1. Introduction

In 2025, global cryptocurrency regulation is reaching a historic inflection point. Once considered a gray area, the cryptoasset sector is now increasingly being reshaped by the visible hand of government. From the proposal and deliberation of a series of landmark crypto bills in the United States to the official implementation of the Stablecoin Ordinance in Hong Kong, major economies around the world have almost simultaneously shifted from a vague, wait-and-see approach, or even a repressive one, to actively building clear regulatory frameworks. This global policy shift signals the crypto industry's departure from its untamed, unregulated era and its entry into a new phase, one predicated on compliance and accelerating integration with traditional finance.

This article aims to comprehensively review and deeply analyze the significant developments in global crypto policy since 2025, and to foresee their profound impact on the future market landscape. We will first focus on the United States, dissecting its legislative, administrative, and regulatory initiatives. We will then turn our attention globally, outlining policy developments in key jurisdictions such as the European Union, Hong Kong, Singapore, and the United Arab Emirates. We will then analyze market prices, institutional trends, and on-chain data to reveal the interplay between policy and market forces. Finally, we will identify several key trends in future global crypto policy, providing investors with forward-looking insights and insights as they navigate this transformation, which presents both opportunities and challenges.

2. Encryption Policy and Market Interaction

In 2025, the crypto market showed a clear policy linkage effect, and the trend of "buying expectations and selling facts" was staged many times. The policy hand is bringing norms and guidance to the crypto industry and is also reshaping the market's operating logic.

1. The linkage between encryption policy and market prices

At the start of 2025, Bitcoin continued its upward trend from the end of the previous year, breaking through its all-time high in early January, reaching $100,000. This surge largely reflected expectations surrounding Trump's election victory and his promised "crypto-friendly" policies. However, market sentiment also fluctuated. Due to the lack of concrete policy details in mid-January, Bitcoin prices experienced a significant correction in February, falling from their early January high of approximately $105,000 to around $70,000, a monthly drop of over 17%. This volatility reflects investors' sensitivity to policy implementation—expectations drive rallies, while delays trigger pullbacks. In early March, when Trump hinted on social media that he would establish a national strategic cryptocurrency reserve, the market was ignited again. Following the weekend announcement, Bitcoin surged 20%, and Altcoin like XRP surged 25% in two days. However, the subsequent official executive order, which did not include plans for direct government purchases of Bitcoin, led the market to believe that the "good news had run its course," and Bitcoin retreated approximately 6% after a brief surge.

As "Crypto Week" approached in the US in July, favorable legislation gradually materialized, triggering a short squeeze-like upward market rally. In mid-to-early July, Bitcoin broke through its previous high and continued to break records, reaching a new all-time high of $120,000 on July 14th. During this period, multiple positive factors converged: the impending passage of a series of bills by the House of Representatives (such as GENIUS and CLARITY) was seen as milestones in establishing the industry's future, prompting investors to invest early. Simultaneously, the US SEC shifted its stance, accelerating the approval of products such as spot Bitcoin and Ethereum ETFs. The market saw sustained and strong capital inflows into Bitcoin spot ETFs, pushing prices to new highs. Crypto-related stocks also rallied, with US-listed mining companies and major cryptocurrency holders seeing strong share prices. Digital asset investment funds saw a net inflow of $3.7 billion in a single week, pushing the industry's assets under management to a record high of $211 billion. Bitcoin-related products alone attracted $2.7 billion, dominating the market, while Ethereum and other assets also saw significant incremental capital inflows. It can be said that the policy dividends drove a rush of capital into the market, directly fueling the market's significant rise.

