The Bitcoin market recorded explosive trading volumes during Asian and US trading hours amid short and medium-term inflows.

As of the 11th, according to CoinGlass, the total Bitcoin balance of major exchanges was approximately 2,262,434.36 BTC.

Over the past day, 2,343.41 BTC was net inflow, and 11,695.65 BTC was net inflow over the past week, showing inflows in both short and medium-term periods. However, over the past 30 days, 9,967.48 BTC was net outflow, indicating that the long-term selling trend continues.

Coinbase Pro holds the most Bitcoin with 706,898.06 BTC. Over the past day, 54.88 BTC was net outflow, 872.29 BTC over the past week, and 47,796.27 BTC over the past month, showing consistent outflow across all periods.

Binance holds 562,419.51 BTC and recorded 2,587.12 BTC net inflow on a daily basis. Over the past week, 5,476.76 BTC was inflow, and over the past month, 26,353.01 BTC was inflow, maintaining a strong inflow trend.

Bitfinex holds 387,956.98 BTC and recorded 134.85 BTC net outflow over the past day, but 803.33 BTC net inflow over the past week and 4,218.03 BTC net inflow over the past month.

Largest Daily Net Inflow ▲Binance (+2,587 BTC) ▲Kraken (+1,243 BTC) ▲bitFlyer (+68 BTC)

Largest Daily Net Outflow ▲OKX (–645 BTC) ▲Bithumb (–307 BTC) ▲Bitfinex (–135 BTC)

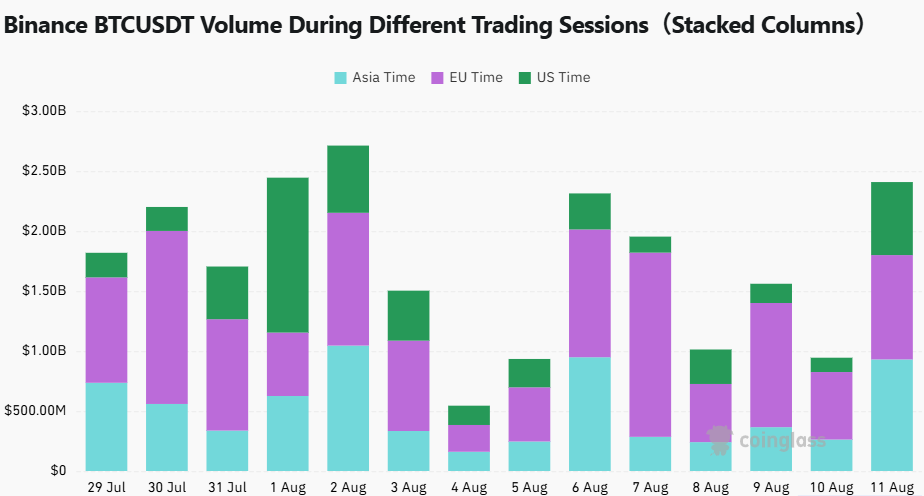

Binance BTCUSDT trading volume was recorded at $929.78 million in the Asian time zone, $869.47 million in the European time zone, and $608.58 million in the US time zone.

Compared to the previous day (August 9th), the Asian (+254.5%) and US (+409.8%) markets saw explosive trading volume increases, while the European market (+54.6%) showed a relatively moderate rise. Particularly, the Asian market jumped from $262.30 million the previous day to around $930 million, concentrating short-term liquidity inflows.

While the buy and sell transaction volumes increased significantly in all three regions, the trading initiative was generally distributed across Asian and US markets.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>