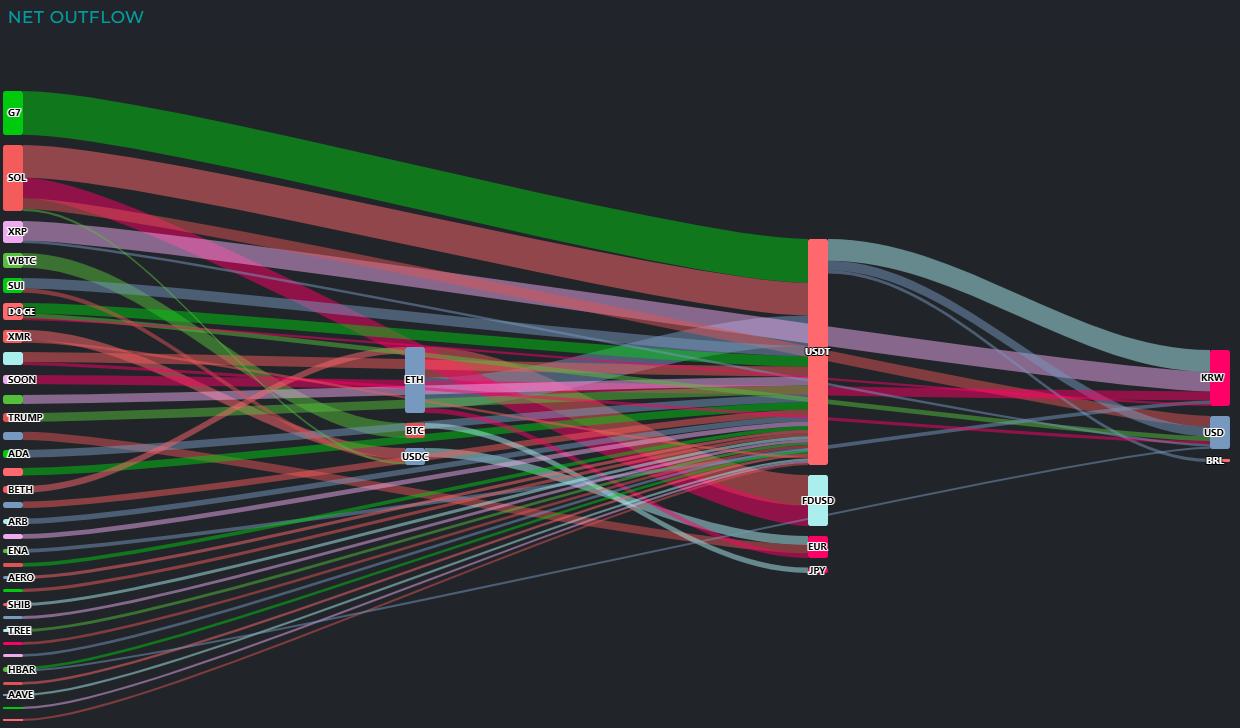

The global cryptocurrency market saw an inflow of over $600 million centered around the US dollar and USDT within a day, with massive buying pressure concentrated on major assets including BTC.

According to Cryptometer as of the 11th, the most active inflow in the global cryptocurrency market over the past 24 hours was in US dollars (USD), with a total of $104.2 million flowing into the market.

USD-based funds mostly flowed to ▲BTC ($82 million), and were also evenly distributed to ▲ETH ($12.1 million) ▲RLUSD ($2.2 million) ▲ZORA ($1.9 million) ▲BCH ($2.2 million) ▲NEAR ($2.9 million) ▲UNI ($910,000).

Korean won (KRW) based inflow was $42.2 million, concentrated on ▲BTC ($36.8 million), and also flowed to ▲MNT ($2.9 million) ▲ETH ($2.6 million).

Euro (EUR) based inflow was $26.6 million, spreading to ▲BTC ($10.2 million) ▲USDT ($8.4 million) ▲XRP ($5.6 million) ▲SOL ($1.2 million) ▲ADA ($1.2 million). British pound ($3.2 million), Brazilian real ($1.4 million), and Canadian dollar ($920,000) were entirely invested in BTC.

In USDT stablecoin, a total of $573.2 million moved, with massive funds flowing to ▲BTC ($285.6 million) ▲USDC ($141.2 million) ▲XRP ($41.1 million) ▲FDUSD ($35 million). Additionally, funds were dispersed to various altcoins like ▲BNB ($10.6 million) ▲ENA ($12.4 million) ▲LDO ($9.4 million), expanding overall market liquidity.

The $141.2 million inflow into USDC went to ▲BTC ($45 million) ▲XRP ($10 million) and also to BNB, LTC, ENA, etc. Funds entering FDUSD ($56.8 million) were reallocated to ▲BTC ($49.8 million) and ▲XRP ($8 million).

On this day, BTC had the largest inflow at $516.6 million, followed by ▲XRP ($65.1 million) ▲ETH ($16.8 million) ▲ENA ($16 million) ▲BNB ($12.2 million) ▲RLUSD ($10.5 million).

Inflows were also confirmed to various altcoins including ▲LDO ($9.4 million) ▲IP ($3.7 million) ▲MNT ($2.9 million) ▲NEAR ($2.9 million) ▲ZORA ($2.9 million) ▲LTC ($2.7 million) ▲ZRO ($2.5 million) ▲RROVE ($1.8 million) ▲ADA ($1.2 million) ▲SOL ($1.2 million).

The largest sell source on this day was G7, with a total of $52.1 million converted to USDT, revealing significant selling pressure.

SOL saw a total net outflow of $78.5 million. These funds were divided into ▲USDT ($38.7 million) ▲FDUSD ($24.4 million) ▲Dollar ($12.8 million) ▲USDC ($2.6 million).

XRP experienced a selling trend of $26.2 million, converted to ▲Korean won ($23.3 million) ▲Dollar ($2.9 million).

SUI saw a total of $17.7 million withdrawn, moving to ▲USDT ($12.5 million) ▲USDC ($5.2 million).

DOGE also saw an outflow of $20.4 million, dispersed to ▲USDT ($12.2 million) ▲Dollar ($5.6 million) ▲Korean won ($2.6 million).

Sporadic selling trends were also seen in XMR, SOON, MNT, TRUMP, RLUSD, PEPE, ADA, etc.

USDT, an intermediate asset, attracted $271.6 million, with some converted to ▲Korean won ($25.8 million) ▲Dollar ($11.4 million) ▲Real ($3.8 million).

USDC received $19.8 million, with some converted to ▲Euro ($10.8 million). FDUSD received $60.9 million.

ETH saw $79.5 million withdrawn, moving to ▲USDT ($37.3 million) ▲FDUSD ($36.5 million). Some of the $17.7 million converted from WBTC to BTC was moved to Japanese yen ($6.5 million).

Consequently, net outflows converted to fiat currencies were tallied as ▲Korean won ($66.9 million) ▲Dollar ($36.3 million) ▲Euro ($26.3 million) ▲Japanese yen ($6.5 million) ▲Real ($3.8 million).

Particularly, Korean won emerged as the final outflow path for various assets like USDT, DOGE, XRP, showing a wide range of exchange movements.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>