2. Exchange liquidity and institutional trends

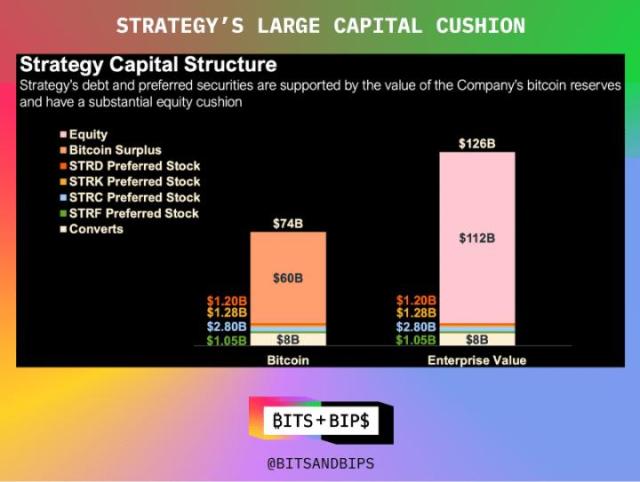

The improved regulatory environment in 2025 is also reflected in the trading market structure. First, liquidity on compliant US exchanges has significantly rebounded. With clearer regulations and the entry of institutional investors, the depth of Bitcoin order books on several major US licensed exchanges (such as Coinbase) has increased significantly, and the US market has once again dominated 1% of global Bitcoin's deep liquidity. Clearer regulation and a professional execution environment have created a positive feedback loop: deeper liquidity attracts more capital, further deepening the market's depth. Furthermore, institutional investor behavior has shifted significantly. In addition to the influx of ETF funds, US listed companies and traditional institutions have shown renewed enthusiasm for Bitcoin investment. Strategy made multiple additional purchases in 2025, and by July its holdings had reached 628,791 Bitcoins, representing 2.994% of the total Bitcoin supply. Furthermore, several Wall Street asset management firms have taken advantage of favorable policies to launch new crypto trusts and funds, providing clients with compliant exposure. According to a CoinShares report, net inflows into digital asset investment products exceeded $10 billion in the first seven months of 2025, far exceeding the full-year level of 2024. Even within traditional hedge funds, crypto assets are beginning to be considered a legitimate component of portfolios.

Source: https://bitbo.io/treasuries/microstrategy

3. On-chain data and liquidity

Long-term holders are becoming the dominant force in Bitcoin's supply. A Coinbase research report indicates that by August 2025, approximately 85% of Bitcoin's supply will be held by long-term wallets, with the proportion of tradable Bitcoin in circulation falling to a historical low. A large amount of Bitcoin, after its early surge, did not return to exchanges but remained in cold wallets. Consequently, Bitcoin balances on exchanges have been declining, indicating that investors are more inclined to hoard Bitcoin for the long term rather than trade it frequently.

