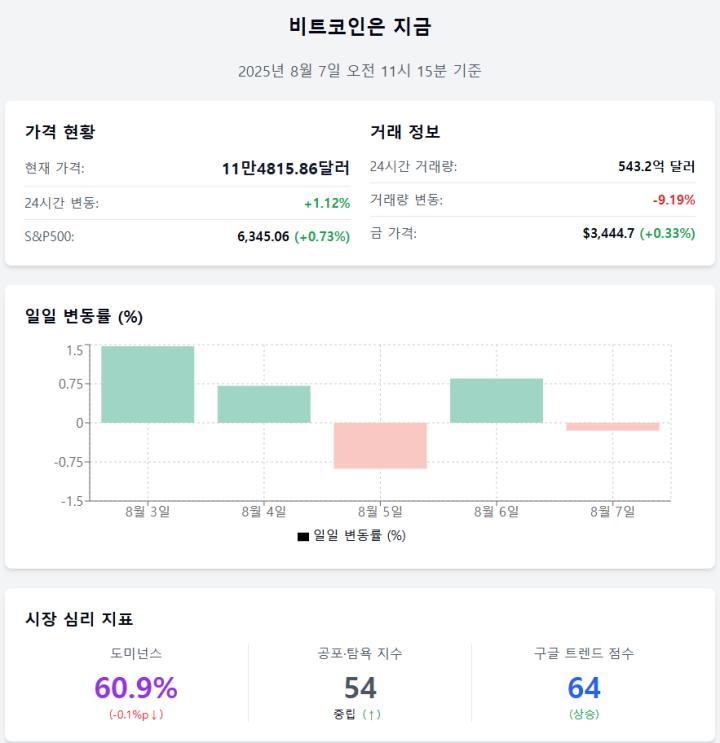

After Bitcoin reached an all-time high of $122,054 on July 14th, the tug-of-war between Bitcoin bulls and bears has kept the price mostly within a range.

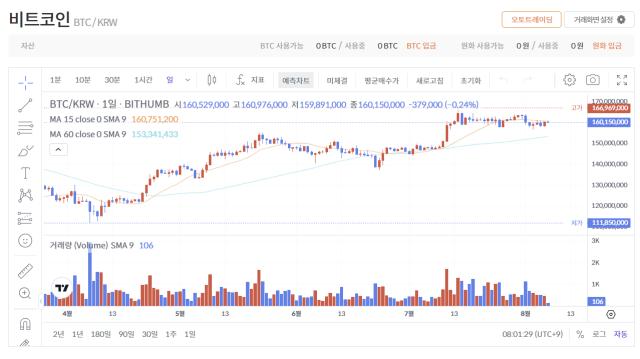

Over the past week, BTC faced resistance at $116,952 and support at $111,855, reflecting an indecisive market. As uncertainty increased, signs began to emerge that the bull market might be coming to an end.

Is Bitcoin's Bull Run Ending?

