As of the morning of August 11th, the major cryptocurrency market showed mixed trends, with Bitcoin and Ethereum continuing their upward movement, while Ripple experienced a slight adjustment. Bitcoin rose to $119,812 (approximately 166.23 million won), showing a 2.75% increase compared to the previous day. Based on the 7-day and 30-day metrics, it has risen by 4.46% and 1.81% respectively, maintaining a stable upward trend. Its market capitalization remains dominant at approximately $2.3848 trillion (about 3,308 trillion won).

Meanwhile, Ethereum has been drawing attention with its higher growth rate compared to Bitcoin. Currently trading at $4,306 (approximately 5.975 million won), its 24-hour fluctuation is limited (0.15%), but it shows a solid growth of 21.74% over 7 days and 45.49% over 30 days. Particularly, it has risen over 75% in the past 90 days, indicating strong technical rebound and market demand. This upward trend suggests Ethereum is at the center of short-term market growth. Ethereum's strength appears to be influenced by institutional investor sentiment recovery and recent application expansions in DeFi and Non-Fungible Token areas.

In contrast, Ripple declined by -0.30% to $3.22 (approximately 4,474 won) compared to the previous day, showing a slight retreat from its upward trend. However, it has recorded a 7.47% increase over 7 days and 14.38% over 30 days, maintaining an overall upward movement. Ripple's volatility remains high, with assessments suggesting an independent trend. Particularly, Ripple has risen 42.94% in the past 60 days, driving investment sentiment, and despite price adjustments, medium to long-term expectations are maintained. Overall, the cryptocurrency market is seen as entering a gradual recovery phase centered on Bitcoin and Ethereum.

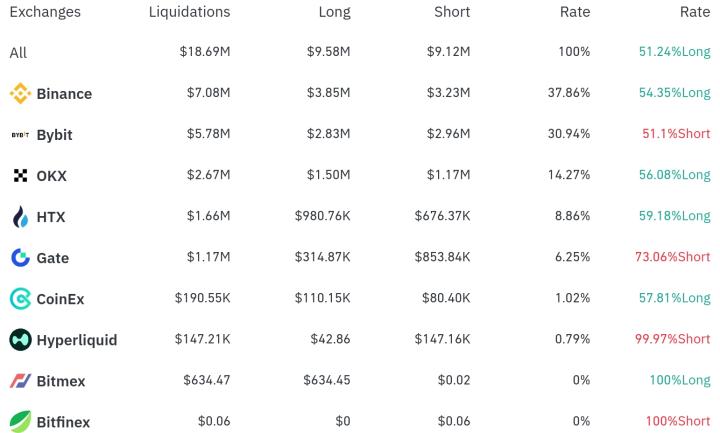

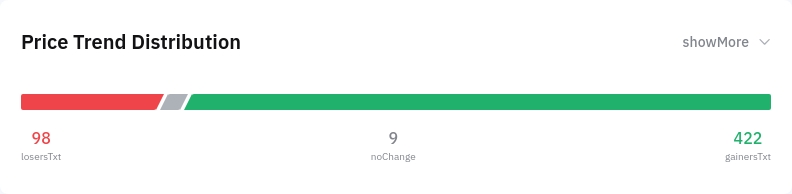

According to Bybit's position profit distribution, 422 traders are in the profit range, significantly surpassing the 98 in the loss range. Profitable traders account for approximately 77% of the total distribution. This reflects the improved derivative market returns due to recent cryptocurrency price increases and suggests a positive market outlook among investors. Ethereum's strength plays a crucial role in expanding the profit position range, closely related to technical indicator rebound trends.

The high profit proportion revealed in position records shows short-term optimistic sentiment and notable rapid response of the derivative market to the upward trend. Despite Ripple's daily decline, the maintained solid profit range indirectly reflects market stability driven by Ethereum and Bitcoin's strength. The expanded profit range indicates high hit rates for long-position strategies and reinforces psychological confidence that prices are unlikely to fall below technical support lines. The synchronization of derivative positions with spot market trends could influence exchange liquidity. This imbalanced profit-loss structure may provide key insights during future price adjustments or re-accumulation phases...

In this context, Ethereum has recorded a monthly growth of about 43%, breaking through $4,300 and approaching the key resistance zone of $4,350-$4,400. This is analyzed as benefiting from recent U.S. macro environment changes, particularly expectations of Federal Reserve rate cuts and dollar weakness. Additionally, regulatory clarity for Ethereum-based products in the U.S. has reduced market uncertainty and stimulated institutional investor inflow. On-chain indicators show continuous decrease in Ethereum supply on exchanges, suggesting strengthened medium to long-term growth structure. However, short-term concerns exist about potential profit-taking around $4,400 due to increased inflows centered on Binance. From a technical perspective, the previous major high points of $4,800-$5,000 are again mentioned as medium-term targets, with the breakthrough of short-term resistance being crucial.

Overall, major cryptocurrencies led by Bitcoin and Ethereum have approached technical resistance zones, entering a directional test. Particularly, Ethereum's relative strength has recently become prominent, slightly lowering Bitcoin's market share, which can be interpreted as reflecting 'altcoin rotation' of some institutional funds. While the accumulation by major investors across large cryptocurrencies is a positive long-term signal, short-term overheating signals should be noted. If key resistance zones are not clearly broken, a potential pullback remains possible. Risk management through divided approach and limit order strategies is required rather than reckless chasing. In this phase of strong upward trend with simultaneous short-term pressure, investors need to flexibly adjust profit-taking ranges and re-entry points.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>