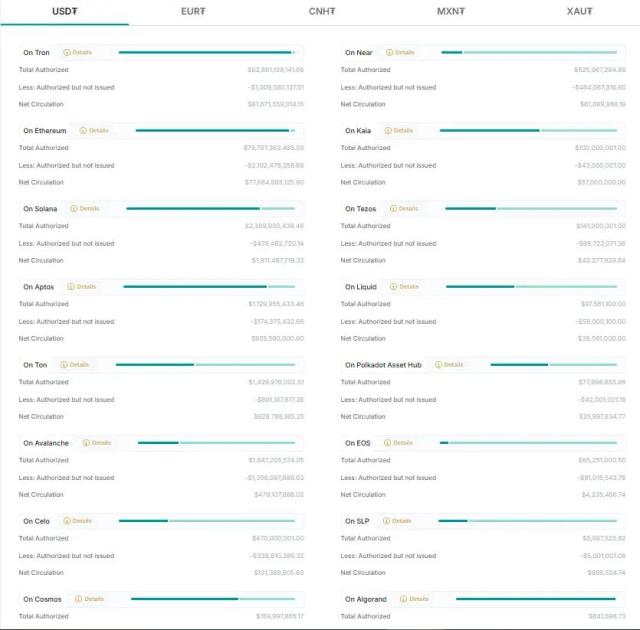

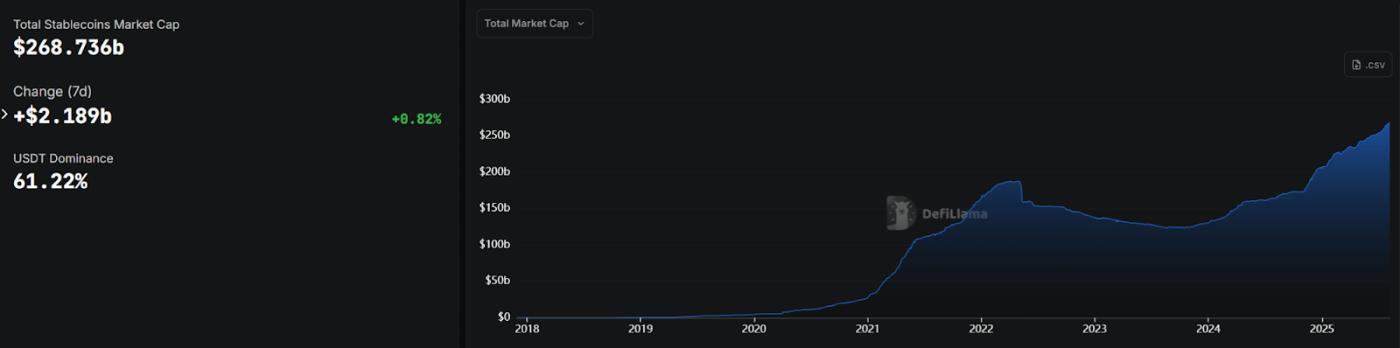

Stablecoin supply and on-chain liquidity have rebounded significantly. After stagnation in 2022-2023, compliant stablecoins began to grow again in 2025, indicating that funds are seeking entry points. The increase in stablecoin issuance is seen as a leading indicator of recovering risk appetite. In particular, with US regulators explicitly supporting dollar-denominated stablecoins, the market capitalization of compliant stablecoins such as USDC has rebounded, with billions of dollars in new issuance occurring in a single month. These stablecoins have provided new liquidity to the market. On-chain data shows that the average daily transaction volume of dollar-denominated stablecoins increased by 28% year-on-year in mid-2025, and the cumulative on-chain payment transaction volume for the year even exceeded that of Visa and Mastercard combined. This highlights the growing role of stablecoins in global capital flows and reflects that regulation is pushing them from the gray area to mainstream payment networks.

Source: https://defillama.com/stablecoins

Overall, the market reaction in 2025 can be summarized as follows: Clarifying policies are driving both incremental capital flows and increased holding interest. Bitcoin, bolstered by its trust and liquidity, has been the biggest beneficiary, with its price hitting record highs and its market capitalization dominance reaching a multi-year high. Ethereum followed closely behind, solidifying its position as "digital silver." Most altcoins, however, have lagged behind or even been marginalized due to regulatory pressure or a lack of new storytelling. On-chain, mainstream assets are rapidly converging towards long-term investors, and trading behavior is becoming more rational. All of this suggests that the crypto market is gradually emerging from its wild past and moving towards a period of maturity and stability.

III. Progress in U.S. Encryption Policy

1. Encryption legislation breakthrough

The year 2025 marked a milestone for crypto legislation in the United States. In addition to the recently passed GENIUS Act and CLARITY Act, several other important cryptocurrency-related legislative proposals are underway, covering key areas such as the prohibition of CBDCs, Bitcoin strategic reserves, consumer protection, mining, and taxation.

GENIUS Act: On July 18th, Trump signed the GENIUS Act, the first comprehensive cryptocurrency legislation passed by the US Congress. Focusing on stablecoin regulation and prohibiting the payment of interest, it marks a significant step forward in US digital asset policy. The GENIUS Act stipulates that only financial institutions (banks, credit unions, and specially approved compliant institutions) protected by federal deposit insurance may issue payment stablecoins. Issuers must maintain 1:1 backing with fiat currency or high-quality reserve assets and submit to monthly reserve disclosures and regular audits. All stablecoin issuers must also comply with the Bank Secrecy Act and implement anti-money laundering and counter-terrorist financing measures. The act aims to provide clear regulatory safeguards for the stablecoin industry and is considered a "banking license" system for stablecoins.

CLARITY Act: Shortly thereafter, the US House of Representatives considered another major bill, the CLARITY Act. This bill aims to clarify the criteria for determining whether a digital asset is a security or a commodity, and to clarify the division of regulatory responsibility between the SEC and the CFTC regarding cryptocurrencies. The CLARITY Act proposes to grant the Commodity Futures Trading Commission (CFTC) broader regulatory authority over non-securities crypto assets while establishing a transition path from securities to commodities for certain tokens that meet decentralized and functional standards, thereby ending the previous regulatory gray area. The CLARITY Act has already passed the House of Representatives and is awaiting Senate review.

The CBDC Ban Act , introduced concurrently with the GENIUS and CLARITY Acts, establishes federal prohibitions against the issuance of a U.S. central bank digital currency (CBDC). The bill has been passed by the House of Representatives and awaits the President's signature or Senate approval. The bill aims to protect financial privacy and limit the Federal Reserve's involvement in the digital currency sector.

The BITCOIN Act was introduced by Senator Cynthia Lummis on March 11, 2025, with a bipartisan co-signatory. The bill aims to consolidate Bitcoin acquired by the federal government through confiscation and other means into a "Strategic Bitcoin Reserve" and requires a purchase plan, such as a proposed purchase of 1 million BTC over five years. It has been submitted to the Senate Banking Committee for review but has not yet reached a vote.

DCCPA: Co-sponsored by several senators, it seeks to uniformly classify most crypto assets as "commodities" and regulate them under the CFTC, while also strengthening consumer protection measures. The bill was launched in 2022 and is still under review.

FIT21 : Passed by the House of Representatives in May 2024, it has yet to be voted on in the Senate. Similar to CLARITY, the bill aims to clarify the regulatory responsibilities of the CFTC and SEC, define standards for the decentralized blockchain industry, and provide exemptions for small-scale issuances. It also incorporates stablecoins into the regulatory framework and clarifies anti-fraud penalties.

