In the past 24 hours, approximately $180 million worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently aggregated data, the liquidated positions were relatively balanced between long and short, suggesting that market volatility affected traders in both directions.

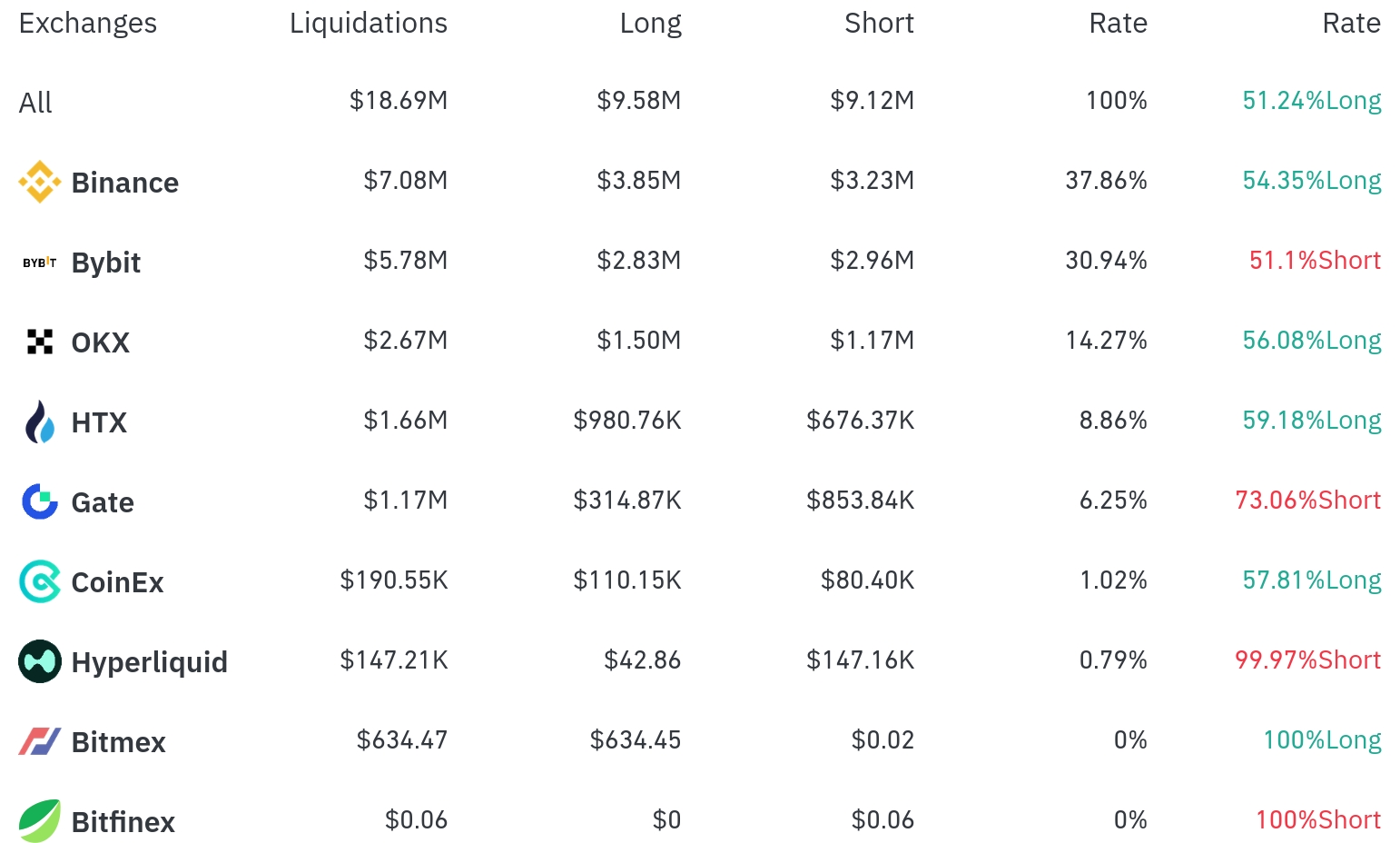

Binance experienced the most position liquidations over the past 4 hours, with a total of $7.08 million (37.86%) liquidated. Among these, long positions accounted for $3.85 million, or 54.35%.

Bybit was the second-highest exchange with liquidations, with $5.78 million (30.94%) of positions liquidated, of which short positions were slightly higher at $2.96 million (51.1%).

OKX saw approximately $2.67 million (14.27%) in liquidations, with long positions at 56.08%.

Notably, Gate exchange showed a very high short position liquidation rate of 73.06%, while Hyperliquid saw almost all liquidations (99.97%) occurring in short positions.

By coin, Ethereum (ETH) recorded the highest liquidation volume. Approximately $104.4 million in ETH positions were liquidated within 24 hours, with the price dropping 1.72% to $4,212. On a 4-hour basis, a large liquidation of $3.29 million occurred in ETH short positions.

Bitcoin (BTC) saw about $48.7 million in positions liquidated within 24 hours, with the current price at $118,238, up 1.30% in 24 hours. Notably, a large liquidation of $7.62 million in BTC short positions occurred over 4 hours, reflecting losses from short positions due to price increases.

Solana (SOL) had approximately $11.77 million liquidated in 24 hours, while among other major altcoins, XRP ($15.73 million) and SOON ($14.03 million) saw significant liquidations.

Dogecoin (DOGE) experienced $8.27 million in liquidations over 24 hours, accompanied by a 3.93% price drop, with mainly short positions ($202.75K) liquidated over 4 hours.

Interestingly, the ENA Token saw a large liquidation of $6.17 million despite a 3.48% price increase, while some altcoins like AVAX (-4.08%) and PEPE (-3.72%) underwent substantial position liquidations alongside price drops of around 4%.

This liquidation pattern in the cryptocurrency market indicates a divergence in the direction of major assets, suggesting that while Bitcoin shows an upward trend, Ethereum and many altcoins are experiencing downward pressure.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>