As of August 11, 2025, 1:25 PM

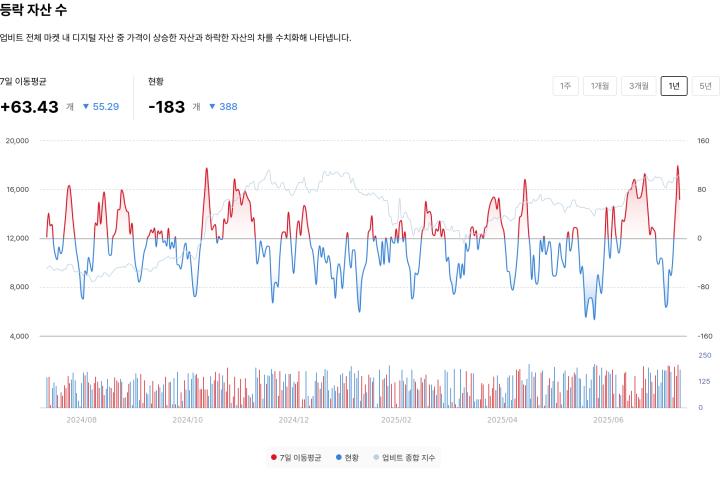

The Bitcoin market is continuing its rebound with buying pressure after a short-term adjustment. With trading volume and public interest surging simultaneously, the sharp decline in dominance is being interpreted as a signal of altcoin strength.

📈 Price Right Now

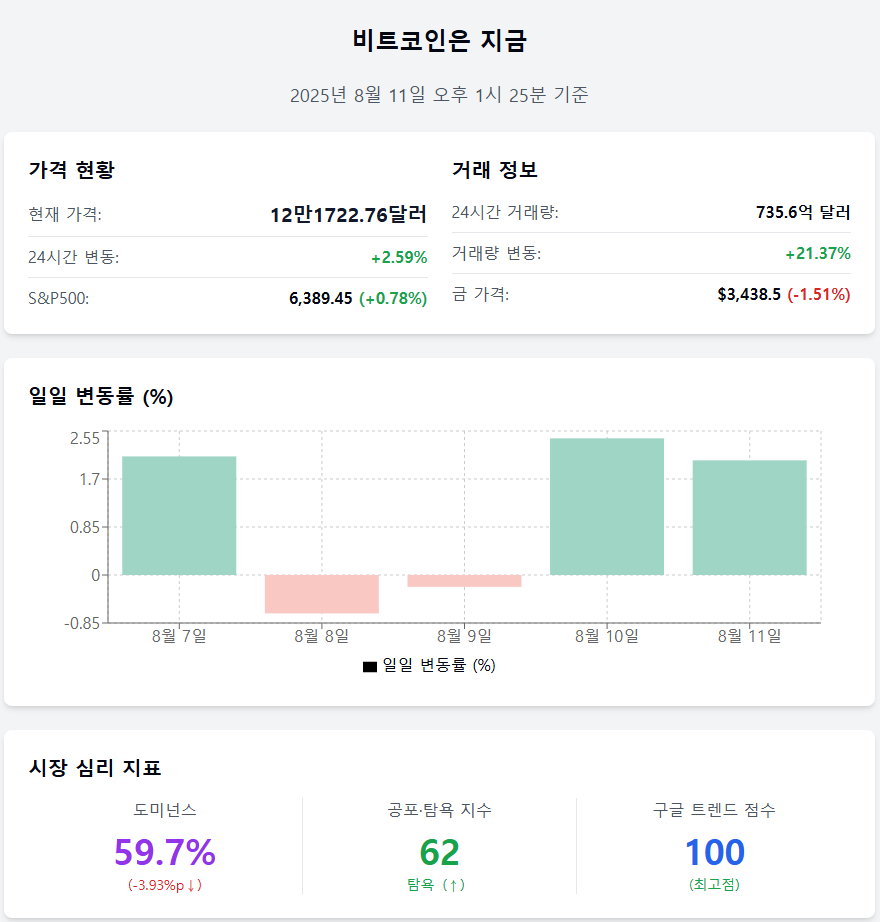

Price $121,722.76 (+2.59%) Bitcoin is trading at $121,722.76, up 2.59% from the previous day. After a short-term adjustment, buying pressure is returning and continuing the upward trend.