Furthermore, some states, such as Texas, passed a state-level "Bitcoin Strategic Reserve" bill in June 2025, allowing governments to invest in digital assets with a market value of at least $500 billion (such as Bitcoin). The White House Digital Asset Task Force released a comprehensive 160-page report, recommending accelerated tax code updates (such as redefining income from mining and staking), the establishment of a regulatory sandbox, and simplified bank access systems. The report's content echoes several draft bills (CLARITY, GENIUS, and Anti-CBDC).

2. Administrative measures and regulatory shifts

While legislation is being advanced, the executive branch and regulators have also taken a series of major measures to reverse the uncertain attitude towards the crypto industry in the past few years, and have begun to coordinate various regulatory agencies from top to bottom to formulate a "chess game" strategy for digital assets.

In January 2025, the newly inaugurated Trump administration issued an executive order titled "Strengthening American Leadership in Digital Fintech," explicitly prohibiting the development or use of any U.S. central bank digital currency (CBDC). This executive order, reversing the previous administration's support for exploring CBDCs, directly halted the Federal Reserve's potential issuance of a digital dollar, citing the need to protect financial privacy and monetary independence. Instead, it emphasized support for dollar-backed stablecoins to maintain the dollar's dominance in the digital age. The order also emphasized protecting citizens' rights to participate in blockchain networks (including mining, node validation, and self-custody), requiring that no laws or policies unduly restrict these activities. More importantly, the order rescinded the Biden administration's 2022 cryptocurrency executive order and the Treasury Department's related framework, establishing the White House Digital Asset Markets Task Force, led by the newly appointed "crypto czar" David Sacks, a former PayPal executive. Bringing together senior officials from the Treasury, Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Department of Justice, the task force mandated that each agency submit a report within 120 days on a unified digital asset regulatory framework to eliminate regulatory overlaps and gaps. On August 7, Trump signed an executive order allowing alternative assets such as private equity, real estate, and cryptocurrencies to enter 401(k) retirement savings plans, which will open the door to approximately $12.5 trillion in retirement account funds.

On the SEC side, with the change of ruling parties, the agency underwent a significant policy shift in 2025. Paul Atkins, Trump's nominee for SEC Chairman, made establishing a regulatory framework for digital assets a top priority upon taking office. He adopted a relatively relaxed regulatory stance, actively promoting the easing of cryptocurrency regulations, including through ETF approvals, regulatory guidance, and litigation settlements. On July 31st, Atkins launched "Project Crypto," an initiative aimed at comprehensively updating US securities regulations to accommodate the blockchain and digital asset markets. He directed SEC staff to develop clear guidance on determining which crypto tokens are securities and to develop disclosure and exemptions to lower the compliance threshold. He also instructed the SEC to work with companies seeking to issue tokenized securities to promote blockchain-based pilots for traditional financial assets.

3. Financial and accounting policies

In terms of financial management and accounting standards, the United States also introduced supporting measures in 2025 to integrate crypto assets with the traditional financial system. In January 2025, the SEC issued Notice SAB 122, revoking the controversial 2022 SAB 121 guidance on crypto custody accounting. Previously, SAB 121 required banks and other institutions to record crypto assets held on behalf of clients as both liabilities and equivalent assets on their balance sheets. This rule was criticized by the banking industry as excessively capital-intensive and hindering banks from providing digital asset custody services. Congress passed a resolution in 2023 attempting to overturn SAB 121, but Biden vetoed it.

Now that the SEC has withdrawn this requirement, banks and other custodians no longer need to make significant provisions in their accounts to safeguard client crypto assets. The American Banking Association (ABA) welcomed this move, stating that it would "allow banks to more confidently serve as custodians of digital assets." This demonstrates that the United States is removing barriers to traditional financial participation in the crypto sector from the perspective of accounting standards, thereby facilitating the entry of compliant funds.

4. Strategic reserves and macroeconomic policies

The Trump administration has also incorporated Bitcoin and other digital assets into its national strategic vision. In March 2025, the White House issued an executive order establishing a "Strategic Bitcoin Reserve" and a "Digital Asset Reserve Account." According to the order, the federal government will centrally deposit Bitcoin seized through law enforcement into the strategic reserve, refusing to sell it for cash. The order also authorizes the Treasury and Commerce Departments to explore budget-neutral options for increasing Bitcoin holdings without increasing taxpayer burdens. At the same time, government agencies are required to report all crypto asset balances to the Treasury Department and the President's Digital Asset Task Force, enabling centralized management of state-owned crypto assets.

