 2024 and mid-2025, the total cryptocurrency market value has actually grown dramatically by 130%.

On November 15, 2021, BTC's highest point was around $69,000, with the total cryptocurrency market value peaking at around $3 trillion; on July 14, 2025, BTC's highest point was $123,091, with the total cryptocurrency market value peaking at around $3.91 trillion.

In contrast, including the garbage meme coins that swarmed during the Meme wave, there are already millions of Altcoins on the chain. This round, Altcoins have suffered a massive collapse.

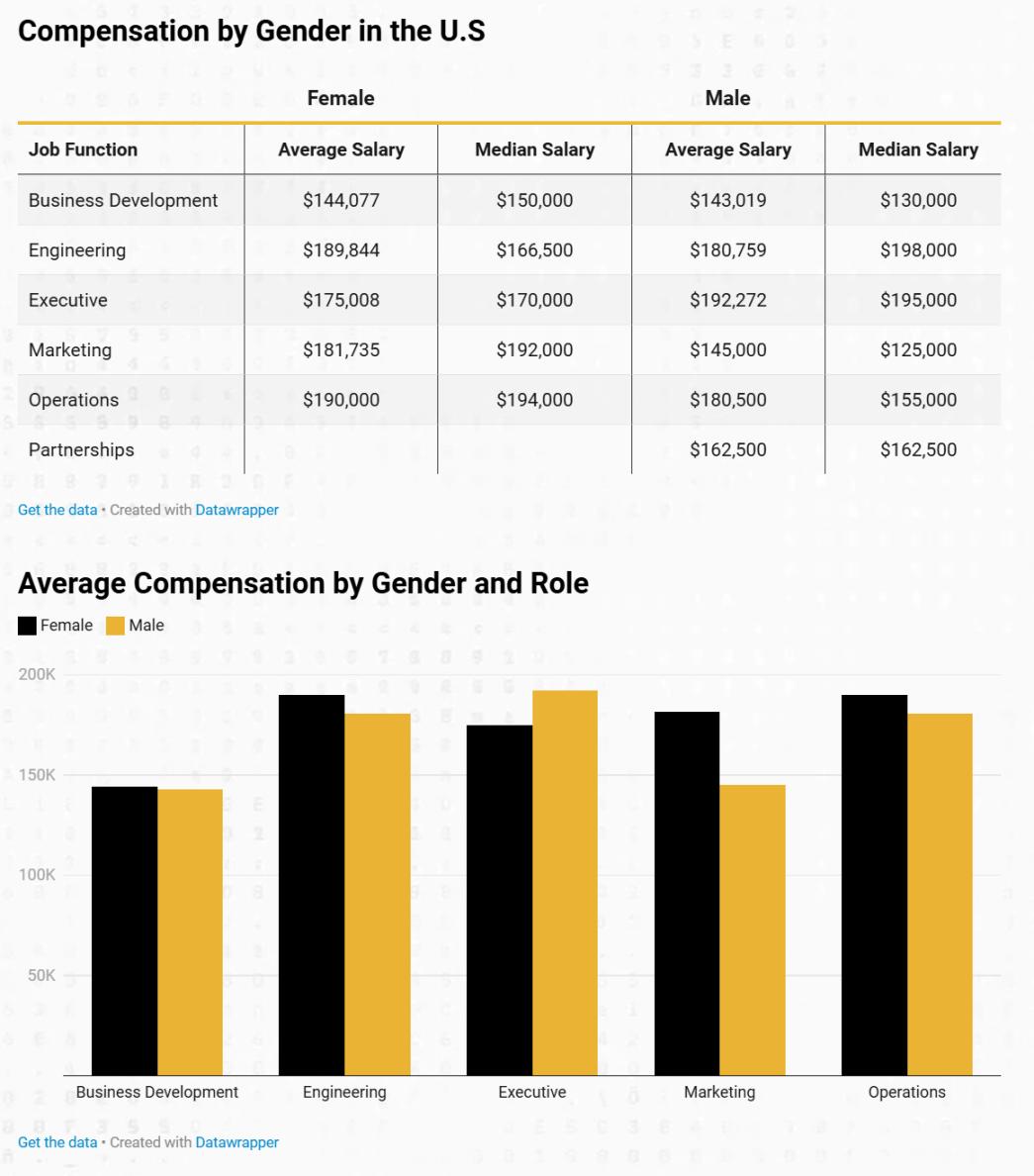

This week, Pantera released the 2024 Crypto Industry Salary Report. Let's see if your salary meets the standard! Recommended article:

《2024 Crypto Industry Salary Report》

- Last year, 3% of people received their salary in cryptocurrency, and this year this proportion has grown 3 times, reaching 9.6%. Stablecoins USDC and USDT dominate, with most people choosing USDC when receiving salaries in cryptocurrency.

