As Ethereum surpasses $4,000, demand for major altcoins strengthens, leading to a significant increase in short position liquidations.

On-chain data shows that interest and accumulation are increasing again. If Ethereum's price momentum is maintained, short position holders may continue to experience losses.

ETH Breaks $4000 with Buying Pressure

A surge in new demand for ETH has driven prices up by 18% over the past week. Strong buying momentum and improved market sentiment helped break the $4,000 price level yesterday, triggering short position liquidations.

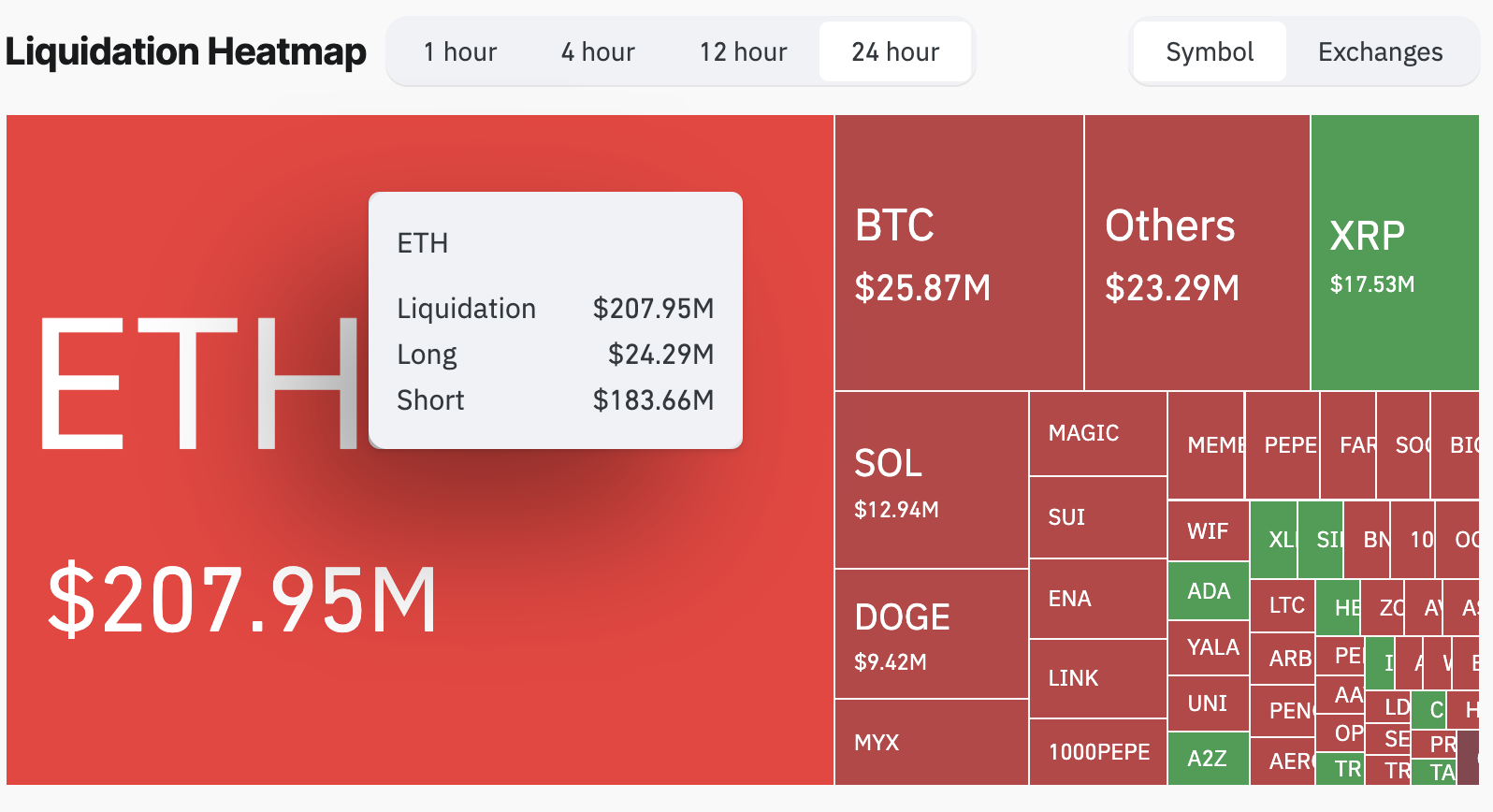

According to Coinglass data, short position liquidations reached $184 million in the past 24 hours, compared to relatively low long position liquidations of $24 million.

This highlights the intensity of the short squeeze, with traders frantically covering their positions during the rally.

However, on-chain data suggests this investor group may experience more losses going forward. ETH may continue to rise.