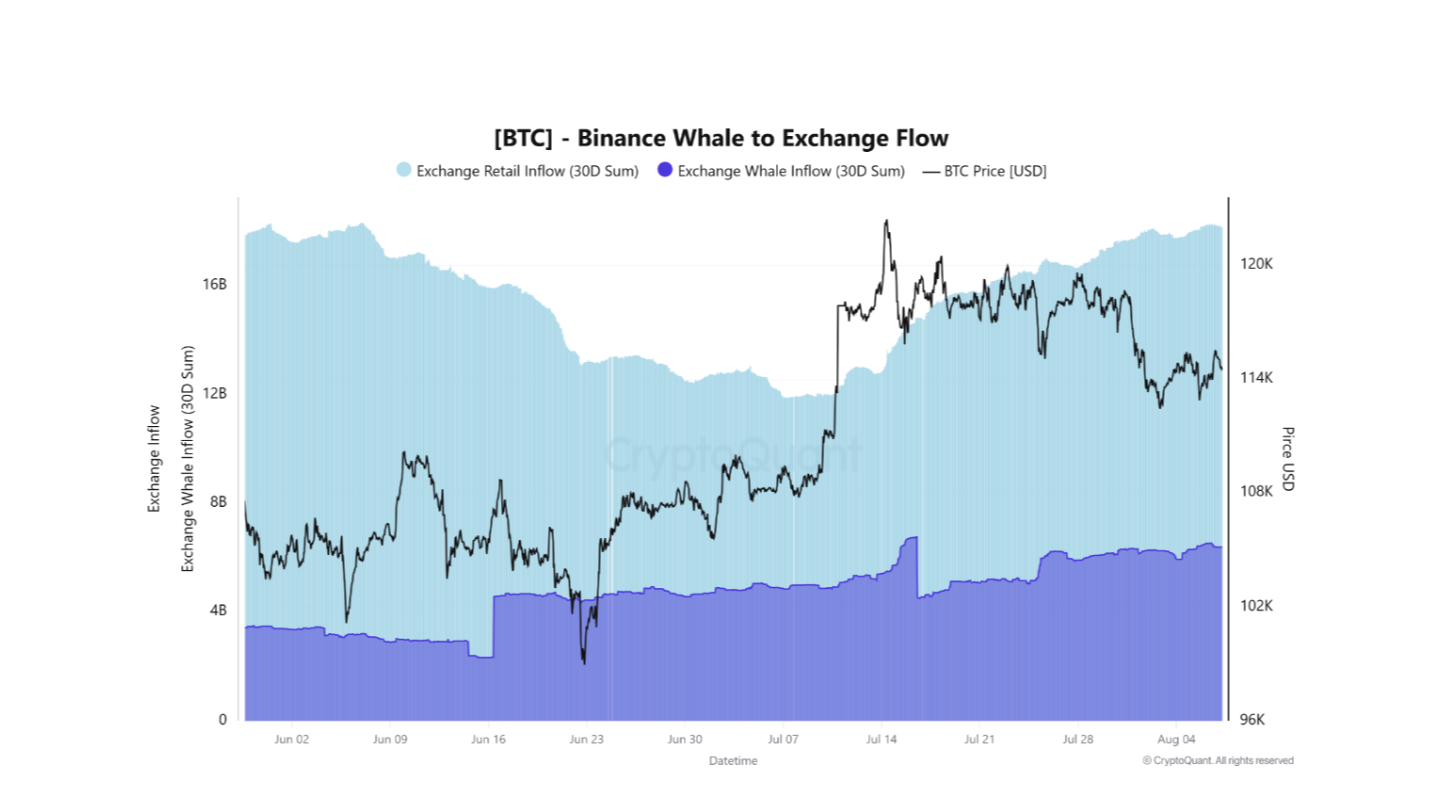

In a recent report, the pseudonymous analyst Arab Chain mentioned that the major coin BTC might be approaching the final stage of its current bull cycle. The key warning sign is that whales are continuously moving coins into Binance.

According to Arab Chain, from late July, BTC whales have moved coins worth between $4 billion and $5 billion to exchanges, which is a pattern associated with the distribution phase.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

The surge in whale inflows to exchanges indicates that large holders are preparing to sell. This can weaken the overall bullish momentum and increase the risk of further BTC price decline.

Moreover, the analyst found that retail participation has been steadily increasing over the past few weeks, despite BTC's lackluster performance. Arab Chain noted that this suggests "late buying" and could face downside risks if the correction intensifies.

The surge in retail activity can positively impact prices as they frequently move coins. However, despite strong retail accumulation in recent weeks, "the market is not following the bullish trend, which suggests potential exhaustion."

The continuous whale inflows to exchanges and increased late retail buying indicate a distribution pattern where large holders are selling positions to enthusiastic retail traders. If history repeats, this setup suggests that BTC's bullish momentum is weakening and increases the likelihood of a steeper market correction in the near term.

BTC Eyes Breaking $120,144, Caution Advised on Decline

Increased selling could strengthen bearish control in the BTC market and increase downward pressure on prices. If selling continues, the coin could test support at $111,855. If bears fail to defend this level, the coin's price could drop to $107,557.

On the other hand, if buying activity strengthens, the coin could break through the resistance at $116,952 and rise to $120,144.