The Trump administration emphasized that this initiative aims to make the United States one of the "first countries to establish an official Bitcoin reserve" to capitalize on Bitcoin's strategic value as "digital gold." US officials estimate that the fragmented disposal of confiscated Bitcoin has cost taxpayers over $17 billion in potential value. The new policy seeks to remedy this by locking up these assets for national needs. The US's official cryptocurrency reserve initiative is a global first, reflecting a significant shift in US policy from its previous emphasis on heavy-handed regulation to a recognition of crypto assets as a strategic resource.

In summary, since 2025, the United States has launched a multitude of initiatives at the legislative, administrative, and regulatory levels, a phenomenon dubbed a "regulatory spring" within the industry. Led by the Trump administration, the US is attempting to position itself as a "global crypto capital," reversing its previous ambiguity and repressive policies through stablecoin legislation, the Market Structure Clarity Act, and executive orders. These measures have had an immediate impact on the market: investor sentiment has significantly improved, and new funds have begun to flow into the US compliant market.

4. Progress of Encryption Policies in Other Countries Around the World

In addition to the United States, many countries and regions around the world are also stepping up efforts to improve their respective cryptocurrency regulatory frameworks in 2025, with a focus on stablecoins, anti-money laundering and market regulations.

EU: The EU's Markets in Crypto-Assets (MiCA) Directive will officially take full effect at the end of 2024, providing a unified blueprint for cryptoasset regulation for member states. MiCA brings cryptoasset issuance and services under EU financial regulation, including strict rules for stablecoins: only entities with an Electronic Money Institution license or credit institution status can issue stablecoins denominated in a single fiat currency (EMT), while tokens backed by a basket of assets (ART) must be established in the EU and authorized by regulators. Stablecoin issuers must meet capital requirements, maintain high-quality and liquid reserve assets, and regularly disclose reserve composition and audit reports to regulators. The implementation of MiCA makes the EU the first major economy to enact comprehensive crypto legislation. In the first half of 2025, member state regulators (such as the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA)) were busy drafting MiCA's supporting technical standards, and crypto service providers such as exchanges and custodians began applying for cross-EU licenses. This unified regulation has brought a certain appeal to the EU market, and it is expected that a number of compliant European trading platforms and stablecoin issuers will emerge by the end of 2025.

UK and Australia: The UK passed the Financial Services and Markets Act in 2023, which includes provisions for the regulation of stablecoins and other crypto-assets. This legislation empowers the Treasury and the Financial Conduct Authority (FCA) to classify the issuance and services of crypto-assets as regulated financial activities. The UK government will consult on specific rules from 2024 to 2025, with the goal of finalizing detailed regulations for stablecoin issuance and the operation of crypto-trading platforms by the end of 2025, bringing them into line with the regulation of traditional financial institutions. The UK's overall approach is positive, hoping to attract crypto-related businesses back to London through improved legislation. Australia is also taking action in 2025: Following the release of its "Token Swap" report in 2022, the Australian government announced plans to propose draft regulations for crypto-asset custody and exchange licensing in 2025, as well as to refine tax guidelines for digital assets.

Hong Kong, China: Hong Kong is actively exploring becoming a testing ground for China's cryptocurrency policy, exploring the opening of exchange operations and public blockchain technology research and development, and establishing a technical regulatory sandbox environment to provide reference for mainland China's cryptocurrency policy. Hong Kong is committed to becoming Asia's compliant crypto hub. As early as June 2023, the Securities and Futures Commission (SFC) implemented a licensing system for virtual asset trading platforms. In 2025, Hong Kong regulators further expressed support for the development of compliant stablecoins and tokenized securities. The Stablecoin Ordinance, which officially came into effect on August 1, explicitly requires any issuer of a stablecoin pegged to the Hong Kong dollar to obtain a license in Hong Kong; failure to do so is illegal. Reserve assets must be highly liquid, high-quality, and equivalent in value to the nominal value of the stablecoin in circulation, and must be subject to supervision and audit by the HKMA. These measures demonstrate Hong Kong's commitment to striking a balance between investor protection and innovation to attract compliant global crypto businesses. Several major exchanges and crypto funds have already established offices or sought licenses in Hong Kong, and market liquidity has rebounded.

Singapore: Singapore adopted an open attitude toward the crypto industry early on, attracting a significant influx of industry companies and talent. However, the collapse of the FTX exchange in 2022 caused significant losses to Singaporean sovereign funds such as Temasek. The collapse of prominent cryptocurrency exchanges such as Three Arrows Capital and Terraform Labs also tarnished Singapore's reputation as an Asian financial hub. Starting in 2023, the Monetary Authority of Singapore (MAS) will gradually tighten regulatory measures. MAS will require approved stablecoins to meet standards for value stability, reserve custody, and capital adequacy, and issuers must obtain the appropriate licenses. This move prevented exchanges such as Binance, Bybit, and Huobi from obtaining licenses, leading to their exit from the Singapore market by the end of 2023. In 2025, MAS will further tighten cryptocurrency trading regulations. After June 30, digital token service providers serving only overseas clients will be required to obtain a license from MAS to continue operating in Singapore. Unlicensed trading platforms will be required to close, in an effort to curb financial crimes such as money laundering using cryptocurrencies. In terms of investment and innovation, Singapore has launched sandbox programs such as "Project Guardian" to explore institutional decentralized finance. In short, Singapore's overall attitude towards the crypto industry is "encourage innovation and prudent supervision."