Trading Volume $7.356 Billion (+21.37%) The 24-hour trading volume has increased by 21.37% to $7.356 billion, with market participation becoming more active alongside the return of short-term investors.

Daily Volatility 2.03% The daily volatility over the past 5 days shows +2.10%(7th), –0.68%(8th), –0.21%(9th), +2.42%(10th), +2.03%(11th). A volatile market with short-term adjustments and rebounds continues.

Asset Comparison S&P500↑ · Gold↓ As of last Friday (8th), the S&P500 index rose 0.78% to 6,389.45, while gold prices fell 1.51% to $3,438.5. Bitcoin maintains an independent upward trend amid risk asset strength.

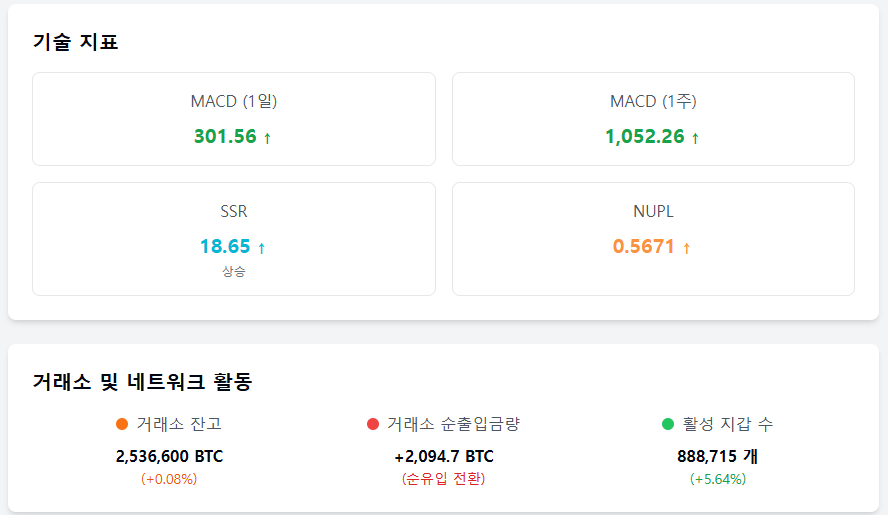

MACD 301.56 The short-term MACD is attempting to turn upward at 301.56, and the 1-week MACD is solidifying the medium-term upward trend at 1052.26.

❤️ Investor Sentiment Now

Dominance 59.7% (–3.93%p) Bitcoin dominance has dropped 3.93 percentage points, clearly showing a trend of fund diversification into altcoins.

Fear & Greed Index 62 (Greed) It has risen from the previous day (59, neutral) and entered the 'greed' zone. Compared to last week (52, neutral), investment sentiment is showing a rapid recovery.

Google Trends 100 Bitcoin-related search scores jumped from 71 on the 10th to 100 on the 11th, significantly expanding public interest.

🧭 Market Now

SSR 18.646 (+0.43) The Stablecoin Supply Ratio (SSR) relative to Bitcoin market cap has increased, suggesting Bitcoin's value has relatively risen. This may indicate limited buying capacity.

NUPL 0.5671 (+0.0102) The Unrealized Profit Ratio has risen, expanding the proportion of investors in the profit zone.

Exchange Balance 2,536,600 BTC (+0.08%) The Bitcoin holdings on exchanges have slightly increased, showing a build-up of short-term selling inventory.

Exchange Net Inflow +2,094.7 BTC (+3.53%) The inflow has increased compared to the previous day, expanding selling pressure across exchanges.

Active Wallets 888,715 (+5.64%) Increased from 841,139 the previous day, on-chain activity has become active again.

Get news in real-time... Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>