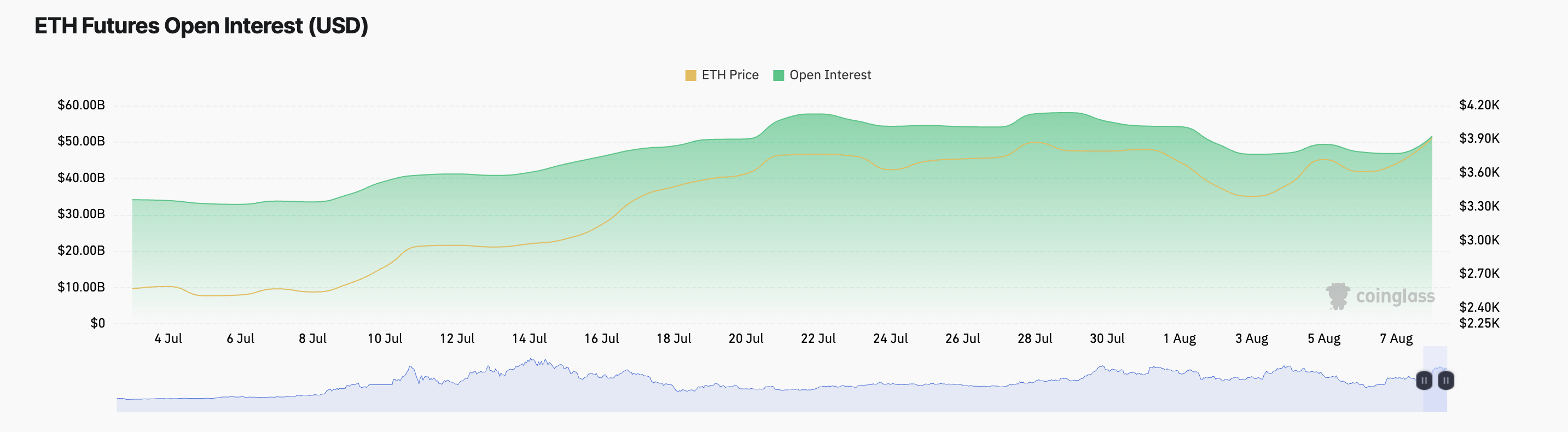

For instance, ETH's futures open interest has risen with the price, indicating active market participation. At the time of reporting, it was $51.61 billion, increasing by 10% in the past 24 hours.

Open interest measures the total number of outstanding futures or options contracts in the market. When an asset's price and open interest rise simultaneously, it indicates traders' strong confidence that the current trend will continue.

In ETH's case, this suggests more investors are actively taking new positions and are confident in the ongoing price momentum.

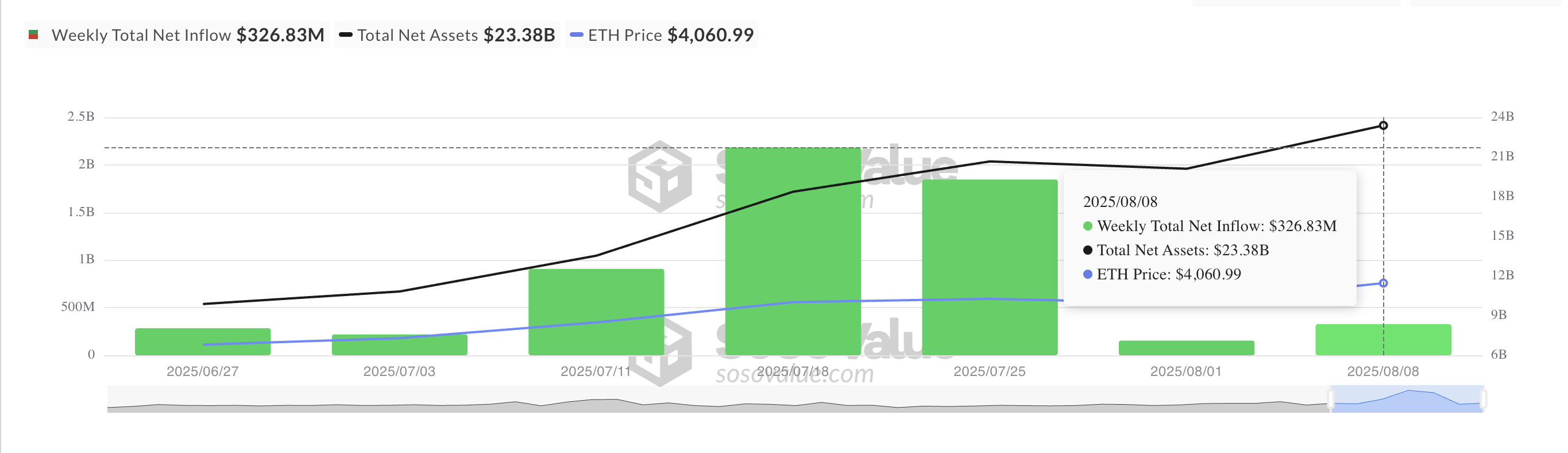

Moreover, renewed institutional interest adds credibility to this positive outlook. According to SosoValue, there were new fund inflows into ETH-based ETFs this week as market sentiment improved.

From August 4 to 8, these funds recorded total inflows of $326.83 million.

The inflow of new institutional capital demonstrates investor confidence and provides an important support base that could sustain ETH's short-term upward trend.

Ethereum Supports at $3909... Next Target Above $4430

ETH is currently trading at $4,160, maintaining a newly established support level near $3,909. If this support is reinforced and buying momentum increases, ETH's price could rise to $4,430, testing and potentially breaking resistance.

A successful breakout could pave the way for ETH to revisit its all-time high of $4,827.

Conversely, if buying pressure weakens, ETH could lose its current upward trend and reverse. Failing to maintain the $3,909 support could cause the price to drop to $3,340.