United Arab Emirates : In recent years, the UAE has actively positioned itself as a crypto-friendly jurisdiction. The Central Bank of the UAE introduced the "Payment Token Services Regulation" rules at the end of 2024. These rules define stablecoins pegged to fiat currencies as "payment tokens" and adopt a tiered access policy: Locally issued stablecoins pegged to the dirham (AED) can apply to qualify as qualified payment tokens for domestic payment settlements, while foreign-issued foreign-currency stablecoins (such as USDT and USDC) are prohibited from domestic use as a means of payment and may only be used for investment and trading purposes. The UAE encourages banks and institutions to issue AED stablecoins and explore government-backed, multi-asset reserve stablecoins (such as those pegged to government bonds or gold). Regulations also prohibit the issuance or use of algorithmic stablecoins and anonymous privacy coins to prevent systemic risks and money laundering concerns. Furthermore, the Dubai Virtual Asset Regulatory Authority (VARA) has released rules on token issuance and marketing from 2023 to 2025, requiring crypto companies operating in Dubai to obtain a license and comply with a series of regulations, including advertising disclosure and investor protection. Overall, the UAE is establishing a multi-layered crypto regulatory system that ensures financial security while making the UAE one of the most attractive crypto hubs in the Middle East.

Thailand: In 2025, Thailand implemented a series of measures combining support and regulation. On one hand, the Thai government announced that starting January 1, 2025, capital gains tax will be exempted on digital asset transactions conducted through licensed crypto trading platforms for five years to encourage compliant trading. This effectively provides investors with tax incentives for participating in crypto investments within a regulated environment, which is expected to increase the attractiveness of the Thai market. On the other hand, the Securities and Exchange Commission of Thailand amended its regulations in April 2025, requiring foreign crypto service providers (exchanges, brokers) to register and obtain a license in Thailand if providing services to Thai citizens; failure to do so will be considered illegal operations. The Thai SEC also strengthened its oversight of crypto advertising and investor suitability.

Pakistan: Pakistan has shifted from its previous ambiguous or even prohibitive stance on cryptocurrencies and is now embracing virtual assets to promote financial modernization. In July, the Pakistani government officially approved the Virtual Assets Act 2025, establishing the Pakistan Virtual Asset Regulatory Authority (PVARA) as an independent regulatory body responsible for licensing and supervising cryptocurrency and virtual asset service providers nationwide. This framework, similar to the Dubai VARA model, aims to introduce licensing and risk management for the domestic crypto industry. State Bank of Pakistan Governor Jameel Ahmad stated that a pilot program for a central bank digital rupee (CBDC) is imminent, and legislation will establish a licensing and regulatory framework for virtual assets. Pakistan has also established a Cryptocurrency Commission (PCC) to promote innovative projects such as blockchain and Bitcoin mining. The government has even invited CZ, founder of the world's largest exchange, as an advisor and plans to establish a national Bitcoin reserve. Overall, Pakistan is attempting to shift from heavy-handed suppression to proactive regulation, hoping to capture a share of the emerging digital financial sector.

Turkey: As an emerging market country with a large crypto user base, Turkey implemented strict new regulations in 2025 to combat illegal activities and maintain financial stability. The Ministry of Finance's Financial Crimes Investigation Bureau has begun implementing a series of anti-money laundering regulations for cryptocurrencies: mandatory real-name verification for all crypto transactions, reporting and review of transactions exceeding 15,000 lira, and delayed settlement for all transactions—standard transfers take 48 hours to complete, and first withdrawals take 72 hours. Furthermore, the new regulations impose a cap on the circulation of stablecoins: individuals are limited to daily stablecoin transactions of the equivalent of $3,000 USD, and a monthly cumulative cap of $50,000 USD. Finance Minister Mehmet SIMşek stated that this measure is intended to "prevent the laundering of funds from illegal gambling and fraud through cryptocurrencies." With an estimated one-fifth of Turkey's population having invested in cryptocurrencies and the third-largest cryptocurrency trading volume globally, the new regulations have a wide-ranging impact on the market. While the new regulations may reduce on-exchange liquidity in the short term, they will help to eliminate illicit financial flows and enhance the legitimacy and transparency of the Turkish crypto ecosystem in the long term.