- Will the cryptocurrency industry return to offline work? Probably not, but the proportion of offline office work has increased 4 times (reaching 6%).

- In terms of median salary, having an MBA does not mean higher pay in the Web3 field. In fact, compensation has slightly decreased.

- In terms of median salary, women earn more than men in marketing, operations, and business development, but men dominate in engineering and executive positions.

- Salaries for engineering positions have generally increased, especially for junior and mid-level positions: junior engineers increased by 25.6%, mid-level engineers by 14.49%, and senior engineers by 4.9%.

The US Treasury stated that this Cambodian group has laundered over $4 billion for clients including North Korean hackers and transnational criminal groups. Recommended article:

《Wing Hang in Cambodia, the "Super Hub" of Crypto Black Industry》

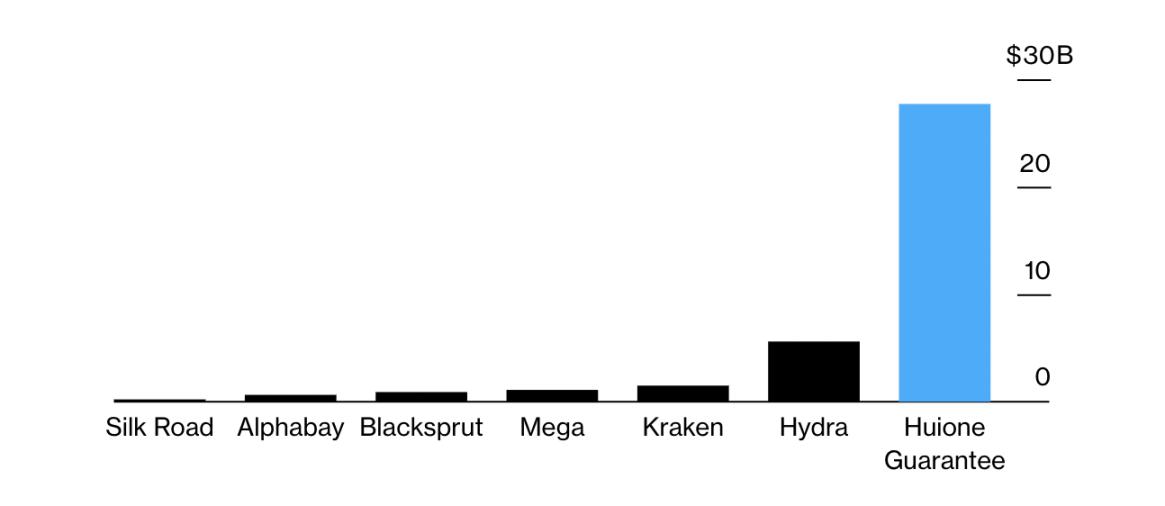

As Wing Hang's influence expands, blockchain investigators have begun to dig deeper, trying to estimate its true scale. One of the largest investigation companies, Elliptic, released a research report in January, concluding that at least $24 billion flowed through Wing Hang's guarantee and its merchants' cryptocurrency wallets. The blockchain intelligence company TRM Labs estimates an even higher amount of $81 billion. Regardless of the estimate, it means Wing Hang's scale far exceeds its largest predecessor - the Russia-operated "Hydra Market" closed by US and German officials.

On August 3rd, according to Bitcoin News, the Satoshi Nakamoto statue located in Lugano, Switzerland was stolen, and the statue's planner Satoshigallery is willing to offer 0.1 BTC as a reward to find the stolen statue. This instantly caught the attention of the crypto industry. Recommended article:

《Statue Sunk in the Lake, Who is Erasing Satoshi?》

The "Disappearing Satoshi" statue has vanished, which is a metaphorical satire.

On October 25th, 2024, the city of Lugano, Switzerland, unveiled a statue commemorating Bitcoin's anonymous creator Satoshi Nakamoto at Ciani Park, hosted by the Plan B initiative in collaboration with Tether and Lugano City. At the time, Tether, located in Switzerland, and Lugano were working together to build the city into a global Bitcoin center.

The stolen modern-style statue was designed by Italian artist Valentina Picozzi, the principal of Satoshigallery, taking 18 months of research and design and 3 months to build. The statue was crafted with vertical stainless steel and weathering steel layers, and when viewed from a specific angle, its face seems to disappear. This illusion symbolizes Bitcoin's anonymous origins and Satoshi's universal identity.

Immediately, a group of Lugano residents initiated a public petition on Change.org. The petition requests the municipal government to provide logistical and safety support to restore this artwork. The artist herself has promised to rebuild at her own expense and provide related services, and Satoshigallery has also stated that they are willing to create and donate a new copy at their own expense. They declared: "We must protect the symbol of innovation and freedom."