The risk of this model is that once the stock price turns into a discount, the company will face difficulties in refinancing, and it will also increase the correlation risk between traditional stock markets and crypto markets.

The "reserve company" model with large holdings of cryptocurrencies by listed entities, after experiencing a frenzy in the first half of the year, is now showing signs of fatigue, with the high premium of their stocks relative to held crypto assets shrinking.

The latest developments show that the premium of the pioneer in this field, MicroStrategy, has significantly fallen. In May this year, its stock price once reached twice the value of its held Bitcoin, but now this premium has dropped to 1.75 times. Other followers, including Bitcoin holder Semler Scientific and Solana holder Upexi, have seen their stock premiums generally decline in the past few weeks, with some companies' premiums even disappearing, with stock prices falling below their crypto asset values.

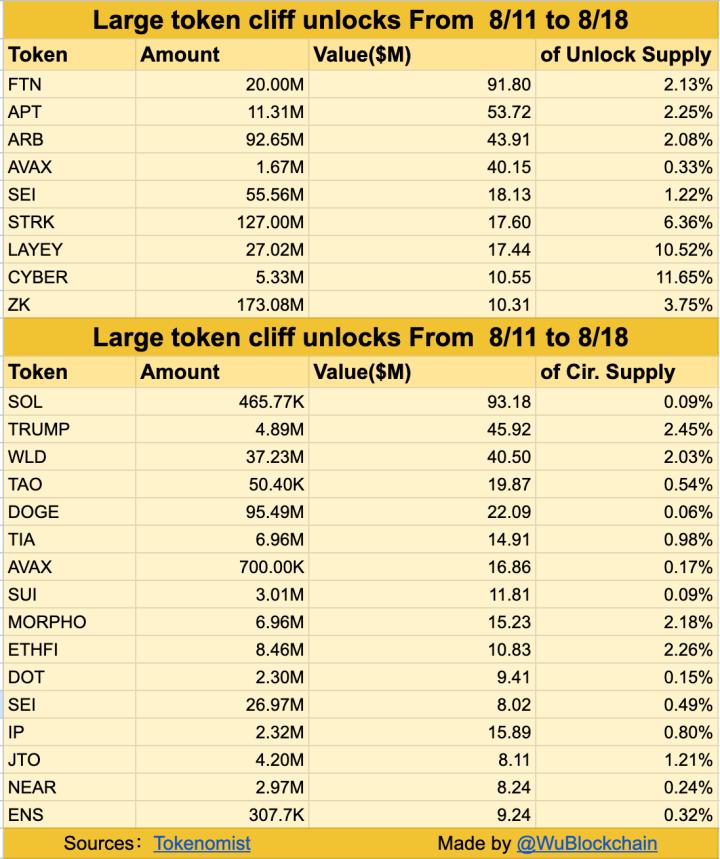

Despite the cooling market sentiment, the influence of "Treasury companies" in the capital market remains enormous. According to crypto consulting firm Architect Partners, U.S. listed companies have announced plans to raise over $91 billion for cryptocurrency purchases this year. According to Dealogic data, this figure far exceeds the total financing of $38 billion in the U.S. traditional IPO market during the same period.

However, the subtle market changes cannot be ignored. Some companies holding non-mainstream tokens have seen their stock prices fall below their net asset value, highlighting the divergence in investor sentiment. The risk of this model is that once the stock price turns into a discount, the company will face difficulties in refinancing, and it will also increase the correlation risk between traditional stock markets and crypto markets.

Financing Frenzy Overshadows IPO, but Market Shows Fatigue

"Crypto treasury stocks" have become a label for over 160 global listed companies, providing investors with a way to obtain crypto asset positions without directly purchasing tokens, functionally similar to crypto ETFs. Strategy has been buying Bitcoin for years, and this year's surging crypto prices triggered a new issuance frenzy.

Cosmo Jiang, a general partner at crypto fund Pantera, said:

"These digital asset tools have almost sucked all the oxygen out of the market. It's the only thing people are talking about."

Pantera has invested hundreds of millions of dollars in over 10 crypto treasury stocks this year.

However, signs of market cooling are becoming clear. Josh Solesbury, Vice President at ParaFi, says reduced summer trading volume and increasing market options are the main reasons for the decline in stock price premiums. Steve Kurz, Global Head of Asset Management at Galaxy Digital, believes:

"The market is showing some fatigue, but I don't think this trend has exhausted its momentum. The market will become differentiated, with winners emerging in different vertical sectors."

Mainstream and Alternative Token Holdings Companies Show Polarized Performance

The market cooling is not uniform but shows significant structural differentiation. Companies holding mainstream tokens are performing far better than those betting on niche, high-risk tokens.

Data from Architect Partners shows that crypto treasury stocks holding mainstream tokens like Bitcoin, Ethereum, or Solana have a median return of 92.8% since announcing their holding strategies.

In contrast, a group of crypto treasury stocks investing in less-known tokens has a median return of negative 24% since their announcement. A typical example is Hyperion DeFi, a company formerly a biopharmaceutical firm Eyenovia, which began purchasing Hyperliquid tokens in June. Although its held tokens are currently worth nearly $60 million, the company's market value is only $30.5 million. Its stock price has plummeted 30% in the past month.

Increased Correlation, Market Volatility Risk Amplified

The inherent risks of the "hoarding" model are being exposed. When the company's stock has a premium relative to its assets, raising funds by issuing stocks to buy more crypto is easy. However, once the stock price turns into a discount, this virtuous cycle will reverse, and the company will struggle to raise new funds. Meanwhile, the decline in the value of the underlying tokens will further suppress the company's stock price, forming a negative loop.

The rise of this model has also deepened the correlation between traditional stock markets and crypto markets, potentially bringing new sources of volatility to the stock market. Matt Zhang, founder of Hivemind, warns:

"As this integration deepens, traditional stock investors will face many unprecedented risks. They may not be accustomed to situations where certain tokens drop 15% in a day, which is common in the crypto realm."

Some venture capital firms are cautious about such investments. Nic Carter, founding partner of crypto venture capital firm Castle Island Ventures, says they have always avoided crypto treasury stocks. He believes:

"These businesses are largely zero-sum games, with returns primarily coming from increasing leverage or letting retail investors buy at unfavorable prices. We believe there are certain reputation risks involved."