India: The Indian government remains cautious and conservative regarding cryptocurrencies, but there are signs of softening. Starting in 2022, India imposed a heavy 30% tax on crypto trading profits and a 1% withholding tax (TDS) at source, leading to a sharp decline in domestic trading volume. However, during its G20 presidency in 2023, India pushed for the IMF and FSB to develop a joint framework for global crypto asset regulation, signaling its preference for unified action under international rules. As of 2025, India had yet to enact specific crypto legislation, and domestic crypto exchage continued to struggle. However, government officials have repeatedly stated that they will not implement a blanket ban on cryptocurrencies, but rather await international consensus. Regarding CBDCs, the Reserve Bank of India is gradually expanding its pilot program for the digital rupee. In the future, India may choose to adjust its policies once global standards become clearer.

Russia : Russia has implemented a differentiated approach to cryptocurrency regulation. Domestically, the use of cryptocurrencies as a means of payment remains strictly prohibited, while the promotion of the digital ruble (CBDC) is accelerating, aiming to strengthen state control over the monetary system. However, internationally, Russia has adopted a significantly more open approach to cryptocurrencies to circumvent Western financial sanctions. In early 2025, the "Law on the Use of Digital Financial Assets in International Settlements" officially came into effect, providing a legal framework for Russian importers and exporters to use cryptocurrencies for trade settlements with friendly countries. The law authorizes certain companies to use mainstream cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins, in international transactions, thereby circumventing the SWIFT system. Furthermore, the Russian government is actively promoting standardized management and taxation of the cryptocurrency mining industry, hoping to leverage the country's abundant energy resources into fiscal revenue and foreign exchange reserves, thereby achieving its strategic goal of "nationalizing crypto mining."

In addition to mainstream economies, some smaller countries are also exploring cryptocurrencies. Bhutan, a small South Asian nation, will continue to deepen its "green mining" strategy in 2025, integrating Bitcoin mining with its abundant hydropower resources to leverage renewable energy to support national fiscal revenue and economic development. In April 2025, the Bhutanese government announced plans to collaborate with international companies to build multiple sustainable mining centers, aiming to become Asia's "green crypto mining hub." El Salvador, on the other hand, is continuing and expanding its national Bitcoin strategy. Following Bitcoin's legal tender status in 2021, it announced the establishment of a "Bitcoin National Wealth Fund" in 2025 to bolster the country's Bitcoin reserves. Furthermore, the Salvadoran government has launched a dedicated Bitcoin bond issuance program, with plans to use the funds raised to build a "Bitcoin City" to further strengthen Bitcoin's strategic support for the national economy.

Overall, by 2025, policies implemented by various countries have shown both convergence and divergence: developed economies place greater emphasis on establishing comprehensive regulatory frameworks, while emerging markets are more focused on preventing financial crime and capitalizing on crypto opportunities. Stablecoin regulation is a common focus, with Europe, the United States, and Hong Kong all enacting regulations to ensure adequate reserves and controlled issuance. Exchange regulation and anti-money laundering are also frequent topics, with countries beginning to apply Know Your Customer (KYC) and Anti-Money Laundering (AML) standards similar to those used in traditional finance to crypto trading activities. It is foreseeable that the legal status and regulatory requirements for cryptocurrencies in major jurisdictions around the world will gradually become clearer.

5. Global Crypto Policy Trends and Outlook

Looking ahead to the rest of 2025 and beyond, cryptocurrency policies may exhibit the following trends, with profound impacts on the global market landscape:

1. Accelerating Global Regulatory Convergence: US policy guidance may push major economies around the world toward similar regulatory frameworks. On the one hand, the GENIUS Act sets a benchmark for stablecoin regulation, and its requirements for compliant reserves and licensing may serve as a blueprint for other countries. For example, regulators in countries like Japan and South Korea are reportedly evaluating the relevance of the new US regulations for their own stablecoin policies. The EU will also observe how the US implements the act and adjust the details of its own regulations. On the other hand, the difficult distinction between securities and commodities that the CLARITY Act seeks to address is a common challenge faced by all countries. If the US successfully classifies tokens above a certain market capitalization and level of decentralization as non-securities, this will provide regulatory guidance for jurisdictions such as the UK and Singapore seeking to develop crypto finance, reducing the "lawless" vacuum. Cross-border regulatory cooperation will also be strengthened. Within the G20 framework, the IMF and the Financial Stability Board (FSB) proposed high-level guiding principles for cryptoasset regulation in 2023. It is expected that by the end of 2025, countries will have developed their own detailed regulations based on these principles and shared information.

2. Market structure becomes more institutional and commoditized: US regulators are shifting towards heavily incorporating traditional finance into the crypto sector, a trend expected to continue. It is expected that by the end of 2025, the CFTC may launch a regulatory framework for on-chain commodity trading, guiding more commodities and indices to be traded on-chain via tokenized tokens and subjecting them to compliance oversight. This will further commoditize and financialize the crypto market, leading to a deeper integration of digital asset markets with traditional commodity markets. Furthermore, a wider range of crypto ETFs and investment products will emerge. Following Bitcoin and Ethereum ETFs, regulators may approve baskets of crypto index ETFs and options ETFs, facilitating institutional investment. Some major Wall Street institutions are already preparing to launch actively managed crypto funds and pension fund crypto portfolios, once regulations allow. Bitcoin may gradually exhibit macroeconomic sensitivity similar to that of gold or the Nasdaq, becoming an "alternative asset" within institutional asset allocation.

3. Competition and Division of Labor among Regional Compliance Centers: In Asia and the Middle East, cities like Hong Kong, Singapore, and Dubai are vying to establish themselves as regional crypto hubs. Hong Kong, with its proximity to mainland China and well-developed financial infrastructure, coupled with the intensive rollout of exchange and stablecoin regulations between 2023 and 2025, has already attracted numerous prominent trading platforms and projects. Singapore, with its robust legal system, tax advantages, and pro-business environment, continues to be a hotbed for blockchain startups. The combined efforts of these two cities are expected to solidify Asia's position as a key player in the global crypto landscape. Middle Eastern cities like the UAE (Dubai) and Saudi Arabia are also vying for attention, attracting crypto companies under pressure in Europe and the United States through relaxed tax systems and open regulations. Over the next few years, we may see a multi-center landscape: North America will see crypto financial hubs like New York and Miami; Europe will see cities like Switzerland and Paris actively embracing regulation; Asia will see Hong Kong and Singapore as shining stars; and the Middle East will see Dubai as a bridgehead. These compliance hubs will dominate the flow of compliant funds and projects.

4. New opportunities for integrating technology and compliance: Clarifying policies will unleash new momentum for industrial innovation. With clarity on prohibited activities, businesses can boldly invest in permitted areas. For example, the US bans CBDCs but supports private stablecoins. This could trigger a surge in bank-issued dollar stablecoins. Traditional banks and fintech companies are collaborating to launch various compliant stablecoins to fill payment gaps, creating a market with enormous potential. Security token issuance is expected to increase, with on-chain stocks and bonds listed on compliant exchanges. Blockchain technology will be increasingly applied in traditional areas such as supply chain finance and trade settlement. Even Web3 technologies, such as decentralized identity (DID) and zero-knowledge proofs, may find applications in privacy compliance and digital identity authentication, driving innovation in compliance technology.

5. Evolution of Investor Behavior: Policy evolution will also profoundly impact investor sentiment. After experiencing the intense regulatory pressures of 2022-2023, global investors have demonstrated a stronger awareness of compliance and risk management during the 2025 rebound. In the near future, we may see US pension plans officially allow allocations to Bitcoin ETFs, and some countries' sovereign wealth funds publicly announce allocations to digital assets as a long-term strategy. These developments will further strengthen market fundamentals and reduce excessive speculation. Of course, new market volatility patterns may also emerge under the new policy environment. For example, due to the involvement of institutional algorithmic trading, short-term market fluctuations may closely track macroeconomic news and liquidity changes. Investors will need to adapt to the rhythm of institutional markets, which differ from the emotional ups and downs driven by retail investors in the past.

Conclusion

In 2025, the cryptocurrency world is undergoing a profound transformation from disorder to order. Compliance has become a dominant theme, and major global economies, from their own perspectives, have almost simultaneously extended a "tangible hand" to this emerging sector, either enacting laws or issuing guidelines to integrate crypto assets into the mainstream financial system. Over the long term, this policy evolution will profoundly shape the crypto industry's infrastructure and investment environment. Clearer rules will drive out bad money and retain good, ushering the industry from its period of unregulated growth into a new phase of compliant and orderly development. For ordinary investors, this means that crypto investment is no longer a shady venture, but is poised to gradually become a legally protected, transparent, and sustainable asset allocation option.

about Us

As the core investment research arm of Hotcoin Exchange, Hotcoin Research is committed to transforming professional analysis into a practical tool. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports." Our exclusive "Hotcoin Selection" column (using AI and expert screening) helps you identify promising assets and reduce the cost of trial and error. Our researchers also meet with you weekly via livestreams to analyze hot topics and predict trends. We believe that this caring support and professional guidance will help more investors navigate the market cycle and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries inherent risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.